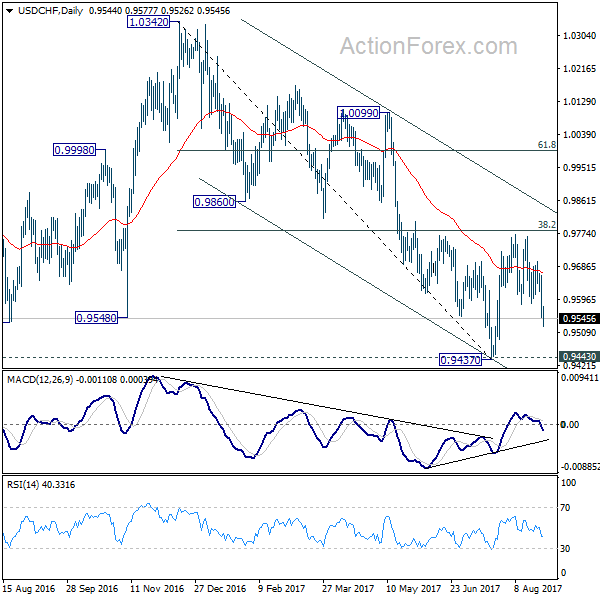

USD/CHF surged to as high as 0.9459 last week but failed to break through 0.9471 resistance and retreated sharply. Break of 0.9318 minor support suggest short term topping. Initial bias is mildly on the downside this week for 55 day EMA (now at 0.9242). On the upside, firm break of 0.9471 will resume the rise from 0.8756 to 61.8% projection of 0.8756 to 0.9471 from 0.9090 at 0.9532.

In the bigger picture, medium term outlook will be neutral at best as long as 0.9471 resistance holds. Larger down trend could still extend through 0.8756 (2021 low). However, firm break of 0.9471 will argue that whole down trend form 1.0342 (2016 high), has completed with waves down to 0.8756. A medium term up trend should be set up to target 1.0237/0342 resistance zone.

In the long term picture, price actions from 0.7065 (2011 low) are currently seen as developing into a long term corrective pattern, at least until a firm break of 1.0342 resistance.