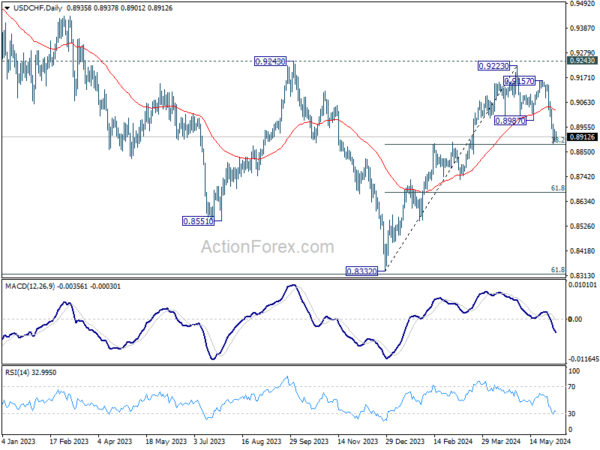

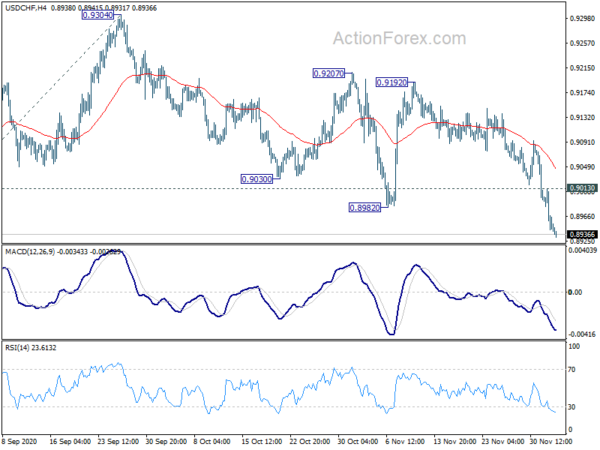

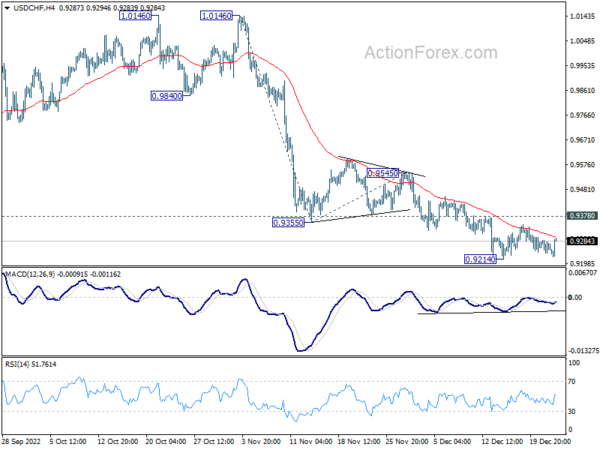

Daily Pivots: (S1) 0.9161; (P) 0.9180; (R1) 0.9220; More….

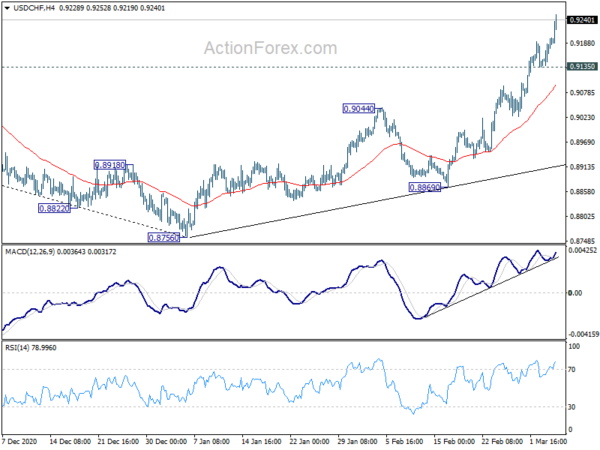

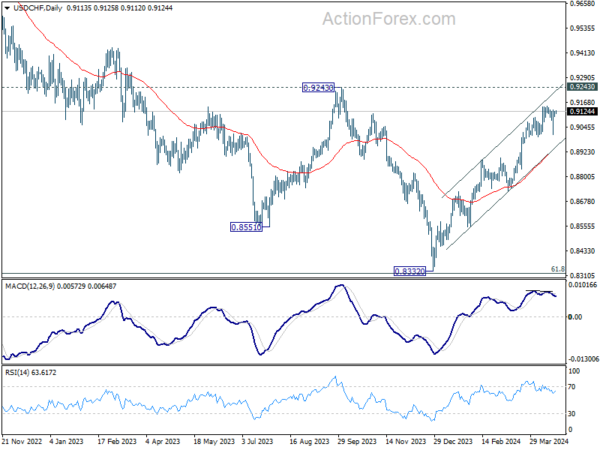

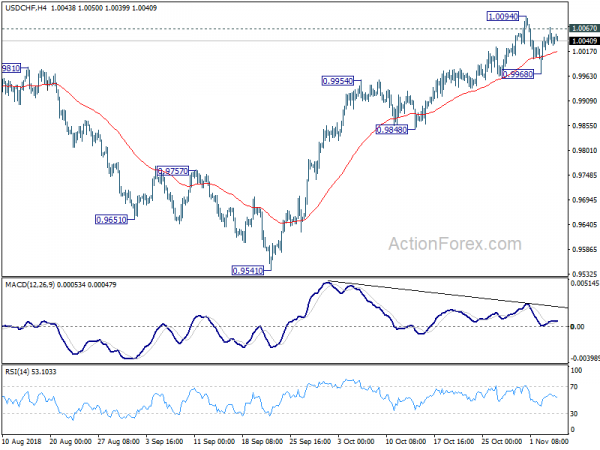

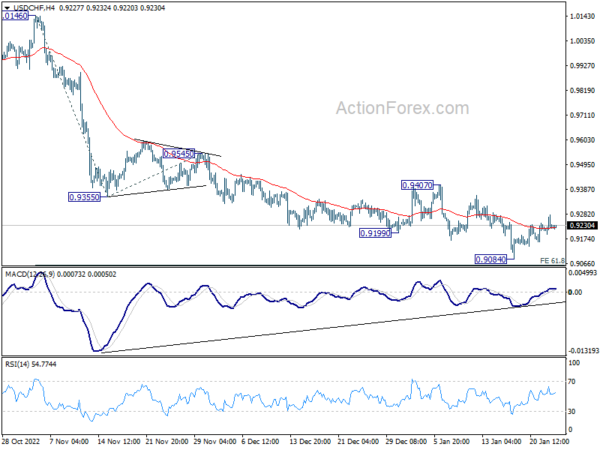

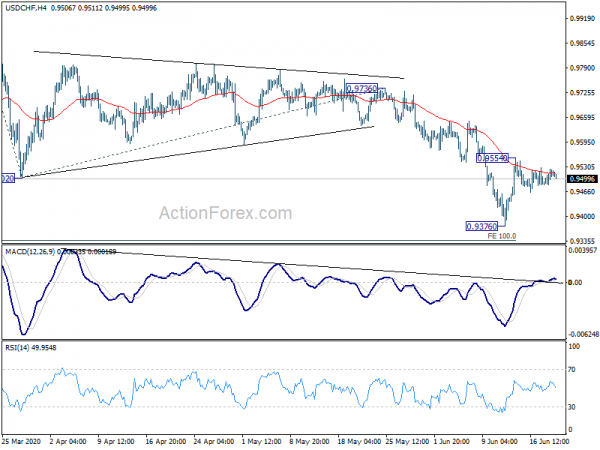

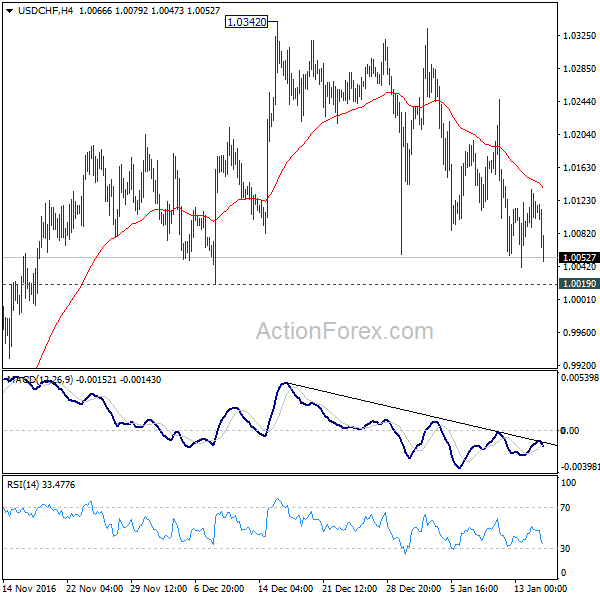

USD/CHF rises to as high as 0.9252 so far today and intraday bias stays on the upside. Next target is 0.9295 resistance and break will carry larger bullish implications. Rise from 0.8756 should then target 61.8% retracement of 0.9901 to 0.8756 at 0.9464. On the downside, break of 0.9135 minor support will turn intraday bias neutral again. But further rally is expected as long as 0.9044 resistance turned support holds.

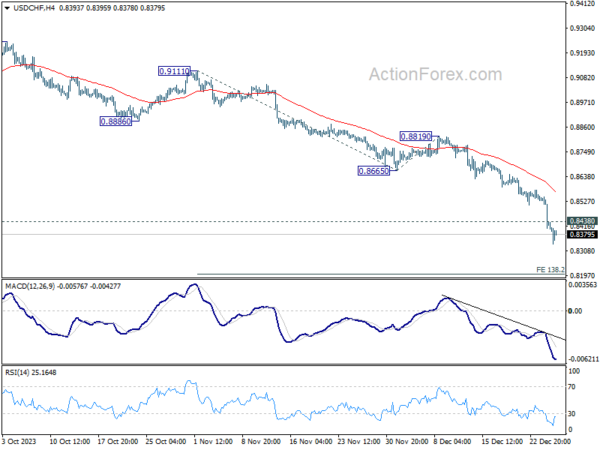

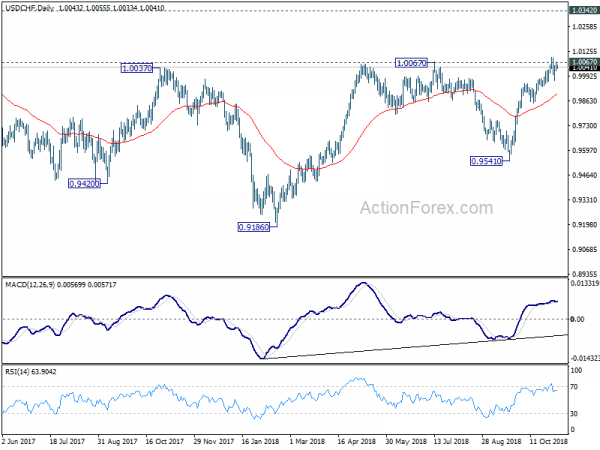

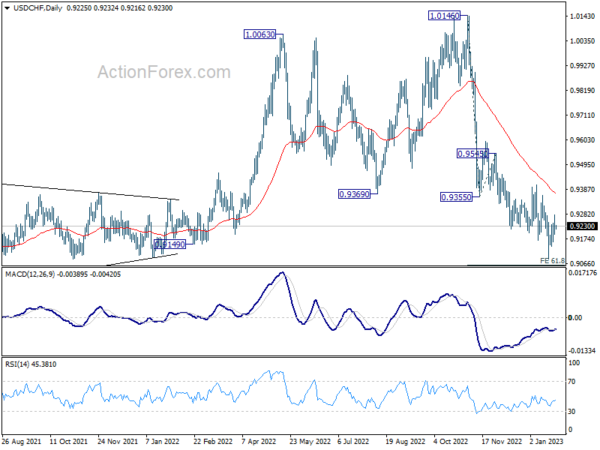

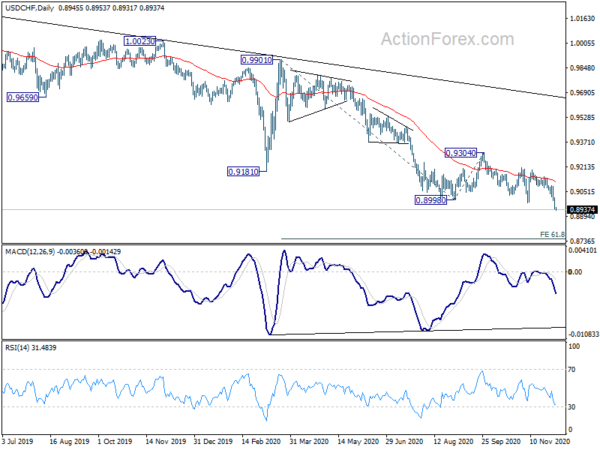

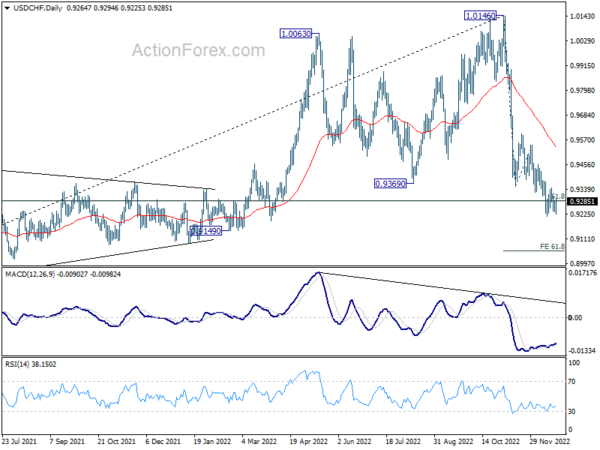

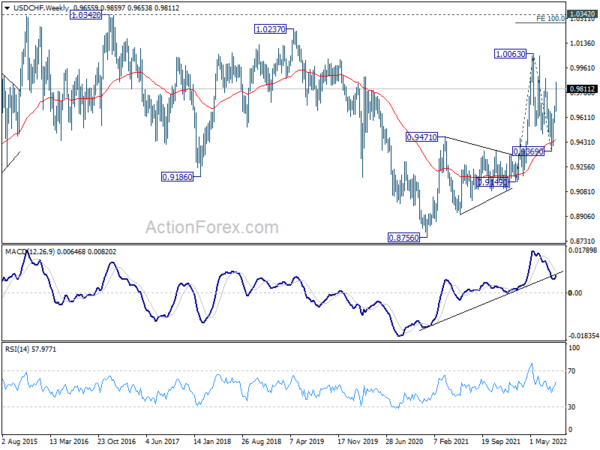

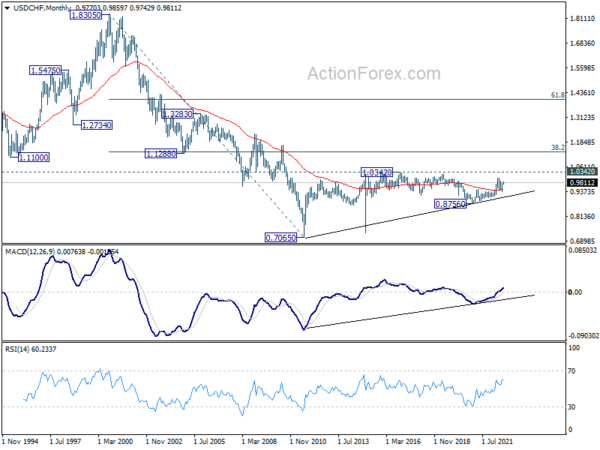

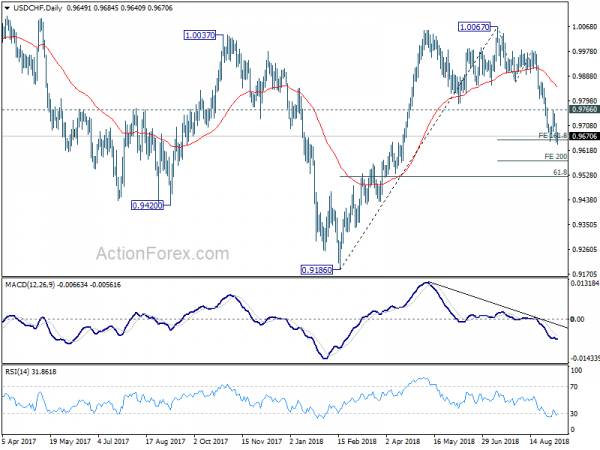

In the bigger picture, decline from 1.0237 is seen as the third leg of the pattern from 1.0342 (2016 high). Firm break of 0.9295 resistance, and sustained trading above 55 week EMA (now at 0.9227), will suggest that the pattern has completed. In this case, further rise could be seen back to 1.0237/0342 resistance zone in the medium term. Though, rejection by 0.9295 will retain medium term bearishness for 138.2% projection of 1.0342 to 0.9186 from 1.0237 at 0.8639.