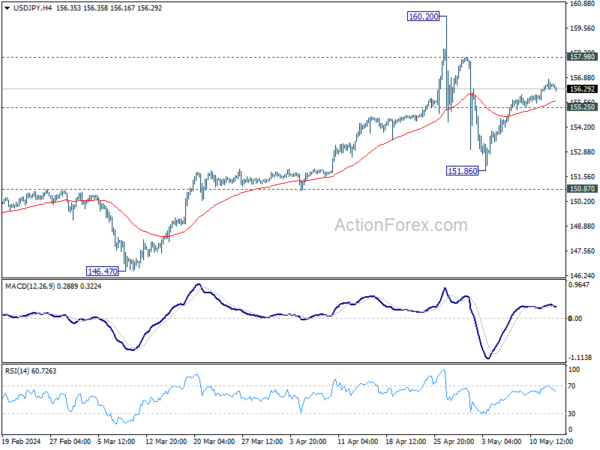

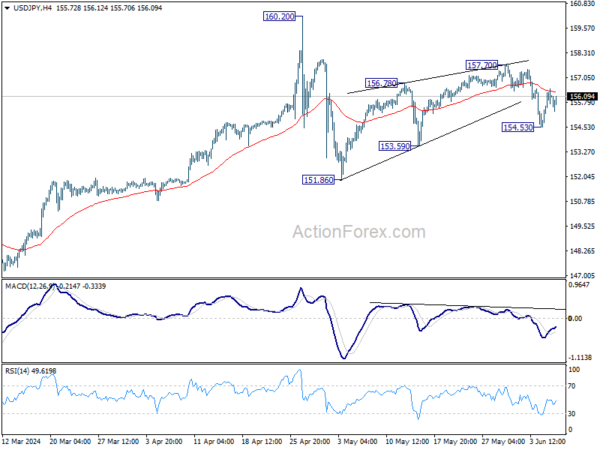

Daily Pivots: (S1) 156.09; (P) 156.43; (R1) 156.78; More…

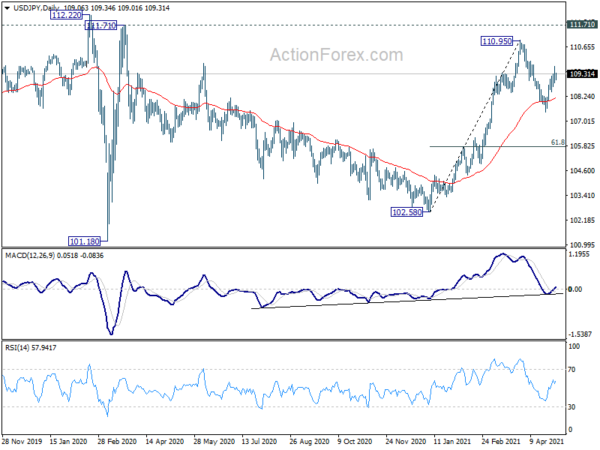

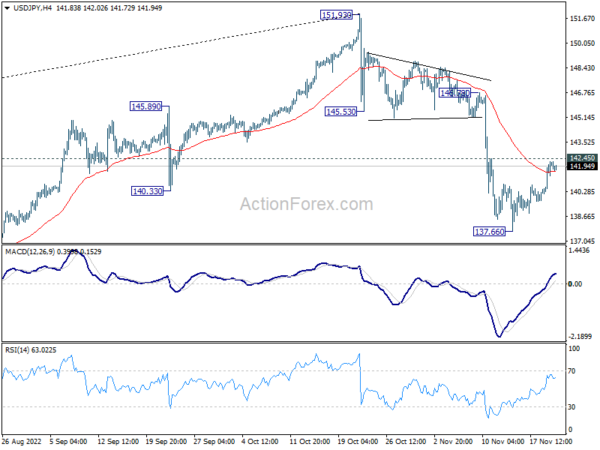

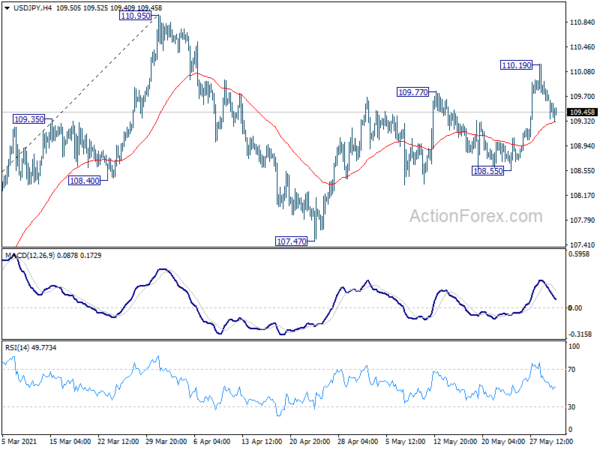

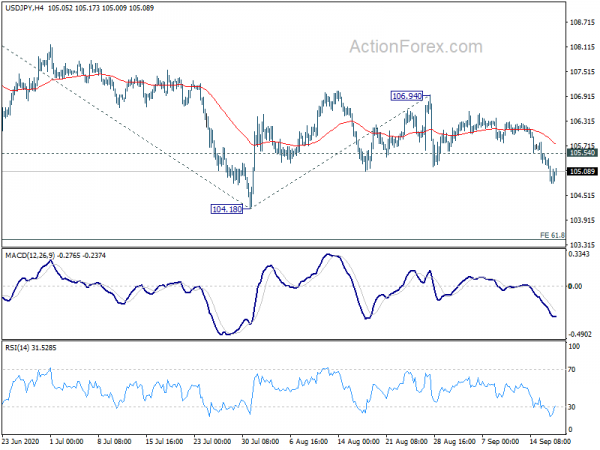

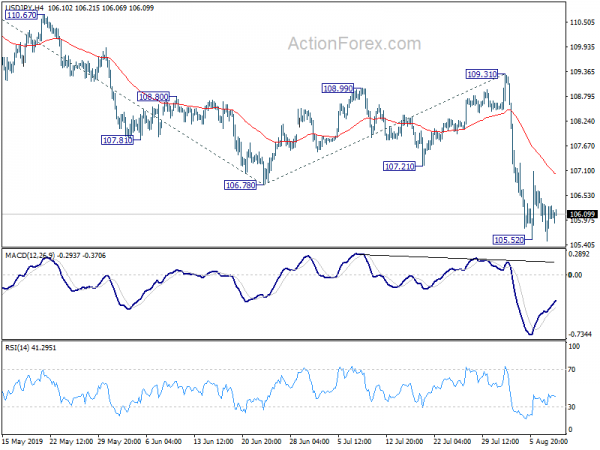

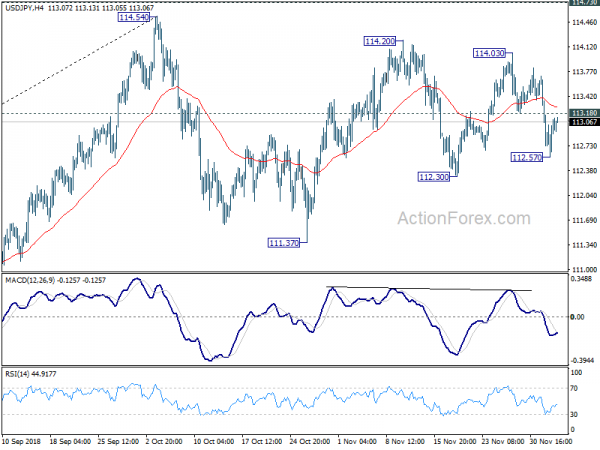

USD/JPY continues to lose upside momentum as seen in 4H MACD. But further rise could still be seen with 155.25 support intact. Rebound from 151.86, as the second leg of the corrective pattern from 160.20, is in progress for 157.98 resistance. On the downside, break of 155.25 minor support will suggest that the third leg has started, and turn bias back to the downside for 151.86 support.

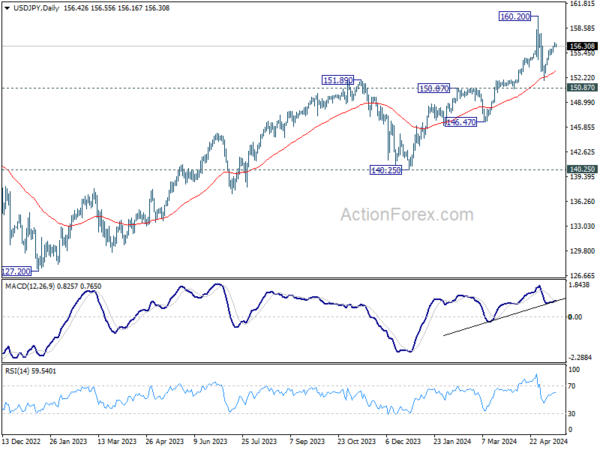

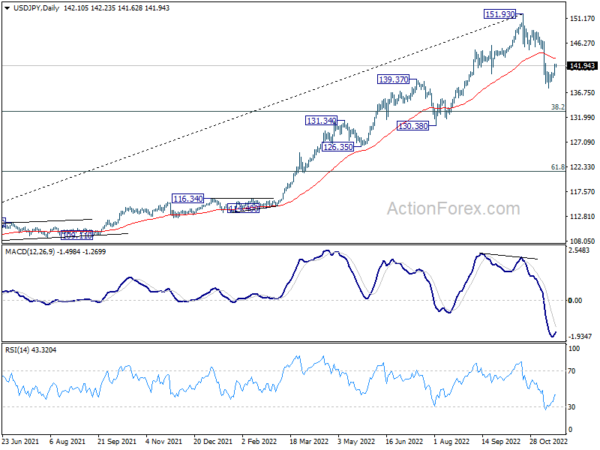

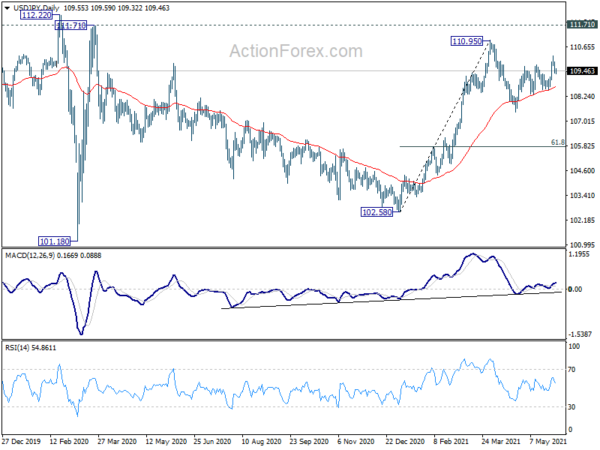

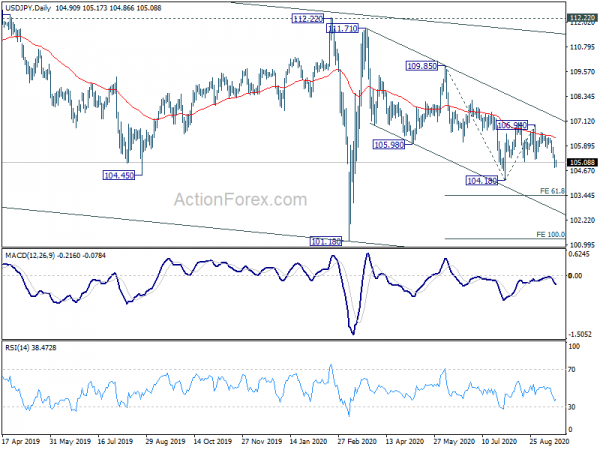

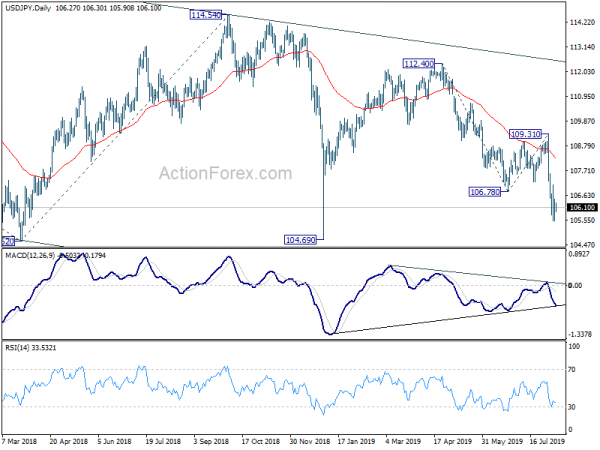

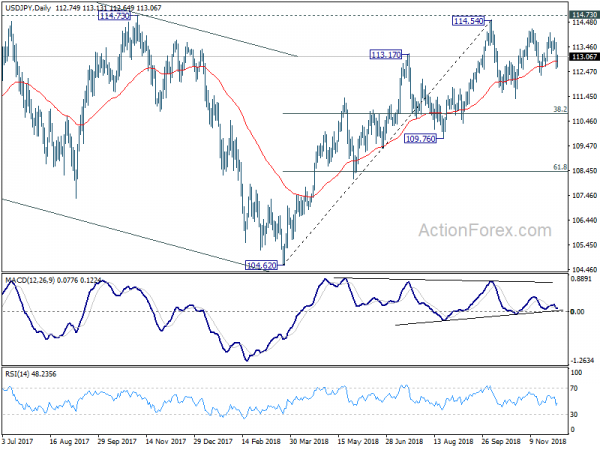

In the bigger picture, a medium term top might be formed at 160.20. But as long as 150.87 resistance turned support holds, fall from there is seen as correcting rise from 150.25 only. However, decisive break of 150.87 will argue that larger correction is possibly underway, and target 146.47 support next.