The Markit/CIPS services PMI will be the main data release out of the UK this week. The closely monitored index is expected to show a further improvement in the UK’s dominant services sector in May when it’s released on Tuesday at 08:30 GMT. However, any potential boost to the pound will likely be short-lived as the British government heads for a showdown with the European Union over Brexit.

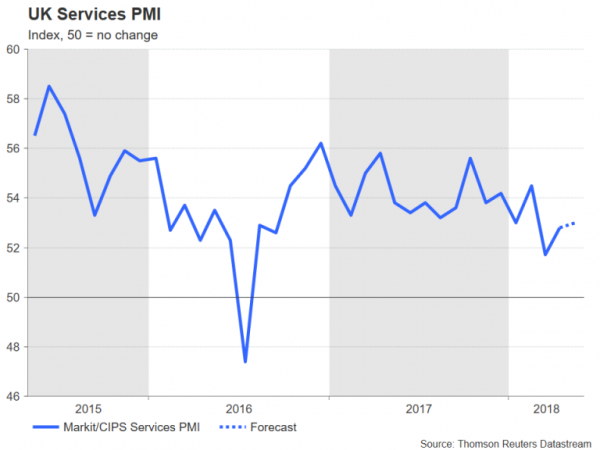

Activity in the services sector decelerated to a 20-month low in March, in line with a broader slowdown in the economy, before recovering slightly in April. It is expected to improve further in May, with the services PMI forecast to rise from 52.8 to 53.0. While an increase in the PMI reading would be a welcome sign that economic growth is starting to pick up in the second quarter, the index remains below the average of 54.2 in 2017.

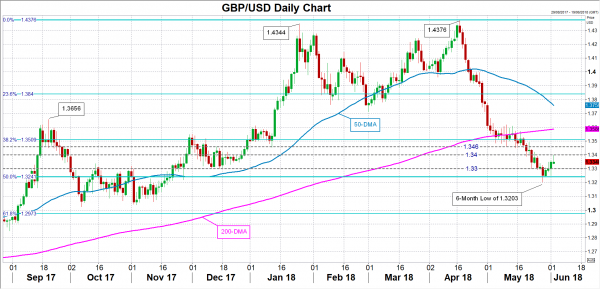

There are tepid signs that growth is gaining momentum in the second quarter. Both the manufacturing and construction PMIs released in the past few days beat expectations in May and a CBI survey of UK firms published on Sunday pointed to rising output in the three months to May. The encouraging data has helped the pound to regain some positive footing against the dollar. The British currency had tumbled to a 6-month low of $1.3203 last week but has since rebounded to just below the $1.34 level.

Another data beat on Tuesday could lift sterling above $1.34 towards potential resistance barriers at the $1.3460 and $1.3510 levels. A disappointing PMI report, however, could lead to a reversal of the pound’s recent gains with the $1.33 support level coming back into scope. A breach of this support would open the way towards the critical 50% Fibonacci retracement of the upleg from $1.2108 to $1.4376, around 1.3240.

While more positive indicators in the coming weeks would boost expectations of a Bank of England rate hike in August, the pound looks set for a choppy ride as Brexit returns to the limelight ahead of an EU summit on June 28-29. The government has said it will publish its plans on how to avoid a hard border between Northern Ireland and the Republic of Ireland in the coming days. The Irish government has given the UK two weeks to put forward proposals on resolving the border problem. However, with the EU adopting an increasingly uncompromising position, a breakthrough on the issue doesn’t seem very likely before the summit.

Another sticking point in the negotiations, which has been complicated by the Northern Irish border issue, is the UK’s plans for a customs partnership and how it will achieve frictionless trade with the EU, having opted not to remain within the European single market. The UK is reportedly working on two versions of a customs model, which will be outlined in the coming weeks. However, hopes for a near-term agreement are low after Michel Barnier, the EU’s chief negotiator, was quoted as saying “Neither of those proposals are operational or acceptable to us”.

In a further headache for Prime Minister Theresa May, the EU Withdrawal bill, which suffered 15 amendments in the House of Lords (the UK’s upper chamber), will return to the House of Commons in the next fortnight. One of the amendments was for the UK to remain in the European Economic Area, which in effect means staying in the single market. If MPs vote in favour of the amendment, it would take the choice on the type of post-Brexit customs arrangement away from the government and force May’s hands into remaining inside the single market.