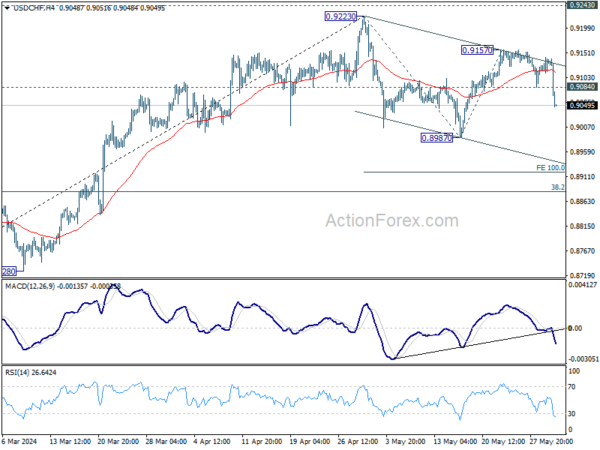

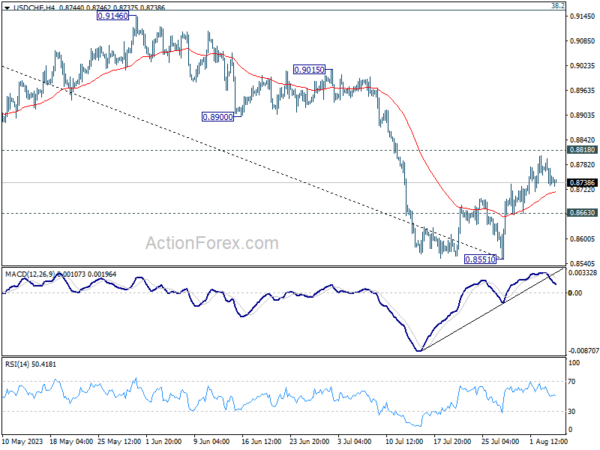

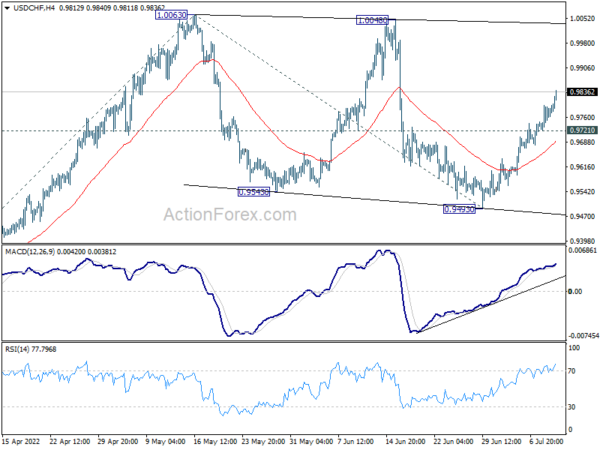

Daily Pivots: (S1) 0.9116; (P) 0.9130; (R1) 0.9147; More….

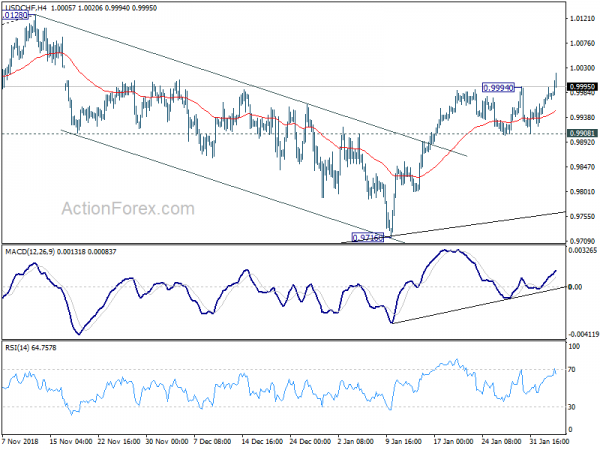

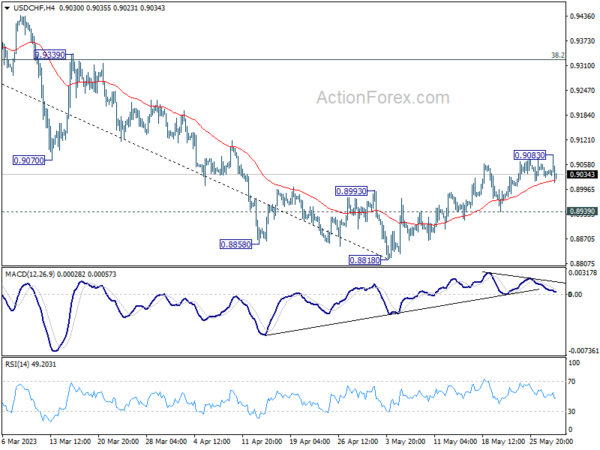

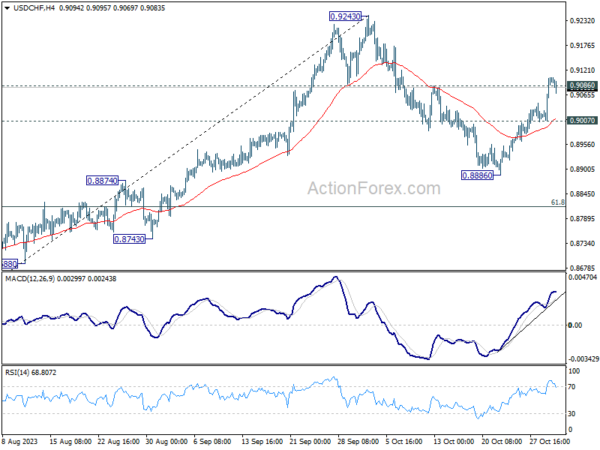

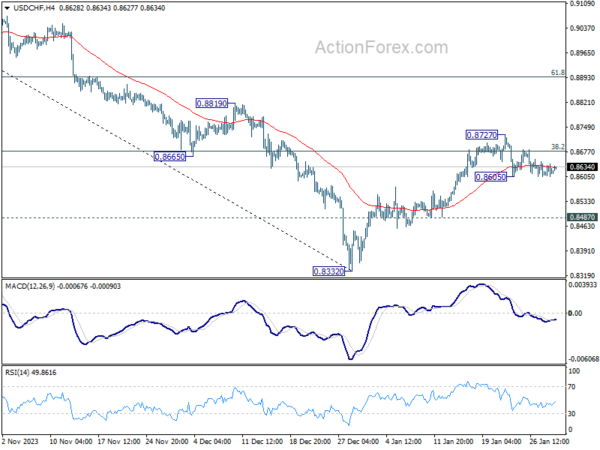

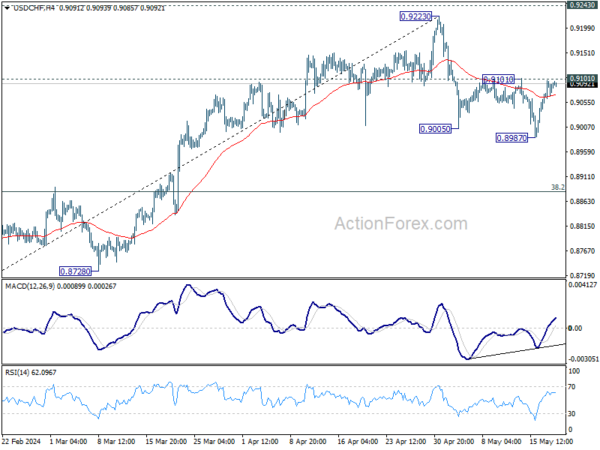

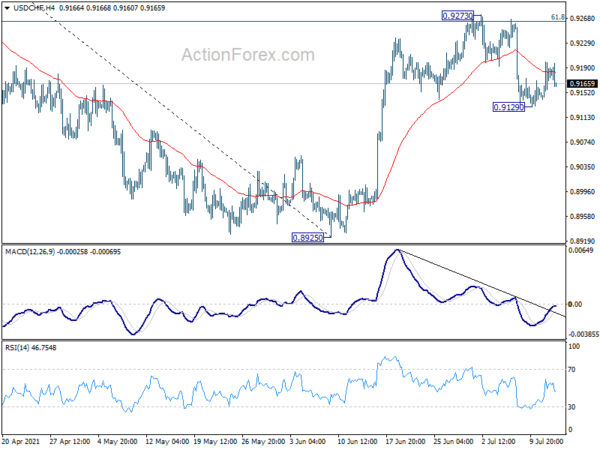

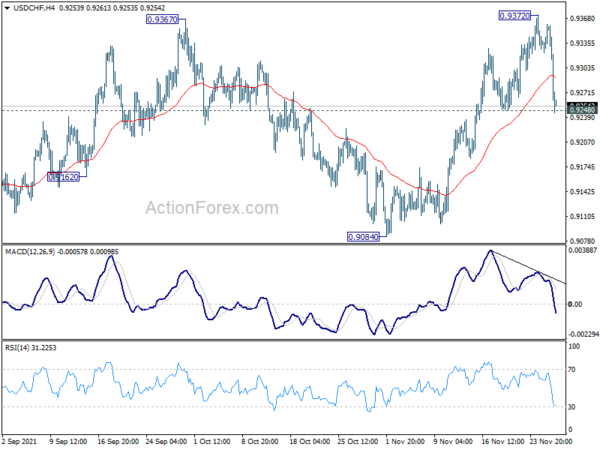

USD/CHF’s fall from 0.9157 accelerates lower today, and the development suggests that rebound from 0.8987 has completed already. Fall from 0.9157 is now seen as the third leg of the pattern from 0.9223. Intraday bias is back on the downside for 0.8987 support first. Break will target 100% projection of 0.9223 to 0.8987 from 0.9157 at 0.8921. On the upside, above 0.8904 minor resistance will turn intraday bias neutral first.

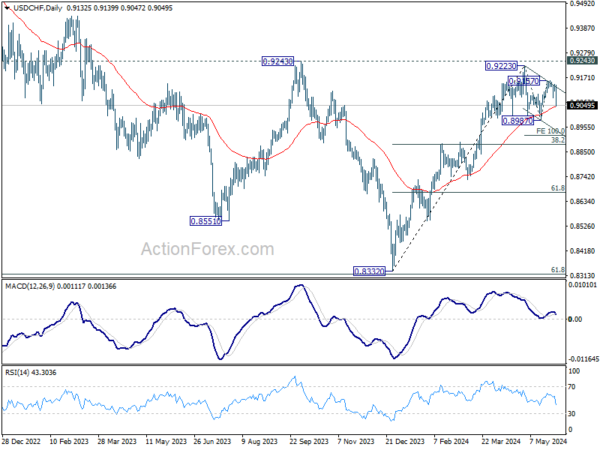

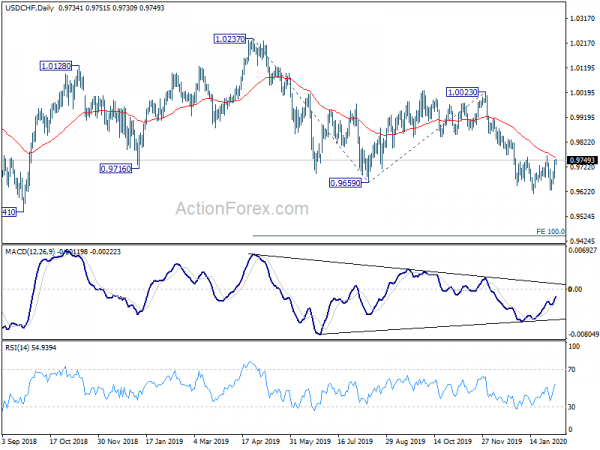

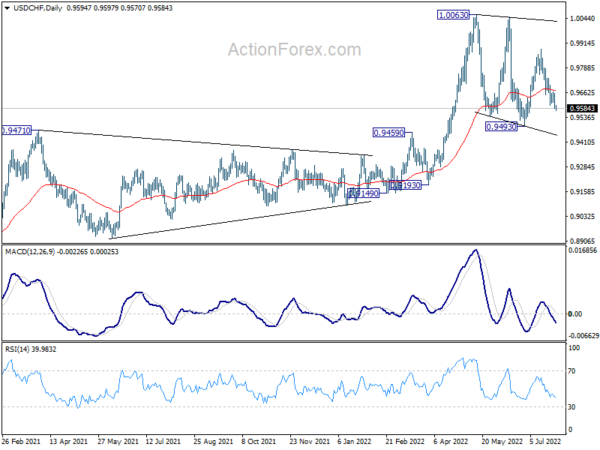

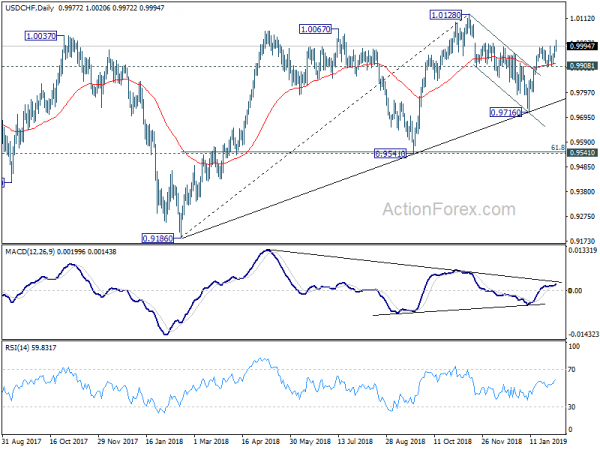

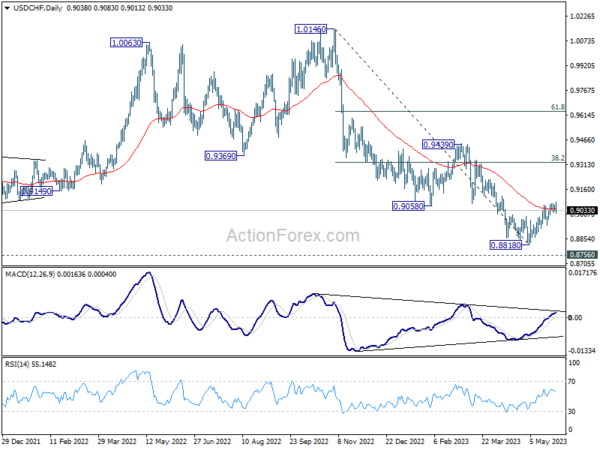

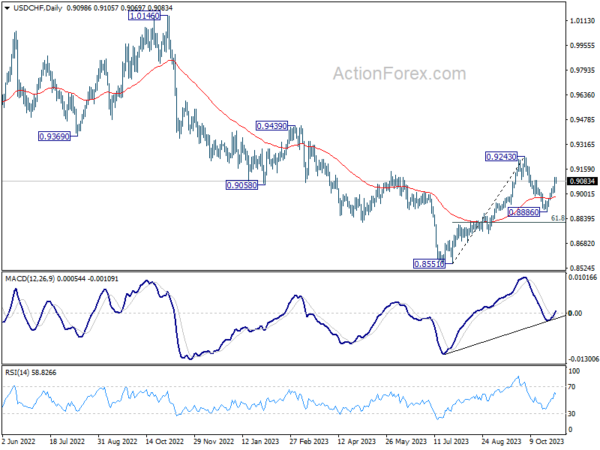

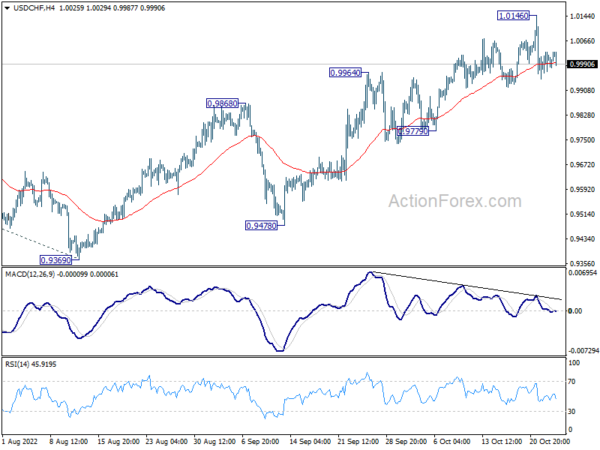

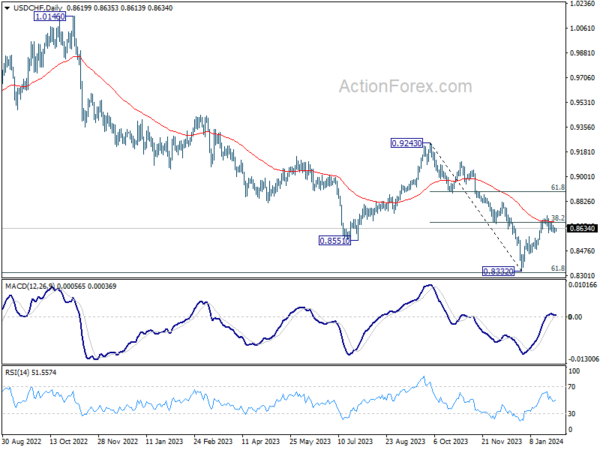

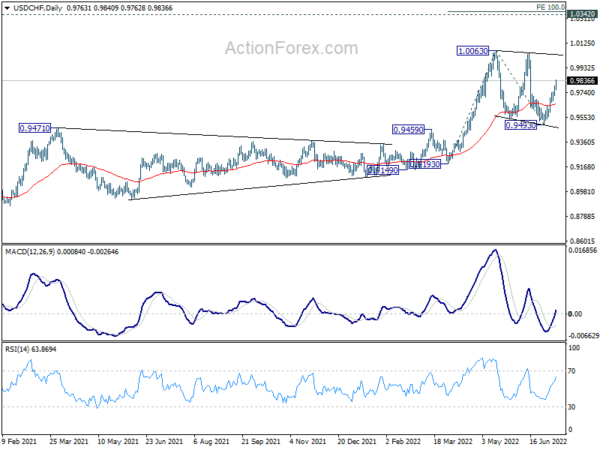

In the bigger picture, price actions from 0.8332 medium term bottom are tentatively seen as developing into a corrective pattern to the down trend from 1.0146 (2022 high). Rejection by 0.9243 resistance, followed by sustained break of 38.2% retracement of 0.8332 to 0.9223 at 0.8883 will strengthen this case, and maintain medium term bearishness. However, decisive break of 0.9243 will argue that the trend has already reversed and turn medium term outlook bullish for 1.0146.