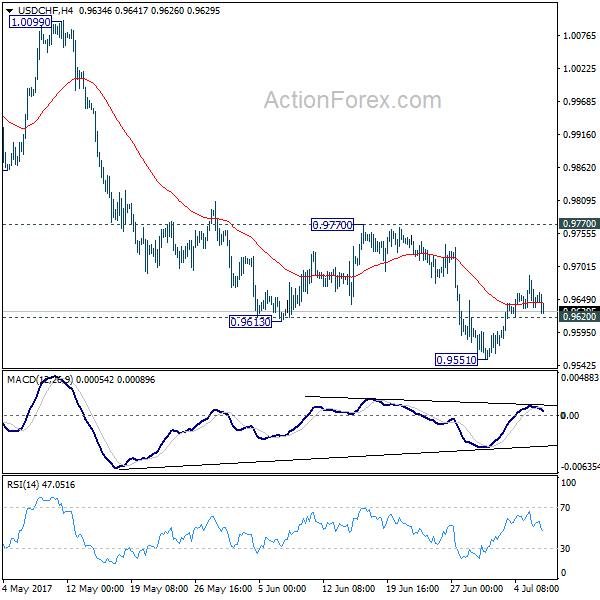

Daily Pivots: (S1) 0.9700; (P) 0.9715; (R1) 0.9732; More…

Intraday bias in USD/CHF remains neutral for the moment and outlook is unchanged. Corrective pattern from 0.9901 might still extend further. Break of 0.9665 minor support will turn bias to the downside for 0.9588 support and possibly below. But overall, downside contained by 61.8% retracement of 0.9181 to 0.9901 at 0.9456 to rebound. On the upside, break of 0.9802 will target a test on 0.9901 high.

In the bigger picture, decline from 1.0237 is seen as the third leg of the pattern from 1.0342 (2016 low). It could have completed at 0.9181 after hitting 0.9186 key support (2018 low). Break of 0.9901 will extend the rebound form 0.9181 through 1.0023 resistance. After all, medium term range trading will likely continue between 0.9181/1.0237 for some more time.