Daily Pivots: (S1) 0.9175; (P) 0.9206; (R1) 0.9234; More….

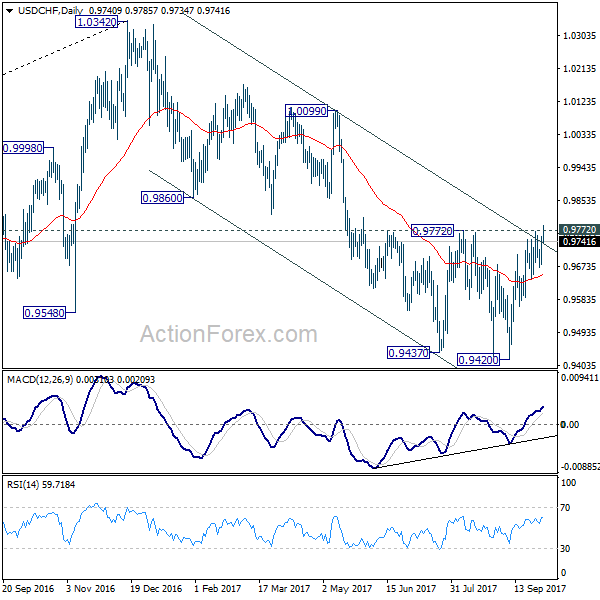

Intraday bias is back on the upside in USD/CHF with break of 0.9250. Further rise would be seen back to 0.9341 resistance first. Break will target 0.9372. On the downside, below 0.9176 will resume the fall form 0.9341 to 0.9090 support. Firm break there will argue that choppy rise from 0.8925 has completed, and turn near term outlook bearish.

In the bigger picture, medium term outlook will be neutral at best as long as 0.9471 resistance holds. Larger down trend could still extend through 0.8756 (2021 low). However, firm break of 0.9471 will argue that the trend has already reversed and rebound the rally from 0.8756 with another impulsive move.