Friday June 1: Five things the markets are talking about

U.S fire the first shot in trade war

Euro equities are looking to close out this wild week in the ‘black,’ a week in which Euro politics and escalating trade tensions have shook markets.

U.S Treasuries have edged lower and the ‘big’ dollar trades somewhat steady for the time being.

Italy’s benchmark index has aggressively rallied to five-month highs on news Italy’s populist parties have reached a deal on forming a government, ending concerns about possible new elections. Even U.S stocks are set to open higher as President Trump pushes ahead with tariffs on imports of metals from its key trading partners – CAD, MXN and EUR.

Even Spanish assets have dismissed the uncertainty surrounding PM Rajoy, who has just been replaced by the Socialist Pedro Sanchez after a no-confidence motion.

The positive overnight market moves would suggest that investors remain optimistic that threats of more international tariffs will not materialize into an all-out trade war, however, only time will tell.

Aside from trade and politics, investors will be focusing on today U.S payroll numbers (08:30 am EDT) for short-term market direction. Payrolls are expected to rise (+190ke) and the unemployment rate is to hold steady at its 18-year low (+3.9%e).

1. Stocks get the green light

In Japan, the Nikkei share average ended lower overnight, as selling in large cap stocks and concerns about U.S tariffs on metal imports erased earlier gains made after a weaker yen (¥109.17) supported exporter firms. The Nikkei fell -0.1%. For the week, it dropped -1.2%. The broader Topix added +0.1%.

Down-under, Australia’s S&P/ASX 200 has recorded its first three-week losing streak in three-months. The index fell -0.4%, putting the week’s drop at -0.7%, with commodities and financials being key pressure points. In S. Korea, the Kospi rallied +0.7% on stronger export data.

In Hong Kong, equities rallied overnight, aided by strong China manufacturing data, while worries over Italy cooled. The Hang Seng index rose +1.4%, while the China Enterprises Index gained +1.8%.

In China, stocks slid as U.S tariffs reignited fears of a global trade war, which has overshadowed China A-shares’ inclusion in MSCI’s benchmark market indexes – its expected to attract a lot of foreign capital inflows. The Shanghai Composite Index fell -0.5%, while the benchmark CSI300 dropped -0.8%.

In Europe, stocks have rallied sharply after Italy’s populist parties reached a deal on forming a government. Italy’s FTSE MIB jumps +2.7%, reversing much of the steep slide it suffered earlier this week. The U.K’s FTSE 100 and Germany’s DAX are up +0.7%, and even Spain’s Ibex 35 has rallied +1.3%.

U.S stocks are set to open in the ‘black (+0.4%).

Indices: Stoxx600 +0.9% at 386.35, FTSE +0.6% at 7725, DAX +0.8% at 12709, CAC-40 +1.1% at 5457; IBEX-35 +1.4% at 9594, FTSE MIB +2.7% at 22373, SMI +1.4% at 8571, S&P 500 Futures +0.4%

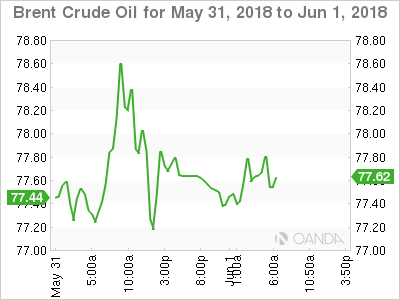

2. Oil prices mixed on inventories, gold unchanged

Oil prices have rallied overnight, supported by a surprise drawdown in U.S crude inventories and by expectations that OPEC may not be able to finalize an increase in output later this month (June 22).

Brent crude is up +20c at +$77.30 per barrel, after settling the last session up +2.8%. U.S West Texas Intermediate crude is down -10c at +$68.01 a barrel.

The Energy Information Administration yesterday reported a draw in crude oil inventories of -4.2m barrels for the week to May 25; a day after the API pressured benchmarks by estimating an unexpected inventory increase of +1m barrels for the same period.

The market was anticipating a build of +1m for last week, after a +5.8m increase a week earlier.

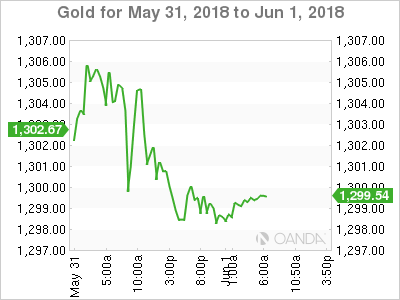

Ahead of the U.S open, gold prices remain steady on renewed fears of a global trade war, while a U.S firm dollar and positive U.S economic data continues to cap market gains. Spot gold is unchanged at +$1,298.29 per ounce, while U.S gold futures for June delivery are down -0.2% at +$1,298 per ounce. Spot gold is down slightly this week.

3. Focus on Spanish yields

Spanish government bond yields trade lower this morning, pulled along by the relief rally triggered by the setup of the new Italian government and ahead of PM Rajoy’s parliamentary confidence vote. The 10-year Spanish bond yield is trading -9.5 bps lower at +1.42%.

Elsewhere, the yield on U.S 10-year notes have gained +1 bps to +2.87%. In the U.K, the 10-year Gilt yield has advanced +3 bps to +1.263%, while in Italy, the 10-year BTP yield has dipped -15 bps to +2.641%, the lowest in a week. In Germany, the 10-year Bund yield has backed up +3 bps to +0.37%, the highest in a week.

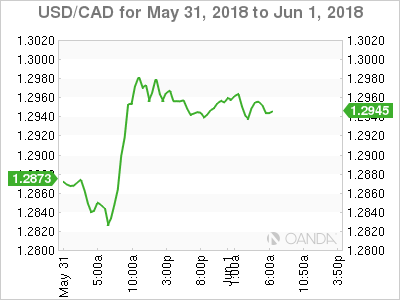

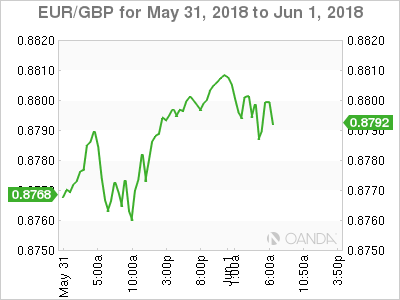

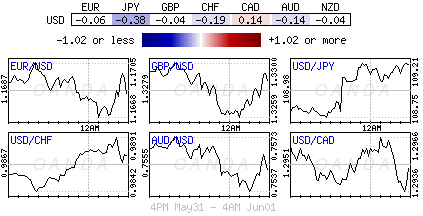

4. Euro, CAD and MXN fall on U.S tariffs

In the long run, an isolationist U.S trade policy is bearish for the ‘big dollar.’

Nevertheless, the EUR (€1.1685), Canadian dollar (C$1.2951) and Mexican peso ($19.9190) have all fallen after the U.S announced tariffs on steel and aluminum imports from Canada, Mexico and the E.U starting today.

Canada and Mexico retaliated within hours after Washington imposed tariffs on steel and aluminum imports. While in Germany, the Economy Minister said today that the E.U might look to coordinate its response with Canada and Mexico.

Note: With the political situation remaining the primary focus in Europe, political uncertainties in E.U’s periphery is expected to keep the EUR under pressure and this despite a stronger-than-expected acceleration in the EMU’s May inflation print yesterday.

GBP/USD (£1.3297) has failed to gather any upward momentum despite a better-than-expected manufacturing PMI reading this morning (see below).

5. U.K manufacturing PMI rises

Data releases this morning showed that U.K manufacturing PMI rose above market expectations to 54.4 (53.5e) in May, but the pound still trades around the same level it was before the release. Why? The data came with warnings.

According to Markit, “although growth of production accelerated to its best during the year-so-far, this was mainly achieved through the steepest build-up of finished goods inventories in the 26-year survey history and a sharp reduction in backlogs of work.”

Moreover, “growth of incoming new business remained solid in May, but the pace of expansion eased to an 11-month low” and “the pace of job creation in the manufacturing sector also lost momentum,” it said.