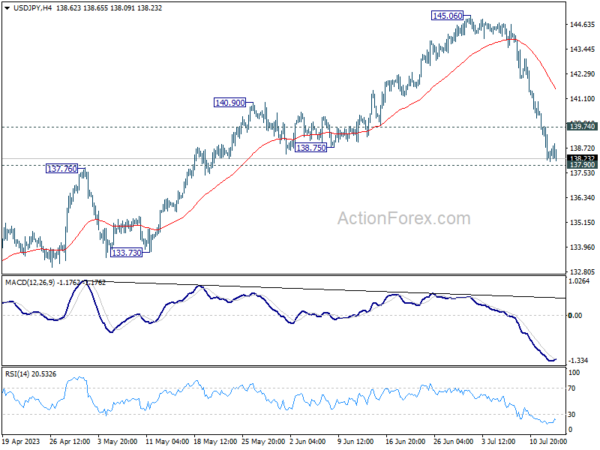

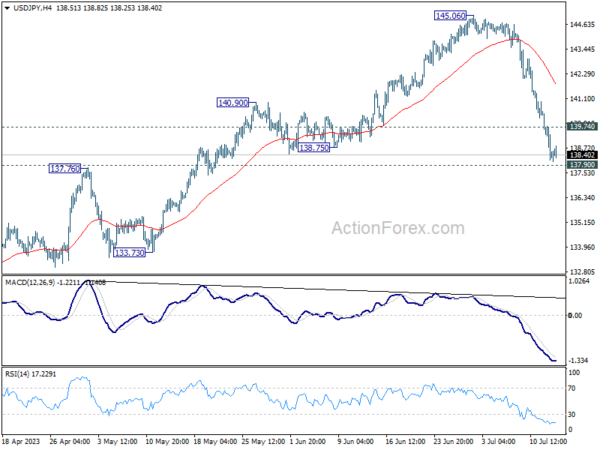

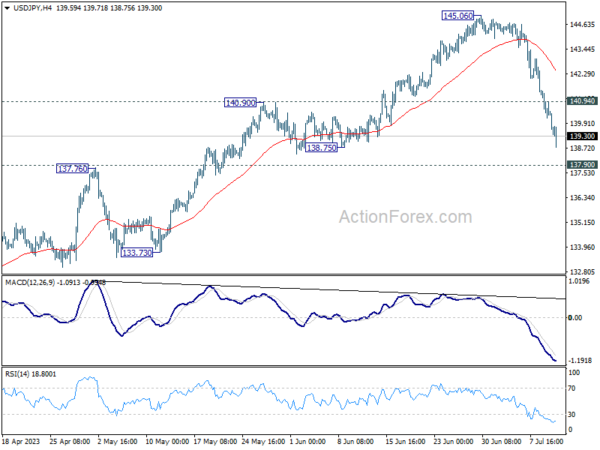

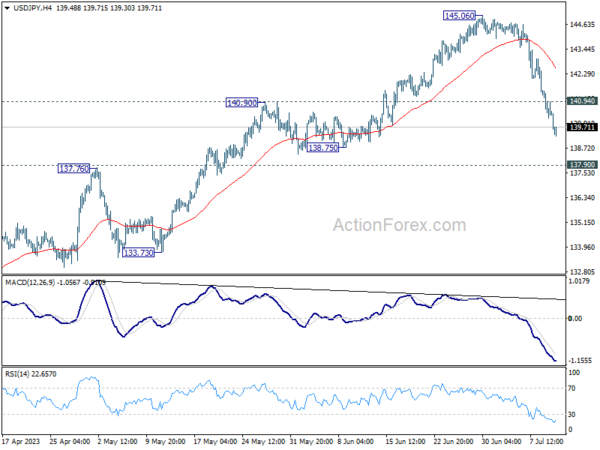

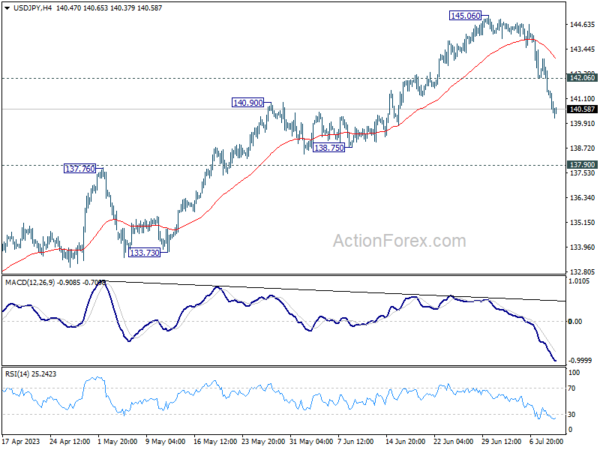

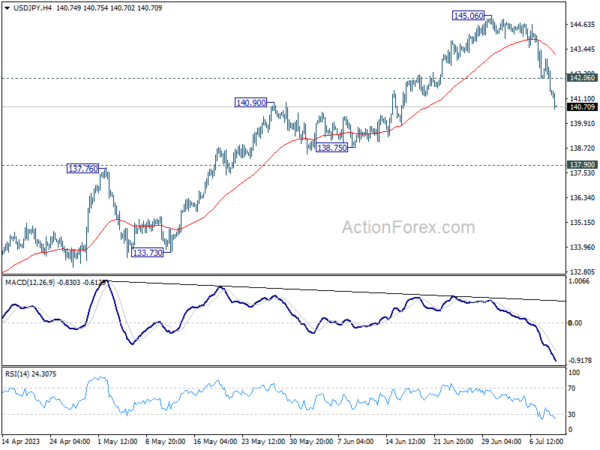

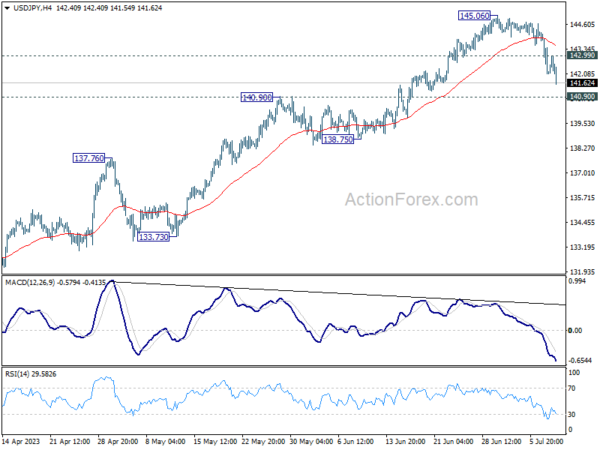

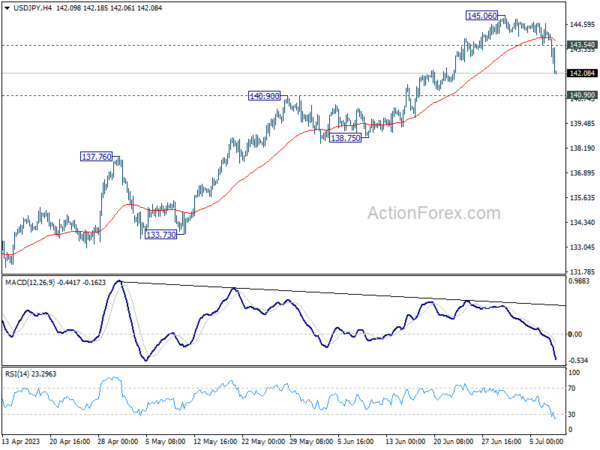

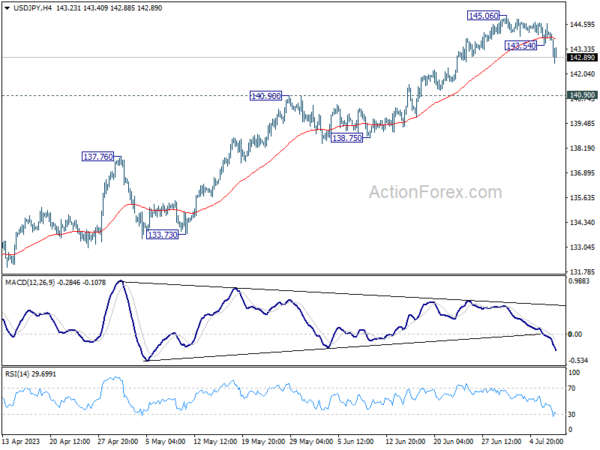

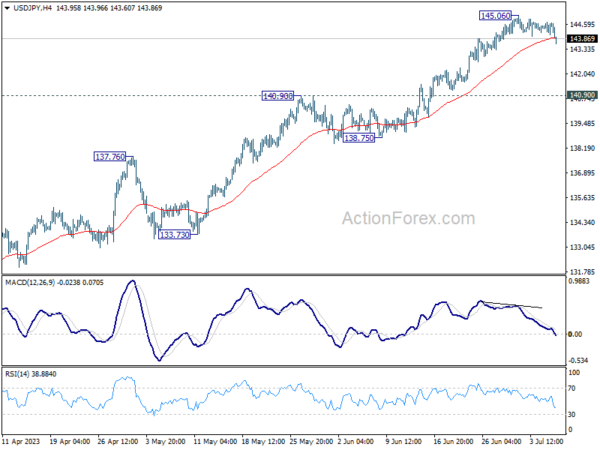

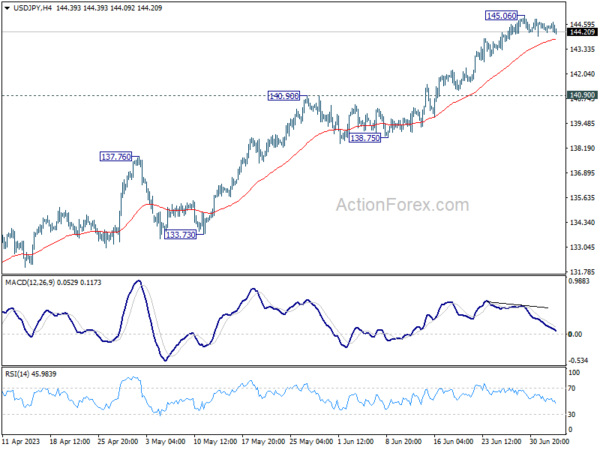

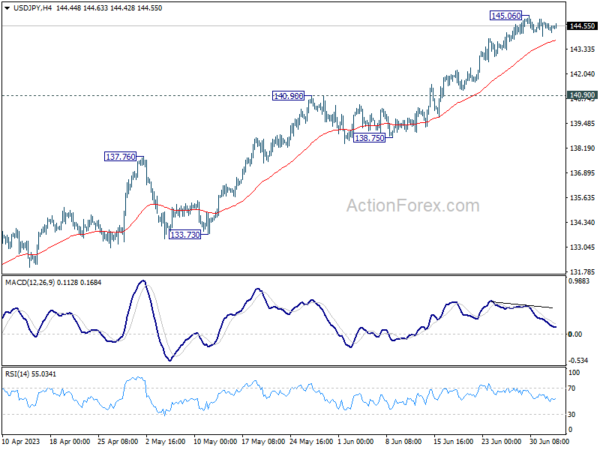

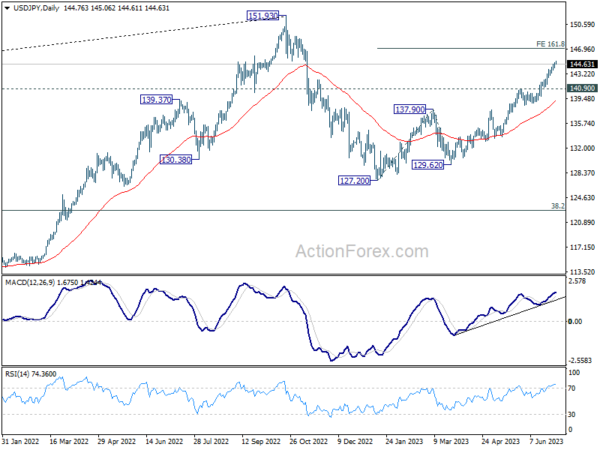

Daily Pivots: (S1) 139.86; (P) 140.66; (R1) 141.16; More…

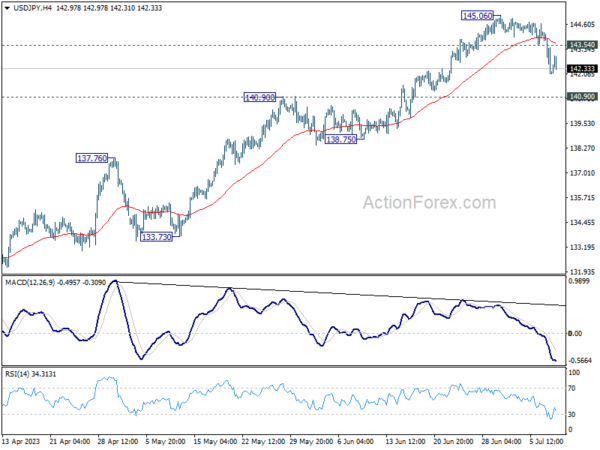

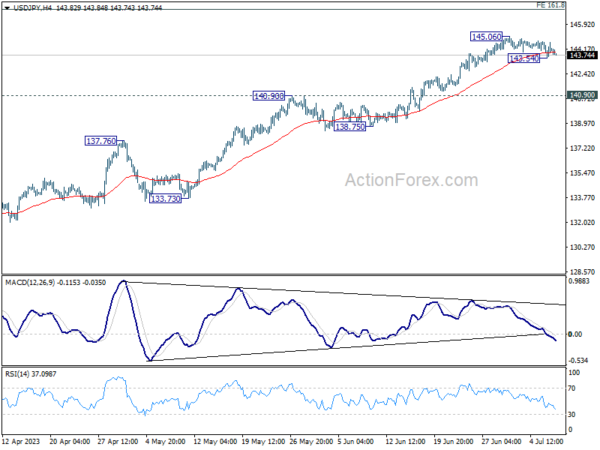

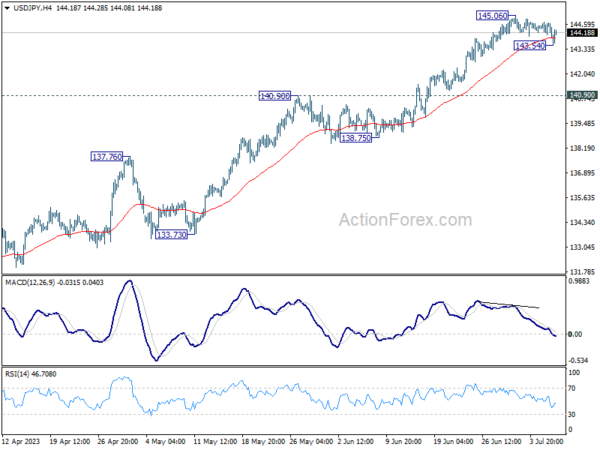

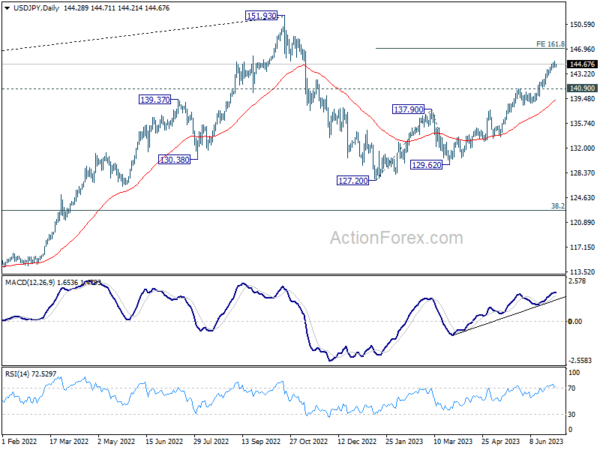

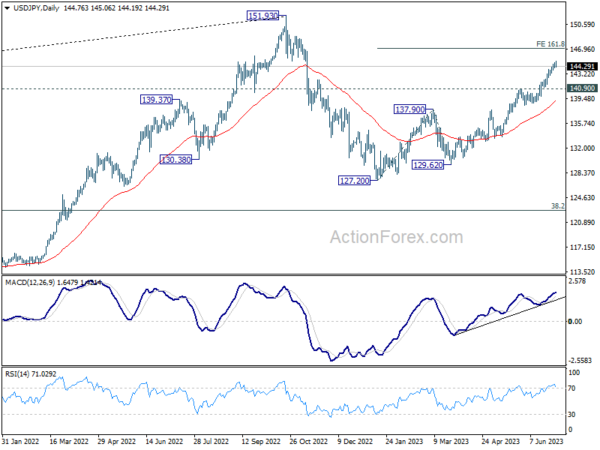

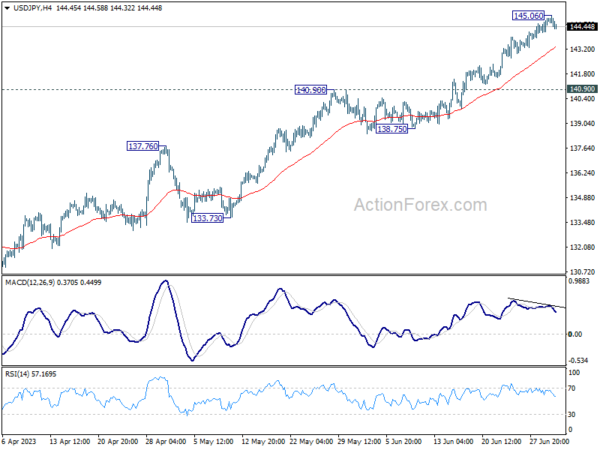

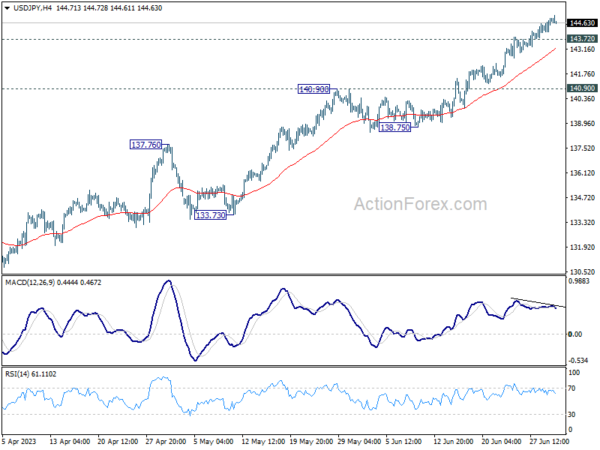

Intraday bias in USD/JPY stays on the downside with focus on 137.90 resistance turned support. Decisive break there will confirm the larger bearish case, and target 127.20 and below. On the upside, above 139.74 minor resistance will turn intraday bias neutral and bring consolidations first, before staging another fall.

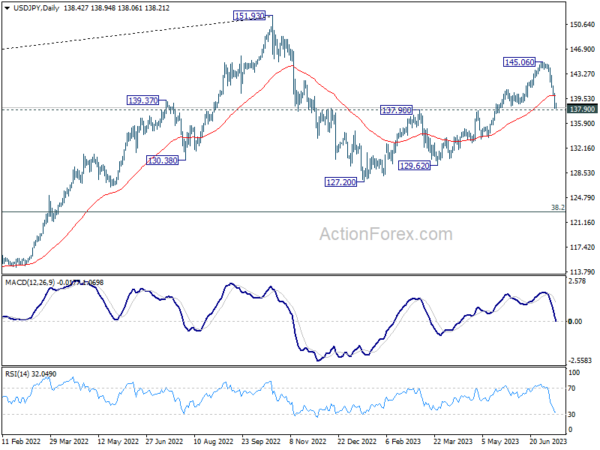

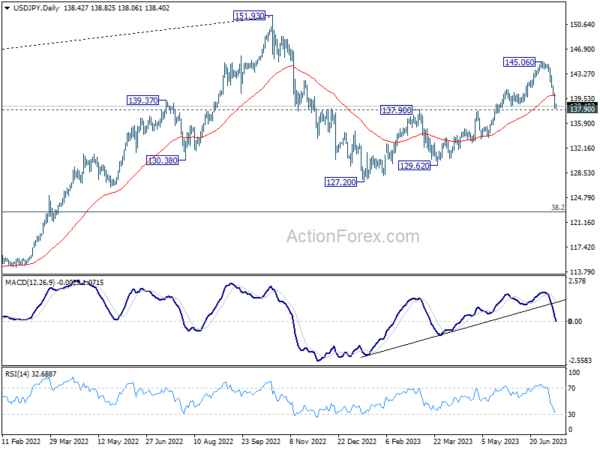

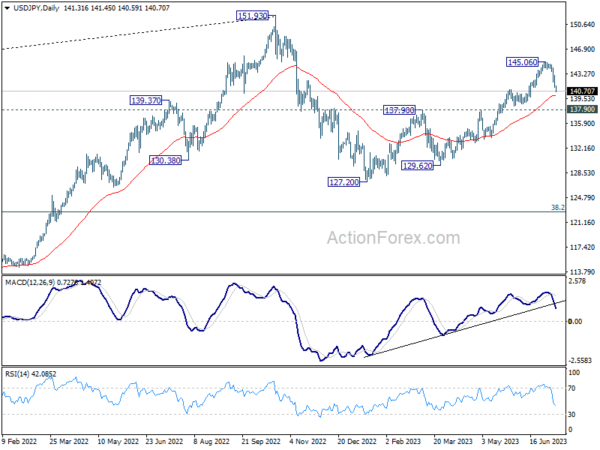

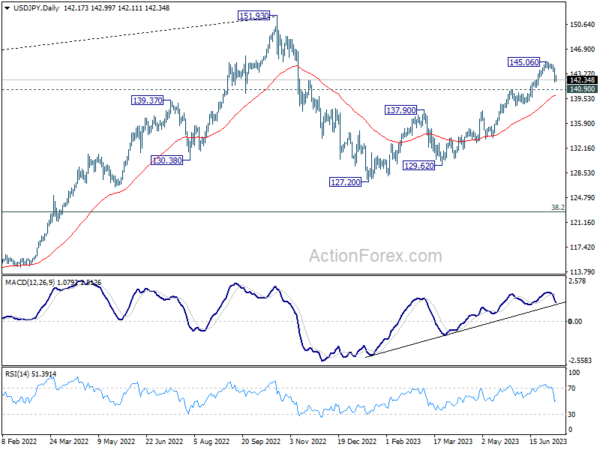

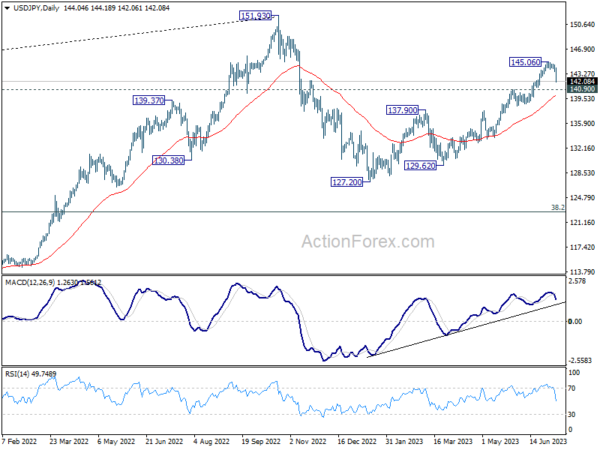

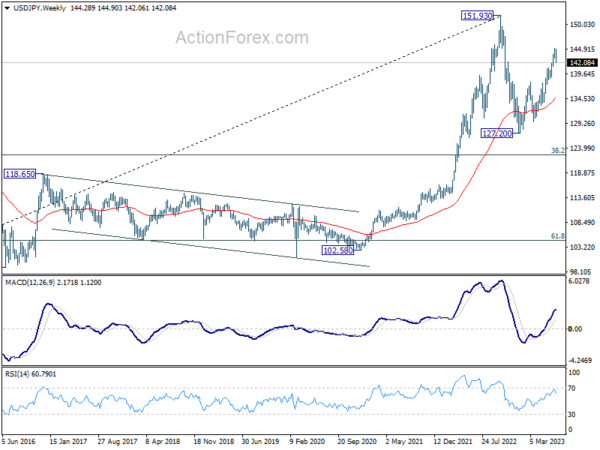

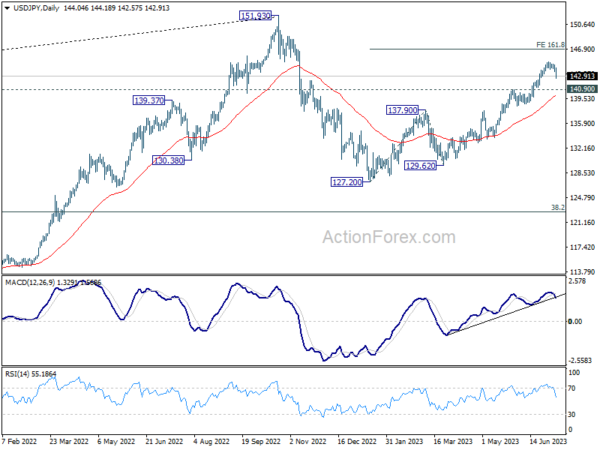

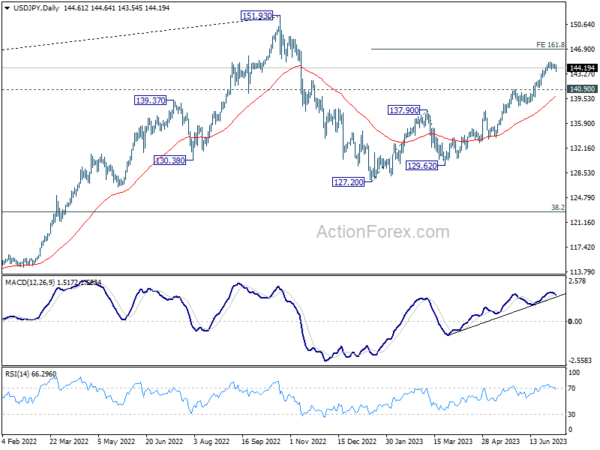

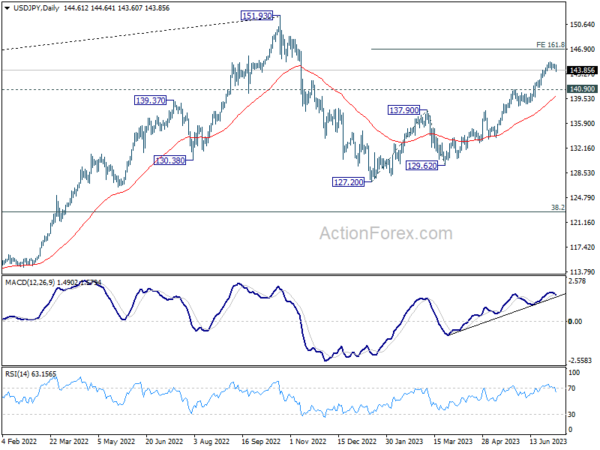

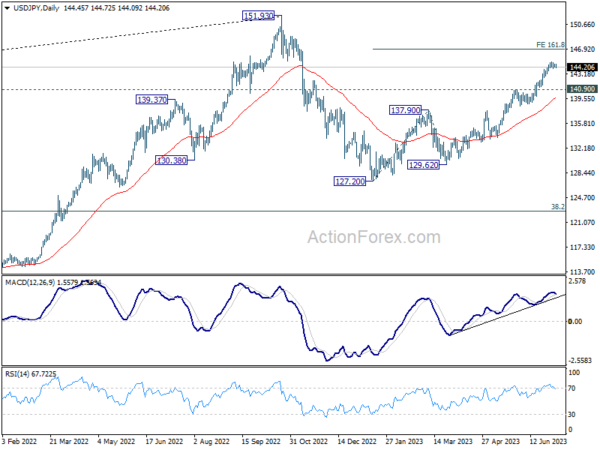

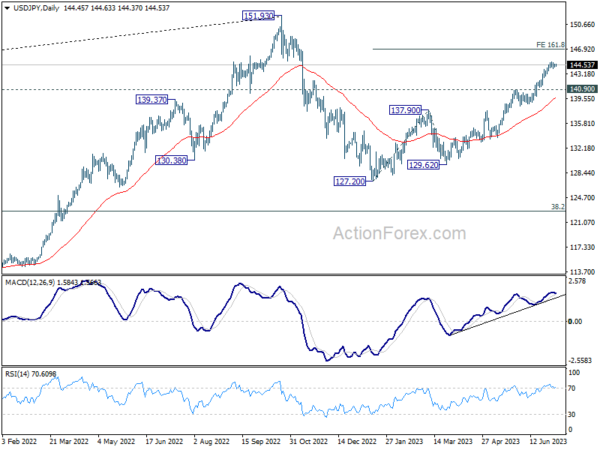

In the bigger picture, current downside acceleration, as seen in daily MACD, argues that fall from 145.06 is already the third leg of the corrective pattern from 151.93 (2022 high). Sustained break of 137.90 resistance turned support should confirm this case and target 127.20 (2023 low) and below. For now, this will remain the favored case as long as 145.06 resistance holds.