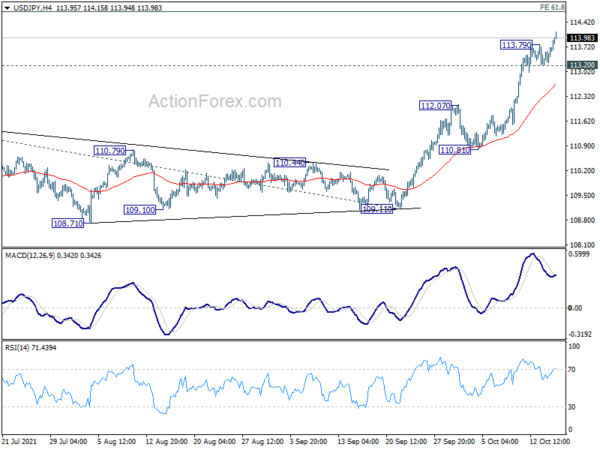

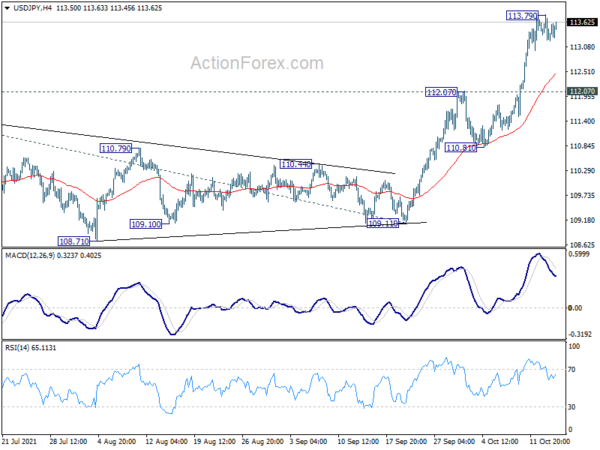

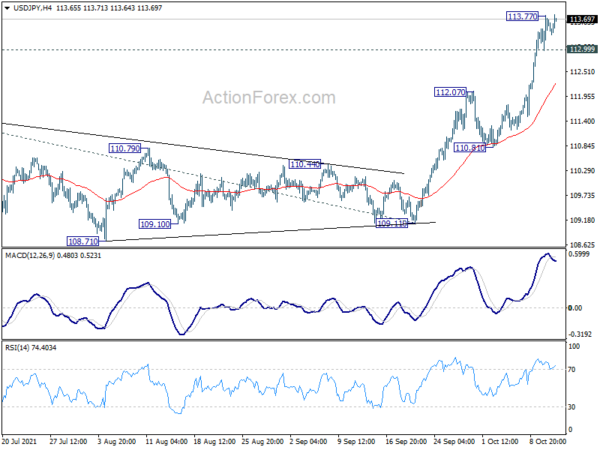

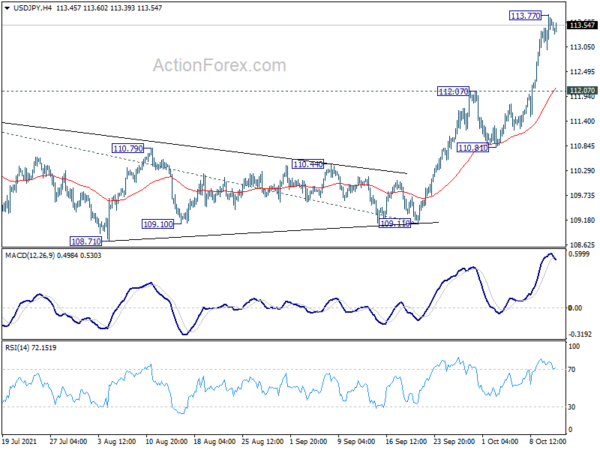

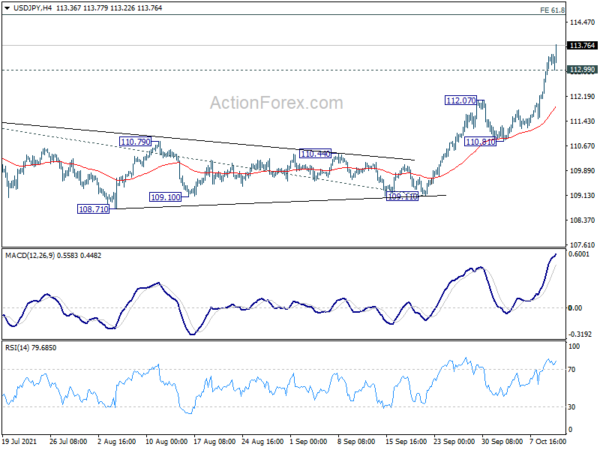

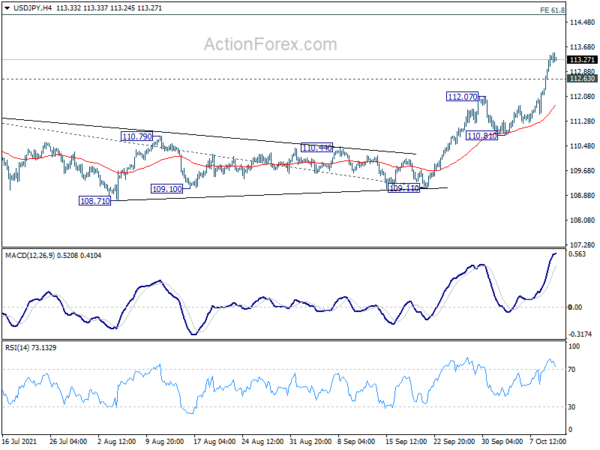

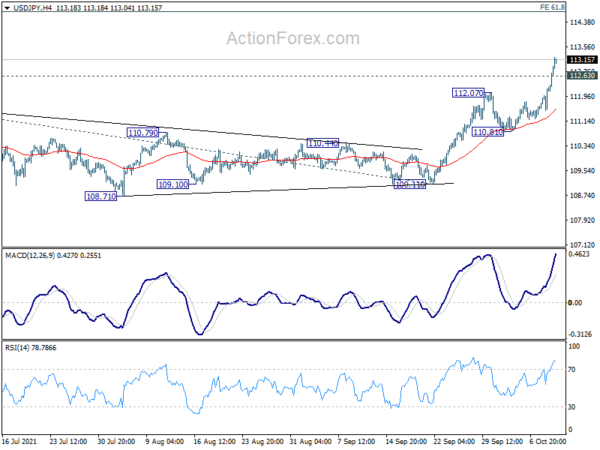

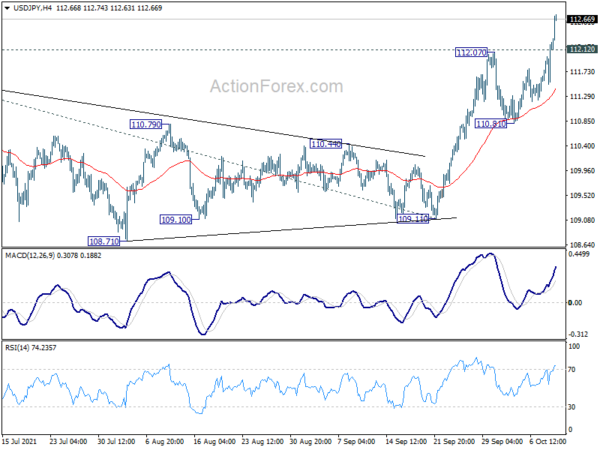

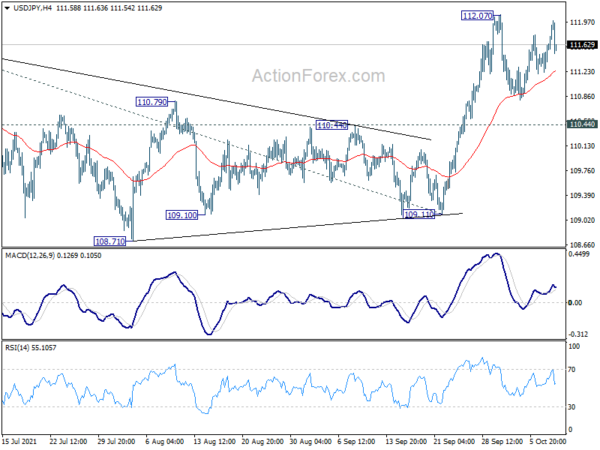

Daily Pivots: (S1) 113.35; (P) 113.54; (R1) 113.86; More…

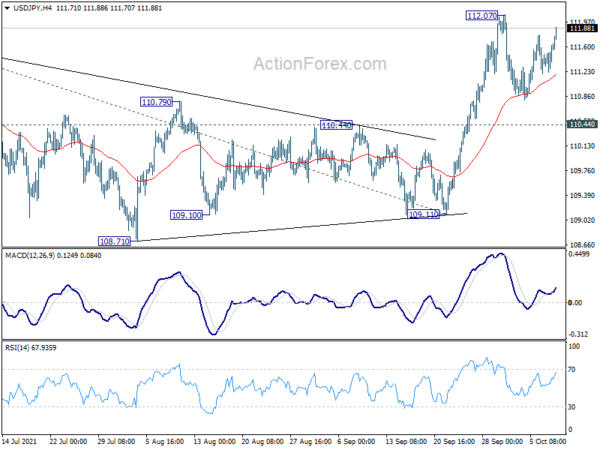

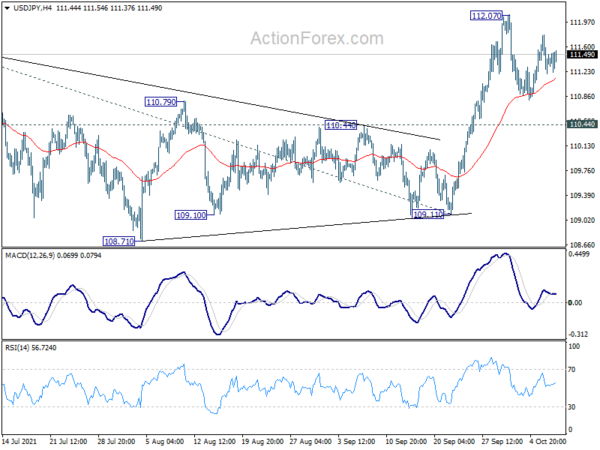

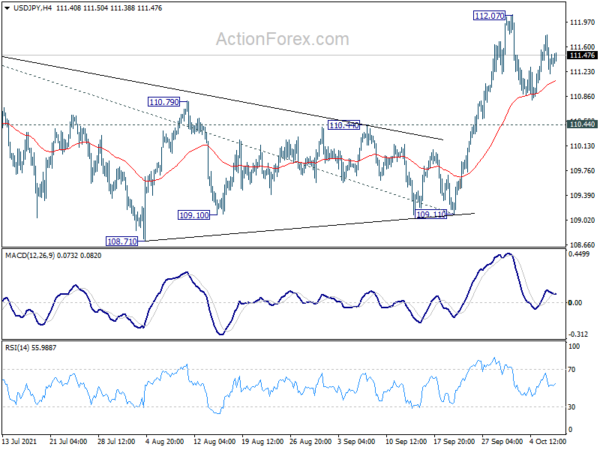

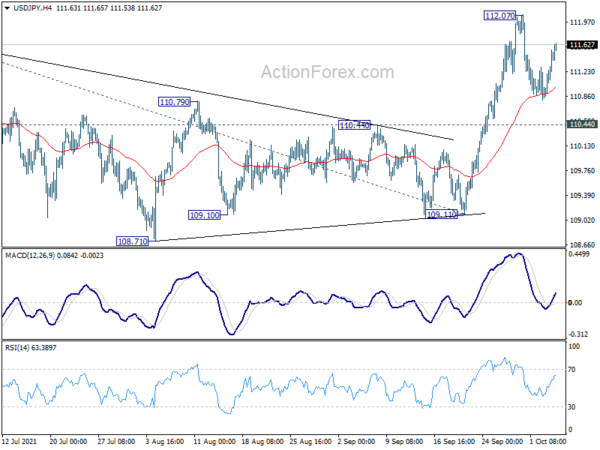

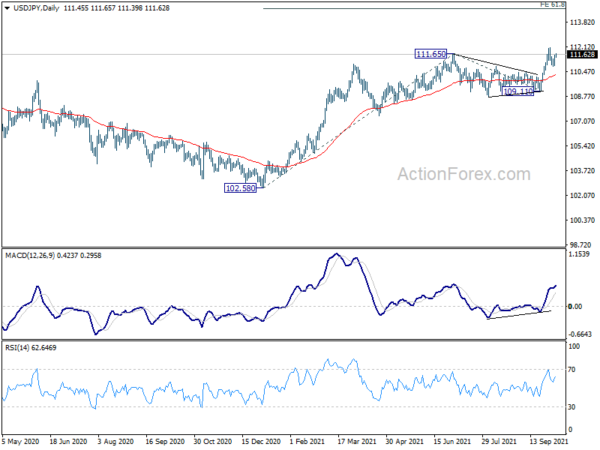

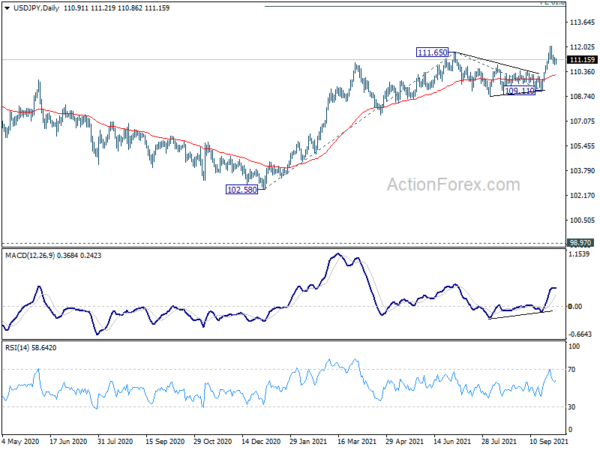

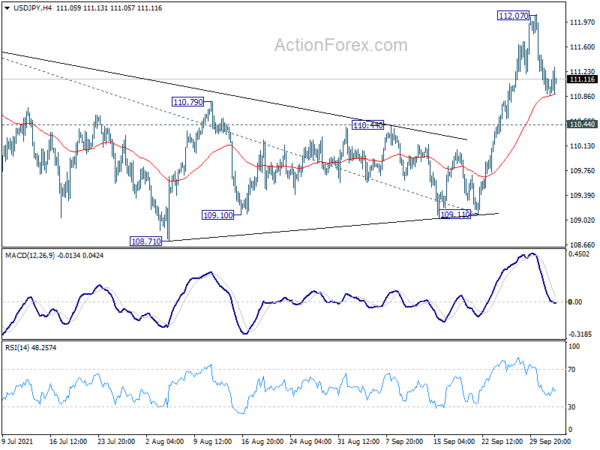

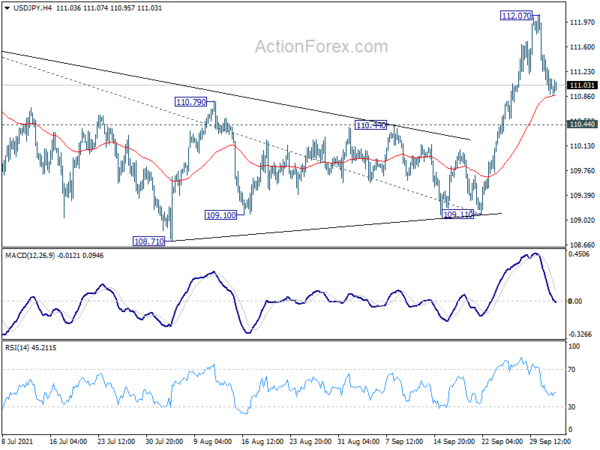

USD/JPY’s rally resumed after brief consolidations and intraday bias is back on the upside. Current rise should target 61.8% projection of 102.58 to 111.65 from 109.11 at 114.71. Firm break there will target 100% projection at 118.18 next. On the downside, below 113.20 minor support will turn intraday bias neutral and bring consolidations again, before staging another rally.

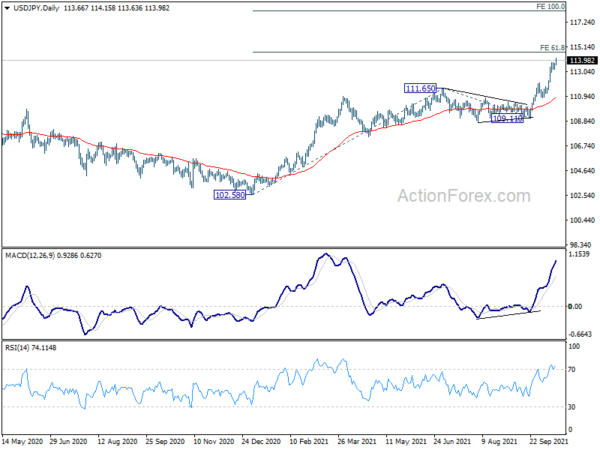

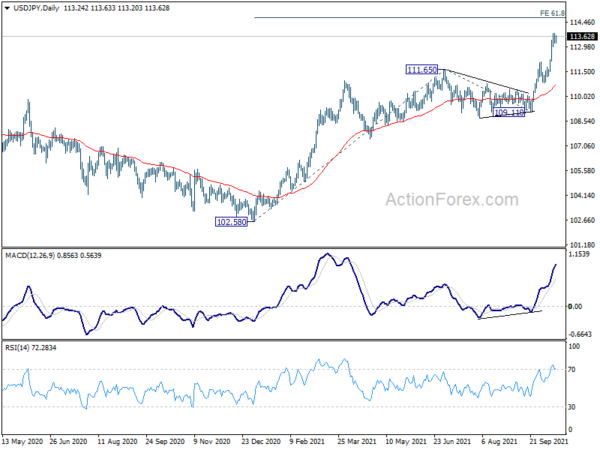

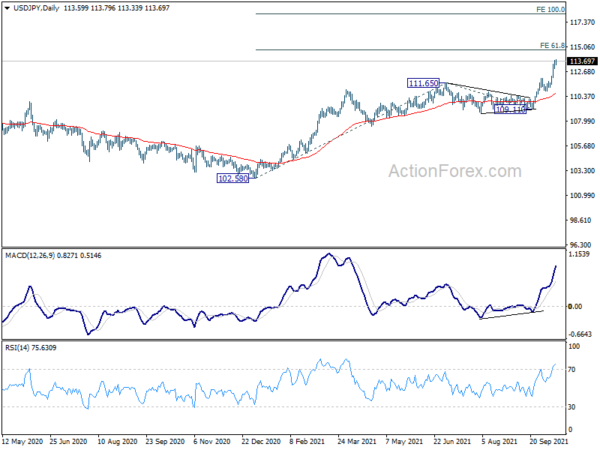

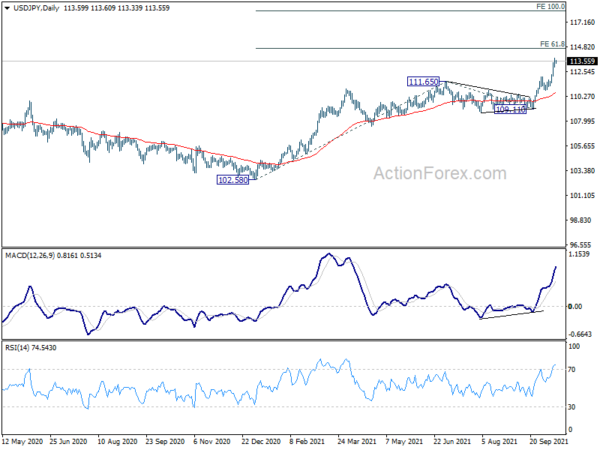

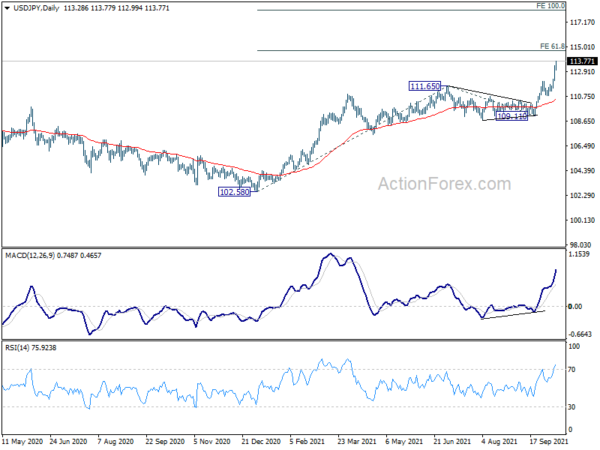

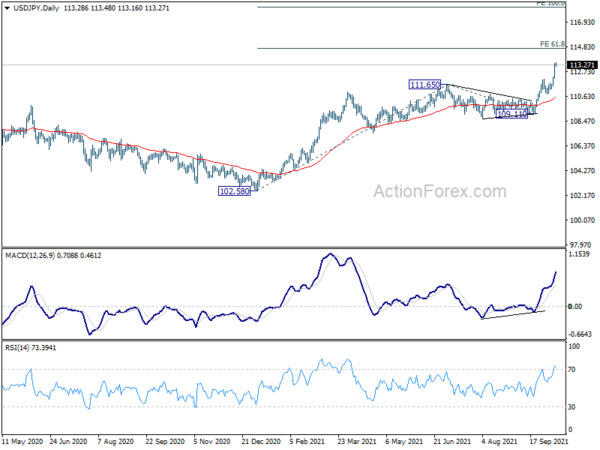

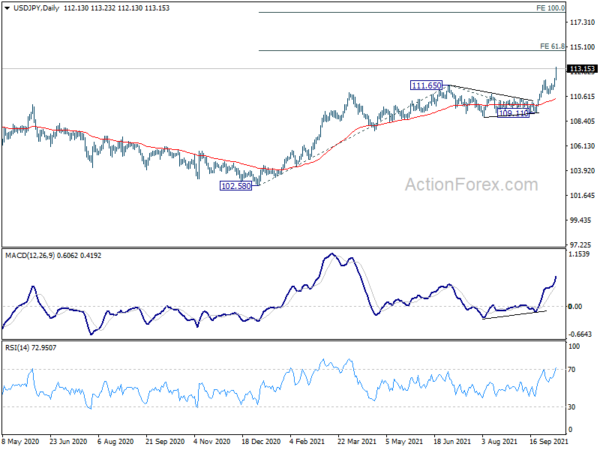

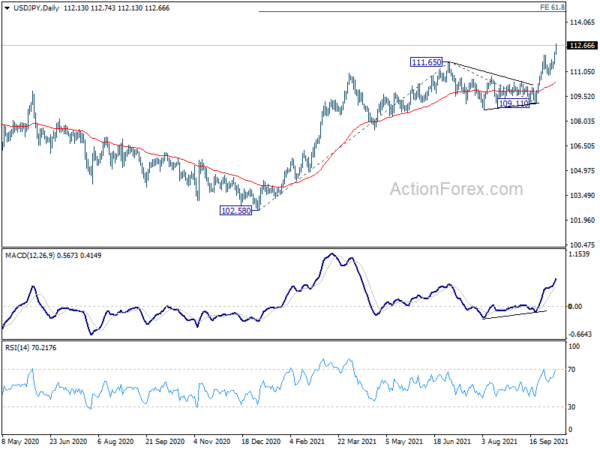

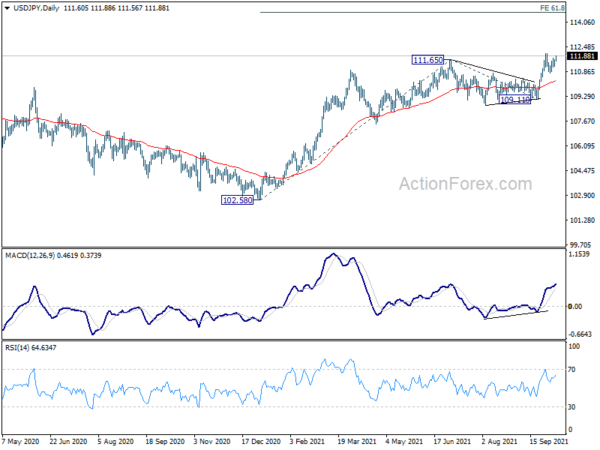

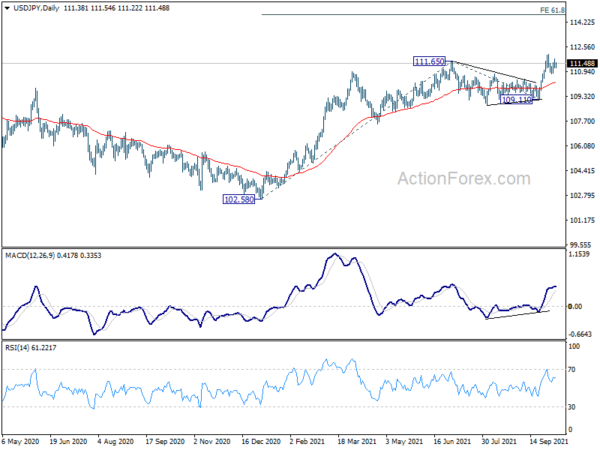

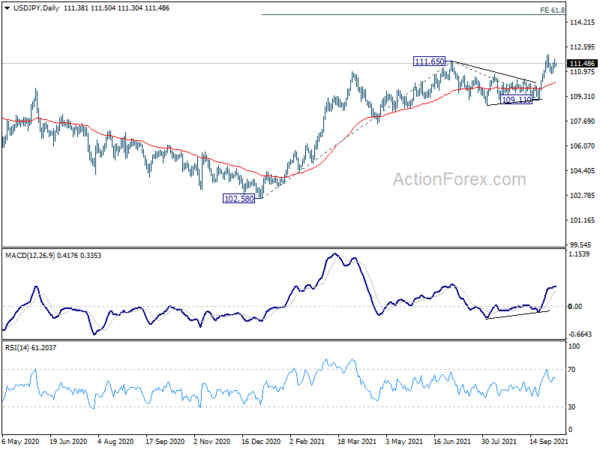

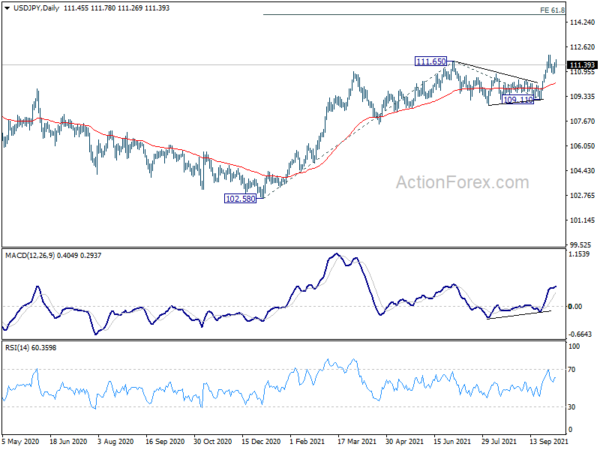

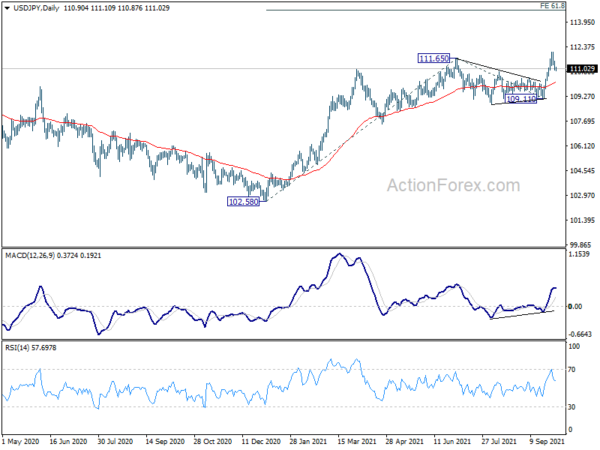

In the bigger picture, corrective decline from 118.65 (2016 high) should have completed at 101.18 already. Rise from the 102.58 is seen as the third leg of the up trend from 101.18. Next target is 114.54 resistance and then 118.65 high. This will now be the preferred case as long as 108.71 support hold, even in case of pull back.