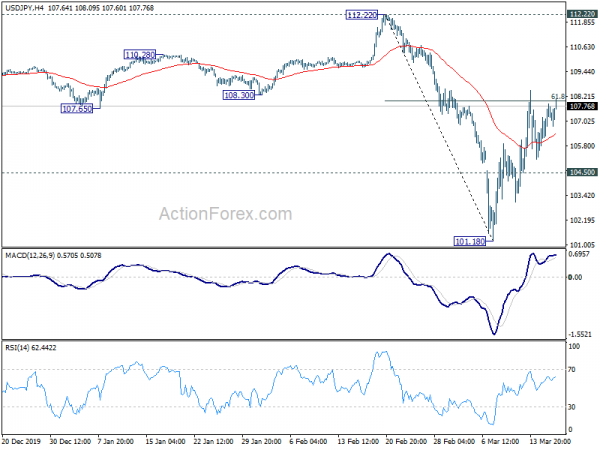

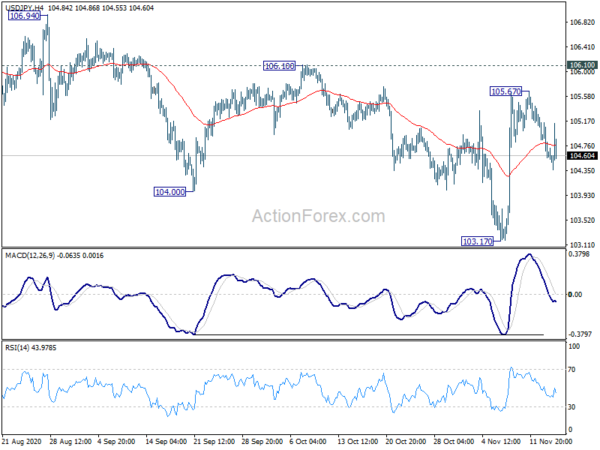

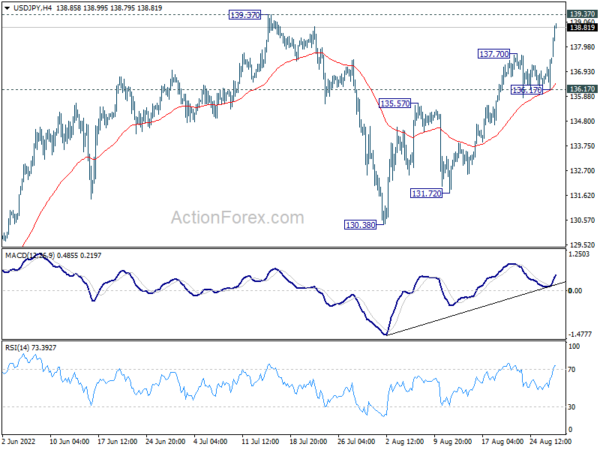

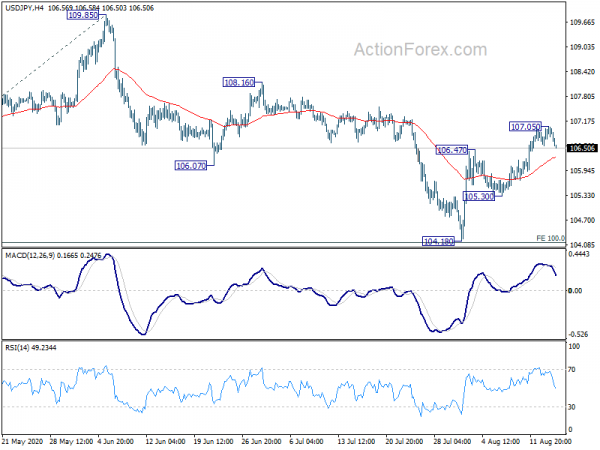

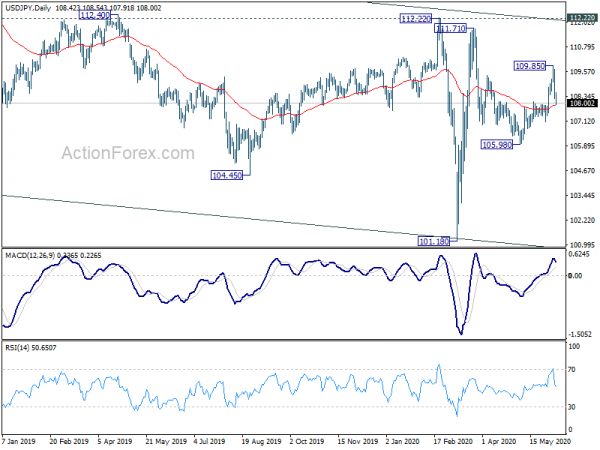

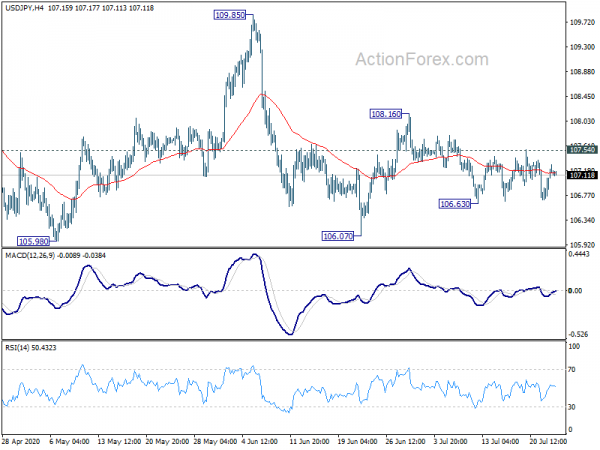

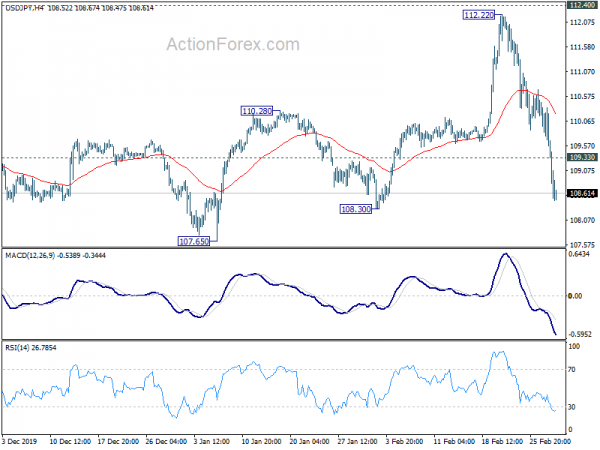

Daily Pivots: (S1) 104.75; (P) 106.38; (R1) 107.62; More..

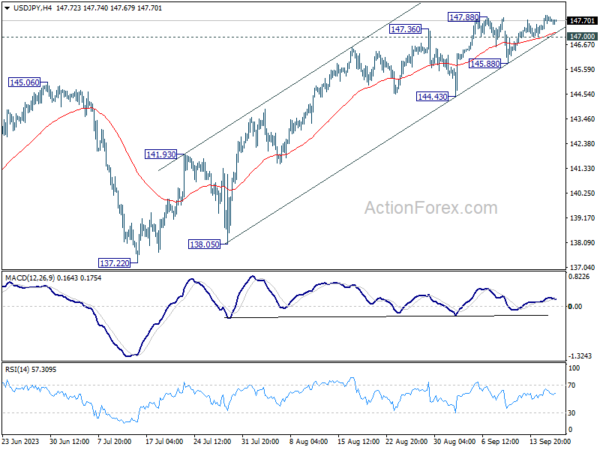

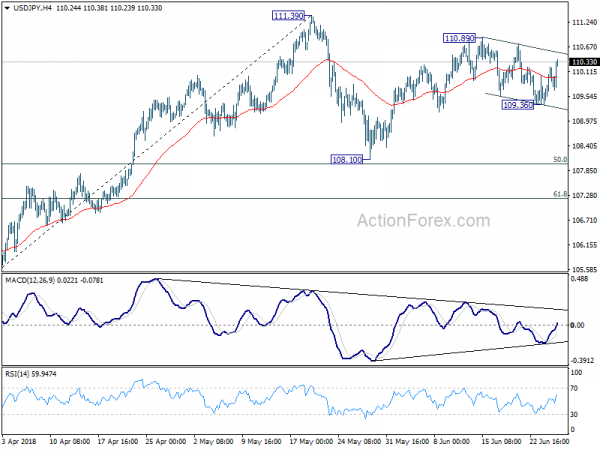

Intraday bias in USD/JPY remains neutral for the moment. Further rise is mildly in favor with 104.50 minor support intact. On the upside, sustained break of 61.8% retracement of 112.22 to 101.18 at 108.00 will target 112.22 resistance next. On the downside, break of 104.50 will turn intraday bias back to the downside for retesting 101.18 low instead.

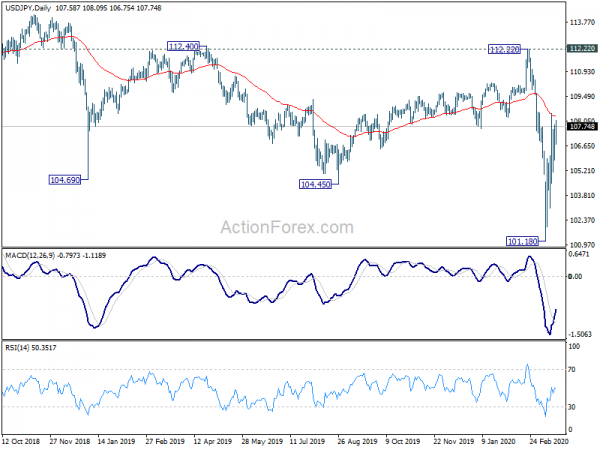

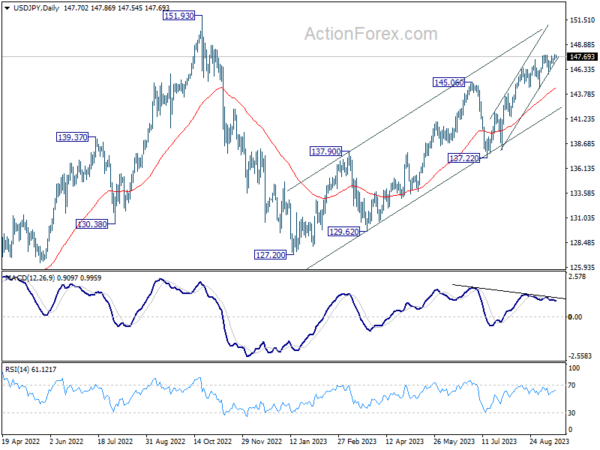

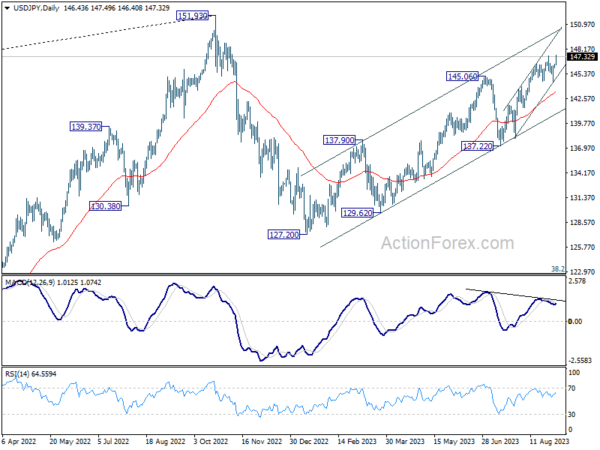

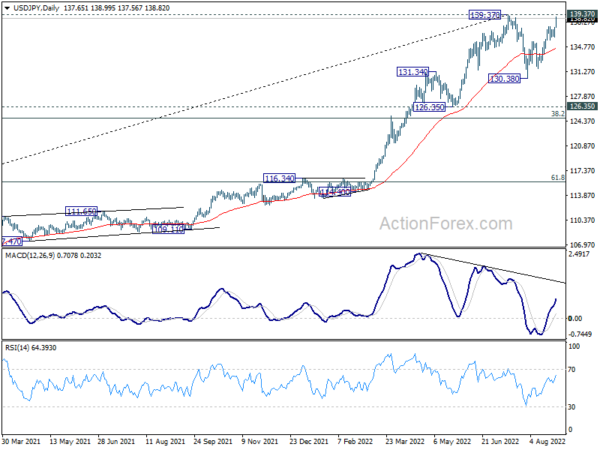

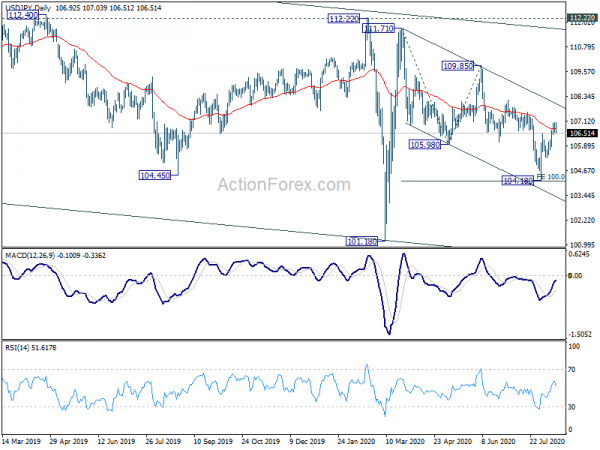

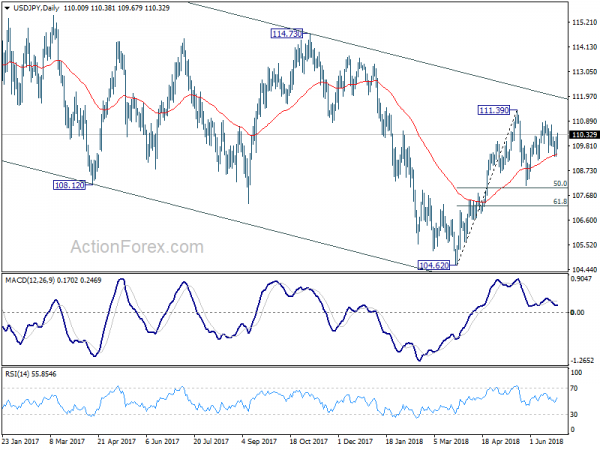

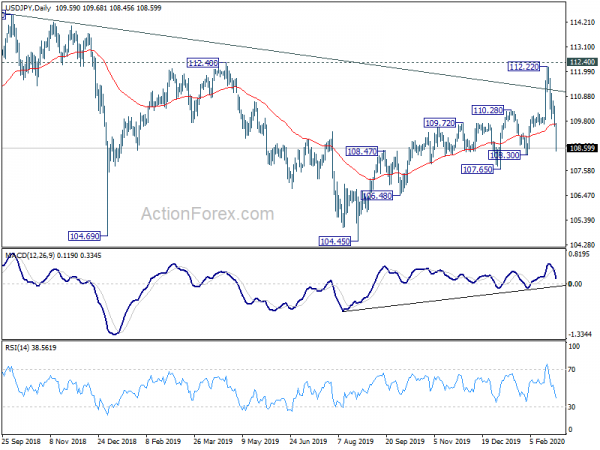

In the bigger picture, fall from 118.65 (Dec. 2016) is still in progress. It’s seen as part of a larger consolidative pattern from 125.85 (2015 high). Such decline could could extend through 98.97 (2016 low). For now, risk will remain on the downside as long as 112.22 resistance holds, even in case of rebound. However, break of 112.22 will be a strong sign on medium term bullish reversal.