Daily Pivots: (S1) 143.39; (P) 144.05; (R1) 144.74; More…

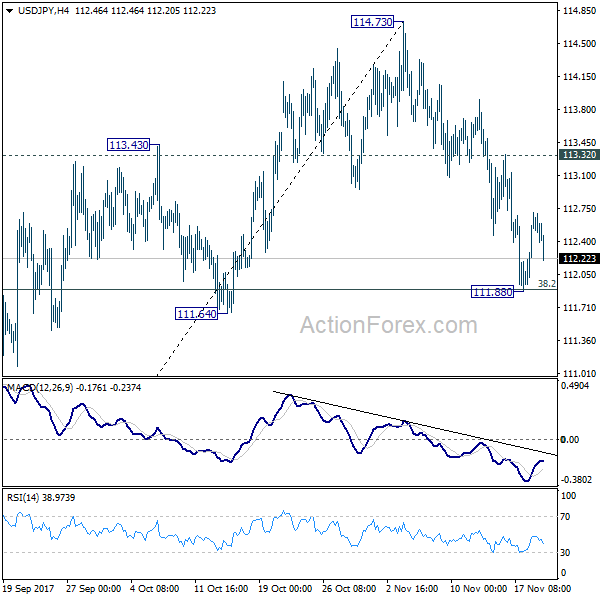

USD/JPY falls sharply today after hitting 145.89 and intraday bias is turned neutral first. Further rally will remain in favor as long as 139.37 resistance turned support holds. Break of 145.89 will resume larger rally to 147.68 long term resistance. However, decisive break of 139.37 will confirm short term topping, on bearish divergence condition in 4 hour MACD. Deeper decline would be seen back towards 130.38 support.

In the bigger picture, up trend from 101.18 is still in progress, as part of the whole up trend from 75.56 (2011 low). Further rise should be seen to 147.68 (1998 high). For now, break of 130.38 support is needed to be the first indication of medium term topping. Otherwise, outlook will stay bullish even in case of deep pull back.