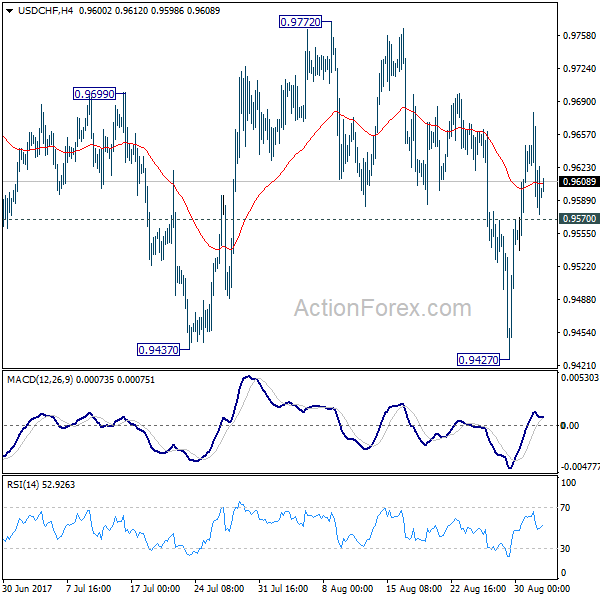

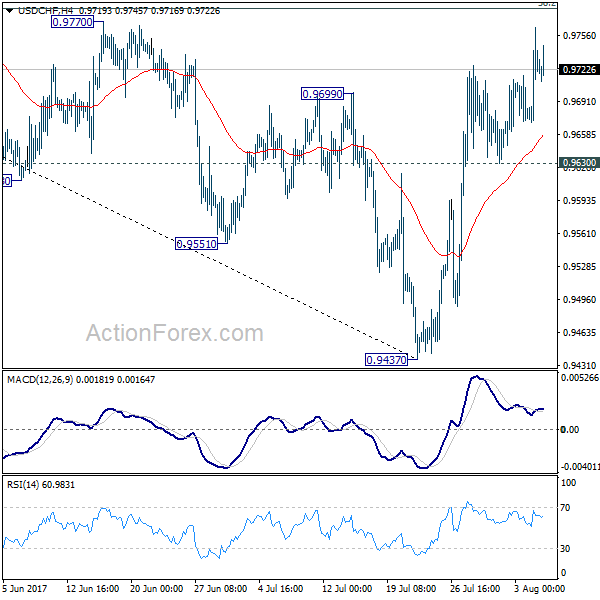

USD/CHF edged higher to 0.9994 last week but quickly turned into consolidation again. Initial bias stays neutral this week first. Downside of retreat should be contained by 38.2% retracement of 0.9716 to 0.9994 at 0.9888 to bring another rally. As noted before, the corrective decline from 1.0128 should have completed at 0.9716 already. On the upside, break of 0.9994 will extend the rise from 0.9716 to retest 1.0128 next. On the downside, though, firm break of 0.9888 will target 61.8% retracement at 0.9822 before completing the retreat.

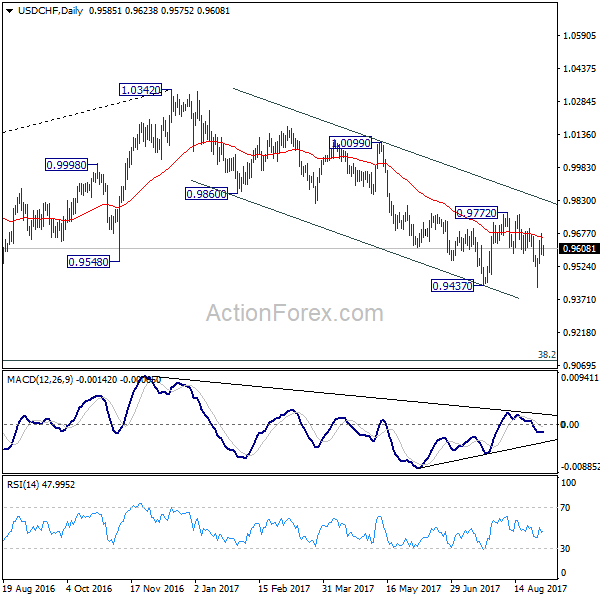

In the bigger picture, USD/CHF drew strong support from medium term trend line and rebounded. That suggests rise from 0.9186 is still in progress. Further break of 1.0128 will confirm up trend resumption and target 1.0342 key resistance. Nevertheless, break of 0.9716 will dampen this bullish view and at least bring deeper fall to 0.9541 key support.

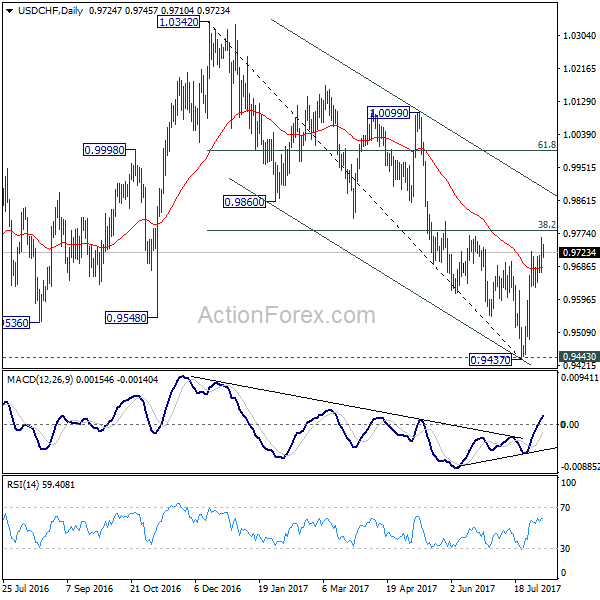

In the long term picture, price actions from 0.7065 (2011 low) are not clearly impulsive yet. Thus, we’ll treat it as developing into a corrective pattern, at least, until a firm break of 1.0342 resistance.