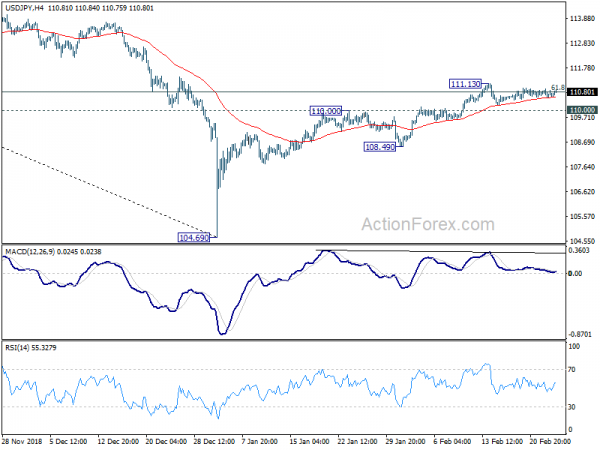

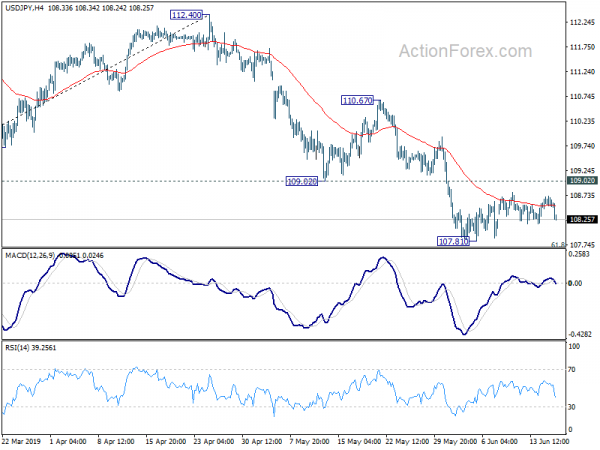

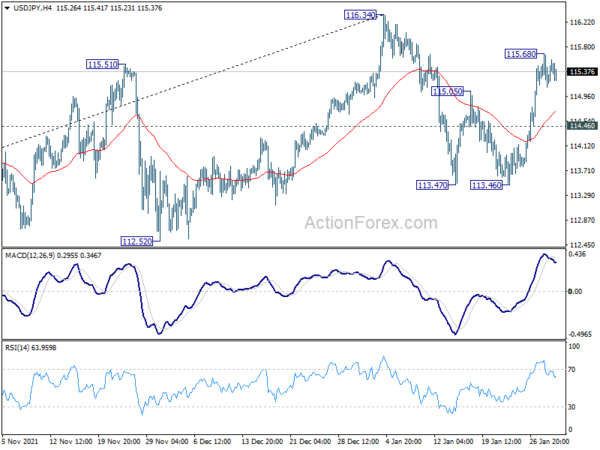

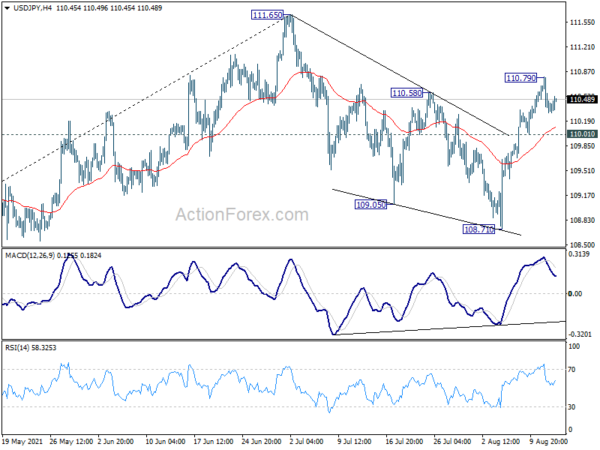

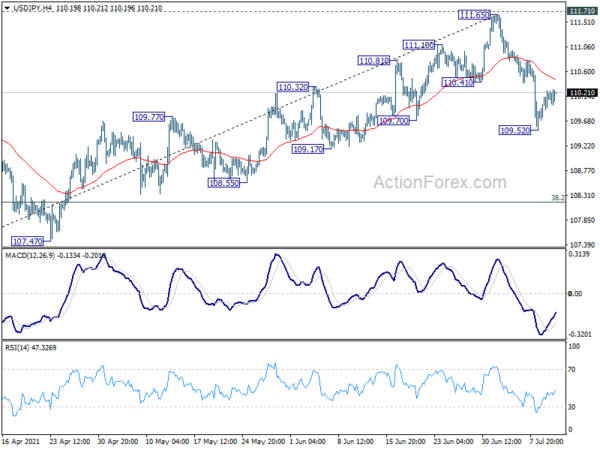

Daily Pivots: (S1) 110.51; (P) 110.71; (R1) 110.87; More…

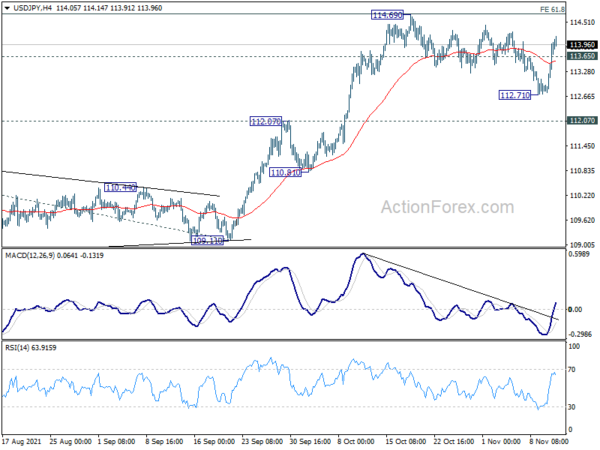

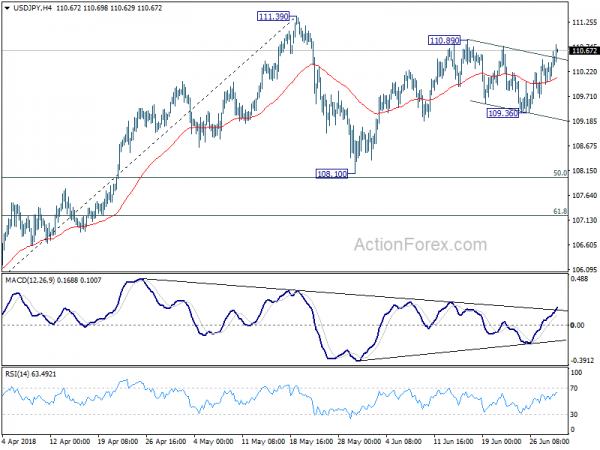

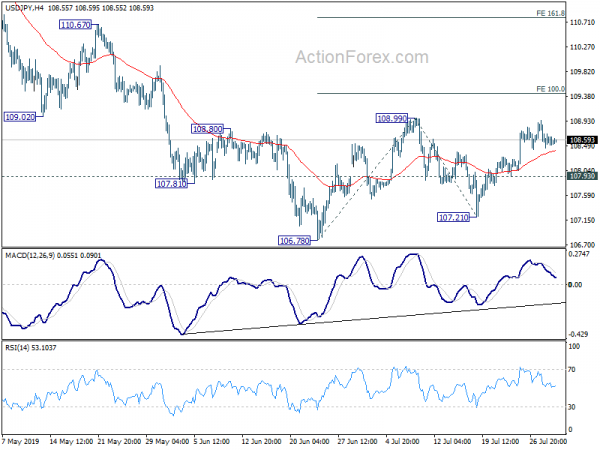

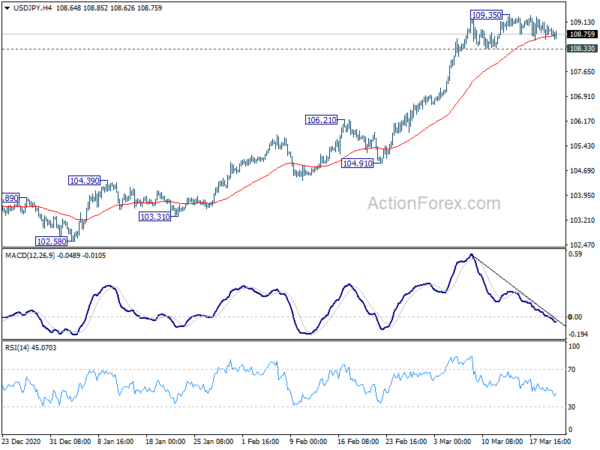

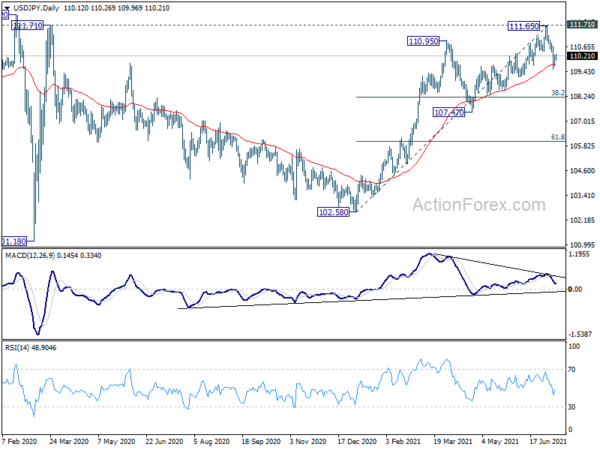

USD/JPY is staying in range below 111.13 and intraday bias remains neutral. On the downside, break of 110.00 resistance turned support will suggest rejection by 61.8% retracement of 114.54 to 104.69 at 110.77 and the rebound from 104.69 has likely completed. Intraday bias will be turned back to the downside for 108.49 support for confirmation. Nevertheless, break of 111.13 should confirm resumption of rise from 104.69 for 114.54 resistance.

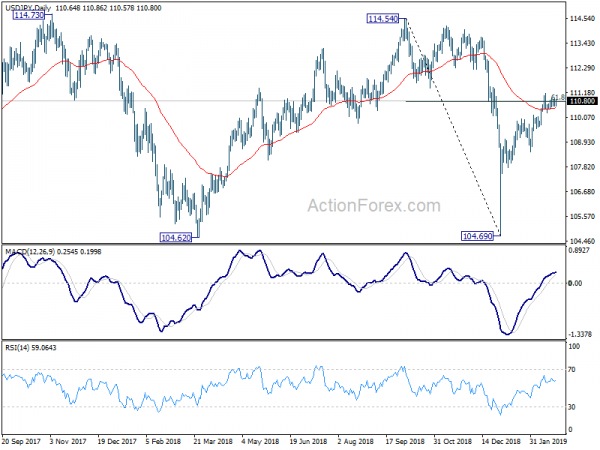

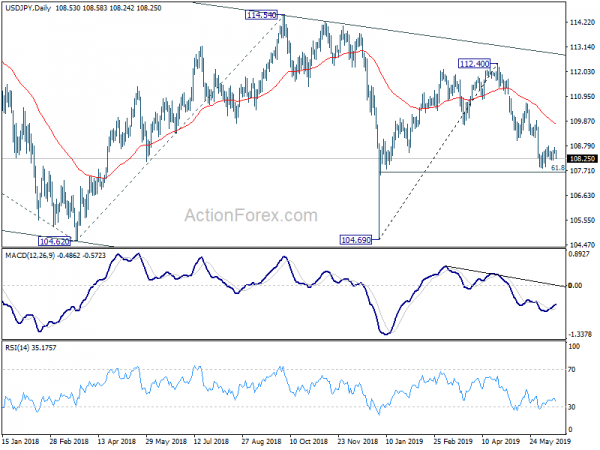

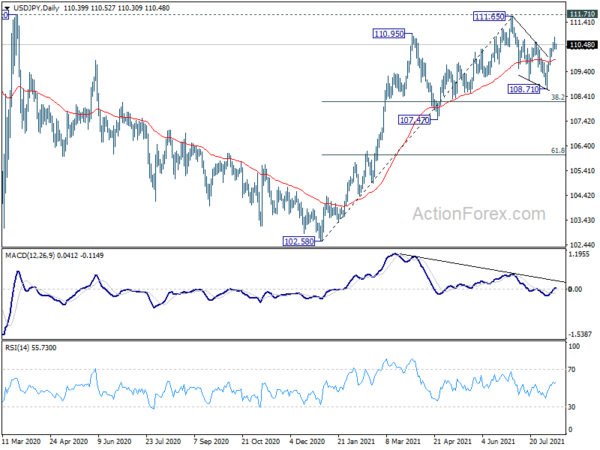

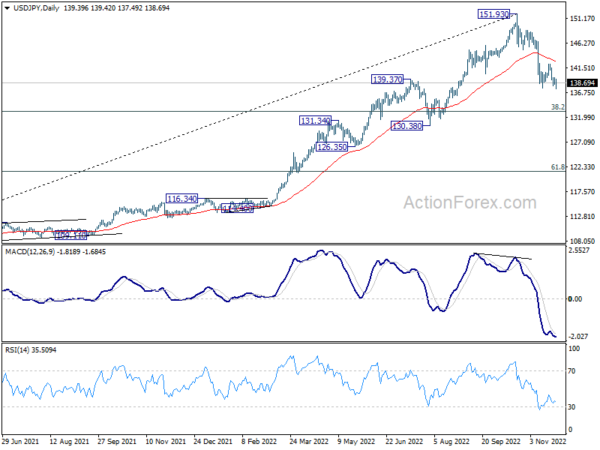

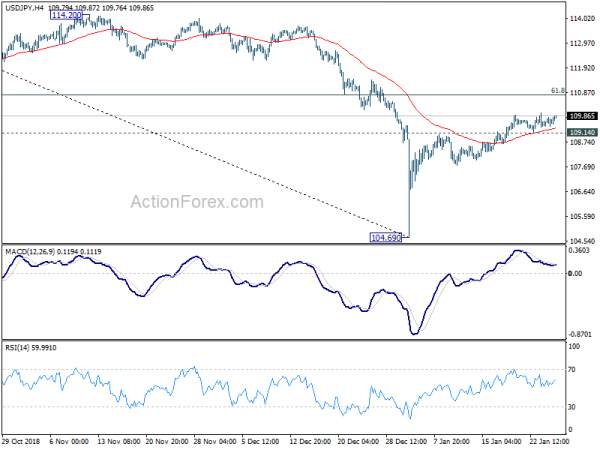

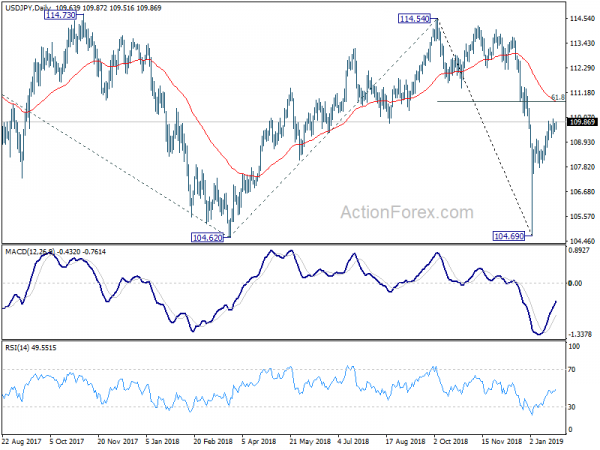

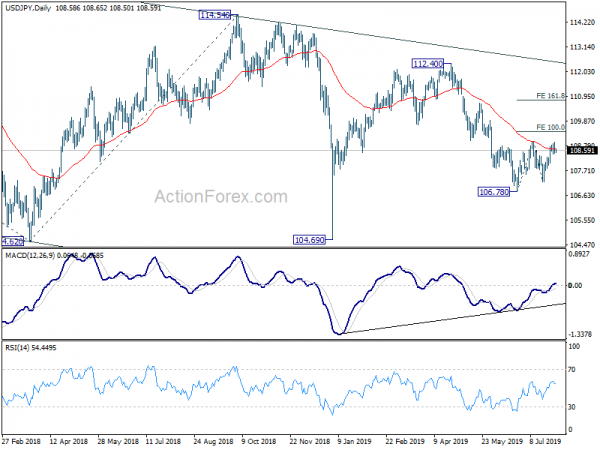

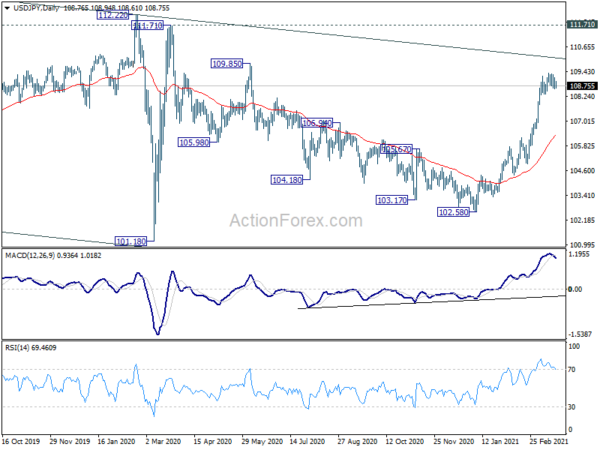

In the bigger picture, while the rebound from 104.69 was stronger than expected, it’s struggle to get rid of 55 day EMA completely. Outlook is turned mixed first. On the downside, break of 108.49 support will revive that case that such rebound was a correction. And, larger down trend is still in progress for another low below 104.62. But sustained trading above 55 day EMA will turn focus to 114.54. Decisive break there will confirmation completion of the decline from 118.65 (2016 high).