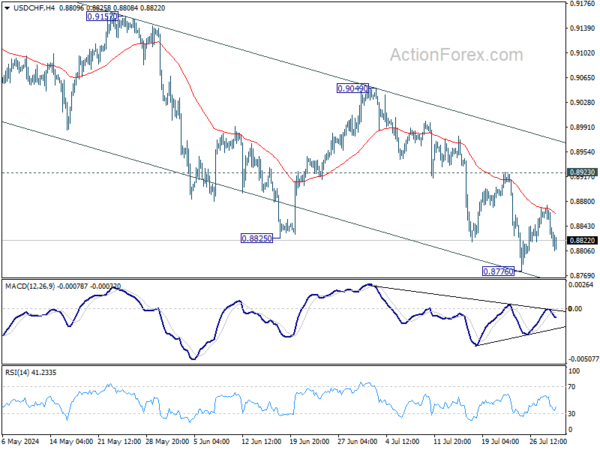

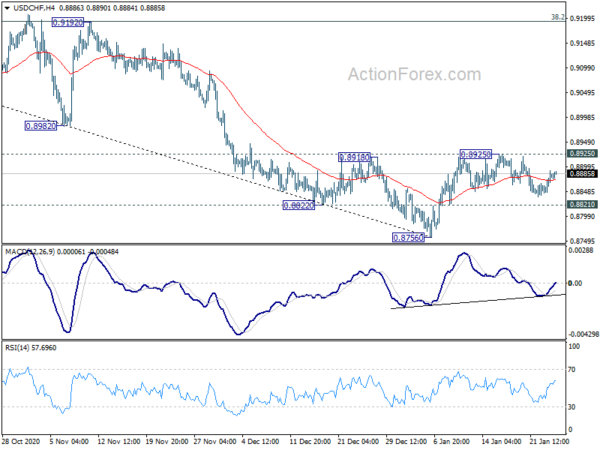

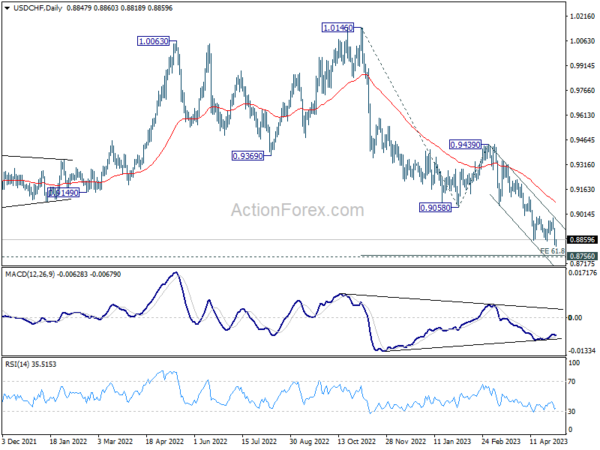

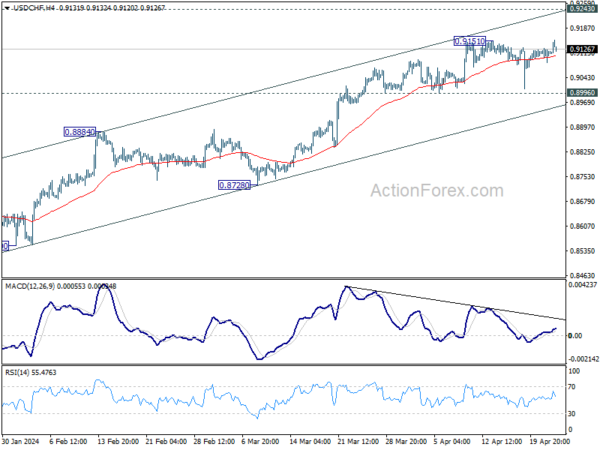

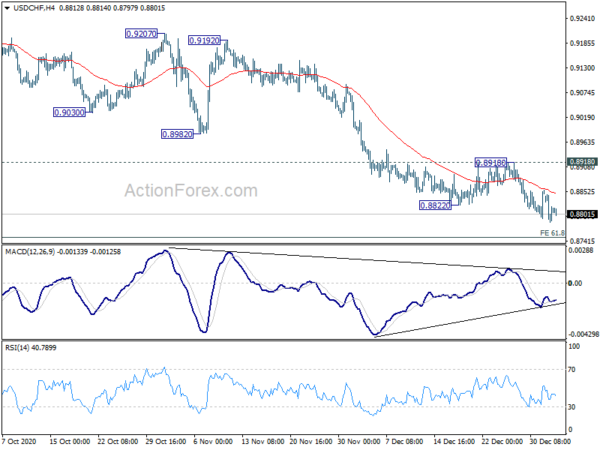

Daily Pivots: (S1) 0.8721; (P) 0.8743; (R1) 0.8773; More….

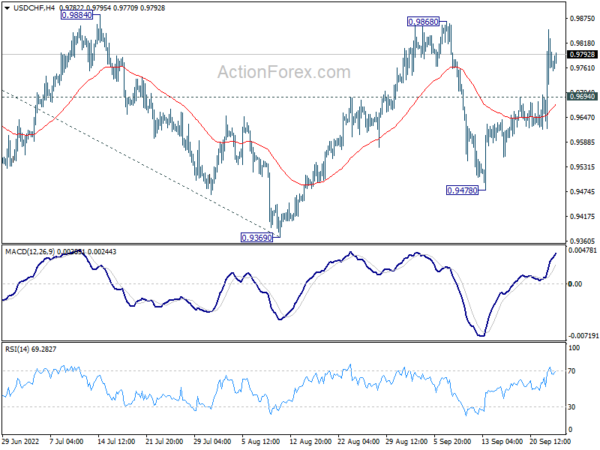

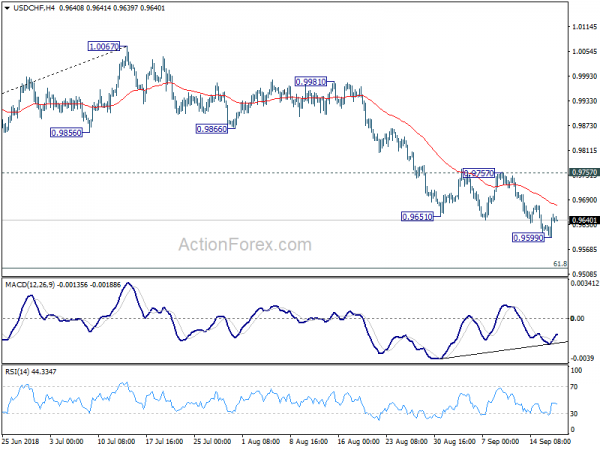

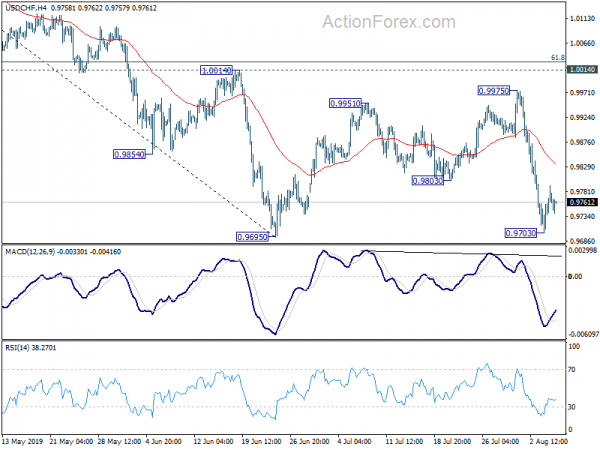

Intraday bias in USD/CHF stays neutral at this point. Another fall is in favor as long as 0.8769 minor resistance holds. Below 0.8665 will resume the decline from 0.9243 to 161.8% projection of 0.9243 to 0.8886 from 0.9111 at 0.8533, which is close to 0.8551 low. However, break of 0.8769 minor resistance should indicate short term bottoming, and turn bias back to the upside for stronger recovery to 0.8886 support turned resistance.

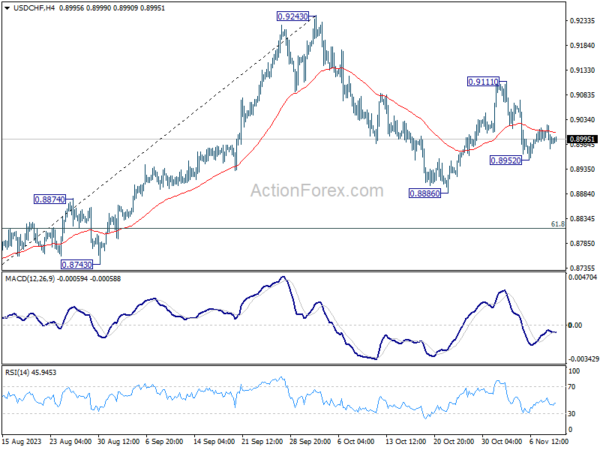

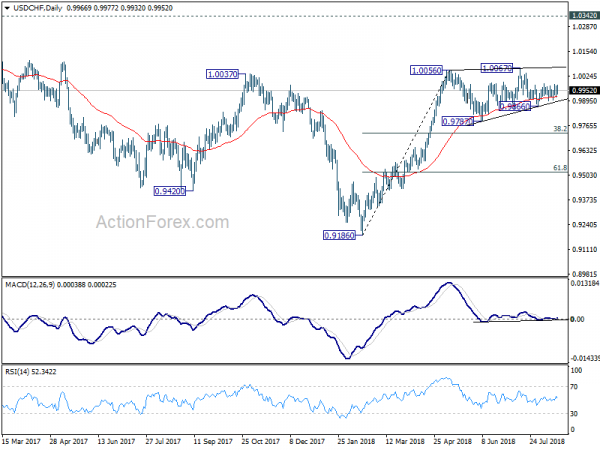

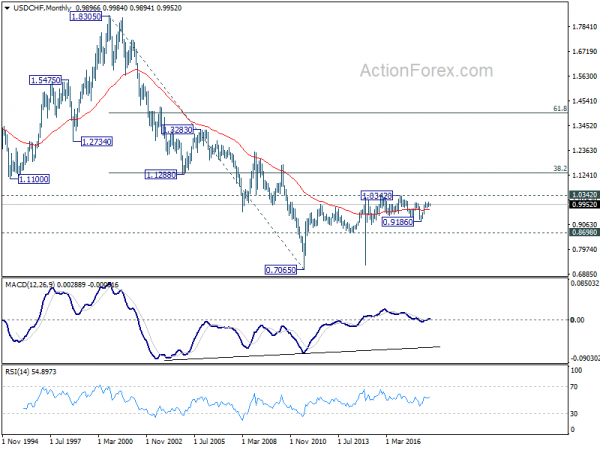

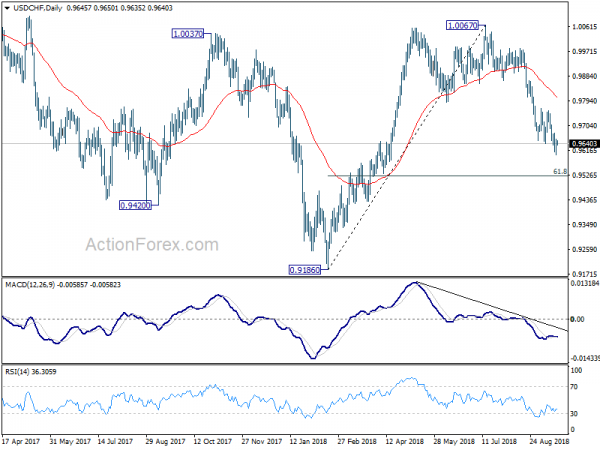

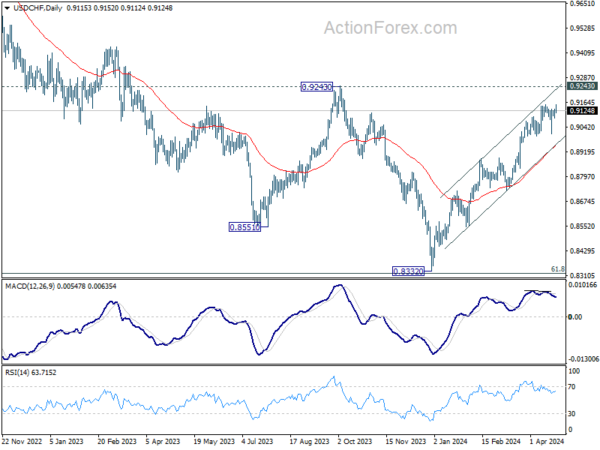

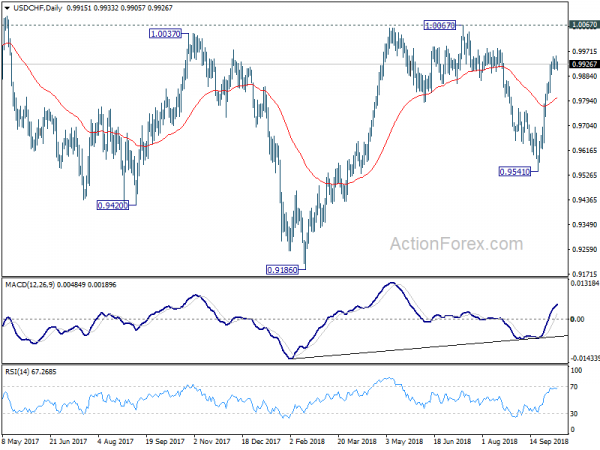

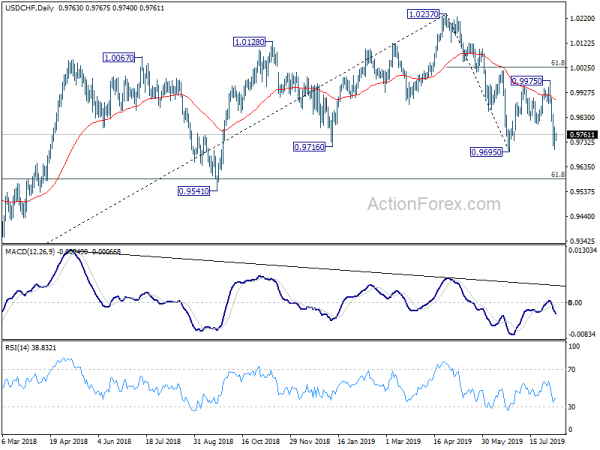

In the bigger picture, price actions from 0.8551 are currently seen as part of a corrective pattern to the decline from 1.0146 (2022 high). Fall from 0.9243 is seen as the second leg for now. Deeper decline could be seen to 0.8551 low but strong support should be seen there to bring rebound. For now, this will remain the favored case as long as 0.8886 support turned resistance holds.