Daily Pivots: (S1) 103.65; (P) 103.87; (R1) 104.24; More..

USD/JPY rebounded strongly after dipping to 103.51 and intraday bias is turned neutral again. Overall, the pair is staying inside the falling channel from 111.71. Break of 103.51 will target 103.17 first. Break there will resume the whole decline to 101.18 low. For now, break of 104.57 resistance is needed to indicate short term bottoming. Otherwise, outlook will stay bearish in case of recovery.

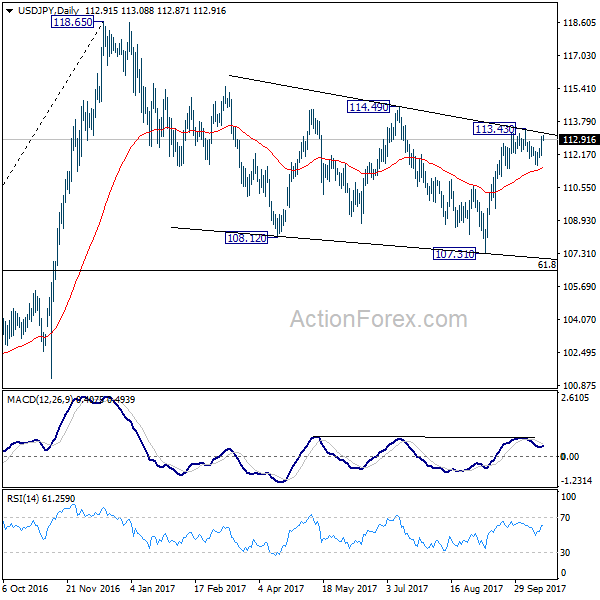

In the bigger picture, USD/JPY is still staying in long term falling channel that started back in 118.65 (Dec. 2016). Hence, there is no clear indication of trend reversal yet. The down trend could still extend through 101.18 low. On the upside, break of 106.10 resistance is needed to be the first signal of medium term reversal. Otherwise, outlook will remain bearish.