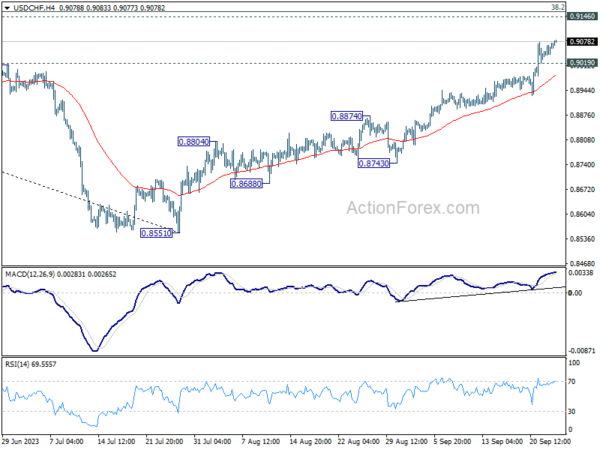

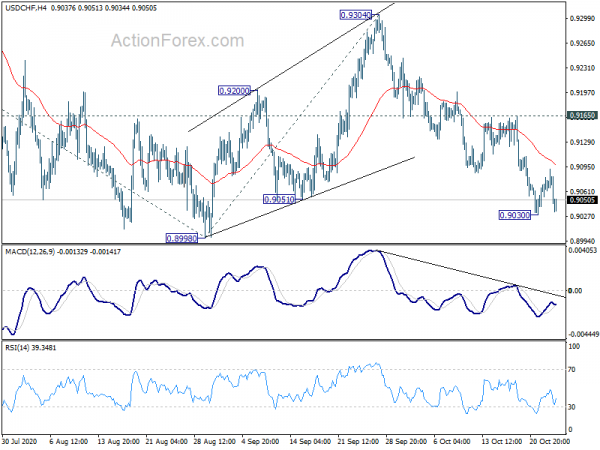

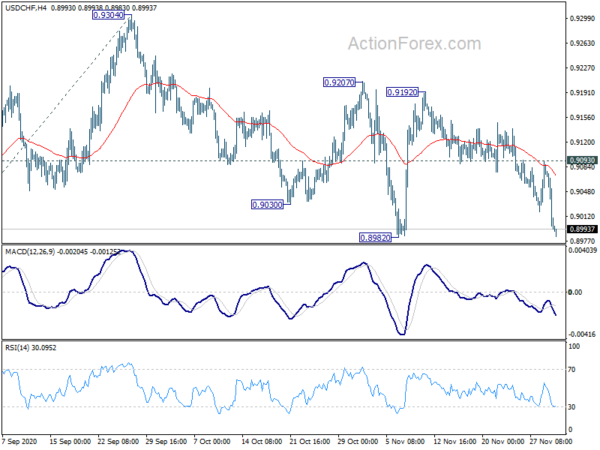

Daily Pivots: (S1) 0.9044; (P) 0.9060; (R1) 0.9086; More….

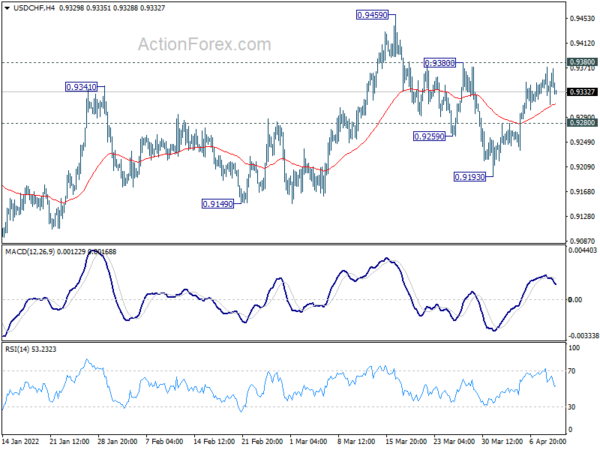

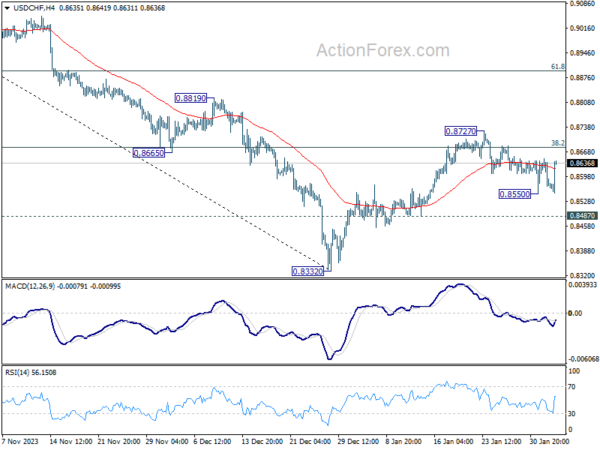

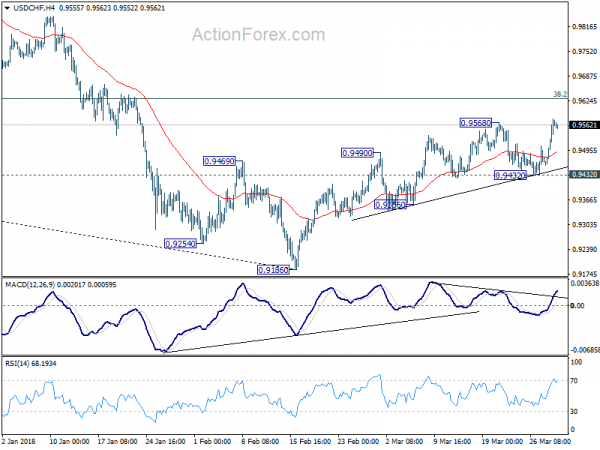

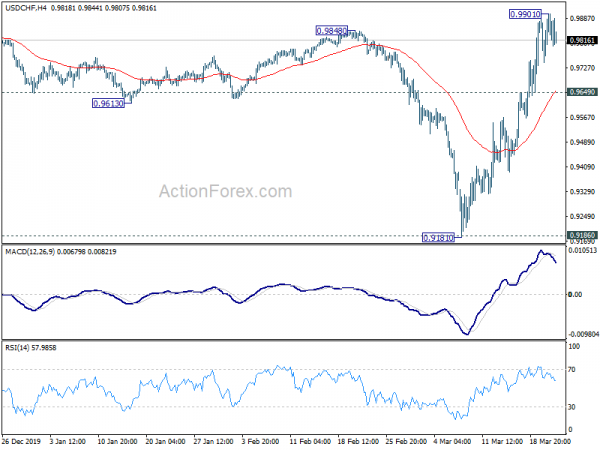

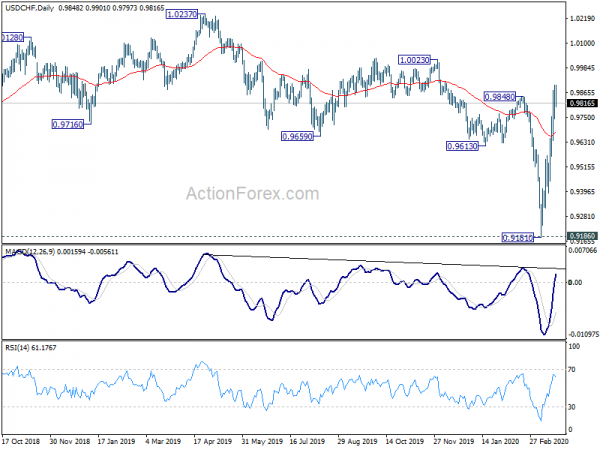

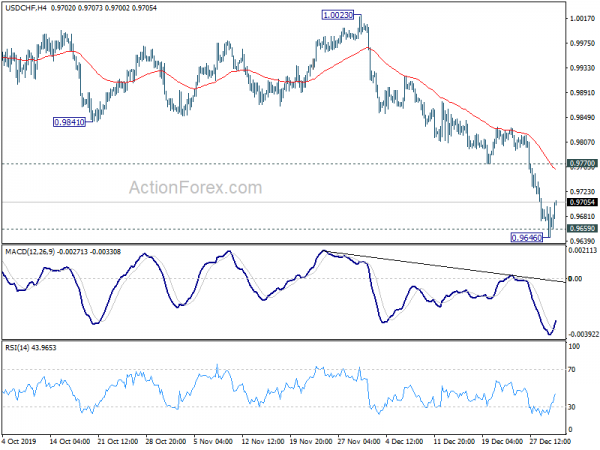

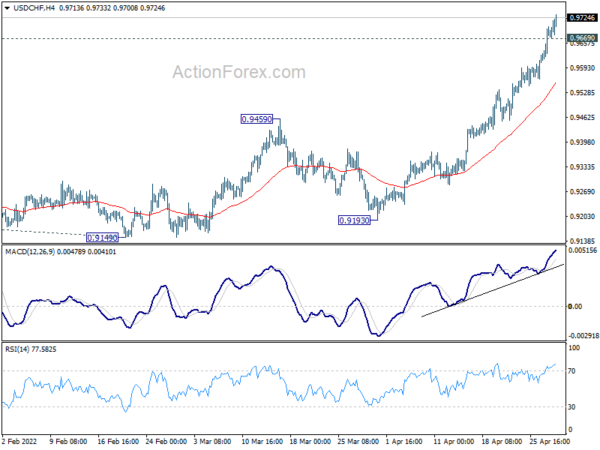

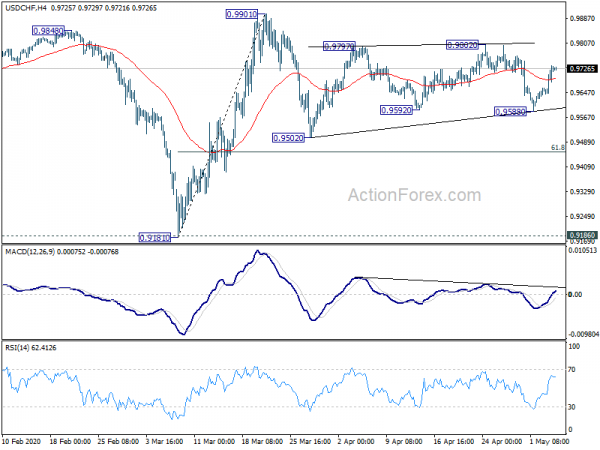

Intraday bias in USD/CHF remains on the upside for the moment. Current rise from 0.8551 is in progress for 0.9146/60 cluster resistance. On the downside, break of 0.9019 minor support will turn intraday bias neutral first. But further rally will remain in favor as long as 0.8874 resistance turned support holds, in case of retreat.

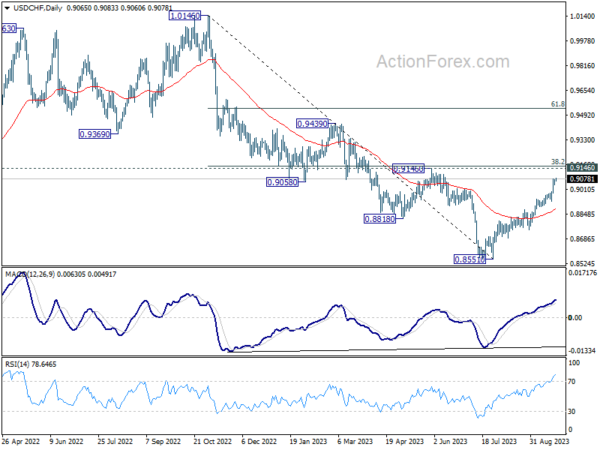

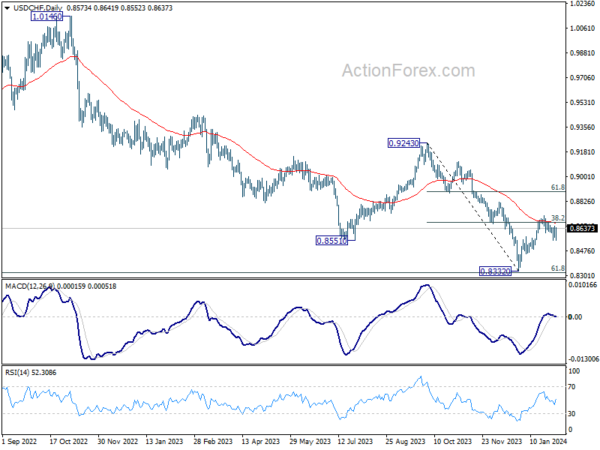

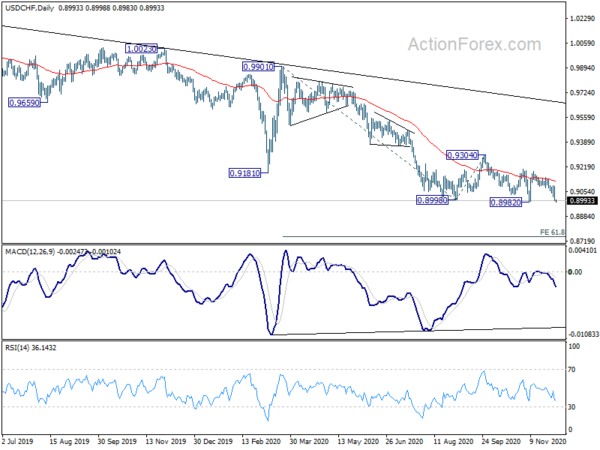

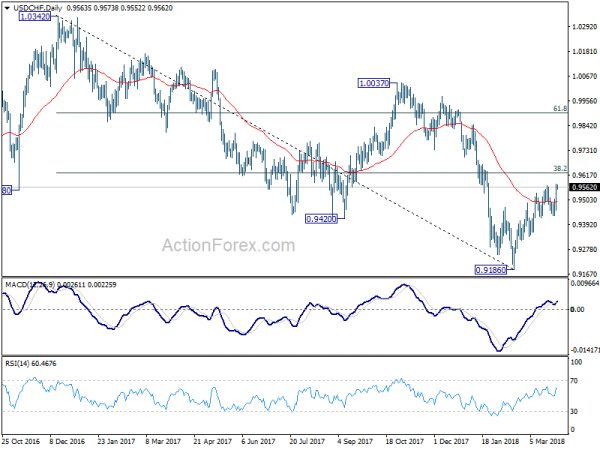

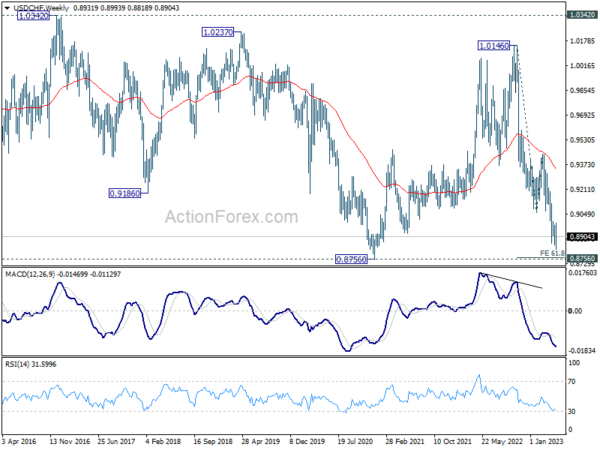

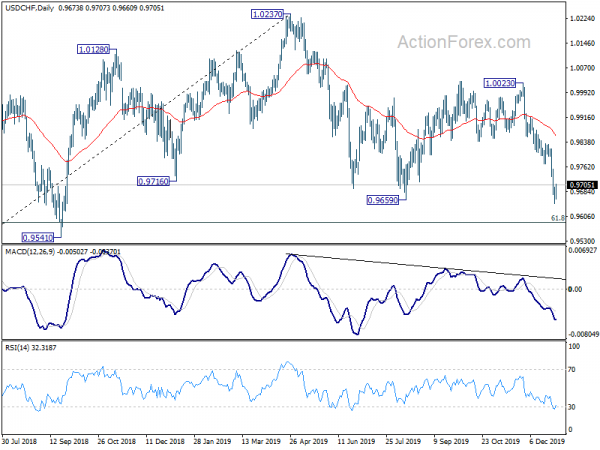

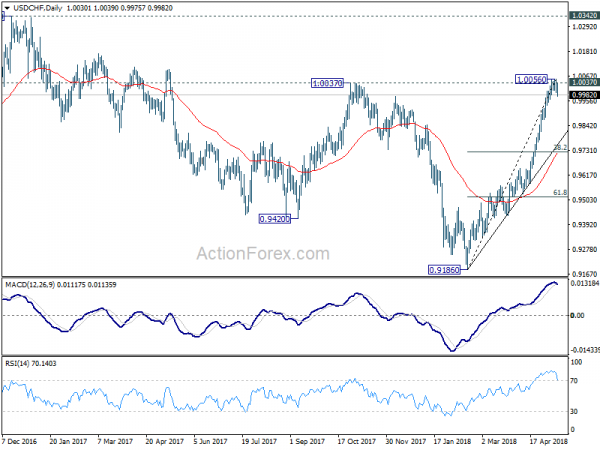

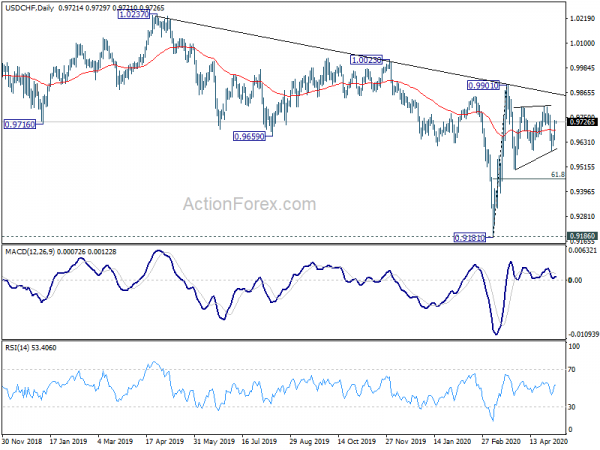

In the bigger picture, rebound from 0.8551 medium term bottom is currently seen as a correction to the downtrend from 1.0146 (2022 high). Further rally would be seen to 0.9146 cluster resistance (38.2% retracement of 1.0146 to 0.8551 at 0.9160). Strong resistance could be seen there to limit upside, at least on first attempt. However, decisive break of 0.9146/60 will indicate trend reversal, and target 61.8% retracement at 0.9537.