USDJPY Outlook

USD/JPY Weekly Outlook

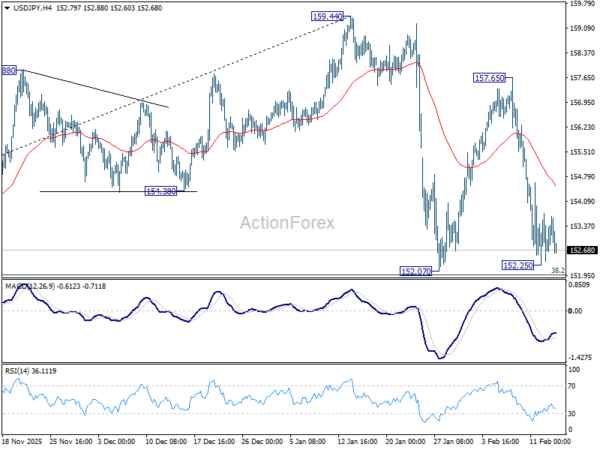

USD/JPY fell sharply last week but the decline lost momentum ahead of 152.07 support. Intial bias stays neutral this week first. With 38.2% retracement of 139.87 to 159.44 at 151.96 intact, price actions from 159.44 are seen as a consolidations pattern only. On the upside, sustained break of 55 4H EMA (now at 154.51) will bring stronger rebound towards 157.65. However, decisive break of 151.96 will argue that it's reversing the rise from 139.87 already. In this case, deeper fall should then be seen to 61.8% retracement at 147.34, and possibly below.

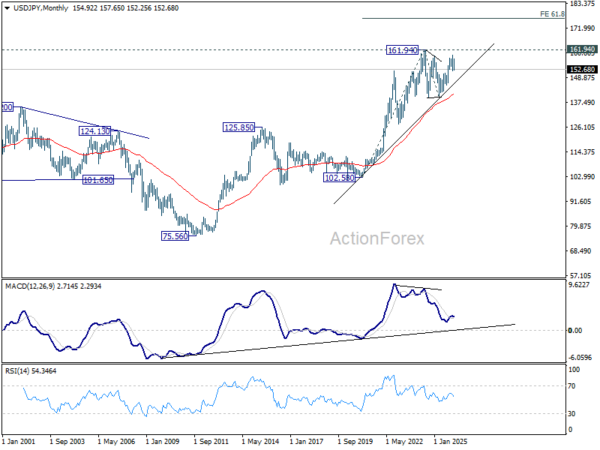

In the bigger picture, outlook is unchanged that corrective pattern from 161.94 (2024 high) should have completed with three waves at 139.87. Larger up trend from 102.58 (2021 low) could be ready to resume through 161.94. This will remain the favored case as long as 55 W EMA (now at 151.71) holds. However, sustained break of 55 W EMA will argue that the pattern from 161.94 is extending with another falling leg.

In the long term picture, up trend from 75.56 (2011 low) is still in progress and might be ready to resumption. Firm break of 161.94 will target 61.8% projection of 102.58 (2020 low) to 161.94 (2024 high) from 139.87 at 176.55 in the medium term. Long term outlook will stay bullish as long as 139.87 support holds, even in case of deep pullback.

USD/JPY Mid-Day Outlook

Daily Pivots: (S1) 152.34; (P) 153.49; (R1) 154.43; More...

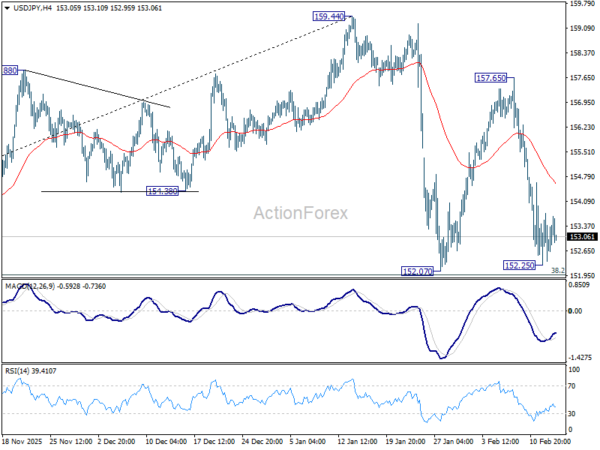

Intraday bias in USD/JPY stays neutral and outlook is unchanged. While another fall cannot be ruled out, strong support should be seen from 38.2% retracement of 139.87 to 159.44 at 151.96 to bring rebound. On the upside, sustained break of 55 4H EMA (now at 154.70) will bring stronger rebound towards 157.65. However, sustained break of 151.96 will argue that it's reversing the rise from 139.87 already. In this case, deeper fall should then be seen to 61.8% retracement at 147.34, and possibly below.

In the bigger picture, outlook is unchanged that corrective pattern from 161.94 (2024 high) should have completed with three waves at 139.87. Larger up trend from 102.58 (2021 low) could be ready to resume through 161.94. This will remain the favored case as long as 55 W EMA (now at 151.68) holds. However, sustained break of 55 W EMA will argue that the pattern from 161.94 is extending with another falling leg.

USD/JPY Daily Outlook

Daily Pivots: (S1) 152.34; (P) 153.49; (R1) 154.43; More...

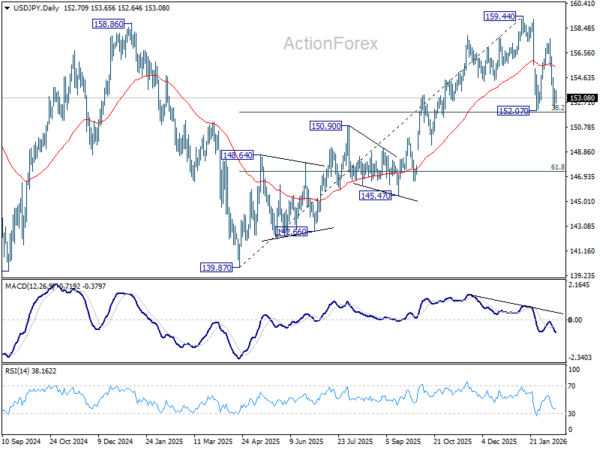

Intraday bias in USD/JPY remains neutral for the moment. While another fall cannot be ruled out, strong support should be seen from 38.2% retracement of 139.87 to 159.44 at 151.96 to bring rebound. On the upside, sustained break of 55 4H EMA (now at 154.70) will bring stronger rebound towards 157.65. However, sustained break of 151.96 will argue that it's reversing the rise from 139.87 already. In this case, deeper fall should then be seen to 61.8% retracement at 147.34, and possibly below.

In the bigger picture, outlook is unchanged that corrective pattern from 161.94 (2024 high) should have completed with three waves at 139.87. Larger up trend from 102.58 (2021 low) could be ready to resume through 161.94. This will remain the favored case as long as 55 W EMA (now at 151.68) holds. However, sustained break of 55 W EMA will argue that the pattern from 161.94 is extending with another falling leg.