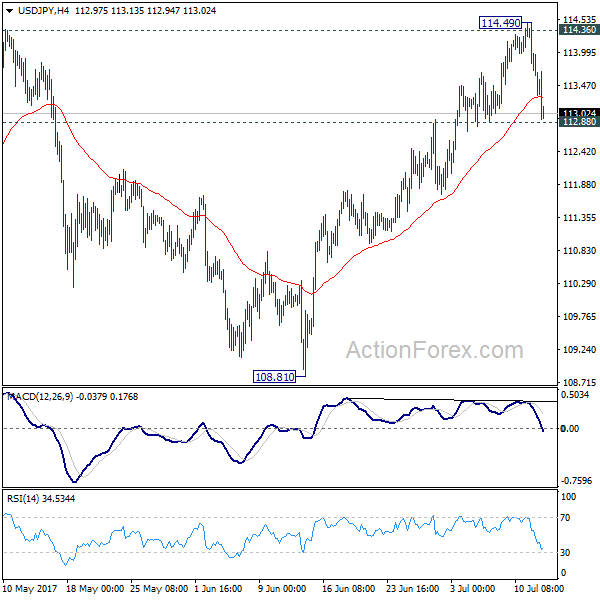

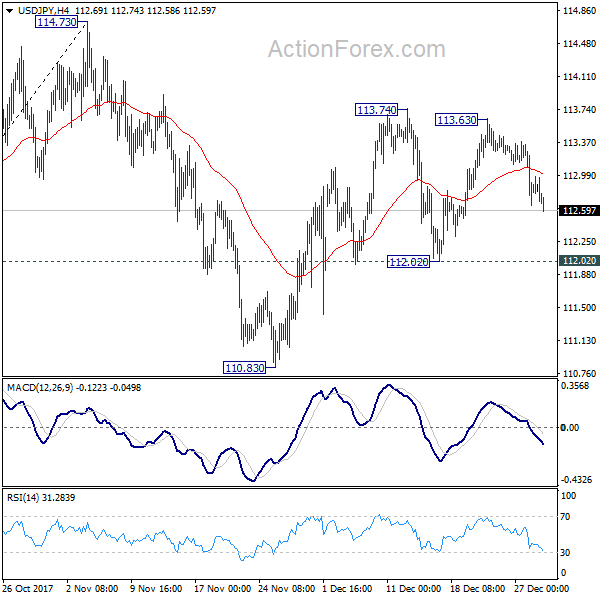

Daily Pivots: (S1) 109.95; (P) 110.21; (R1) 110.49; More…

USD/JPY’s break of 109.79 support suggests that rise from 107.47 has completed at 110.81, after rejection by 110.95 resistance. Consolidation pattern from 110.95 could have started the third leg already. Intraday bias is back on the downside for 109.17 support first. Break there will confirm and target 107.47 again. For now, risk will stay on the downside as long as 110.81 holds, in case of recovery.

In the bigger picture, medium term outlook is staying neutral with 111.71 resistance intact. On the upside, decisive break of 111.71/112.22 resistance will suggest medium term bullish reversal. Rise from 101.18 could then target 118.65 resistance (Dec 2016) and above. However, sustained break of 107.47 support would revive some medium term bearishness, and open up deep fall to 61.8% retracement of 102.58 to 110.95 at 105.77 and below.