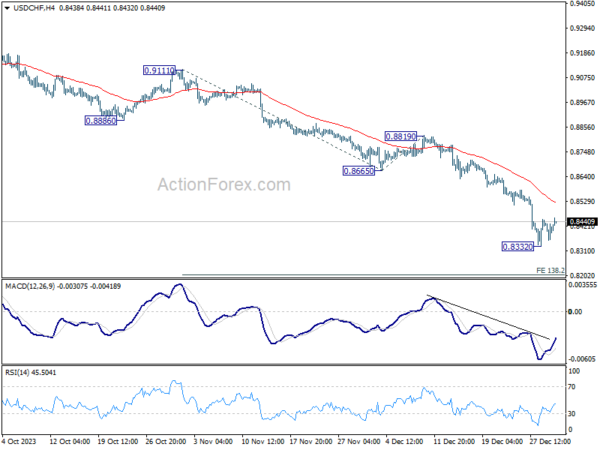

Daily Pivots: (S1) 0.9447; (P) 0.9461; (R1) 0.9478; More…

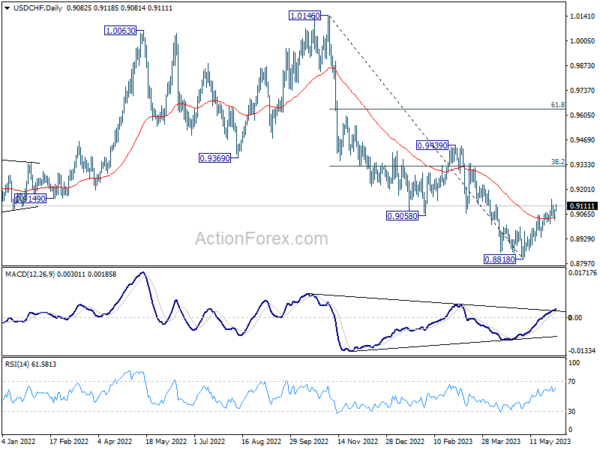

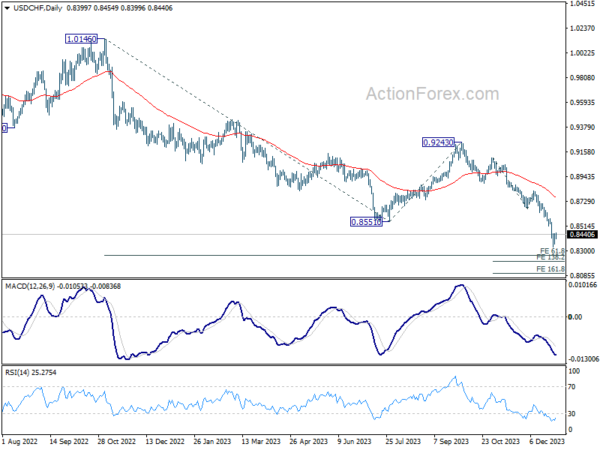

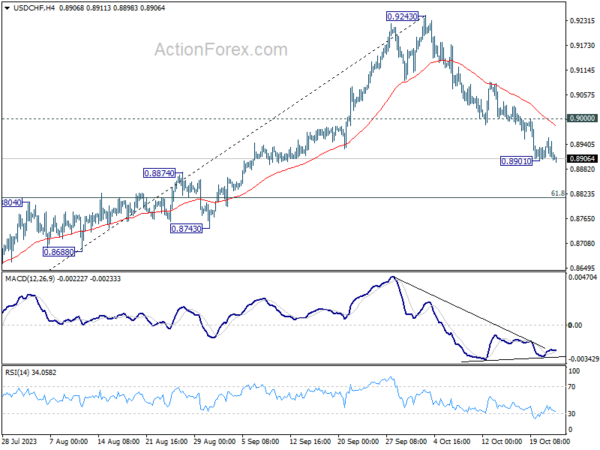

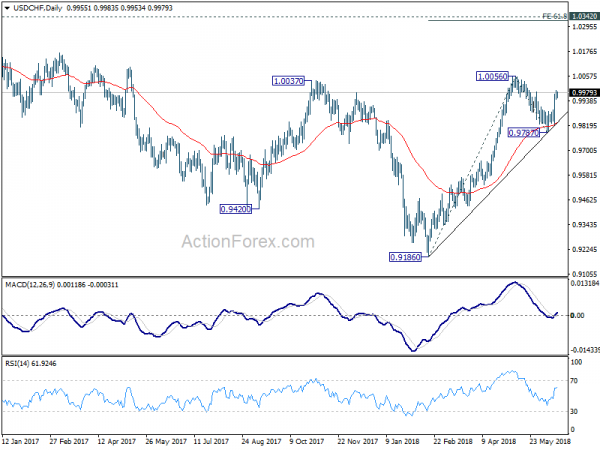

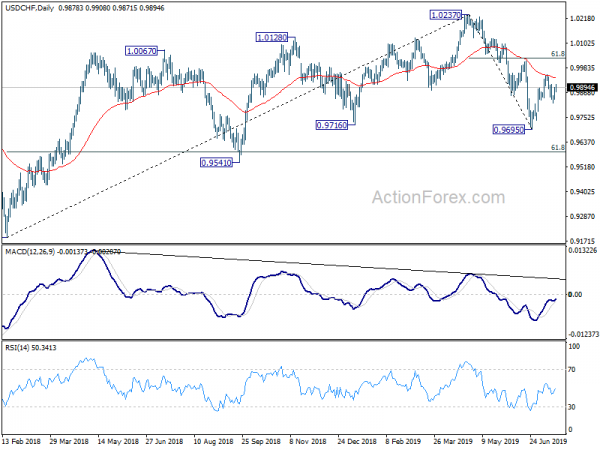

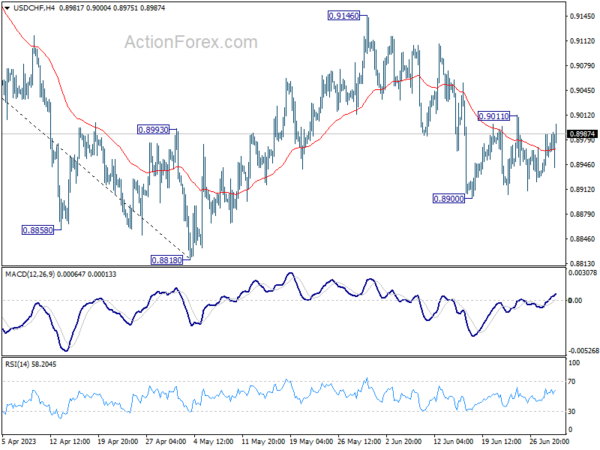

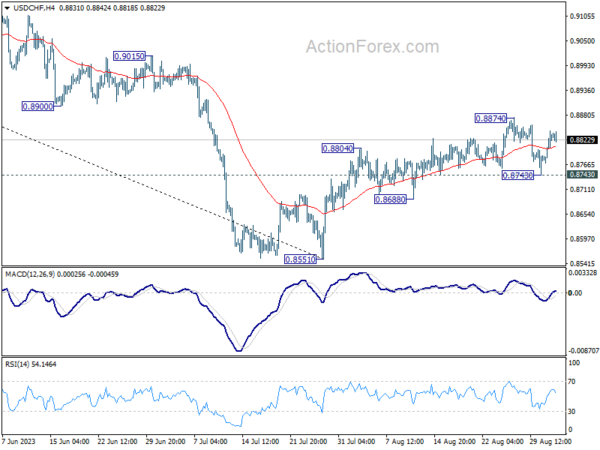

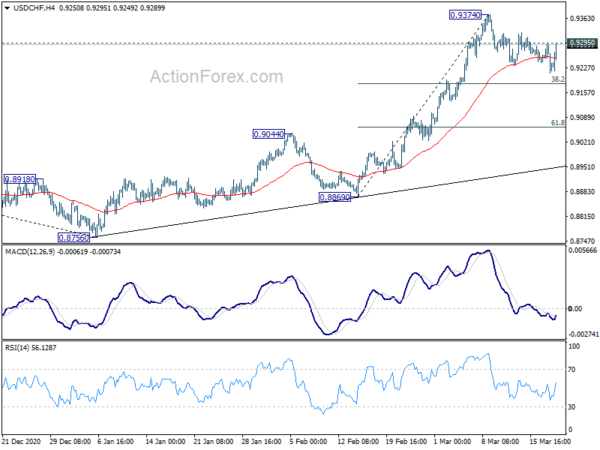

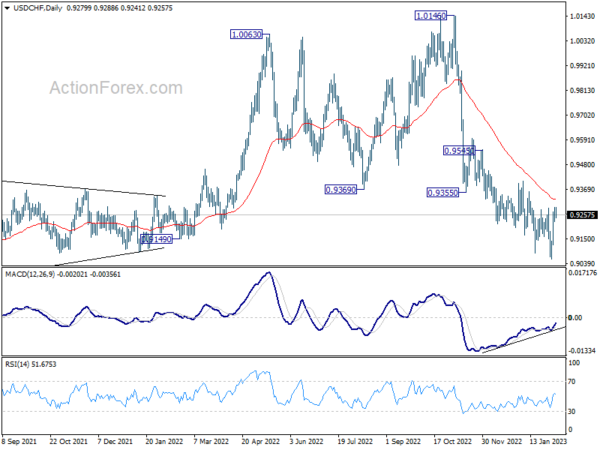

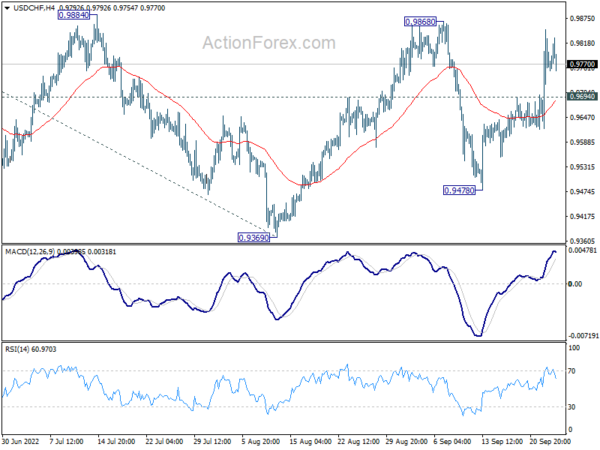

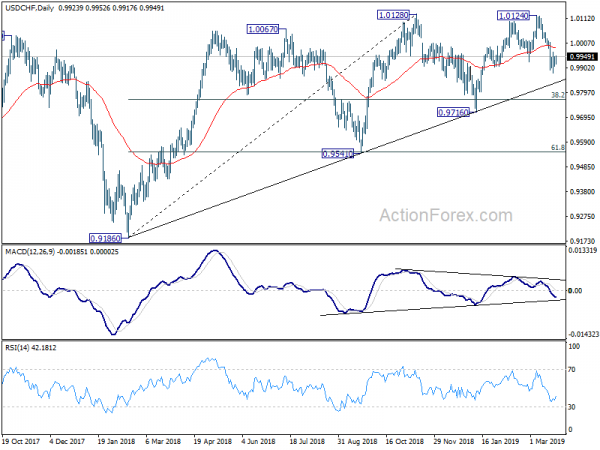

With 0.9492 minor resistance intact, intraday bias in USD/CHF remains on the downside for further decline. Sustained trading below 0.9443 key support will extend the down trend from 1.0342 to 161.8% projection of 1.0342 to 0.9860 from 1.0099 at 0.9319. On the upside, above 0.9492 minor resistance will turn bias neutral and bring recovery. But outlook will remain bearish as long as 0.9699 resistance holds.

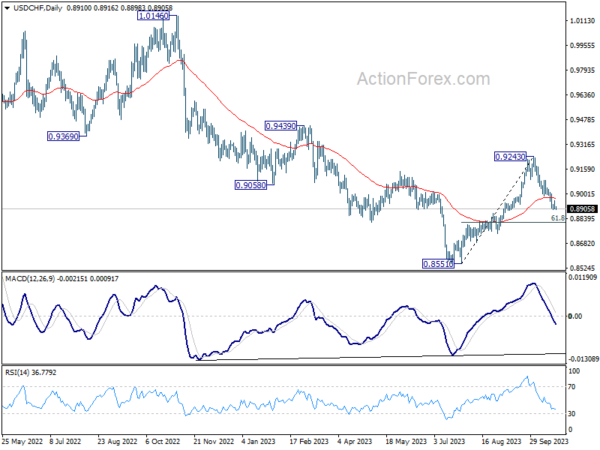

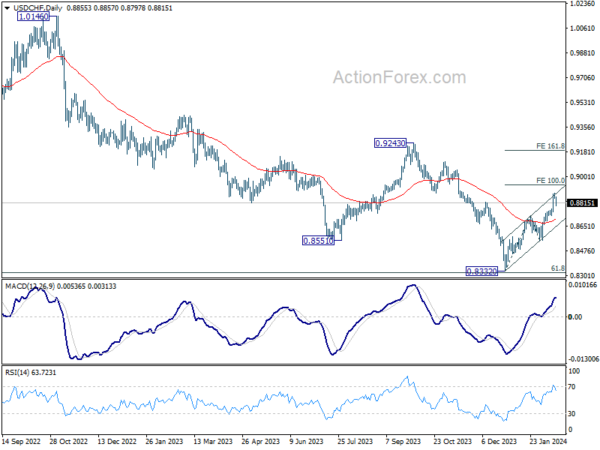

In the bigger picture, focus is now back 0.9443 key support level. Sustained break there indicate underlying bearish momentum and would target 0.9 handle and possibly below. Meanwhile, strong rebound from current level and break 0.9699 resistance will extend long term range trading between 0.9443/1.0342.