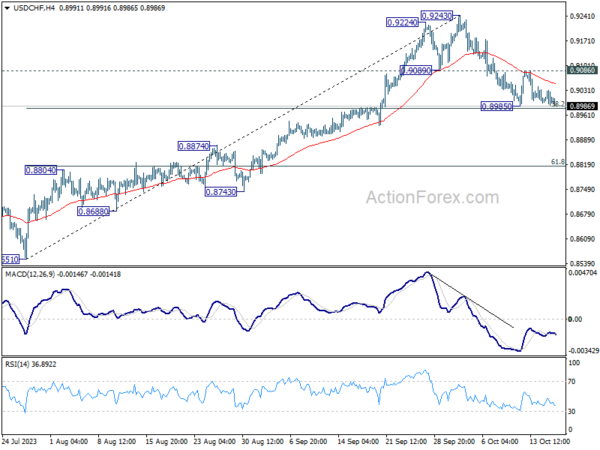

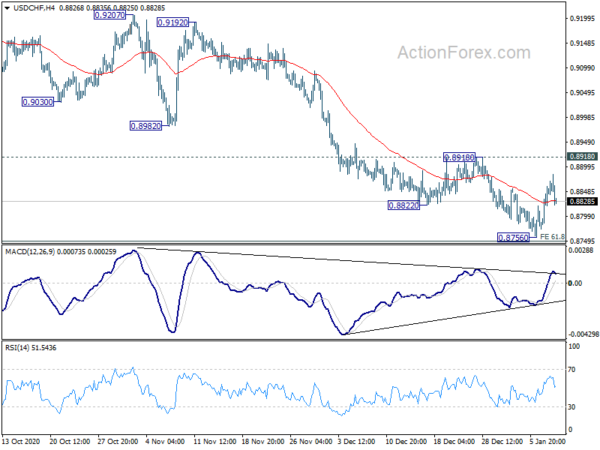

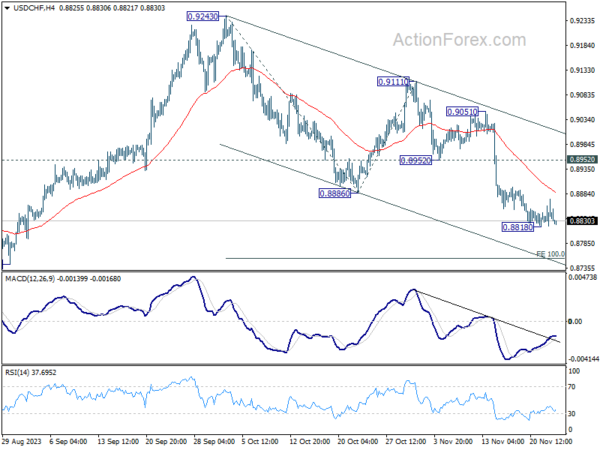

Daily Pivots: (S1) 0.8985; (P) 0.9008; (R1) 0.9027; More….

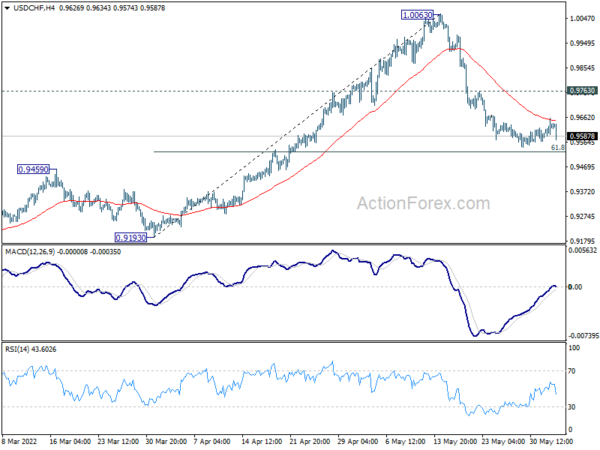

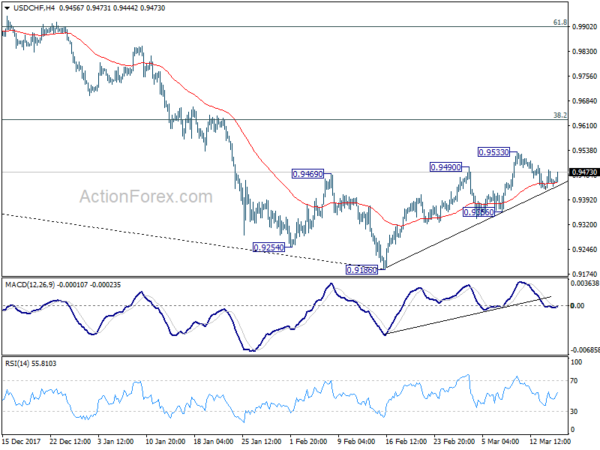

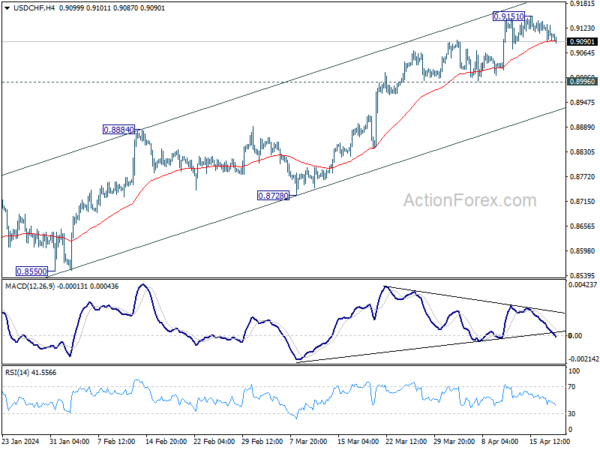

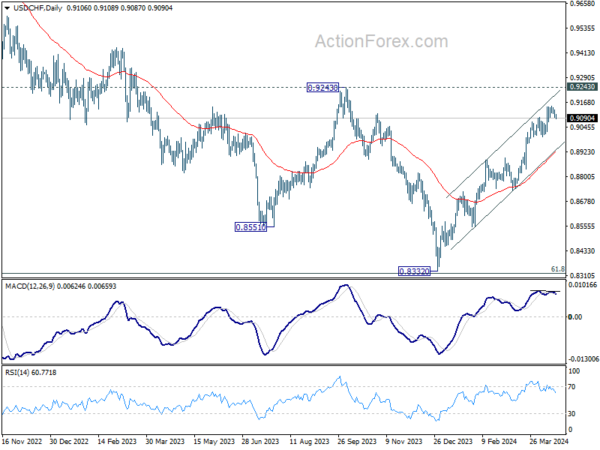

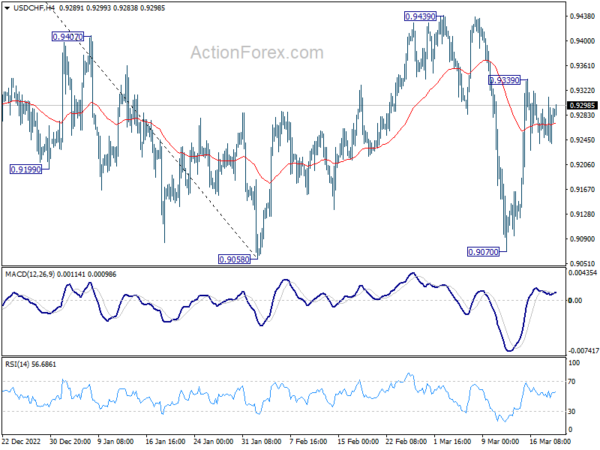

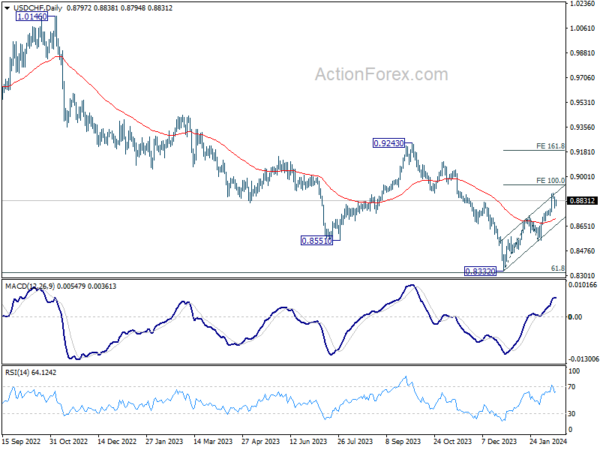

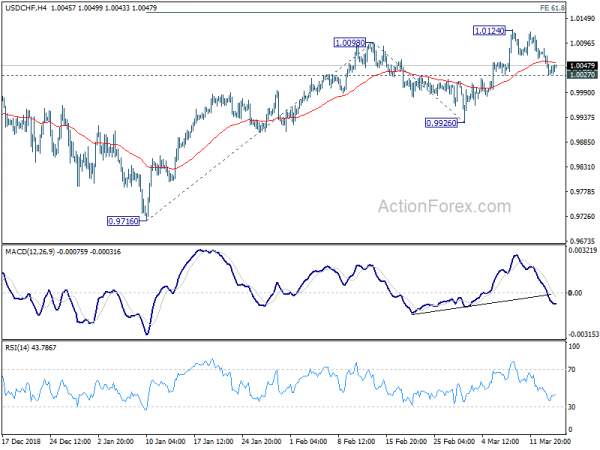

Intraday bias in USD/CHF stays neutral and outlook is unchanged. On the upside, break of 0.9086 resistance will indicate that pull back from 0.9243 has completed, and turn bias to the upside for retesting this high. However, sustained break of 38.2% retracement of 0.8551 to 0.9243 at 0.8979 will argue that deeper fall is under way to 61.8% retracement at 0.8815.

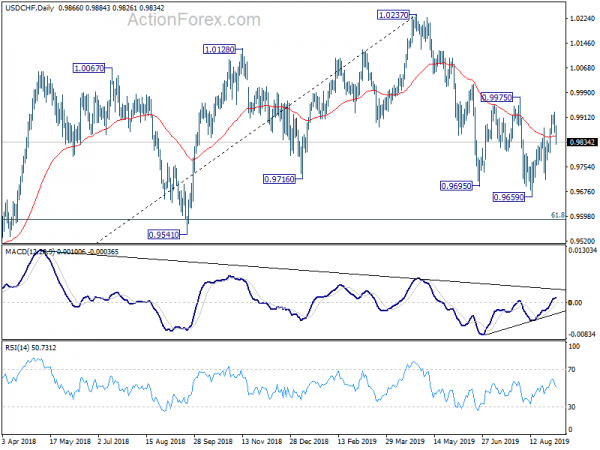

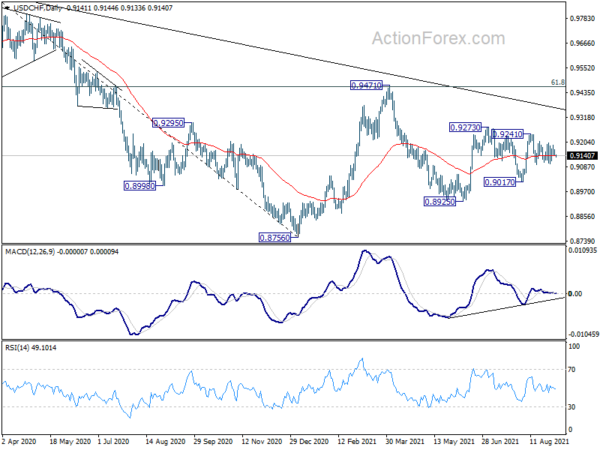

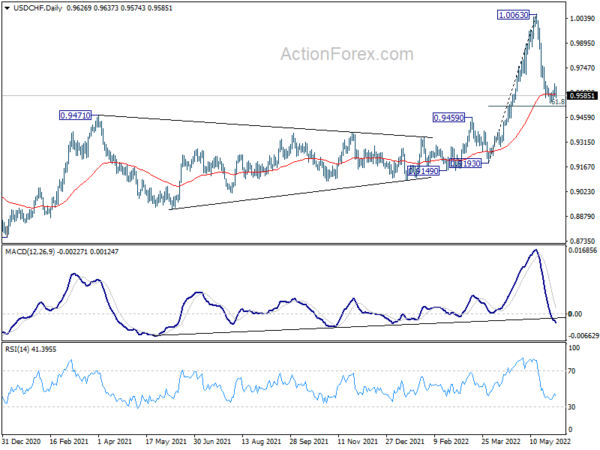

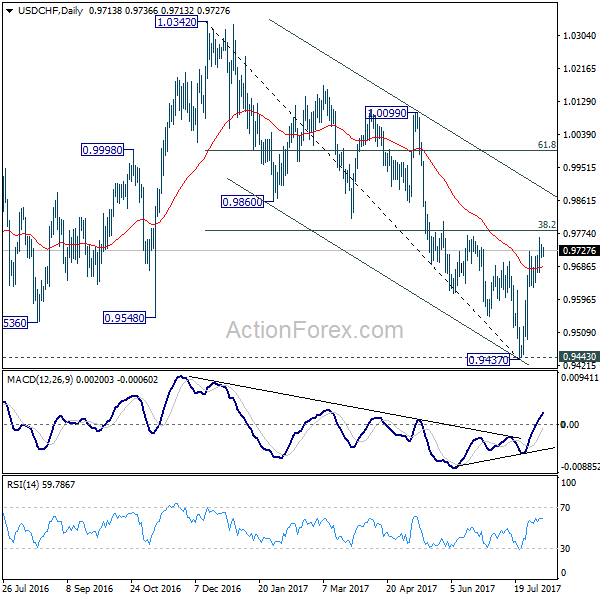

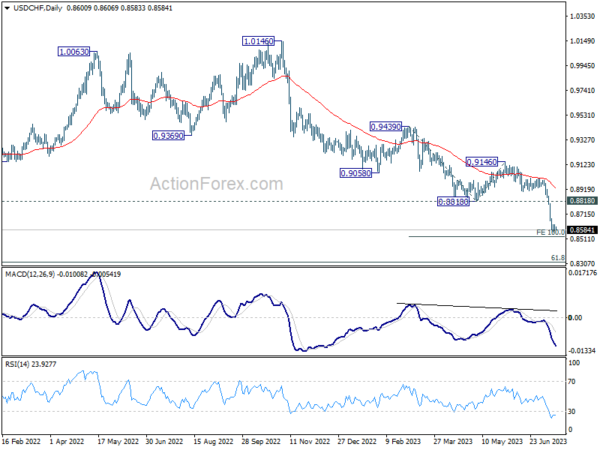

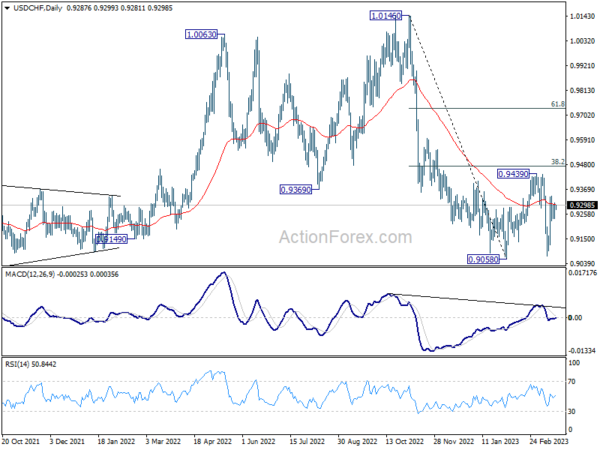

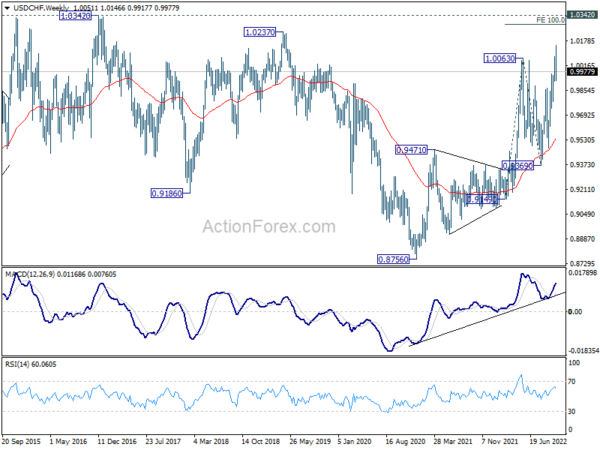

In the bigger picture, as long as 55 D EMA (now at 0.8976) holds rise from 0.8551 is viewed as reversing whole down trend from 1.0146 (2022 high). On resumption, further rise should be seen to 61.8% retracement of 1.0146 to 0.8551 at 0.9537 and above. However, sustained break of 55 D EMA will revive medium term bearishness, for retesting 0.8551 low at a later stage.