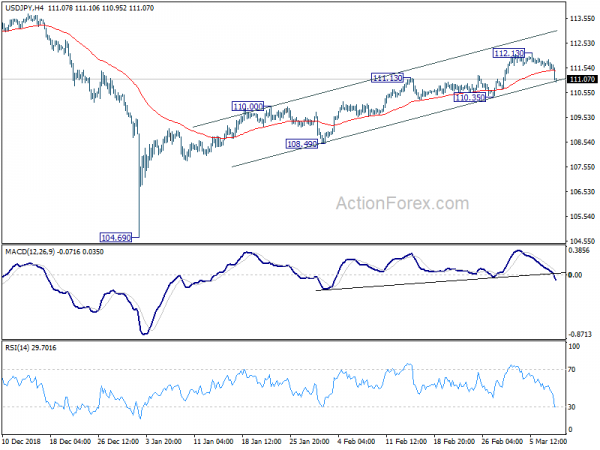

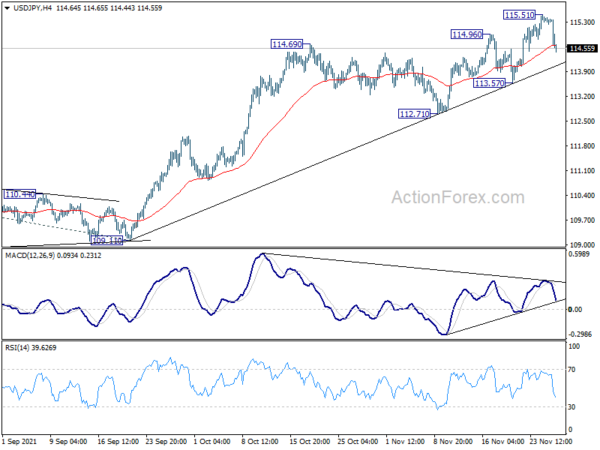

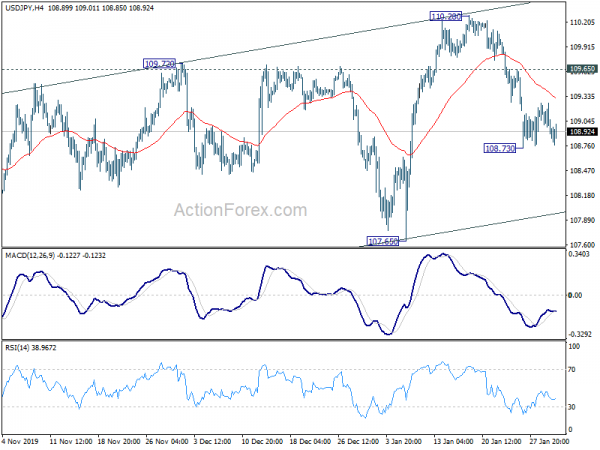

Daily Pivots: (S1) 111.42; (P) 111.64; (R1) 111.80; More…

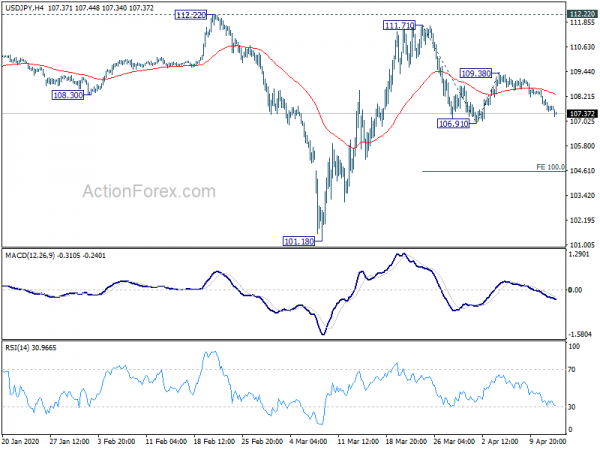

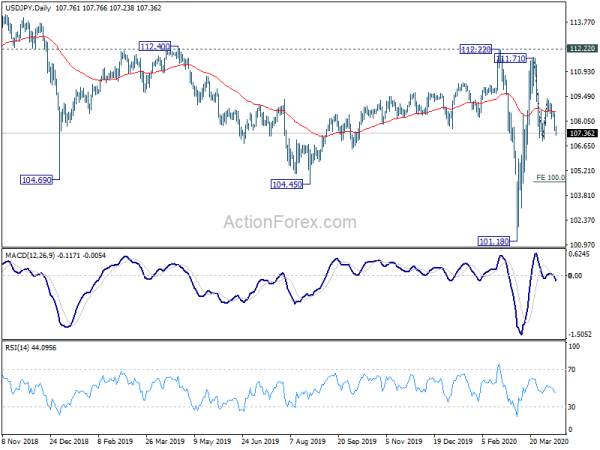

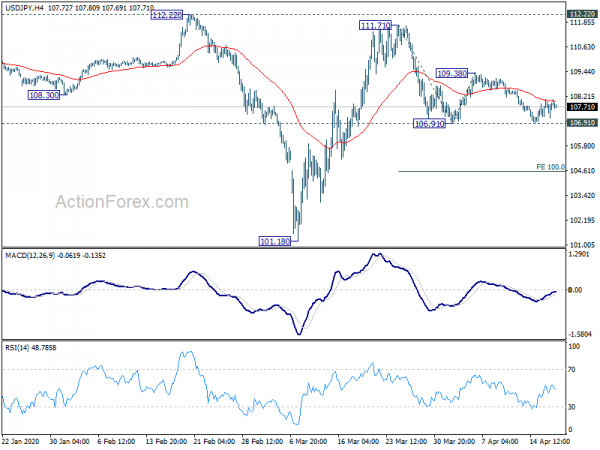

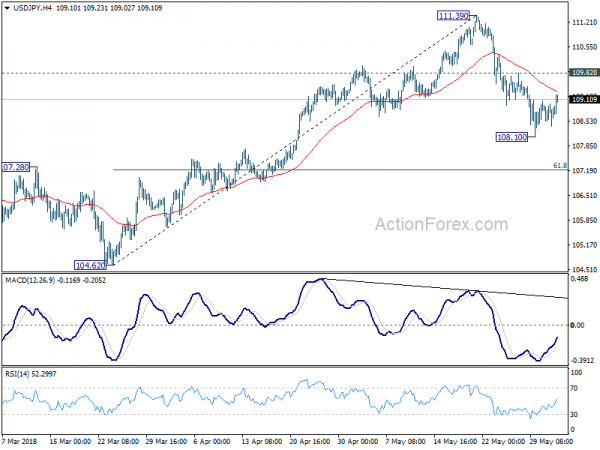

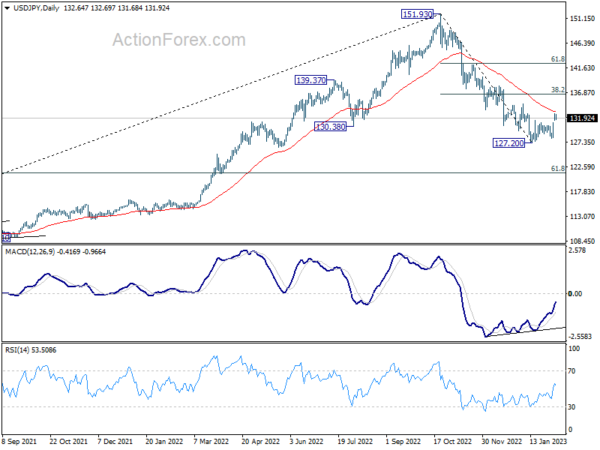

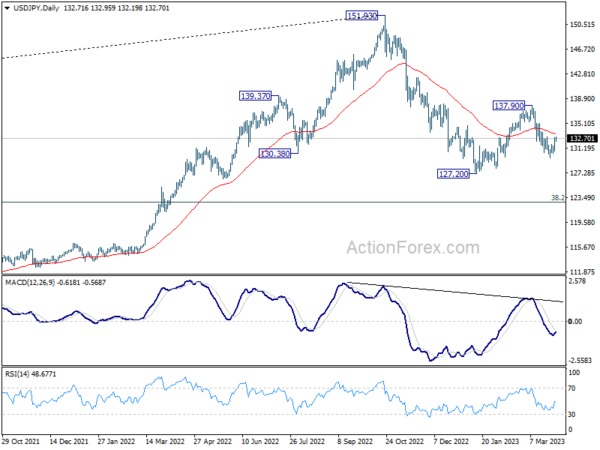

USD/JPY dropped sharply to as low as 110.95 so far and breaches near term channel support. With 110.35 support intact, near term outlook remains bullish and rise from 104.69 is still in favor to resume. On the upside, break of 112.13 will target 114.54 resistance next. However, firm break of 110.35 should confirm near term reversal and turn outlook bearish for 108.49 support and below.

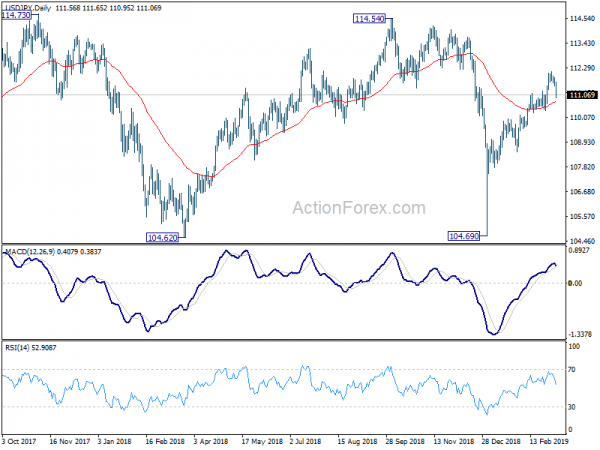

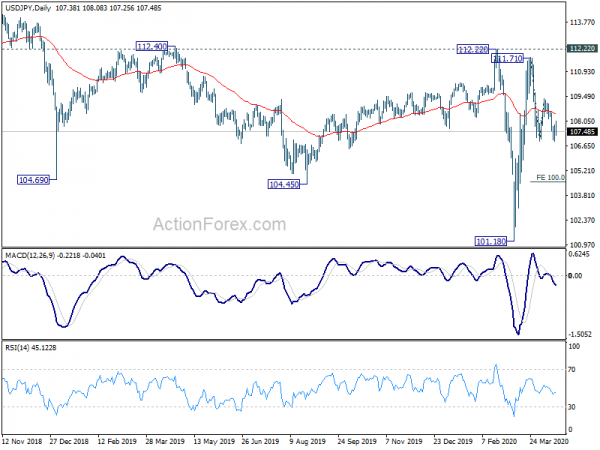

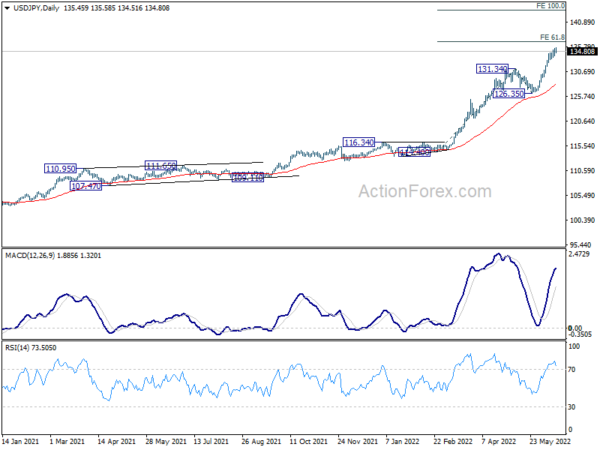

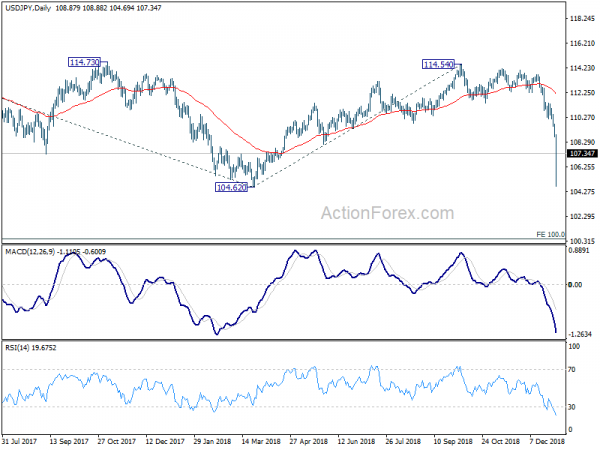

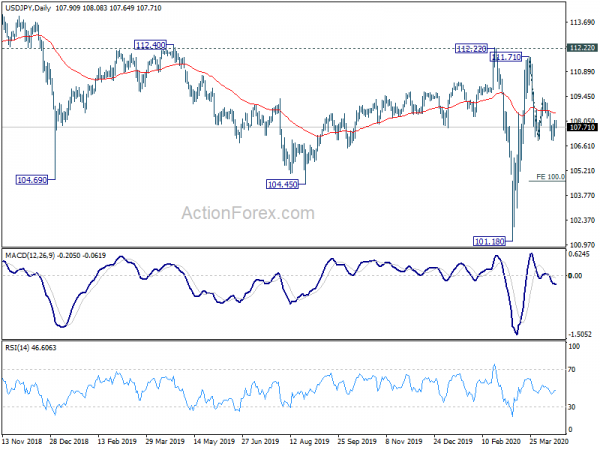

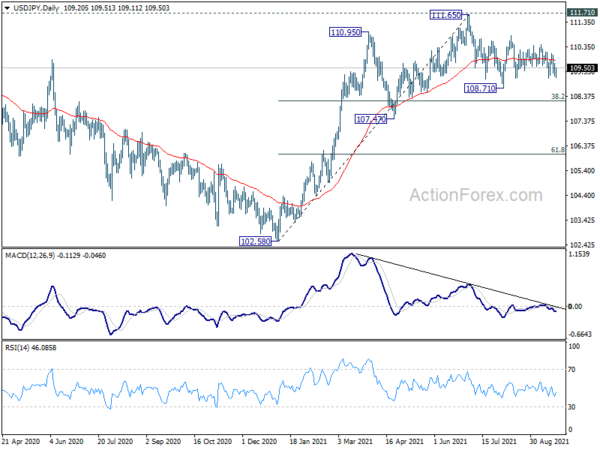

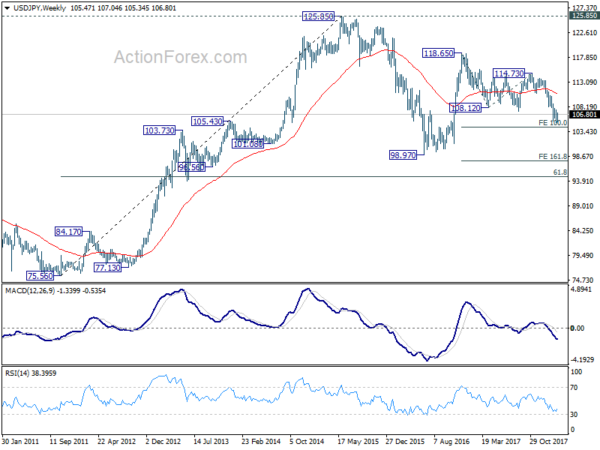

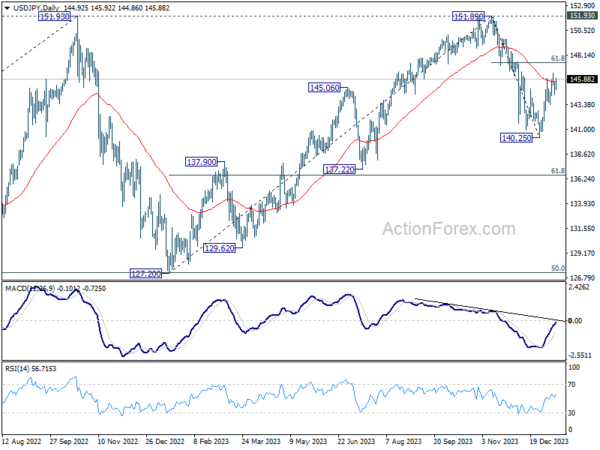

In the bigger picture, current strong rebound from 104.69 argues that decline from 118.65 (2016 high) has completed with three waves down to 104.69, after failing 104.62. More importantly, the rise from 98.97 (2016 low) could be resuming. Focus now turns back to 114.54 resistance, decisive break there will add more credence to this bullish case and target 118.65. This will now be the favored case as long as 110.35 support holds.