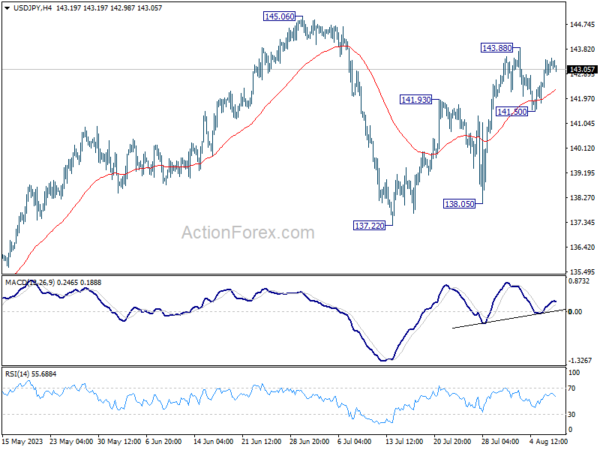

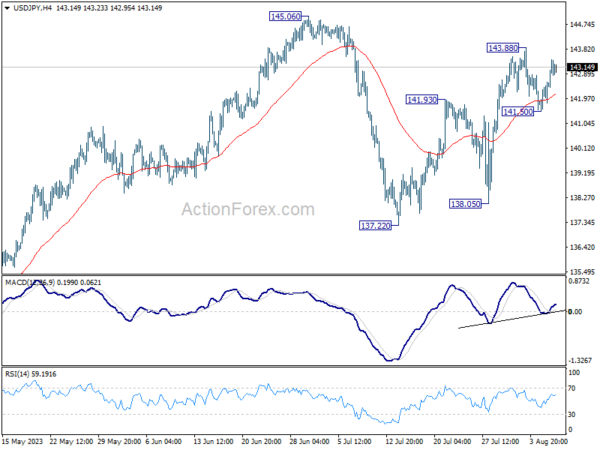

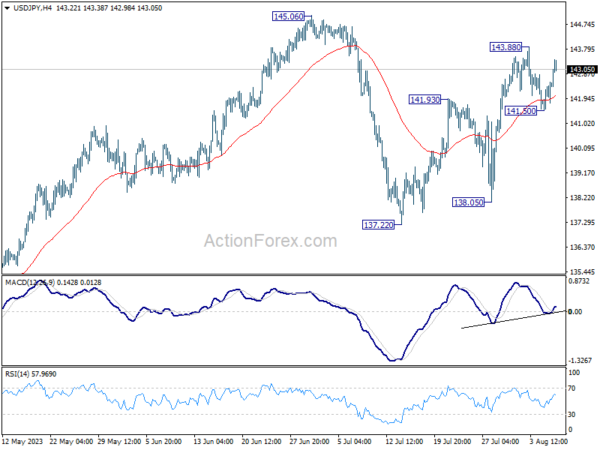

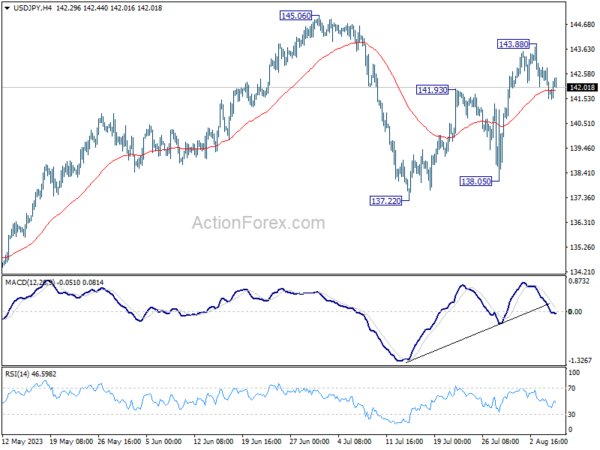

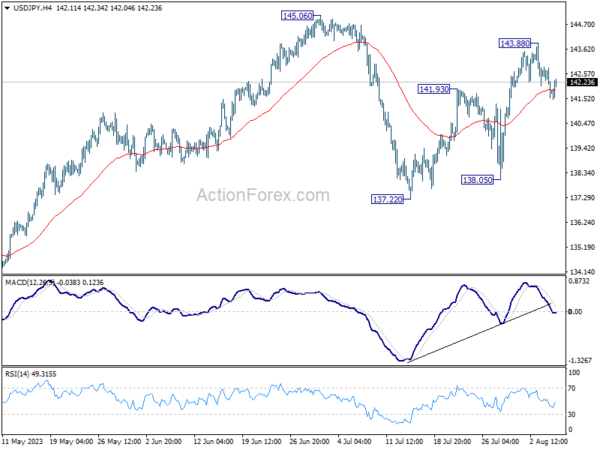

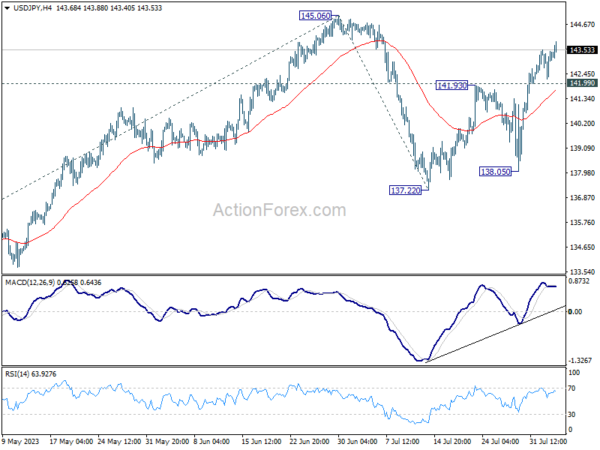

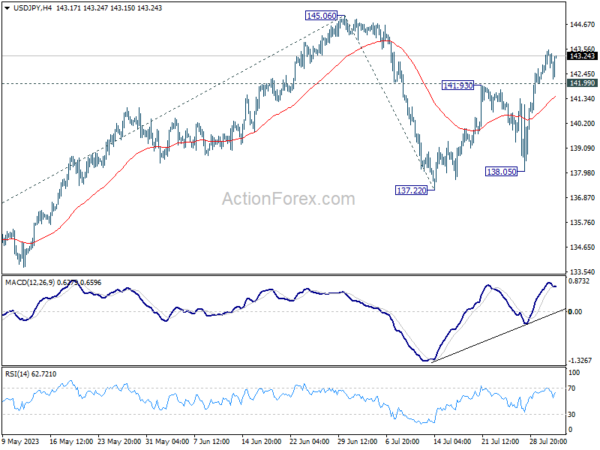

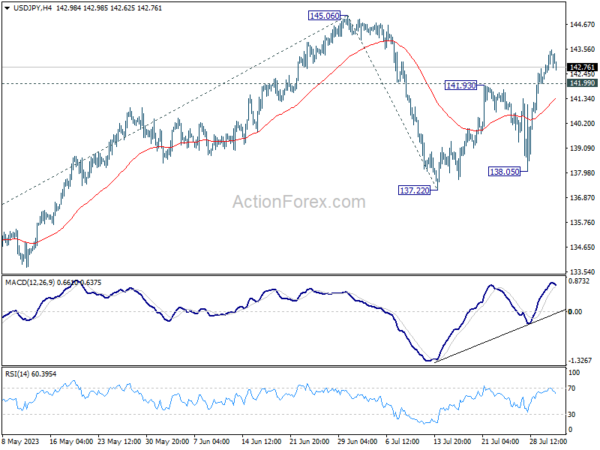

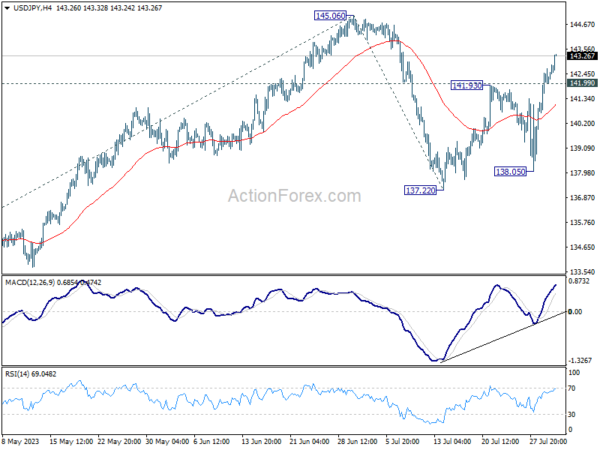

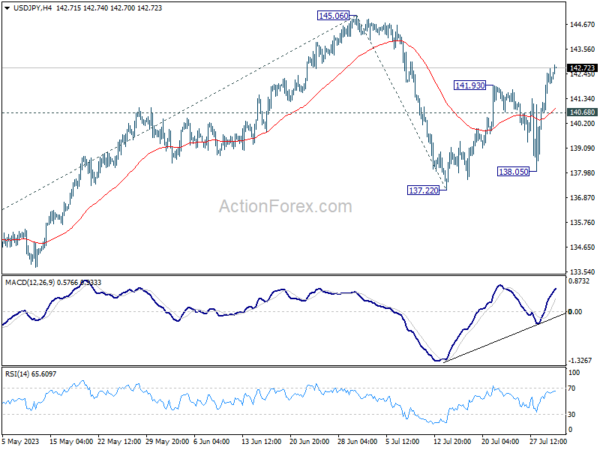

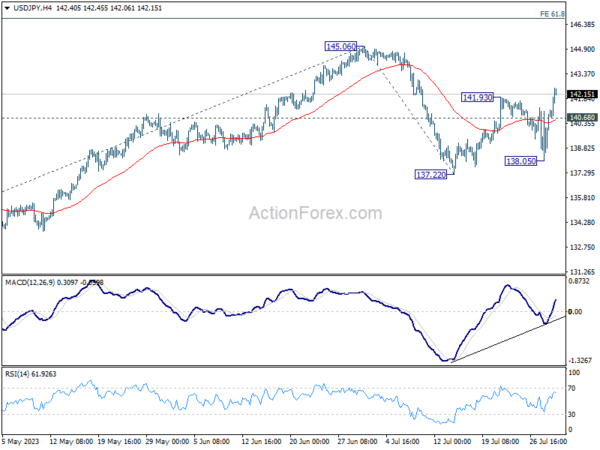

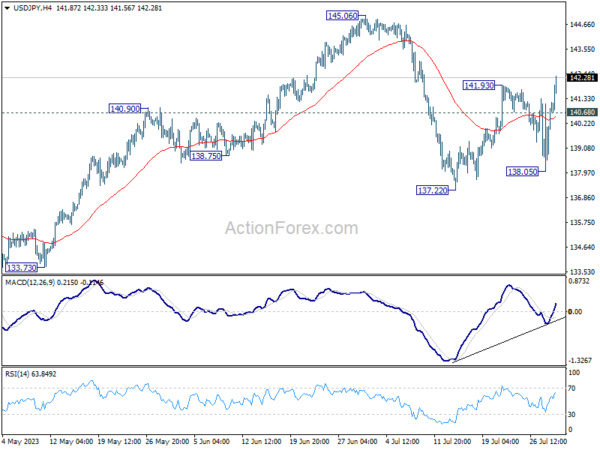

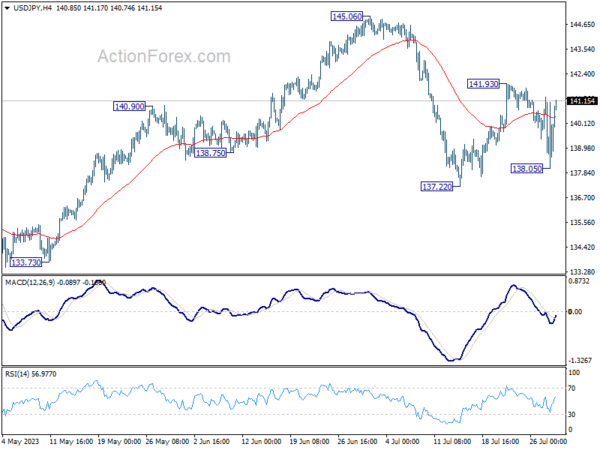

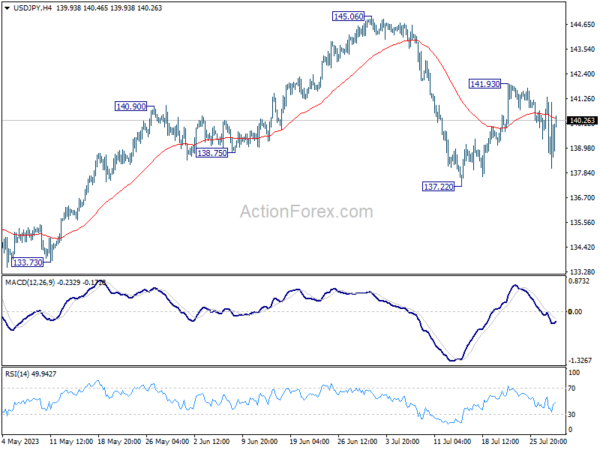

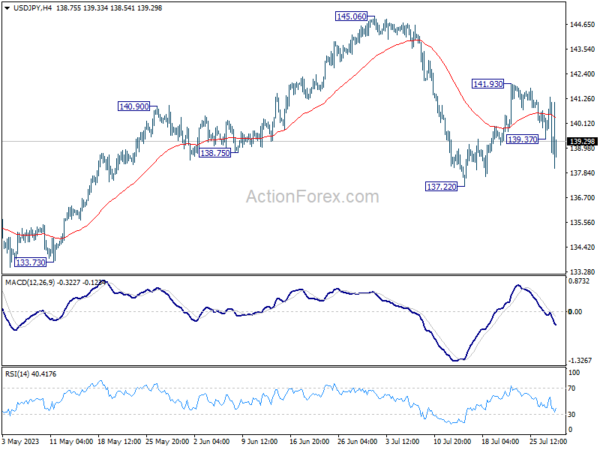

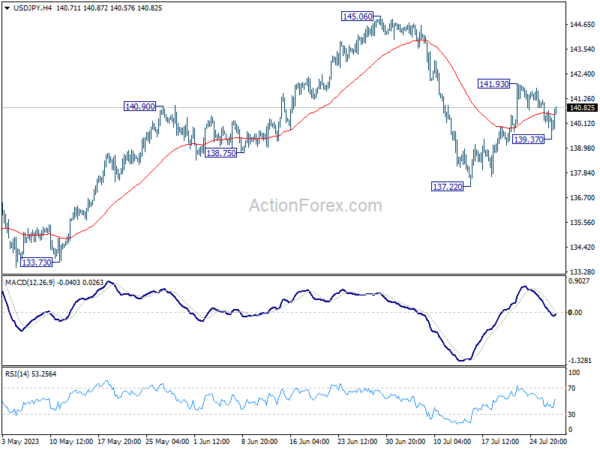

Daily Pivots: (S1) 142.69; (P) 143.10; (R1) 143.78; More…

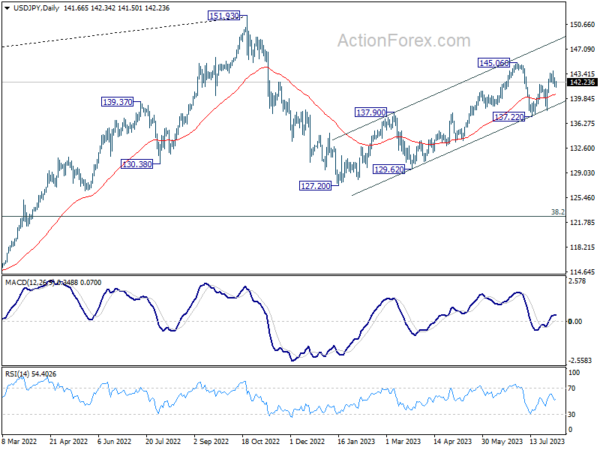

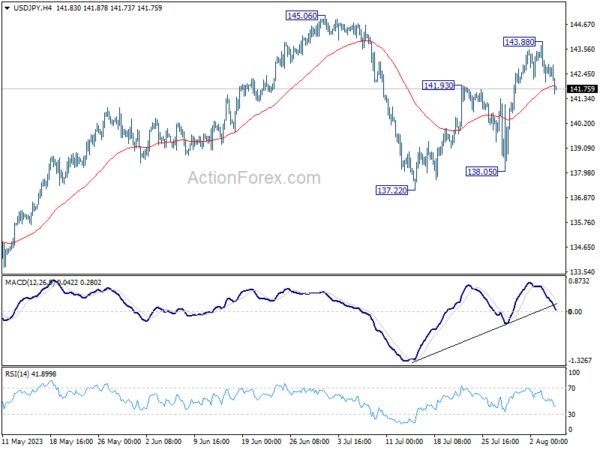

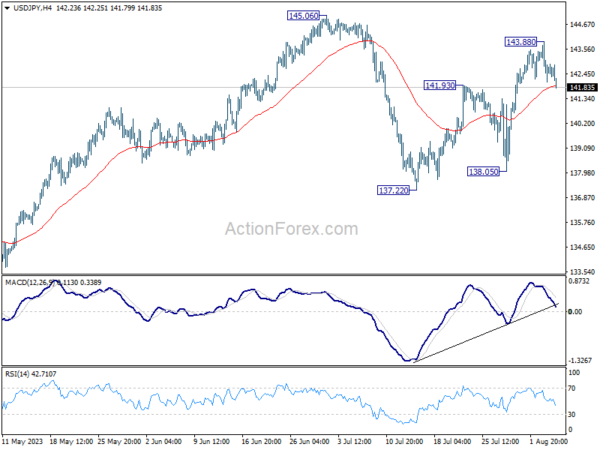

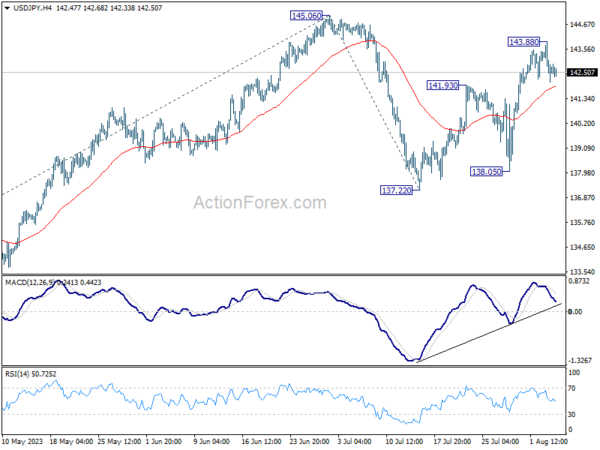

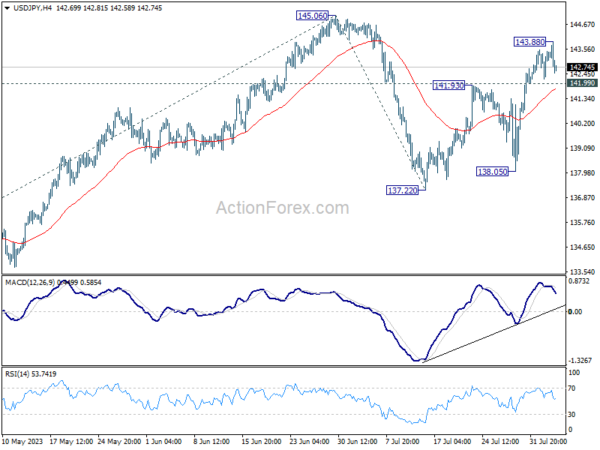

Intraday bias in USD/JPY stays neutral at this point. On the upside, break of 143.88 will resume the rebound from 137.22 to retest 145.06. Decisive break there will resume whole rally from 127.20. On the downside, however, break of 141.50 will turn bias back to the downside for 55 D EMA (now at 140.60).

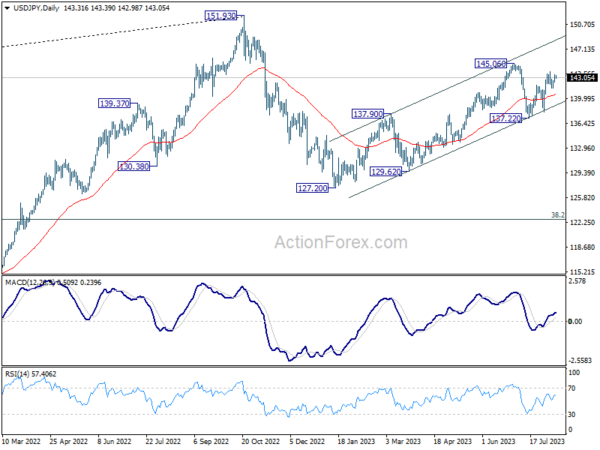

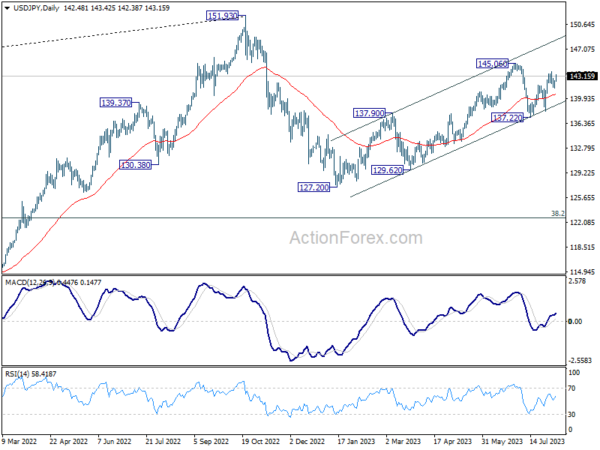

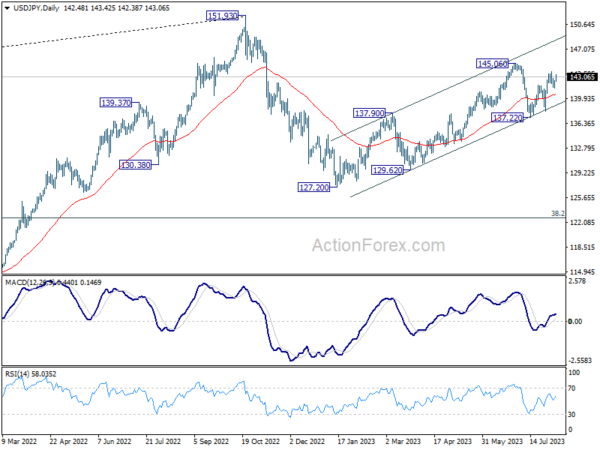

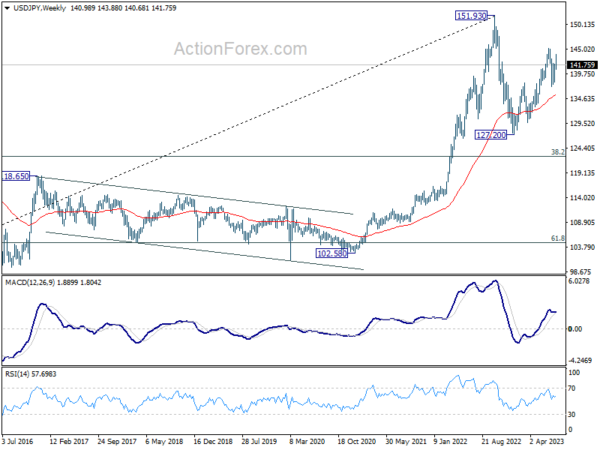

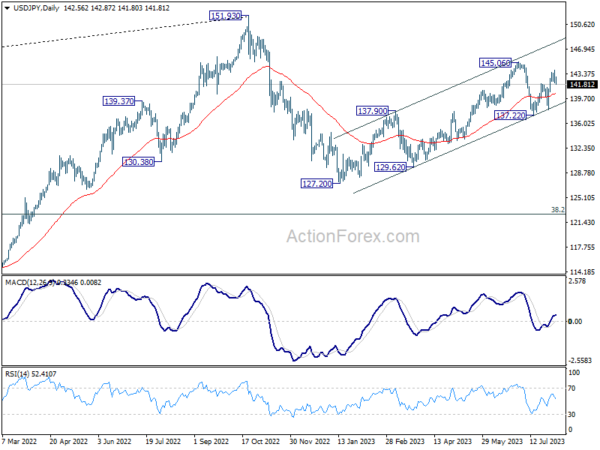

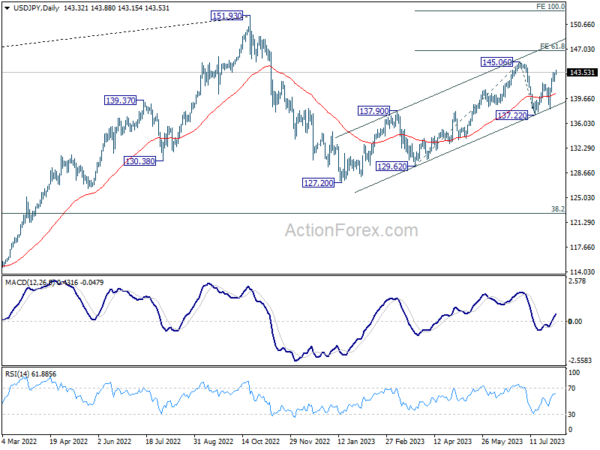

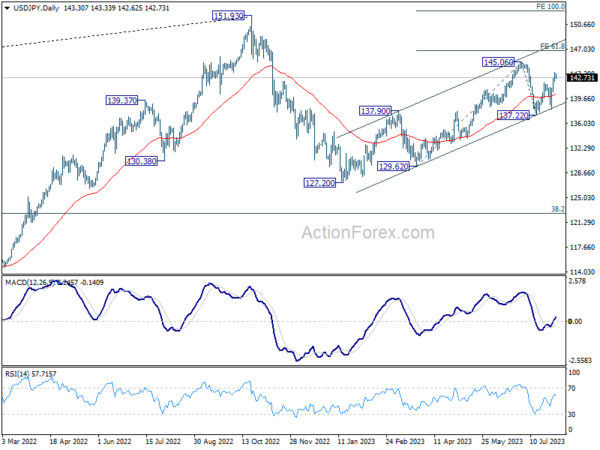

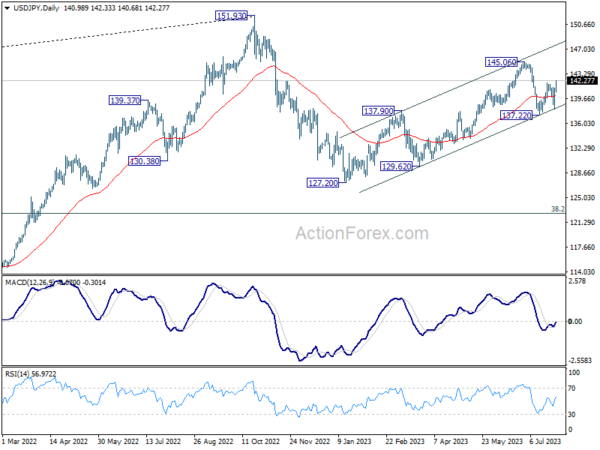

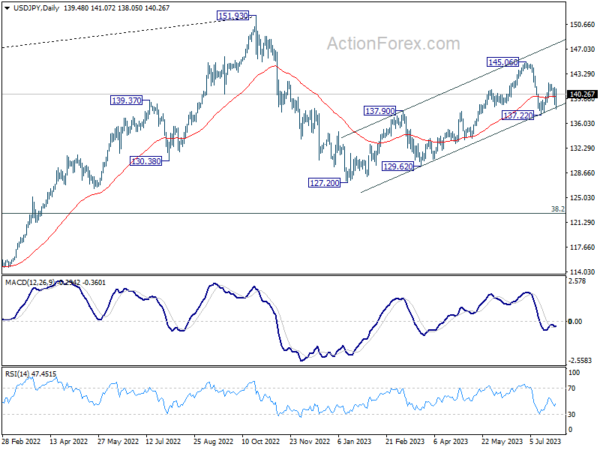

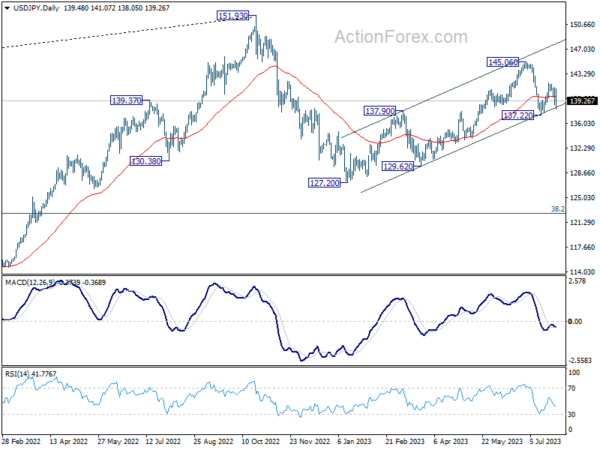

In the bigger picture, overall price actions from 151.93 (2022 high) are views as a corrective pattern. Rise from 127.20 is seen as the second leg of the pattern and could still be in progress. But even in case of extended rise, strong resistance should be seen from 151.93 to limit upside. Meanwhile, break of 137.22 support should confirm the start of the third leg to 127.20 (2023 low) and below.