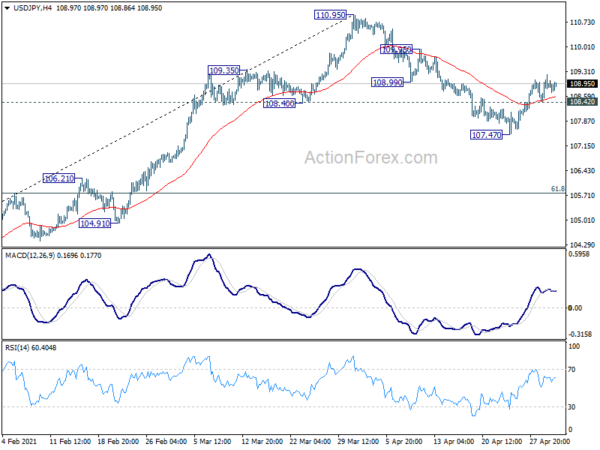

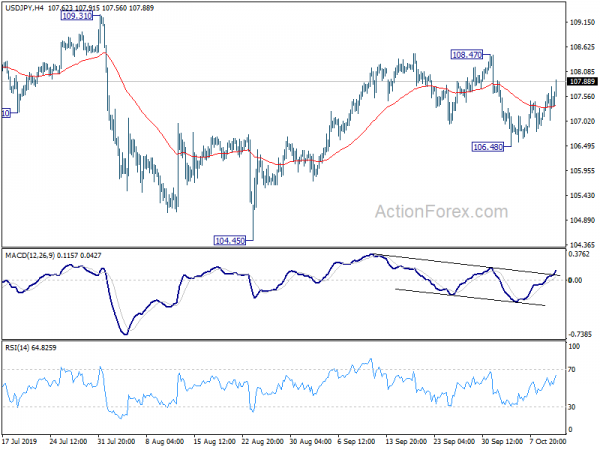

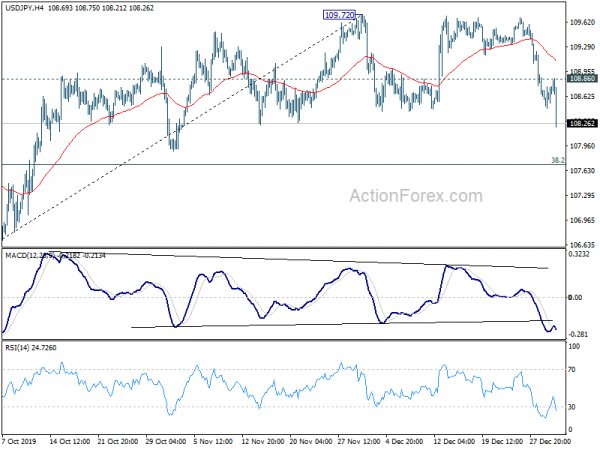

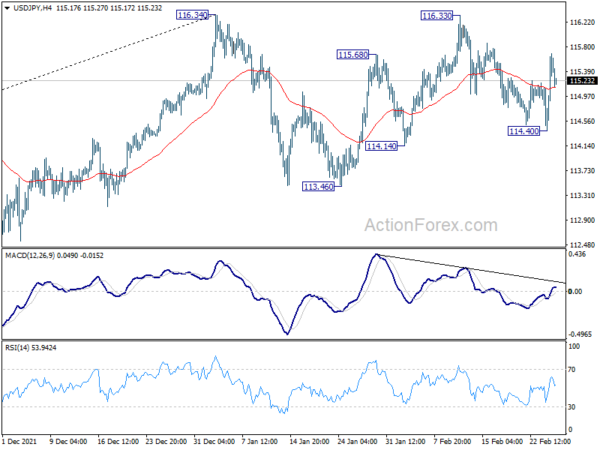

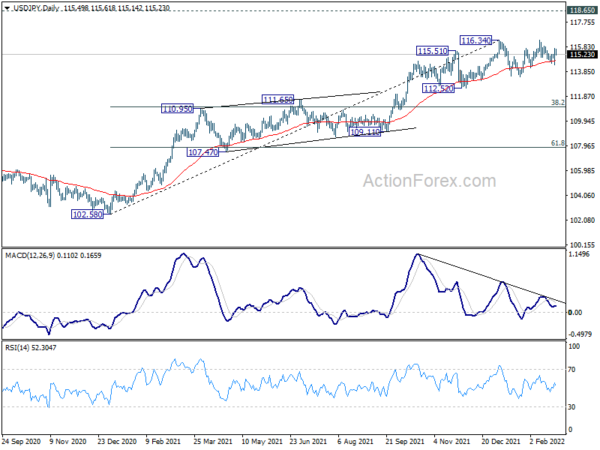

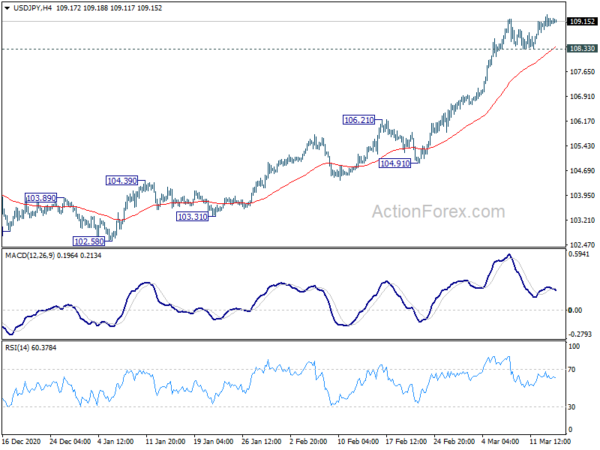

Daily Pivots: (S1) 108.50; (P) 108.86; (R1) 109.28; More…

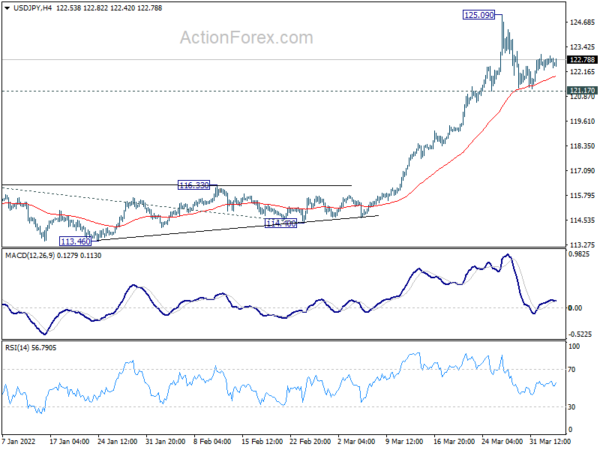

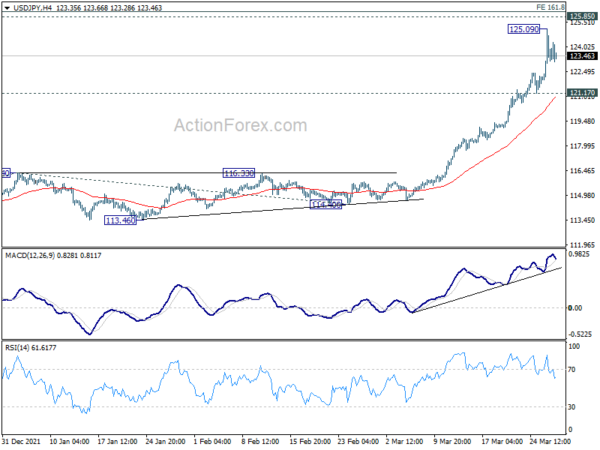

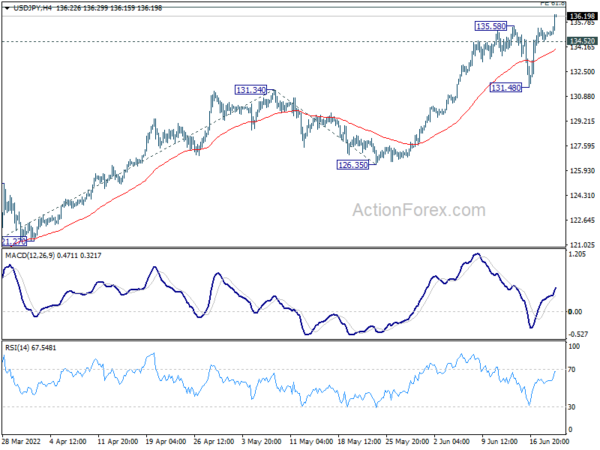

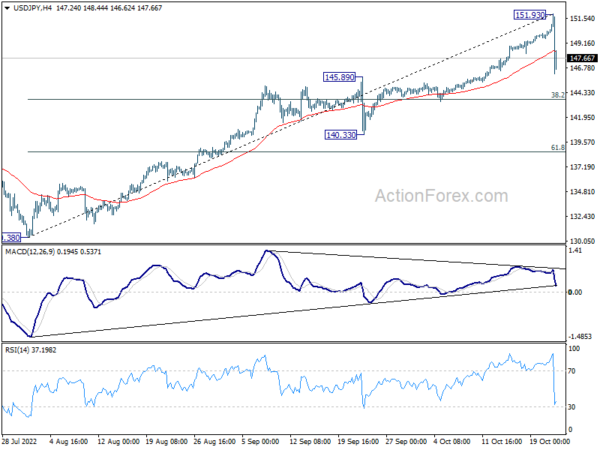

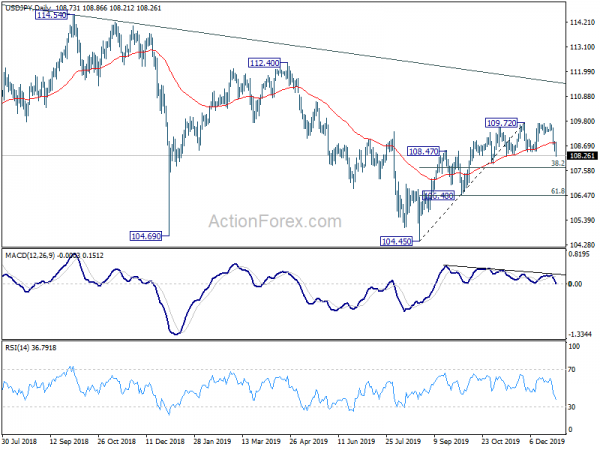

No change in USD/JPY’s outlook. Further rise is in favor for 109.95 resistance first. Break there will bring retest of 110.95 high. On the downside, break of 108.42 minor support will turn bias to the downside for 107.47 support again.

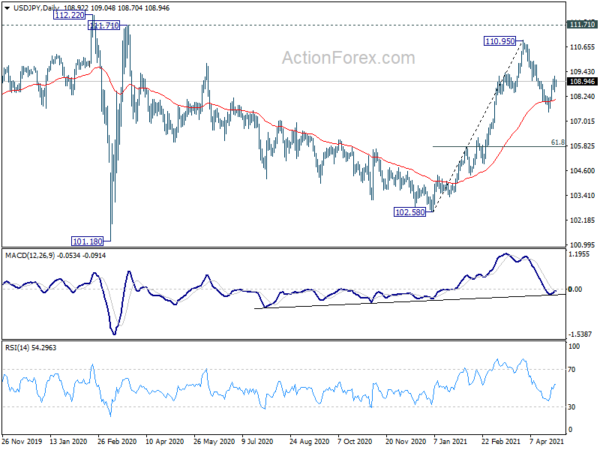

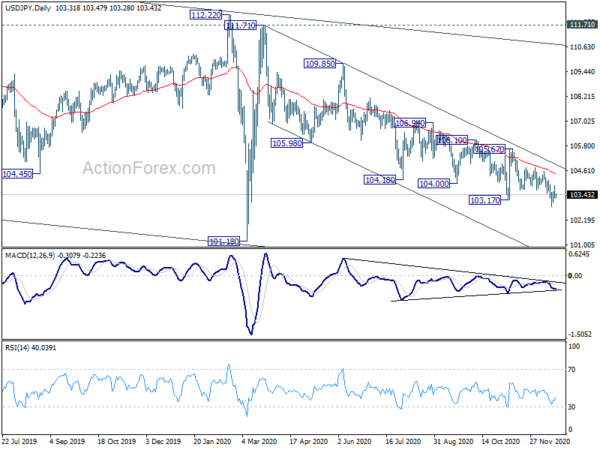

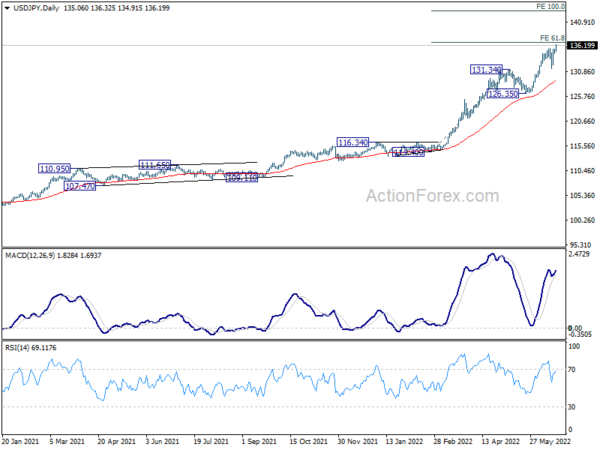

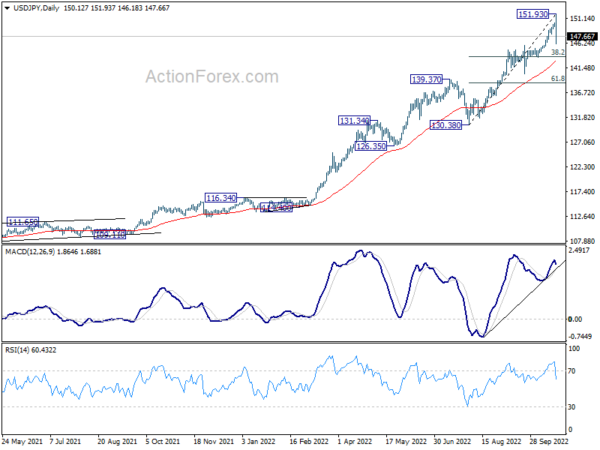

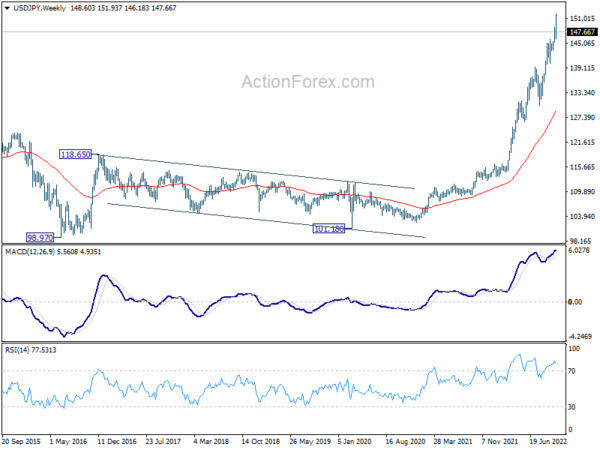

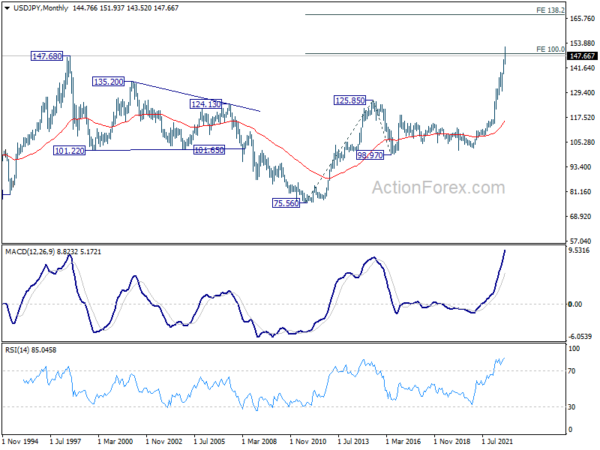

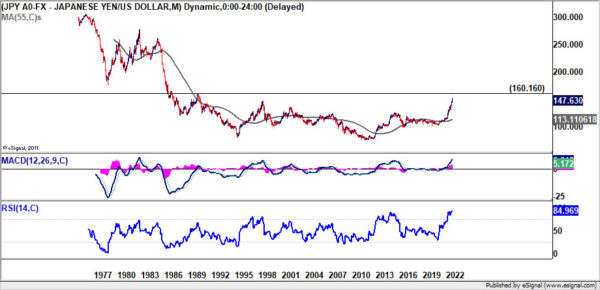

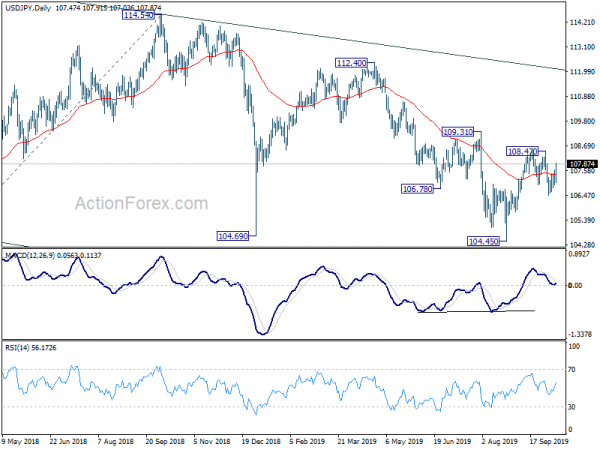

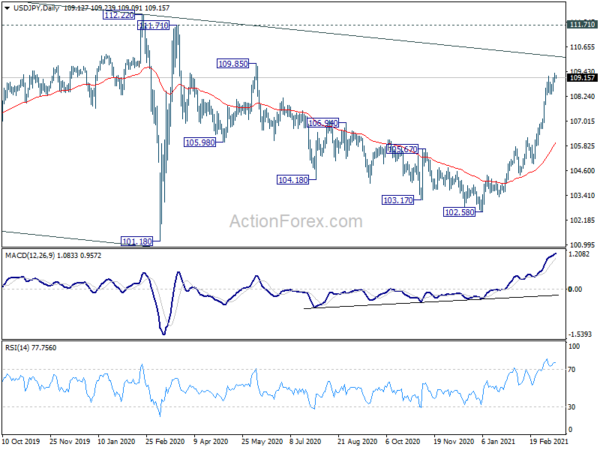

In the bigger picture, rise from 102.58 might have completed at 110.95, as the third leg of the pattern from 101.18 low. Medium term outlook is neutral first, as the pair could have turned into sideway trading between 101.18/111.71. We’d look at the structure and momentum of the price actions from 110.95 to gauge the chance of upside breakout at a later stage.