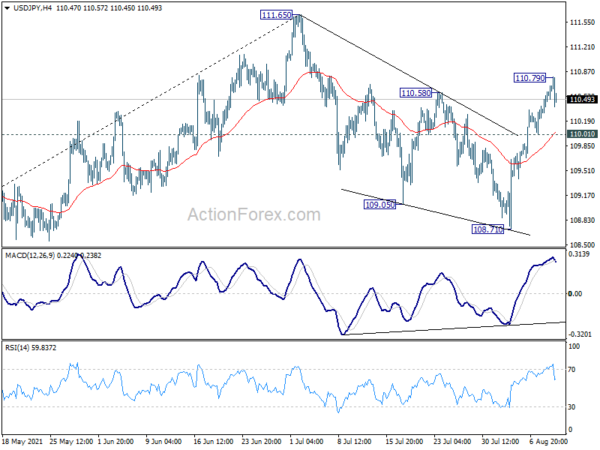

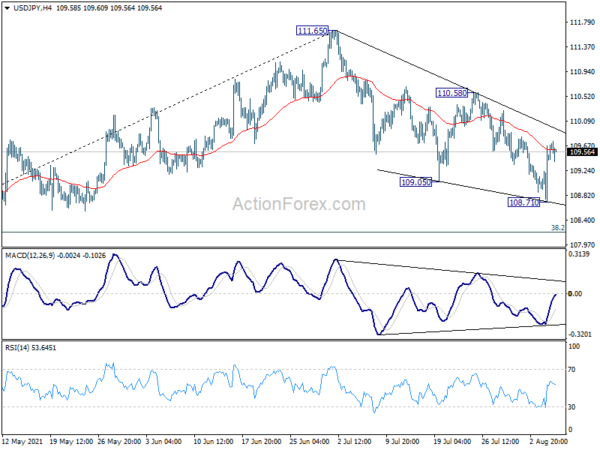

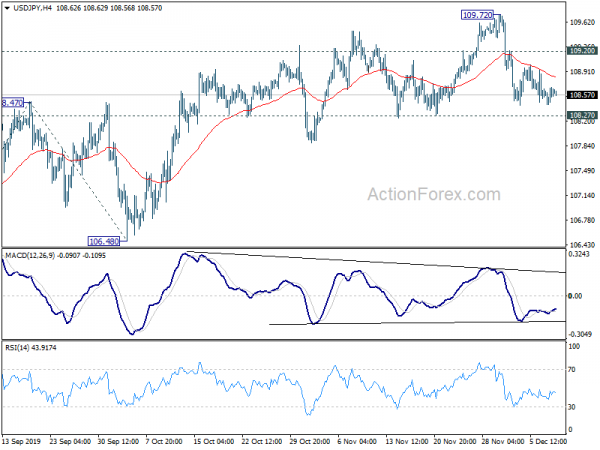

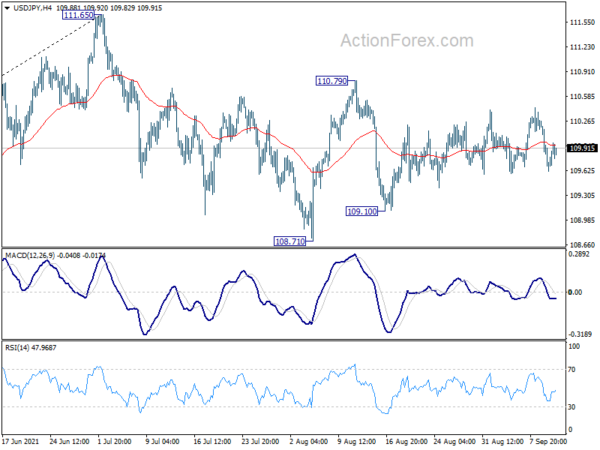

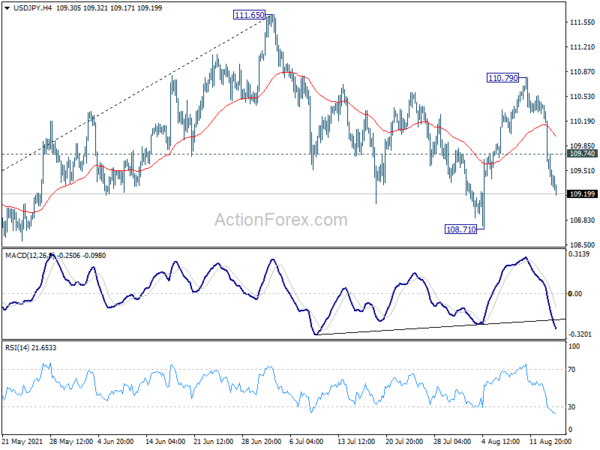

Daily Pivots: (S1) 110.37; (P) 110.49; (R1) 110.69; More…

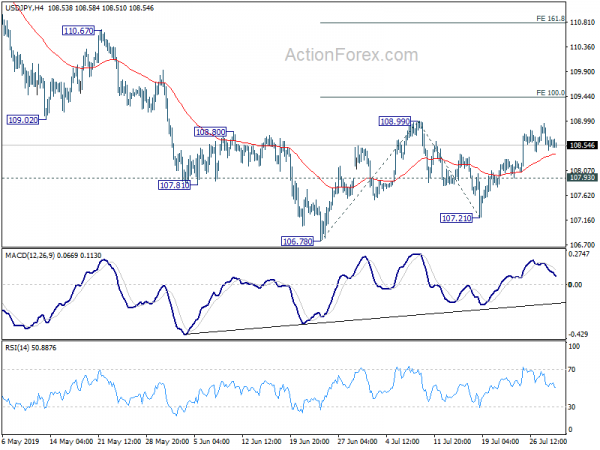

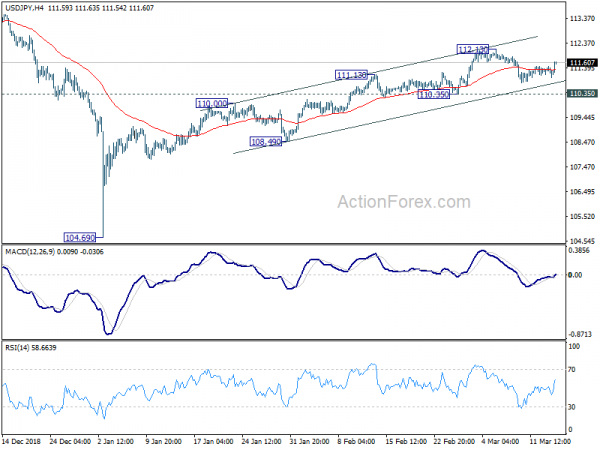

Intraday bias in USD/JPY is turned neutral with 4 hour MACD crossed below signal line. Corrective fall from 111.65 should have completed with three waves down to 108.71. Another rise is in favor with 110.01 support intact. Break of 110.79 will turn bias to the upside for retesting 111.65 high. However, break of 110.01 will dampen this bullish view, and turn bias to the downside for 108.71 support.

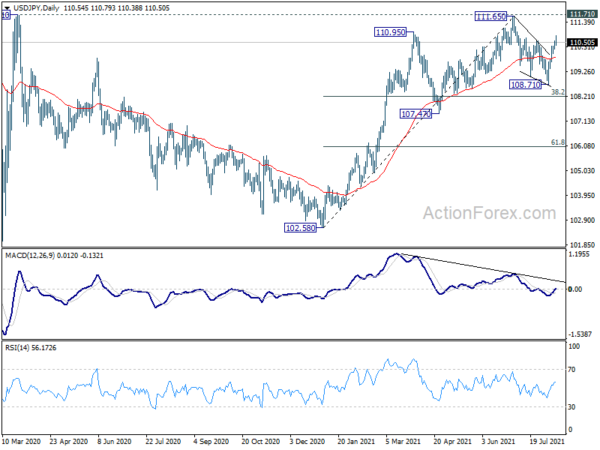

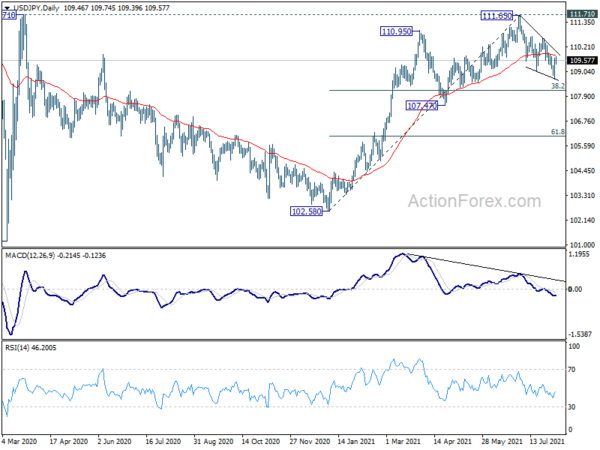

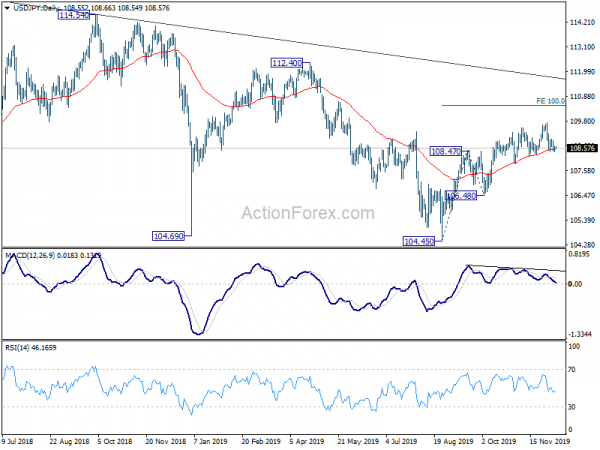

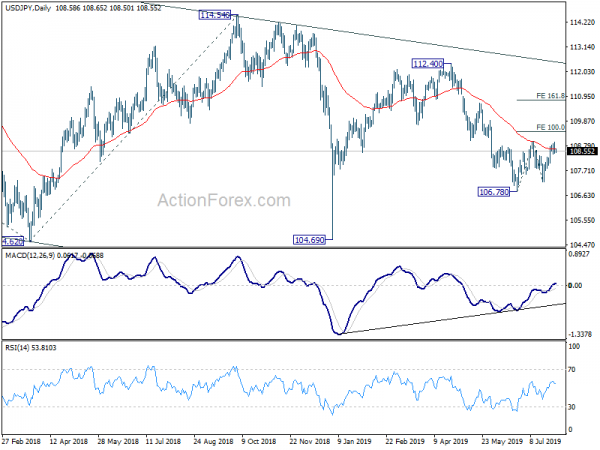

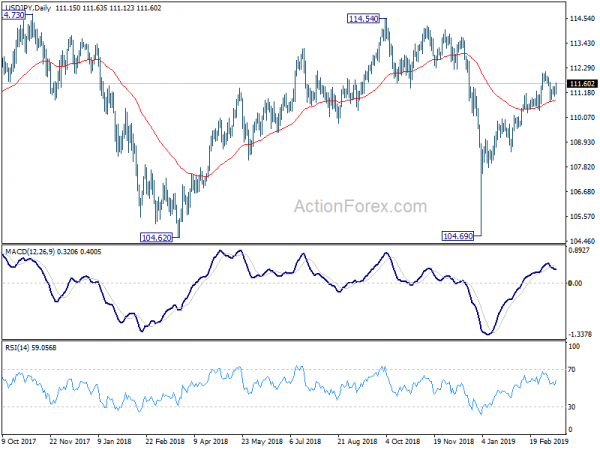

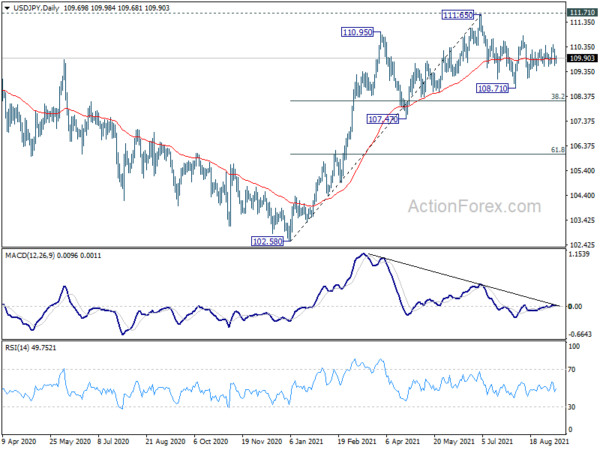

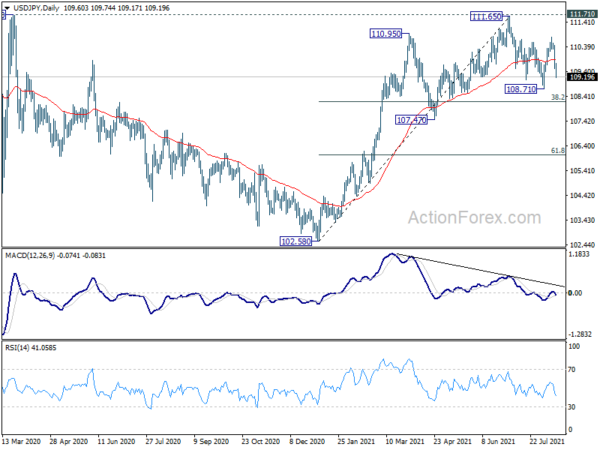

In the bigger picture, medium term outlook is staying neutral with 111.71 resistance intact. The pattern from 101.18 could still extend with another falling leg. Sustained trading below 55 day EMA will bring deeper fall to 107.47 support and below. Nevertheless, strong break of 111.71 resistance will confirm completion of the corrective decline from 118.65 (2016 high). Further rise should then be seen to 114.54 and then 118.65 resistance.