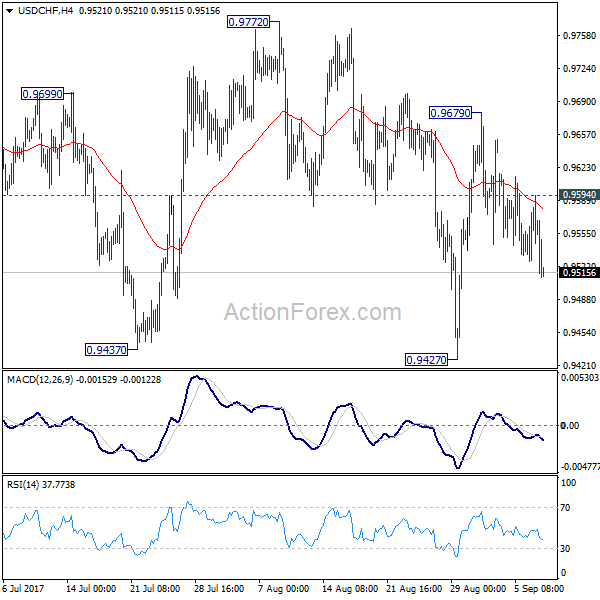

Daily Pivots: (S1) 0.9535; (P) 0.9559; (R1) 0.9590; More….

USD/CHF’s break of 0.9527 minor support suggests that fall from 0.9679 is going to extend lower. Intraday bias is turned back to the downside for 0.9427 low. Break of 0.9427 will resume whole decline from 1.3042. On the upside, above 0.9594 minor resistance will turn intraday bias neutral again. Also, noted that USD/CHF is close to to 0.9443 key support, consolidation from 0.9427 might extend further. But still, break of 0.9772 resistance is needed to confirm near term reversal. Otherwise, outlook stays bearish for another decline.

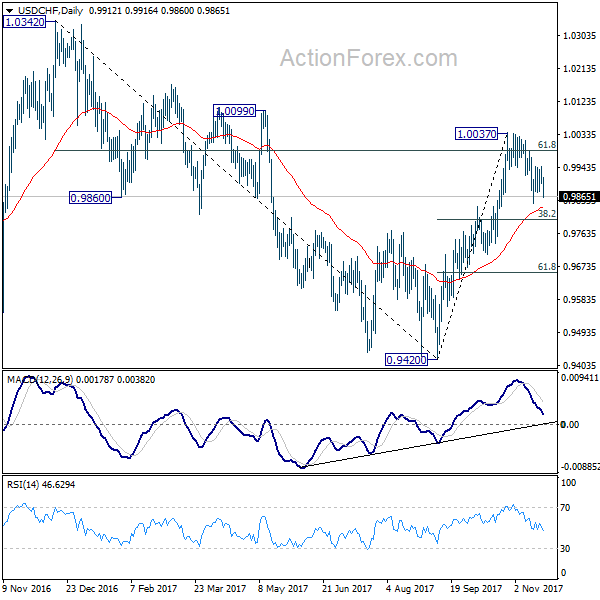

In the bigger picture, current development suggests that 0.9443 key support (2016 low) could be taken out firmly as down trend form 1.0342 extends. There are various interpretation of the price actions. But in any case, medium term outlook will stay bearish as long as 0.9772 resistance holds. Current down trend could extend to 38.2% retracement of 0.7065 (2011 low) to 1.0342 (2016 high) at 0.9090. However, break of 0.9772 will indicate that USD/CHF has successfully defended 0.9443 again and turn outlook bullish for 1.0099 resistance.