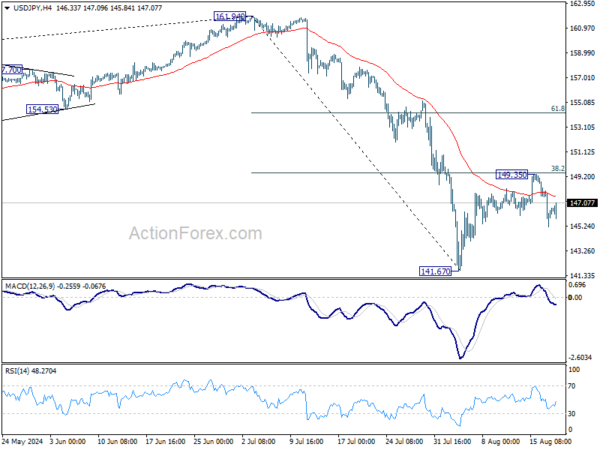

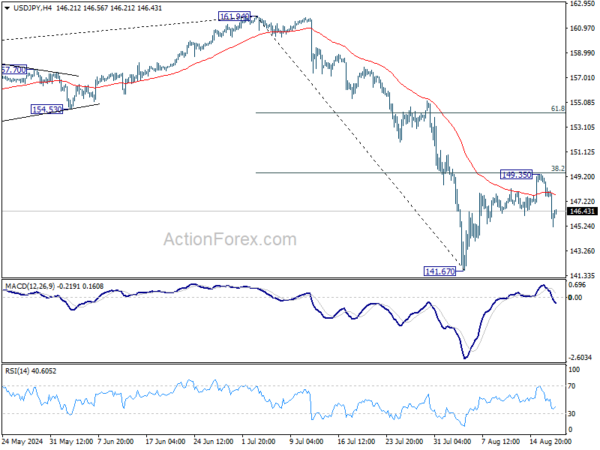

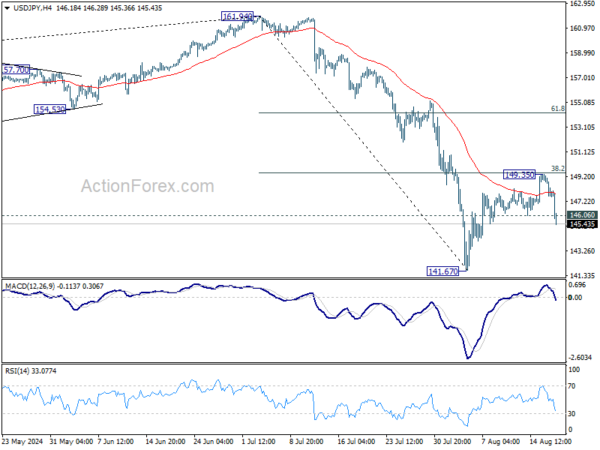

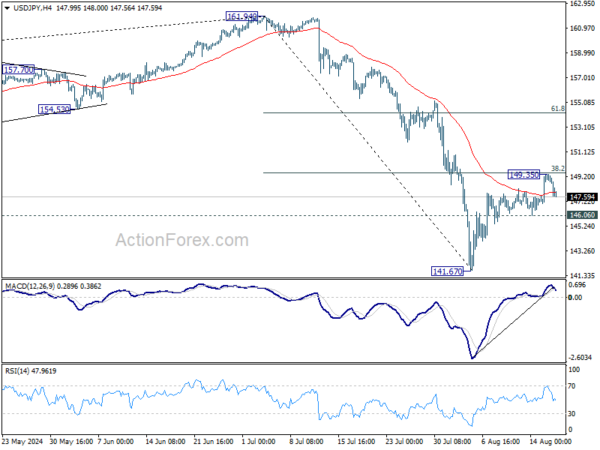

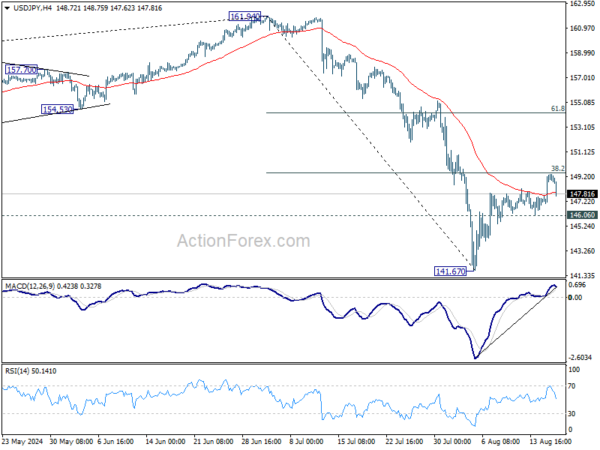

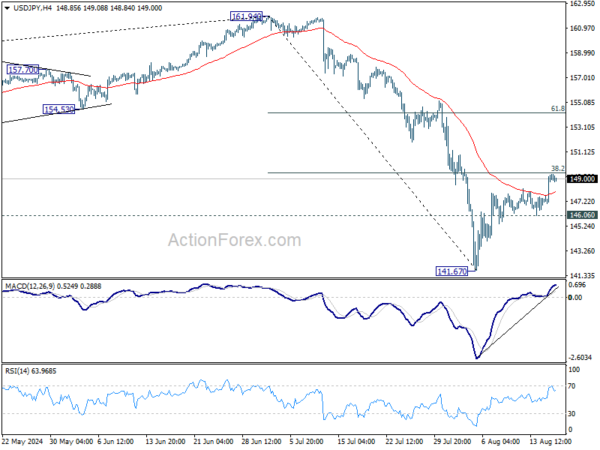

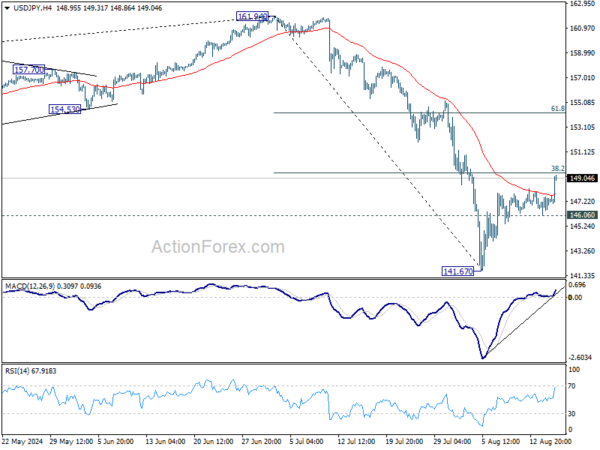

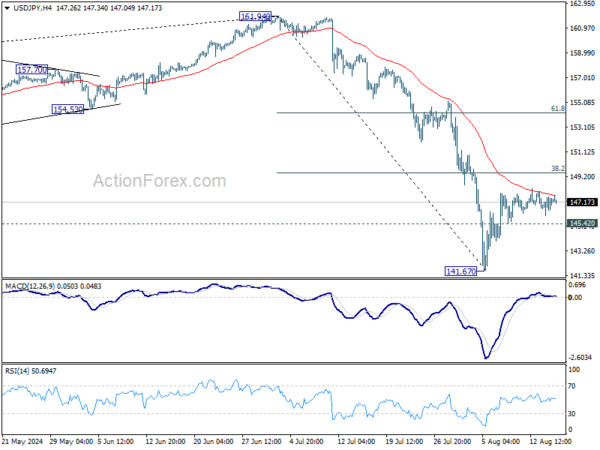

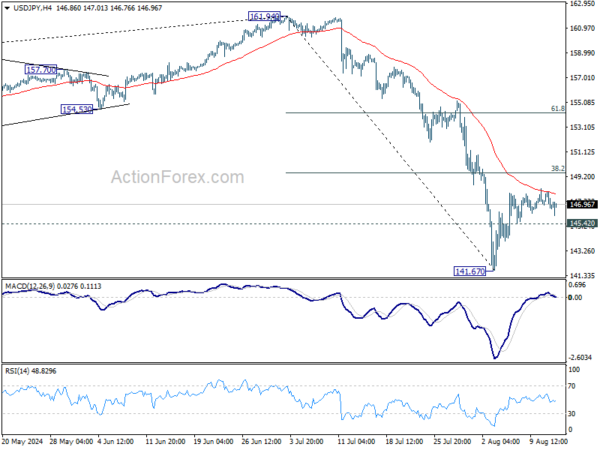

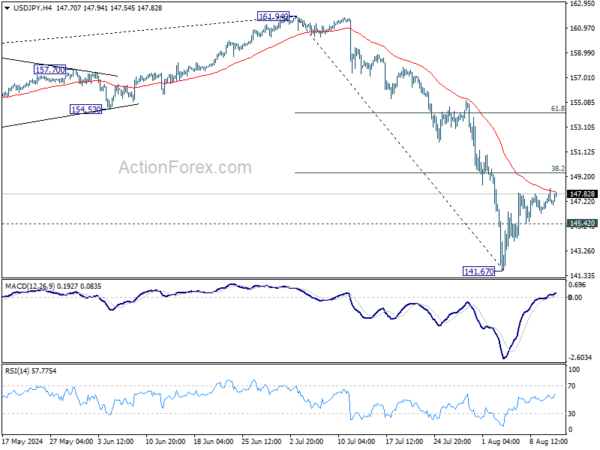

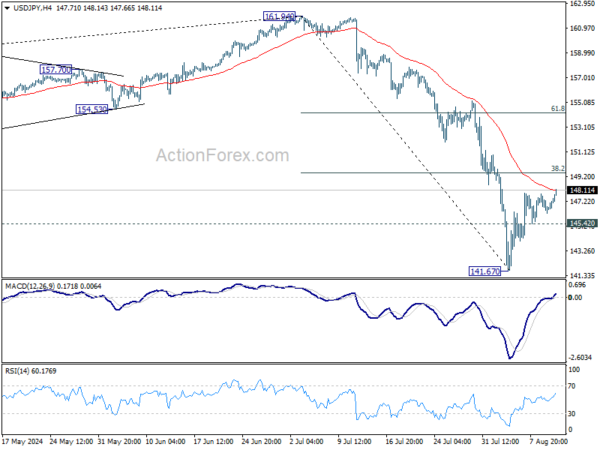

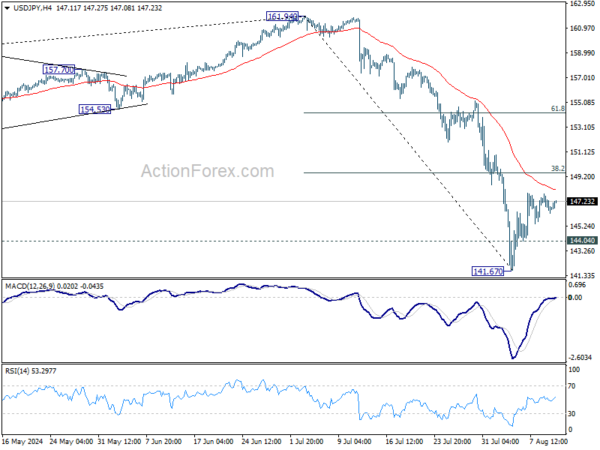

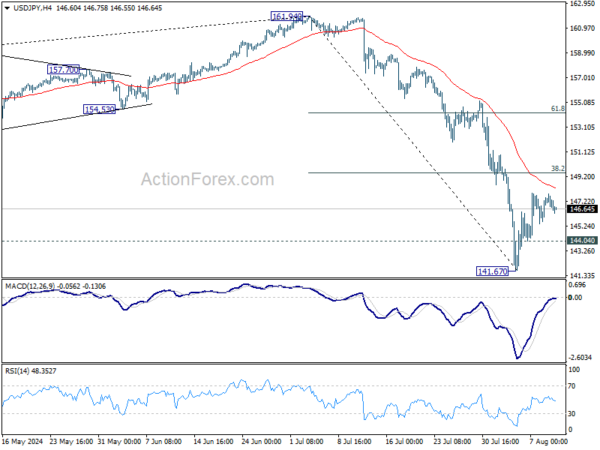

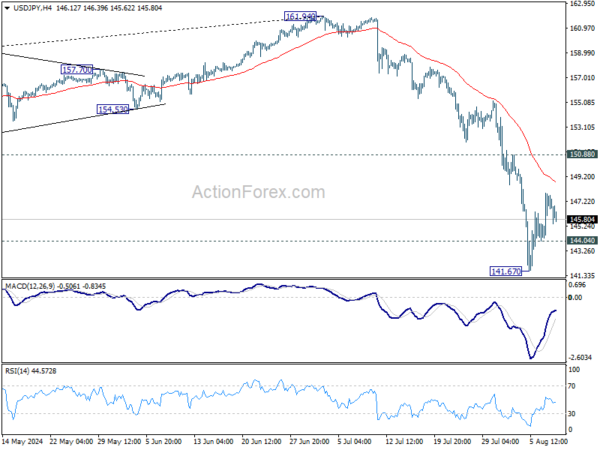

Daily Pivots: (S1) 145.17; (P) 146.62; (R1) 148.04; More…

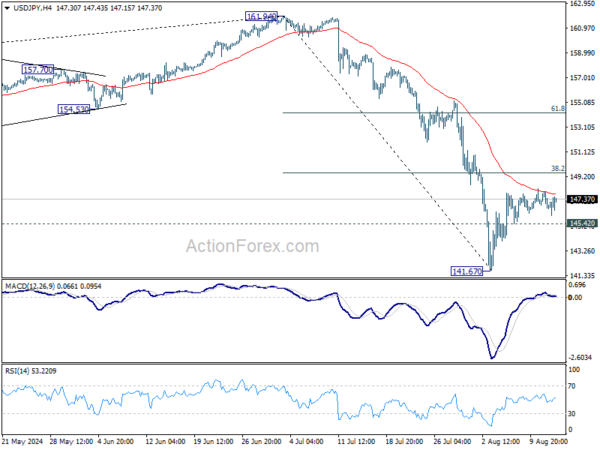

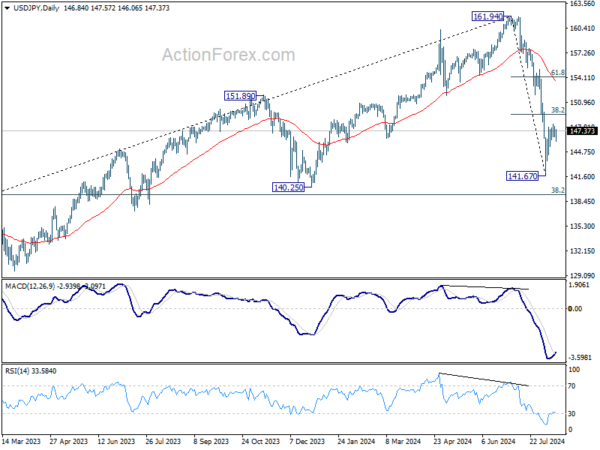

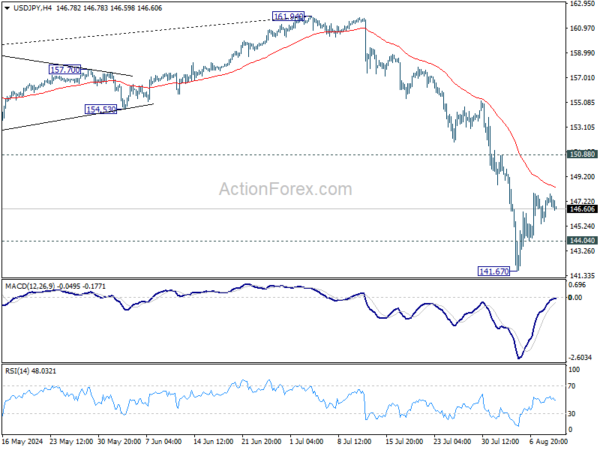

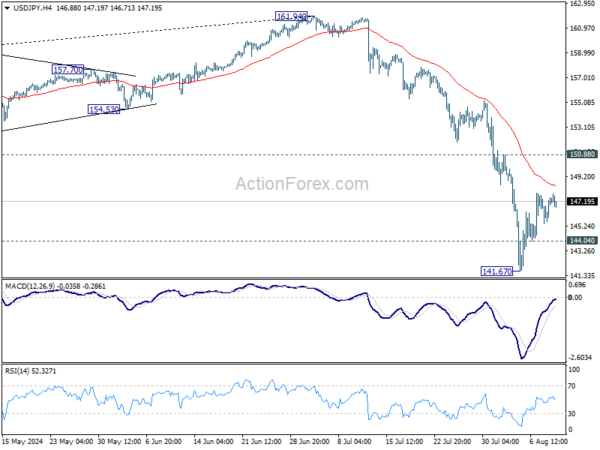

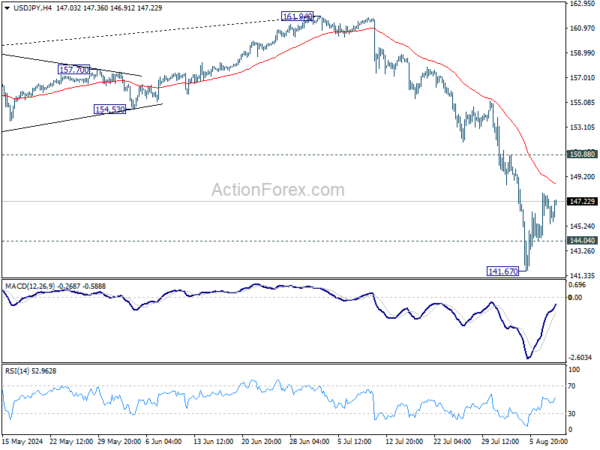

Intraday bias in USD/JPY remains mildly on the downside at this point. Rebound from 141.67 could have completed at 149.35 after rejection by 38.2% retracement of 161.94 to 141.67 at 149.41. Deeper fall would be seen to retest 141.67 low. Firm break there will resume the whole fall from 161.94 to 139.26 fibonacci level next. For now, risk will stay on the downside as long as 149.35 resistance holds, in case of recovery.

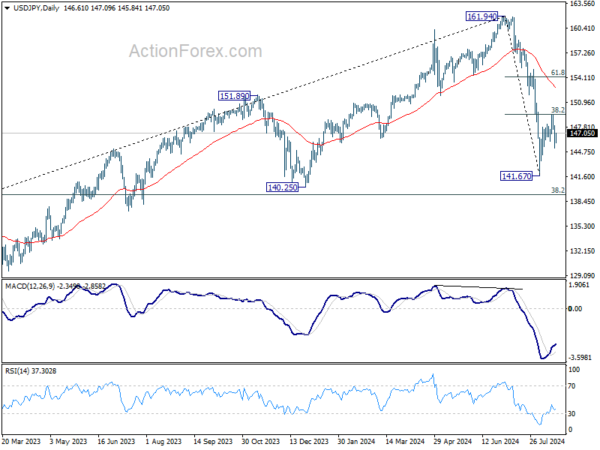

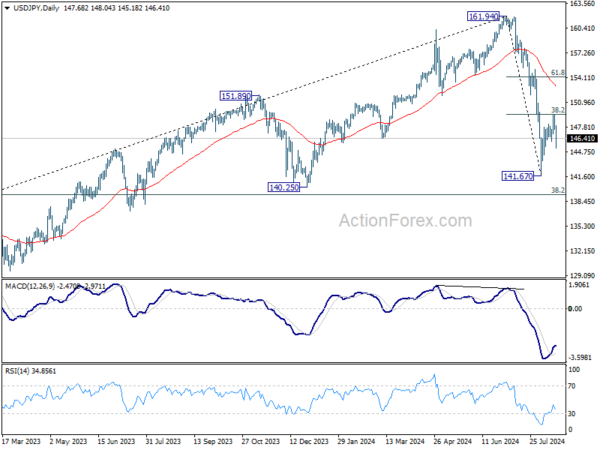

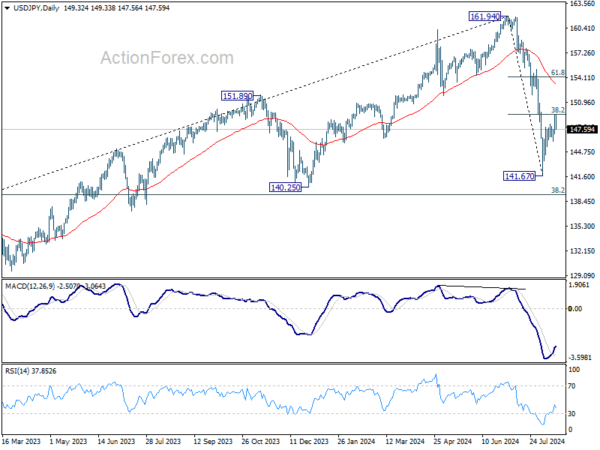

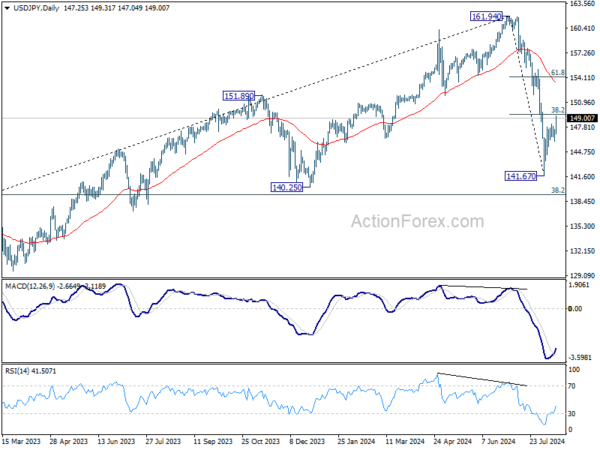

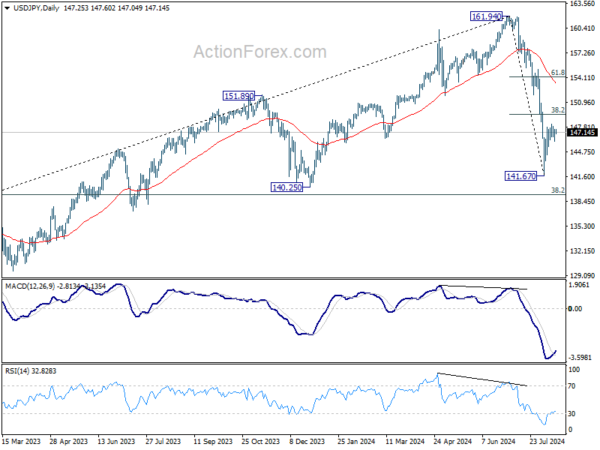

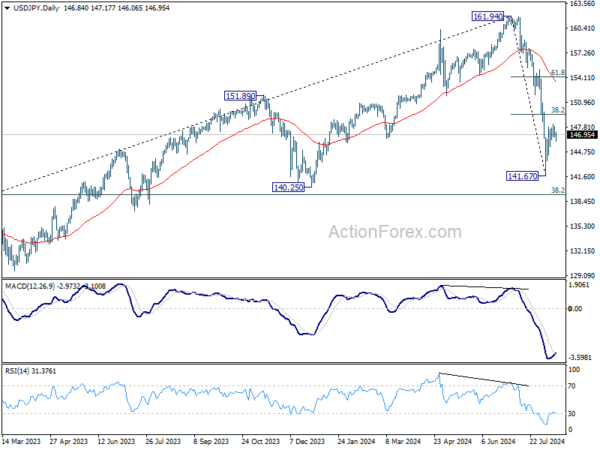

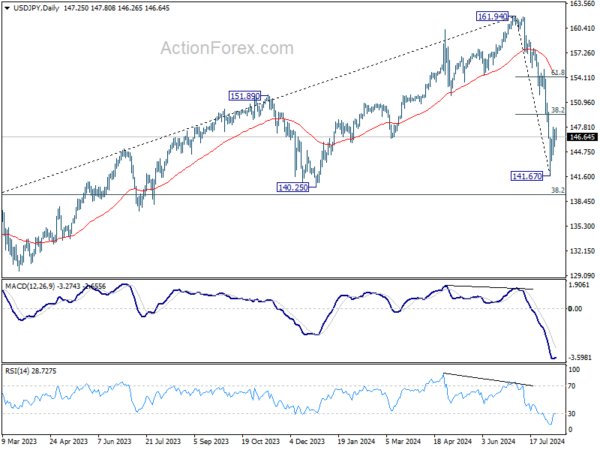

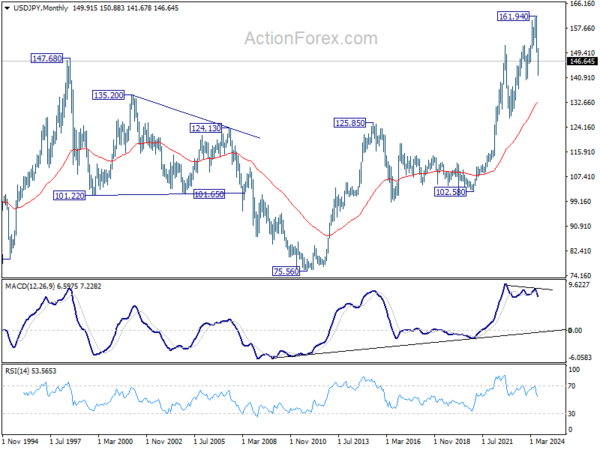

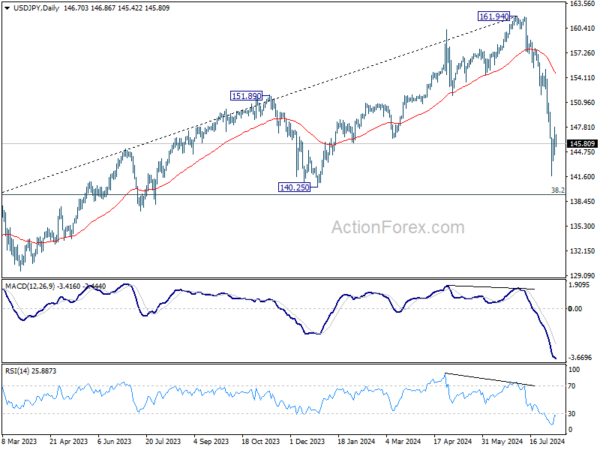

In the bigger picture, fall from 161.94 medium term is seen as correcting whole up trend from 102.58 (2021 low). Deeper decline could be seen to 38.2% retracement of 102.58 to 161.94 at 139.26, which is close to 140.25 support. In any case, risk will stay on the downside as long as 55 W EMA (now at 149.63) holds. Nevertheless, firm break of 55 W EMA will suggest that the range for medium term corrective pattern is already set.