Daily Pivots: (S1) 151.04; (P) 151.40; (R1) 151.98; More…

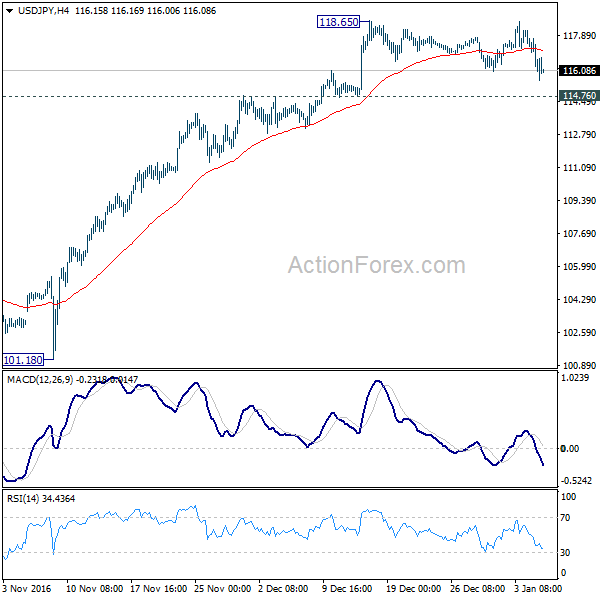

No change in USD/JPY’s outlook as range trading continues. Intraday bias remains neutral at this point. On the downside, break of 150.80 will turn bias back to the downside for deeper pull back to 55 D EMA (now at 149.65). On the upside, however, sustained break of 151.93 key resistance will confirm long term up trend resumption.

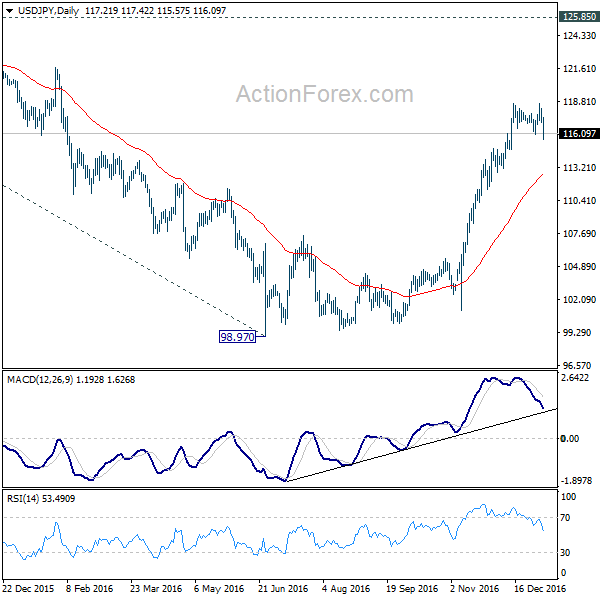

In the bigger picture, correction from 151.87 (2023) high could have completed at 140.25 already. Rise from 127.20 (2023 low), as part of the long term up trend, is probably ready to resume. Decisive break of 151.93 resistance (2022 high) will confirm this bullish case. Next medium term target will be 61.8% projection of 127.20 to 151.89 from 140.25 at 155.20. This will remain the favored case as long as 146.47 support holds, in case of another pullback.