The Swiss National Bank is leaving the SNB policy rate unchanged at 1.75%. The significant tightening of monetary policy over recent quarters is countering remaining inflationary pressure. From today’s perspective, it cannot be ruled out that a further tightening of monetary policy may become necessary to ensure price stability over the medium term. The SNB will therefore monitor the development of inflation closely in the coming months. To provide appropriate monetary conditions, the SNB is also willing to be active in the foreign exchange market as necessary. In the current environment, the focus is on selling foreign currency.

Banks’ sight deposits held at the SNB will continue to be remunerated at the SNB policy rate of 1.75% up to a certain threshold. Sight deposits above this threshold will be remunerated at an interest rate of 1.25%, and thus still at a discount of 0.5 percentage points relative to the SNB policy rate.

Inflation has declined further in recent months, and stood at 1.6% in August. This decrease was above all attributable to lower inflation on imported goods and services.

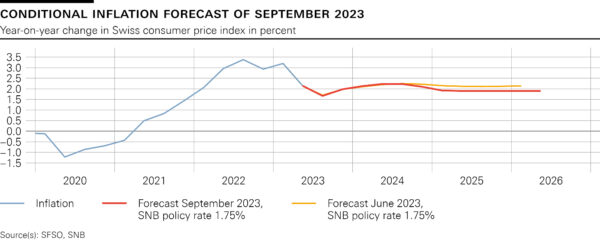

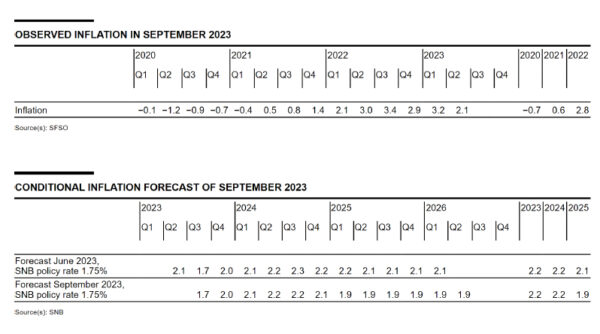

The new conditional inflation forecast is based on the assumption that the SNB policy rate is 1.75% over the entire forecast horizon (cf. chart 1). In the medium term, the new forecast is somewhat below that of June, mainly due to the economic slowdown and slightly lower inflationary pressure from abroad. The inflation forecast puts average annual inflation at 2.2% for 2023 and 2024, and at 1.9% for 2025 (cf. table 1). It is thus just within the range of price stability at the end of the forecast horizon.

Global economic growth was moderate in the second quarter of this year. Although inflation continued to decline in many countries, it remains clearly above the respective targets. Against this background, numerous central banks tightened their monetary policy further during the last quarter, albeit at a slower pace than in the previous quarters.

The growth outlook for the global economy in the coming quarters remains subdued. At the same time, inflation is likely to remain elevated worldwide for the time being. Over the medium term, however, it should return to more moderate levels, not least due to more restrictive monetary policy.

This scenario for the global economy remains subject to large risks. In particular, the high inflation in some countries could be more persistent than expected, necessitating a further tightening of monetary policy there. Equally, the energy situation in Europe could deteriorate again in Q4 2023 and Q1 2024. A pronounced slowdown in the global economy therefore cannot be ruled out.

Swiss GDP stagnated in the second quarter of 2023. The services sector once again grew solidly, while value added in manufacturing contracted significantly. The labour market remained robust, and utilisation of overall production capacity continued to be above average, albeit only slightly.

Growth is expected to remain weak for the rest of the year. Subdued demand from abroad, the loss of purchasing power due to inflation, and more restrictive financing conditions are having a dampening effect. Overall, Switzerland’s GDP is likely to grow by around 1% this year. In this environment, unemployment will probably continue to rise slightly, and the utilisation of production capacity is likely to decline somewhat.

The forecast for Switzerland, as for the global economy, is subject to high uncertainty. The main risk is a more pronounced economic slowdown abroad.

Momentum on the mortgage and real estate markets has weakened noticeably in recent quarters. However, the vulnerabilities in these markets remain.