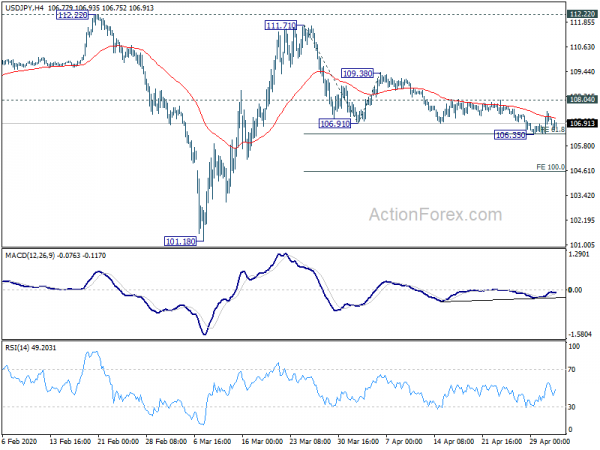

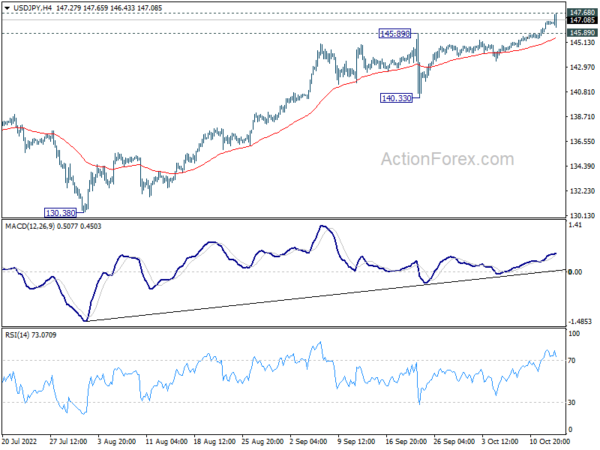

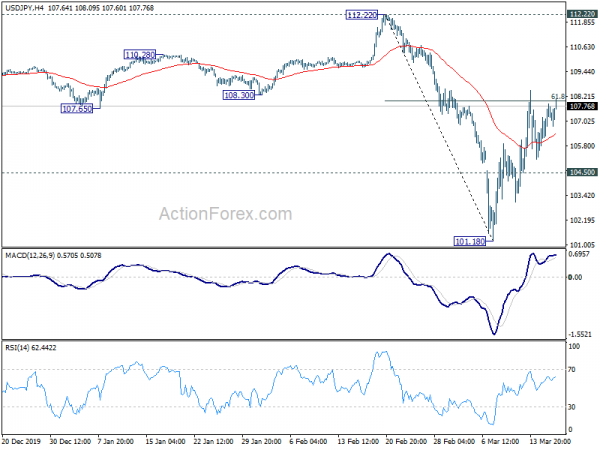

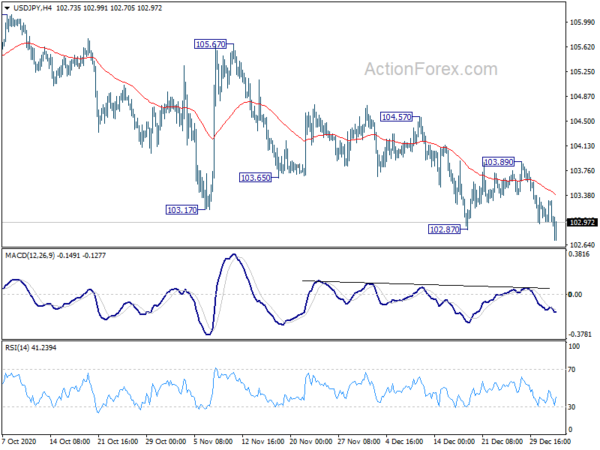

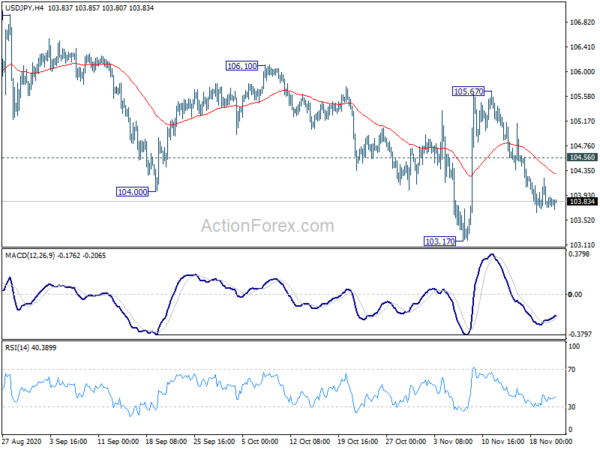

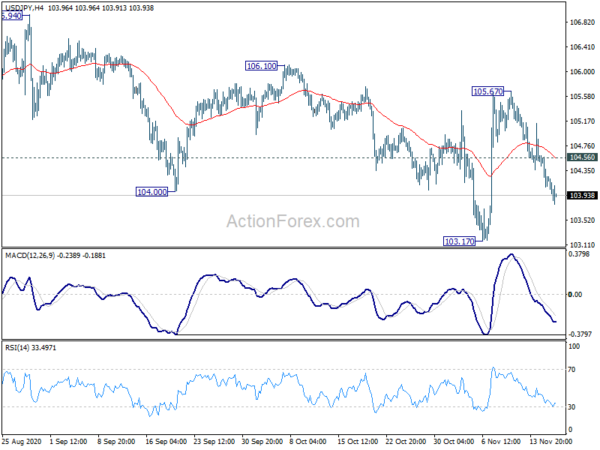

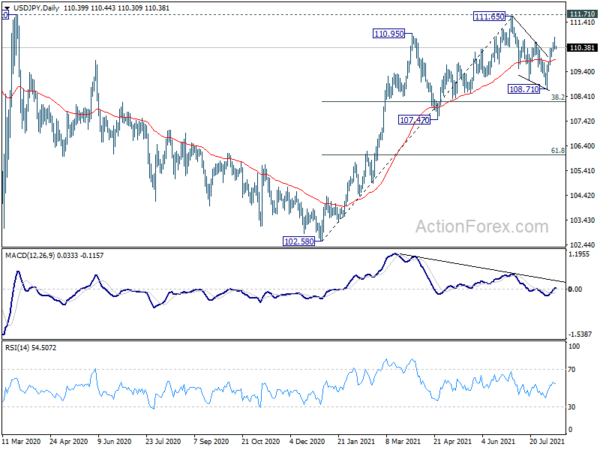

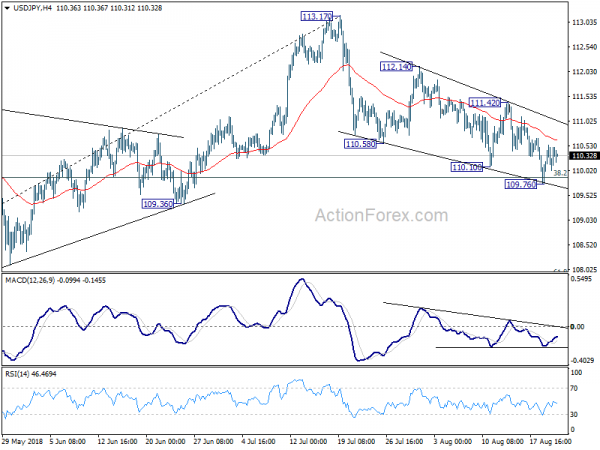

USD/JPY dropped to 106.35 last week but recovered since then. Some support was seen from 61.8% projection of 111.71 to 106.91 from 109.38 at 106.41. Yet, the strength of the recovery was very limited. Initial bias remains neutral this week first. On the downside, break of 106.35 will target 100% projection of 111.71 to 106.91 from 109.38 at 104.58. Reactions from there could reveal whether fall from 111.71 is corrective or impulsive. On the upside, break of 108.04 resistance will suggest completion of the fall form 111.71 and target 109.38 resistance next.

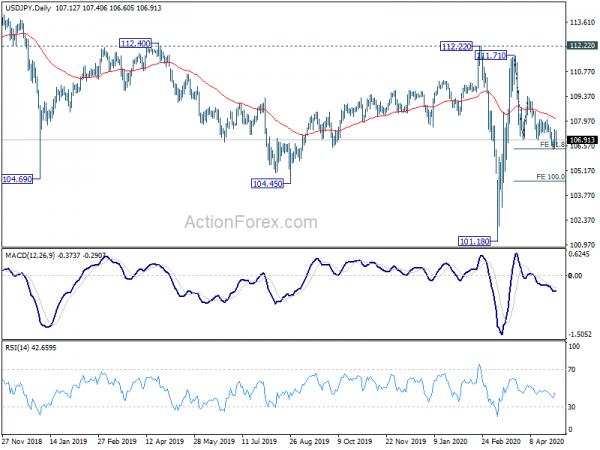

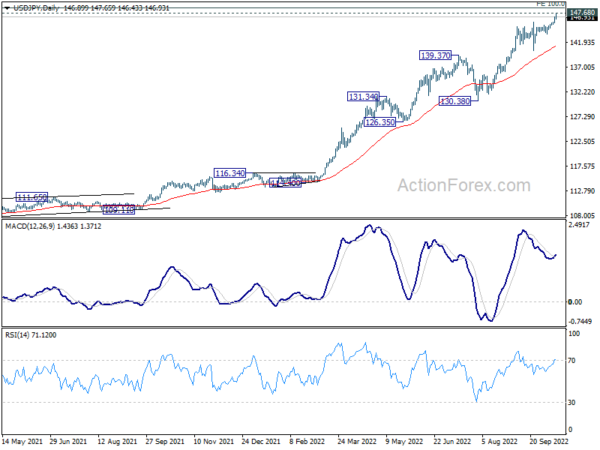

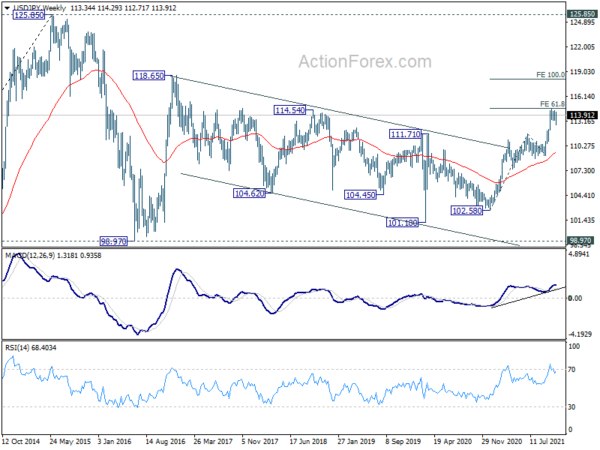

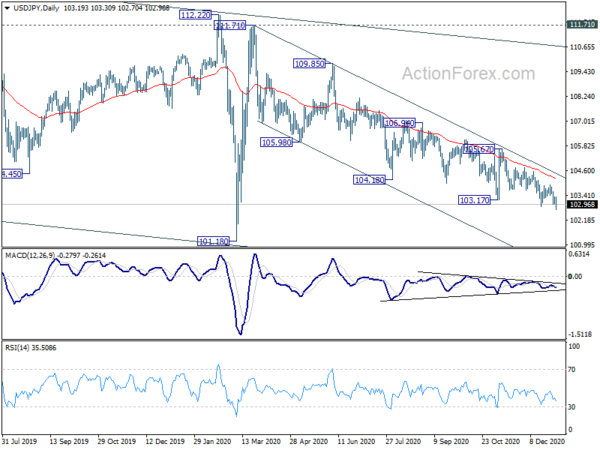

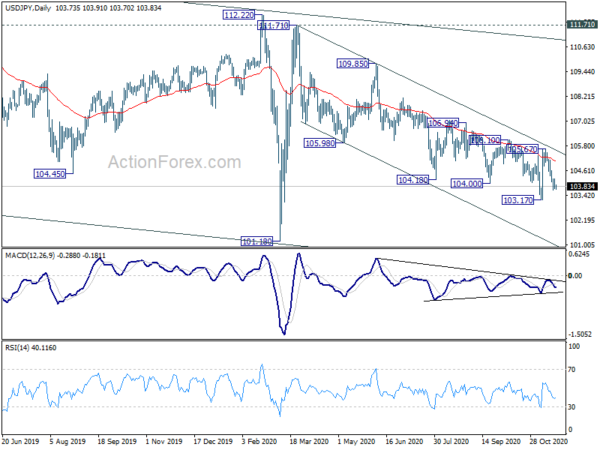

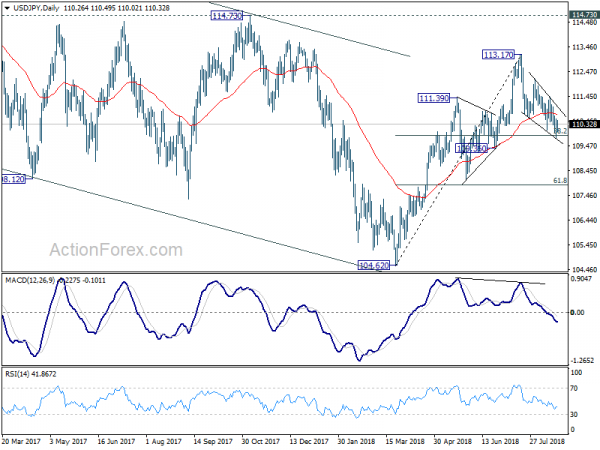

In the bigger picture, at this point, whole decline from 118.65 (Dec 2016) continues to display a corrective look, with well channeling. There is no clear sign of completion yet. Break of 101.18 will target 98.97 (2016 low). Meanwhile, sustained break of 112.22 should confirm completion of the decline and turn outlook bullish for 118.65 and above.

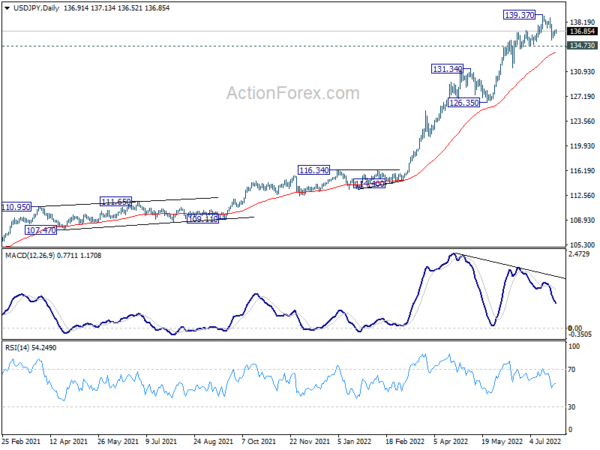

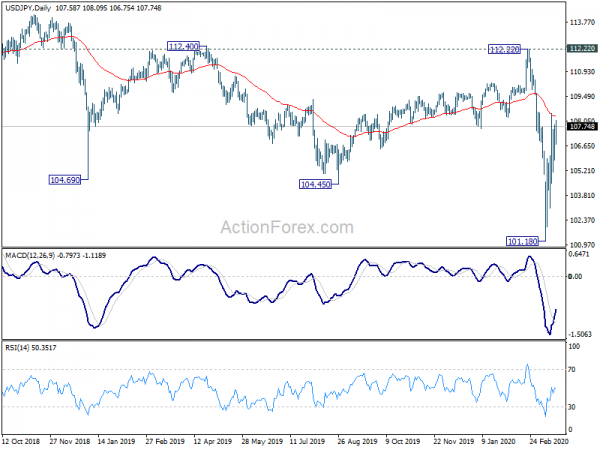

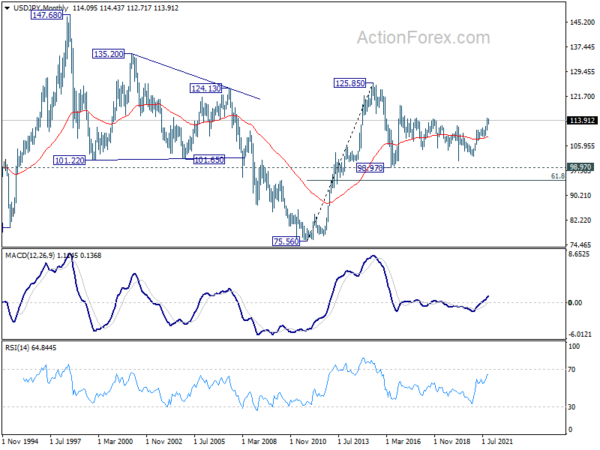

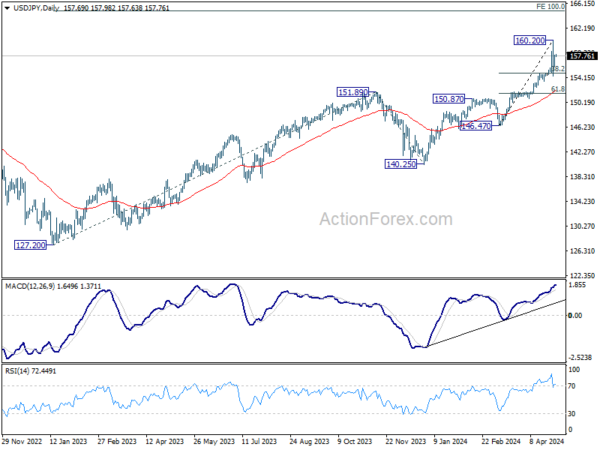

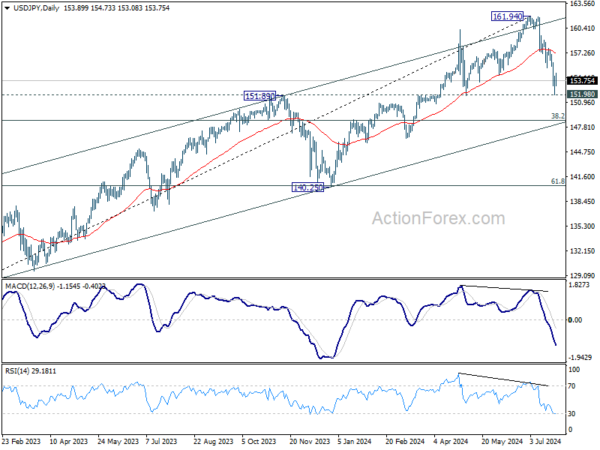

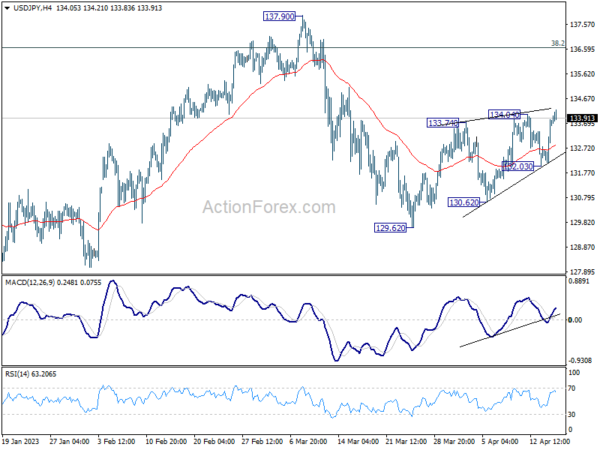

In the long term picture, the rise from 75.56 (2011 low) long term bottom to 125.85 (2015 high) is viewed as an impulsive move, no change in this view. Price actions from 125.85 are seen as a corrective move which could still extend. In case of deeper fall, downside should be contained by 61.8% retracement of 75.56 to 125.85 at 94.77. Up trend from 75.56 is expected to resume at a later stage for above 135.20/147.68 resistance zone.