Here are the latest developments in global markets:

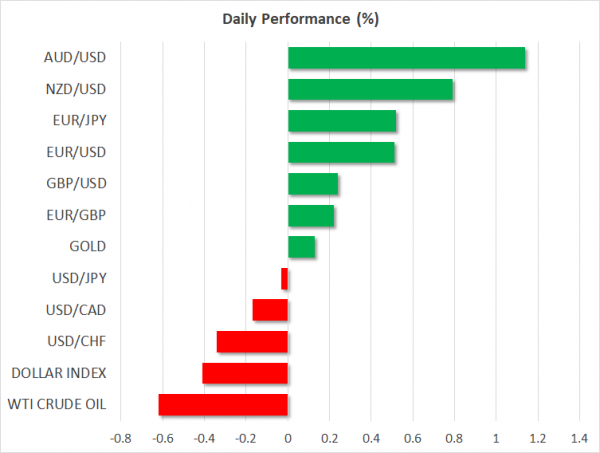

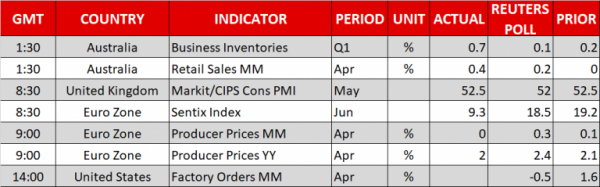

FOREX: The Australian dollar continued to outperform its peers rallying by 1.12% against its US counterpart and by 1.20% against the Japanese yen as upbeat retail sales readings and business inventories raised growth prospects ahead of the release of Q1 GDP growth on Wednesday. Its New Zealand cousin was also moving higher, elevated by 0.82% versus the greenback, despite markets in New Zealand being closed for public holiday. Euro/dollar and euro/yen climbed to 1 ½-week highs of 1.1736 (+0.60%) and 128.67 (+0.63%) respectively as the political relief in Italy lifted chances for a 10bps rate hike by the ECB in June 2019. Money markets are now seeing a chance of 50% compared to 30% in the previous week, a month ahead of what they believed last week. Meanwhile, producer prices and the Sentix investor confidence index out of the Eurozone came in lower-than-expected, though the euro shrugged off the miss in data and advanced higher instead. Pound/dollar crawled up to 1 ½-week highs as well, peaking at 1.3397 after May’s construction PMIs surpassed forecasts but remained steady at April’s levels. Dollar/yen was steady at 109.54, with investors cautious on how the trade story will develop after the US imposed steel and aluminum import tariffs on the EU and its NAFTA partners, Canada and Mexico, with the latter ones having already taken countermeasures. The dollar index was down by 0.43% at 93.78.

STOCKS: European stocks opened higher on Monday supported by gains in the utility sector, while easing political concerns encouraged investors to allocate more funds in riskier assets. The pan-European STOXX 600 and the blue-chip Euro STOXX 50 were both up by 0.49% at 0930 GMT. The German DAX 30 rose by 0.25%, the French CAC 40 climbed by 0.44% and the UK’s FTSE 100 increased by 0.68%. The Spanish IBEX 35 was the best performer after a tense week, surging by 1.58%, while the Italian FTSE MIB was on the recovery, rising by 0.61%. US stock futures were all flashing green, pointing to a positive open.

COMMODITIES: Oil prices were on the back foot, with WTI crude oil being down by 0.11% at $65.74 per barrel and the London-based Brent lower by 0.44% at $76.45. On Friday, Baker Hughes showed an increase in US oil rigs, which drove the total count of rigs to the highest since March 2015. Investors were also worried that the falls in Venezuelan and Iranian output, as well as Washington’s concerns about oil’s recent rally, which was characterized as taken too far, could persuade OPEC members to raise supply at their policy meeting on June 22. In precious metals, gold was steady at $1,293.80 per ounce.

Day Ahead: US factory orders to gather attention before RBA statement

Looking ahead, the rest of the day will be fairly quiet, while the aussie and the dollar will attract some attention by investors as economic releases out of Australia and the US later in the day might bring volatility to the currencies.

In the US, factory orders will be the only major pending figures (1400 GMT). The numbers published by the US Census Bureau are expected to show a contraction of 0.5% m/m in new manufacturing orders in April after growth of 1.6% in the prior month. The US currency would be eyed ahead of the releases.

As for central bank meetings, the Reserve Bank of Australia (RBA) will announce its rate decision during the Asian trading session on Tuesday, at 0430 GMT. Policymakers are widely anticipated to keep interest rates unchanged to 1.5% and as such, attention will turn to the phrasing of the accompanying statement. Although the RBA is expected to remain concerned about low inflation and wage growth, it will likely reaffirm its positive growth outlook. Net exports contribution data for the first quarter will be closely watched ahead of the rate decision, with scope to push the aussie higher if the numbers, which are a good indication to GDP growth due on Wednesday, surprise to the upside. Analysts believe that the measure will rebound by 0.5% q/q after contracting by an equivalent percentage in the previous quarter.

Chinese Caixin Services PMI are also due on Tuesday at 0145 GMT.

In terms of public appearances. At 1700 GMT Bank of England Member of Monetary Policy Committee Silvana Tenreyro will speak in Guildford.

A speech by the ECB President Mario Draghi on Tuesday on the occasion of the Bank’s 20th anniversary in Frankfurt, Germany has been canceled.