Daily Pivots: (S1) 111.66; (P) 111.85; (R1) 112.04; More…

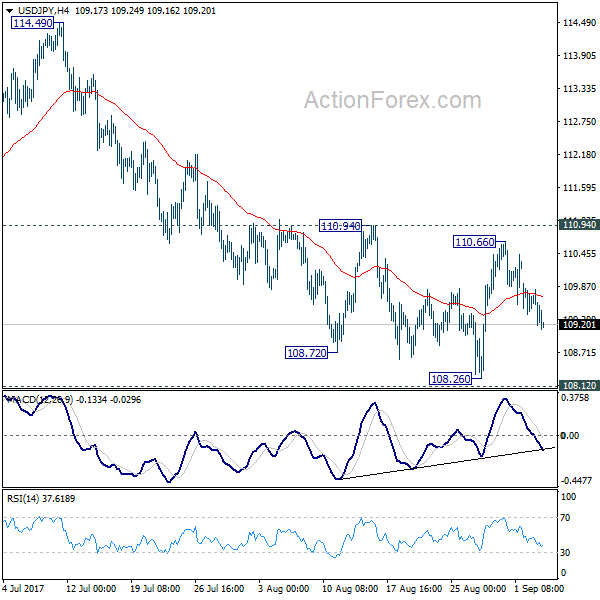

Outlook is USD/JPY remains unchanged and intraday bias stays neutral first. Focus remains on 112.13 key resistance. Decisive break there will resume whole rise from 104.69 for 100 % projection of 109.71 to 111.82 and 110.84 at 112.95 first. On the downside, firm break of 111.69 minor support will turn bias to the downside for 110.84 support. Break will bring deeper fall back to 109.71 support.

In the bigger picture, medium term outlook in USD/JPY remains a bit mixed as it’s staying inside falling channel from 118.65, but there are signs of bullish reversal. On the upside, break of 114.54 resistance will revive the case the corrective fall from 118.65 has completed with three waves down to 104.69. And whole rise from 98.97 (2016 low) is resuming for 118.65 and above. But before that, outlook stays neutral first.