Daily Pivots: (S1) 104.97; (P) 105.22; (R1) 105.38; More...

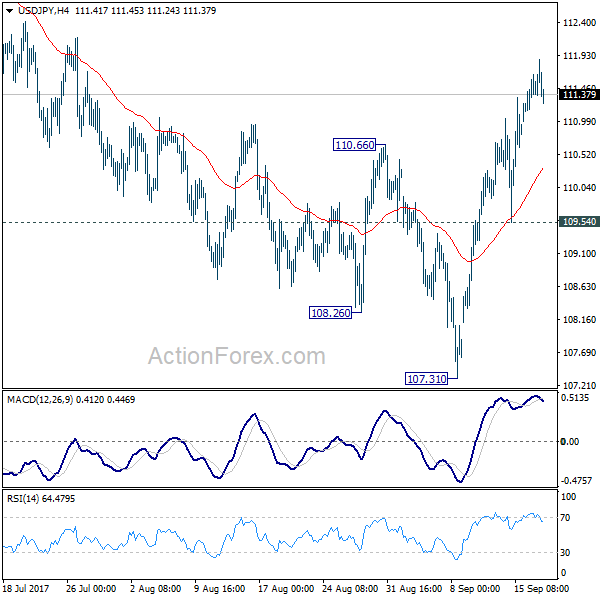

USD/JPY is staying in consolidation from 105.67 and intraday bias remains neutral first. Further rise is still expected with 104.73 support intact. On the upside, firm break of 106.10 resistance should confirm completion of fall from 111.71, and turn outlook bullish for further rally. On the downside, break of 104.57 minor support will turn bias back to the downside for 103.17 low instead.

In the bigger picture, USD/JPY is still staying in long term falling channel that started back in 118.65 (Dec. 2016). Hence, there is no clear indication of trend reversal yet. The down trend could still extend through 101.18 low. On the upside, break of 106.10 resistance will suggest that the decline from 111.71 has completed. Focus will then be back to this resistance to signal medium term reversal.