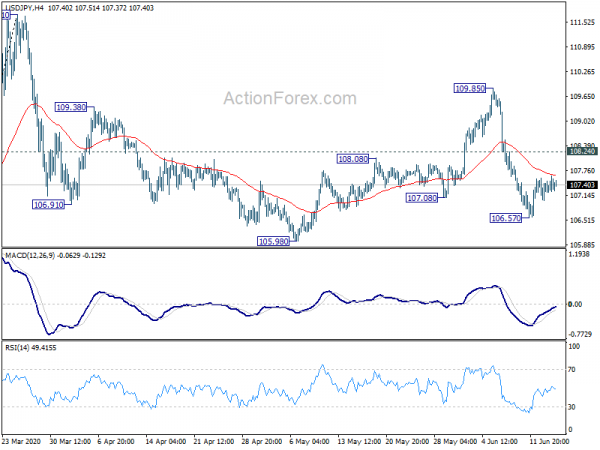

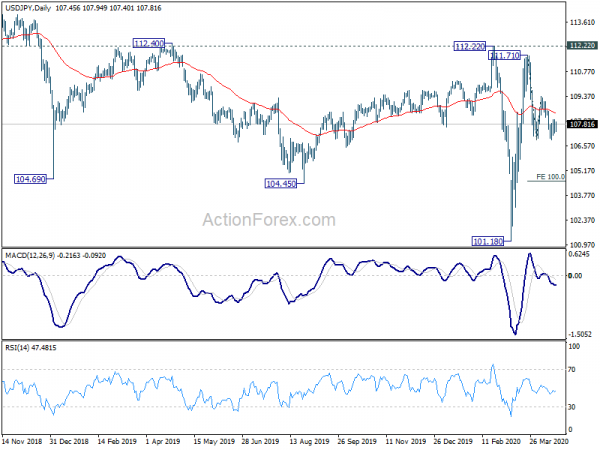

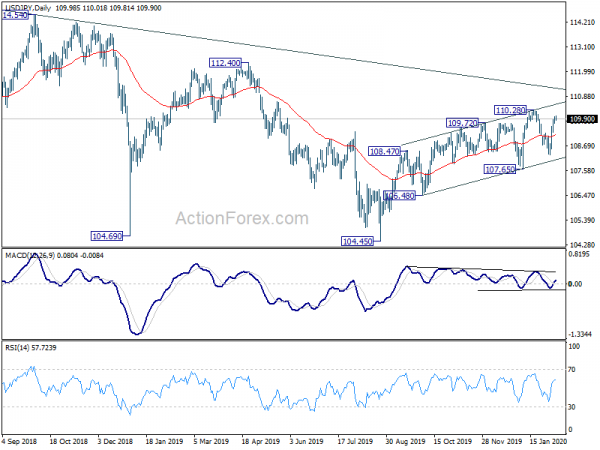

Daily Pivots: (S1) 107.05; (P) 107.31; (R1) 107.62; More..

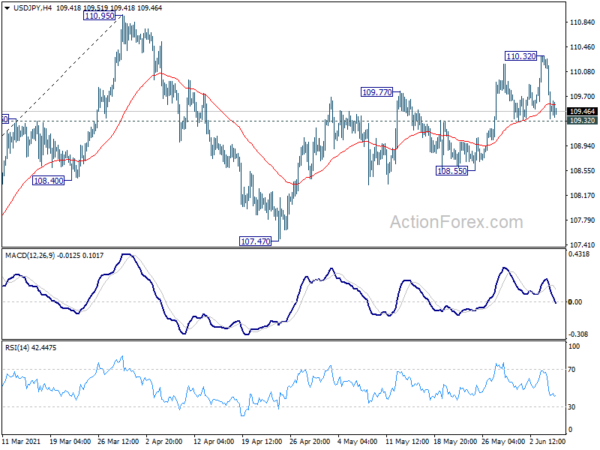

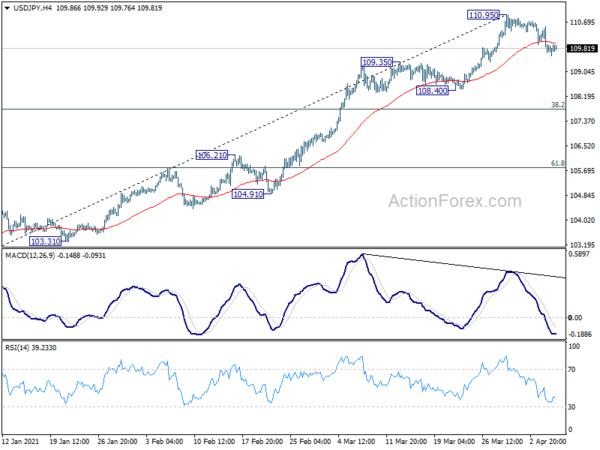

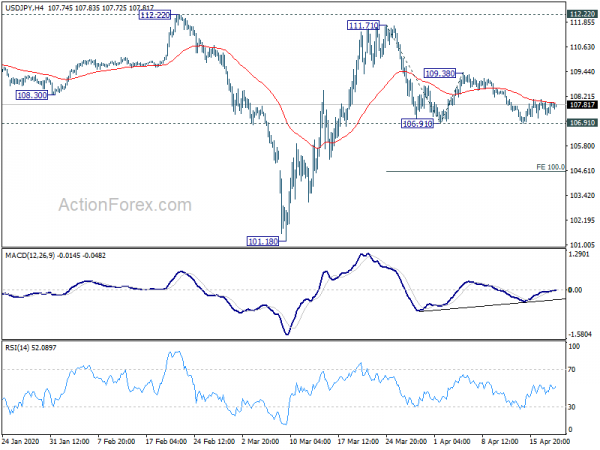

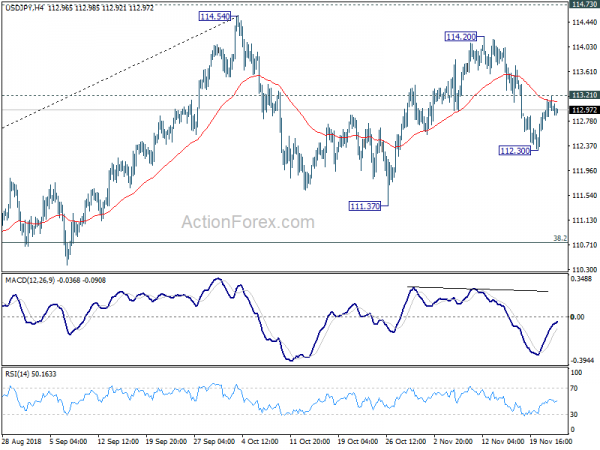

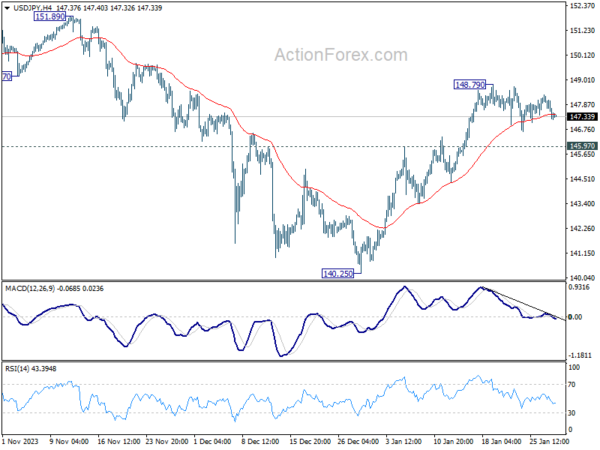

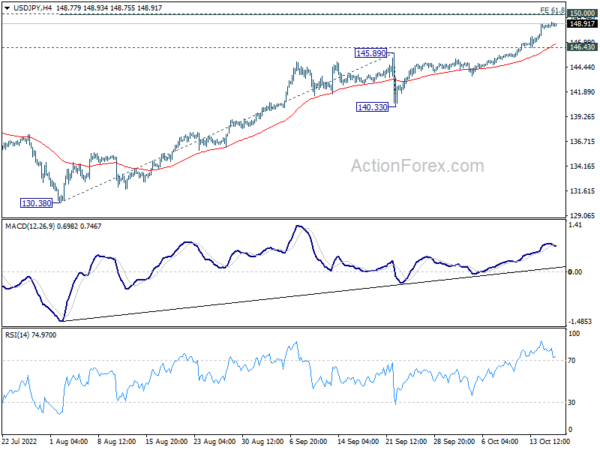

Intraday bias in USD/JPY remains neutral for the moment. Further decline will remain in favor as long as 108.24 minor resistance holds. On the downside, break of 106.57 will target 105.98 support and below. But downside should be contained by 61.8% retracement of 101.18 to 111.71 at 105.20 to bring rebound. On the upside, break of 108.24 will turn bias back to the upside for 109.85 resistance.

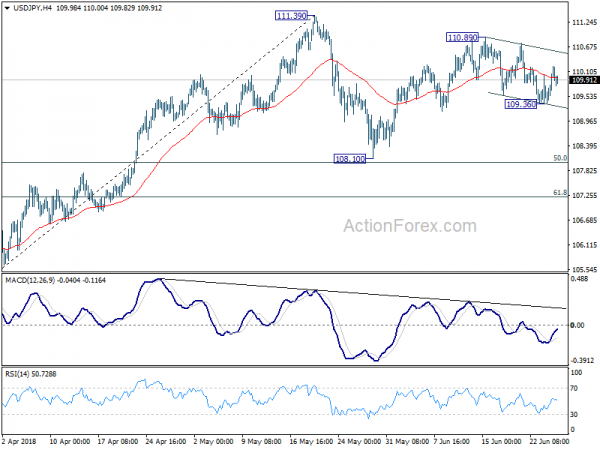

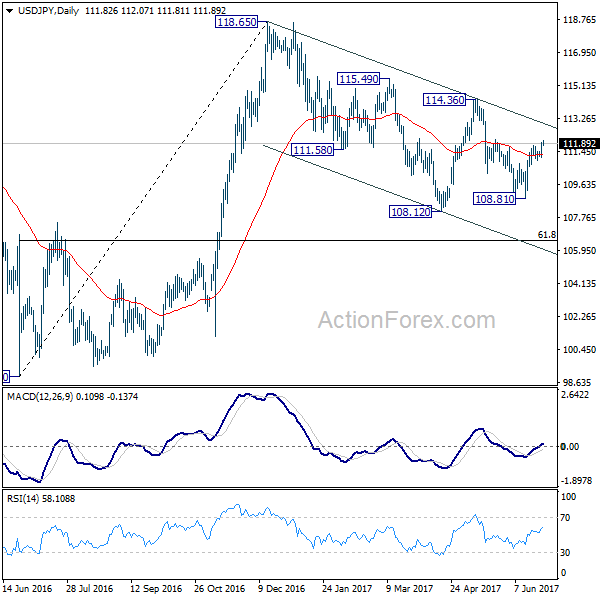

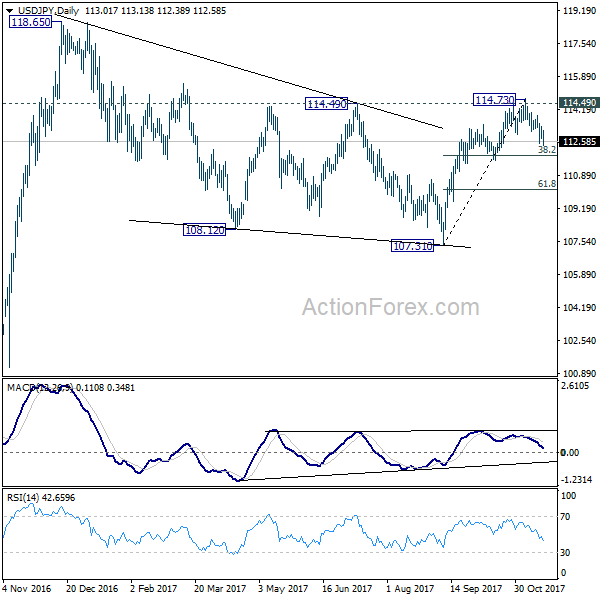

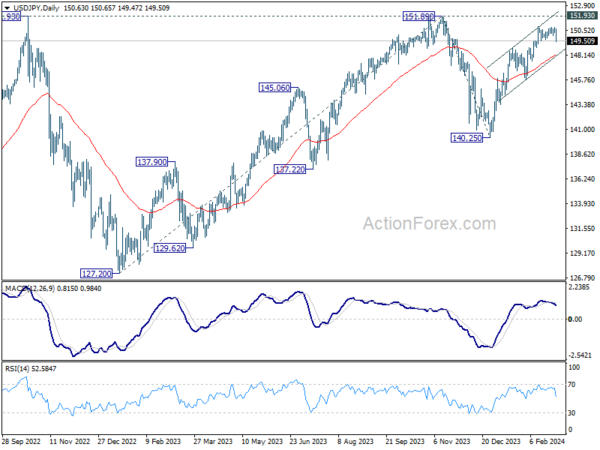

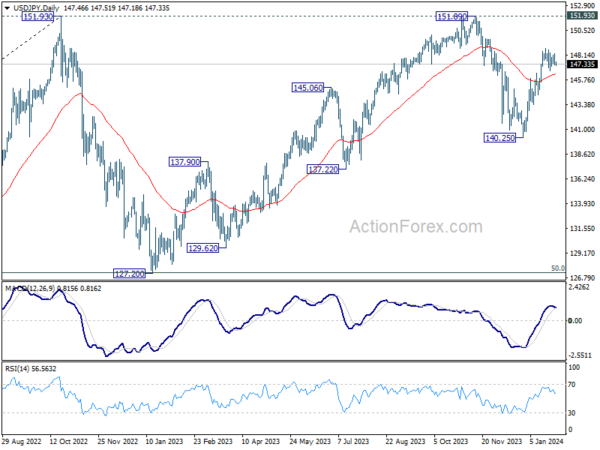

In the bigger picture, USD/JPY is still staying in long term falling channel that started back in 118.65 (Dec2016). Hence, there is no clear indication of trend reversal yet. Break of 105.98 support could extend the down trend through 101.18 low. However, sustained break of 112.22 should confirm completion of the down trend and turn outlook bullish for 118.65 and above.