Daily Pivots: (S1) 139.73; (P) 140.46; (R1) 140.98; More…

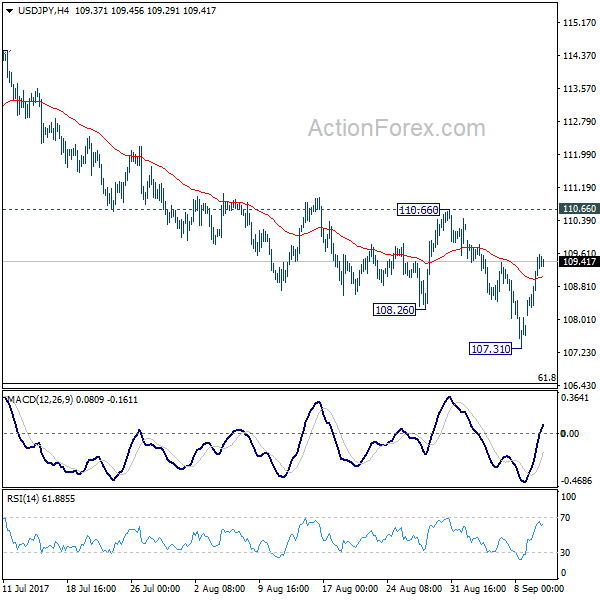

Breach of 139.74 minor support argues that recovery from 137.22 has completed at 141.93. Intraday bias in USD/JPY is back on the downside for retesting 137.22 support. Firm break there will resume whole decline from 145.06. On the upside, however, break of 141.93 will resume the rebound from 137.22 instead.

In the bigger picture, overall price actions from 151.93 (2022 high) are views as a corrective pattern. Current development suggests that the second leg (the rise from 127.20) might not be over yet. But even in case of extended rise, strong resistance should be seen from 151.93 to limit upside. Meanwhile, break of 137.22 support should confirm the start of the third leg to 127.20 (2023 low) and below.