Daily Pivots: (S1) 150.14; (P) 150.42; (R1) 150.81; More…

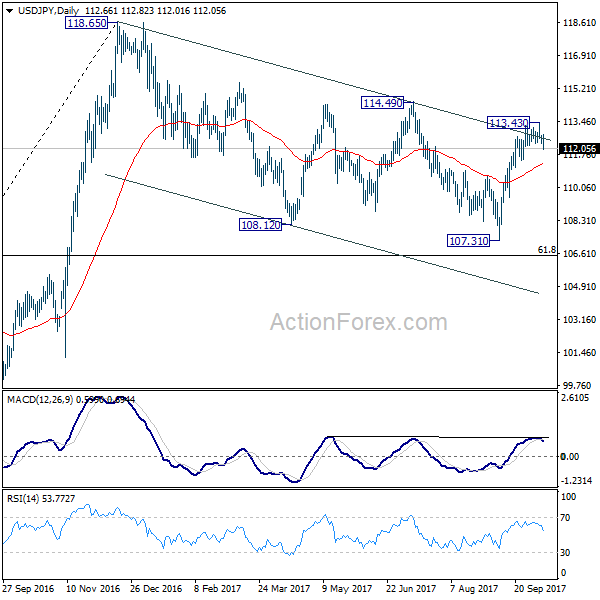

No change in USD/JPY’s outlook as range trading continues. Another retreat cannot be ruled out, but downside should be contained by 148.79 resistance turned support to bring rise resumption. Above 150.87 will resume the rally from 140.25 to 151.89/93 key resistance zone. Decisive break there will confirm larger up trend resumption of 155.50 projection level next. However, firm break of 148.79 will turn bias to the downside for 145.88 support.

In the bigger picture, fall from 151.89 is seen as a correction to the rally from 127.20, which might have completed at 140.25 already. Firm break of 151.89/93 resistance zone will confirm up trend resumption, and next target will be 61.8% projection of 127.20 to 151.89 from 140.25 at 155.50. This will now remain the favored case as long as 140.25 support holds.