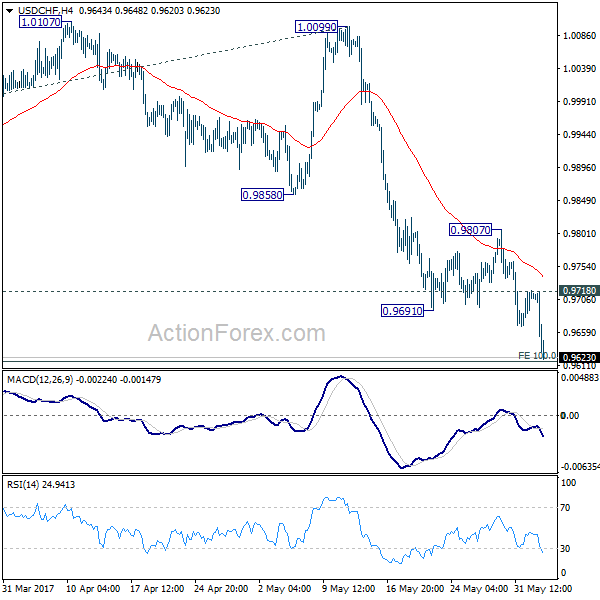

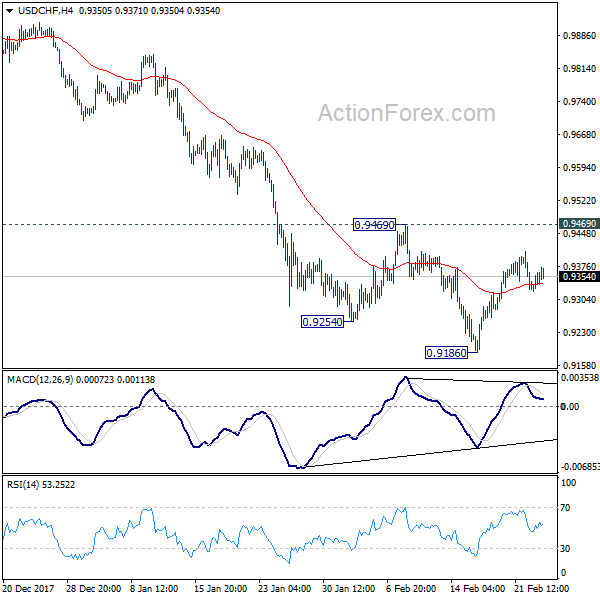

Daily Pivots: (S1) 0.9185; (P) 0.9202; (R1) 0.9223; More…

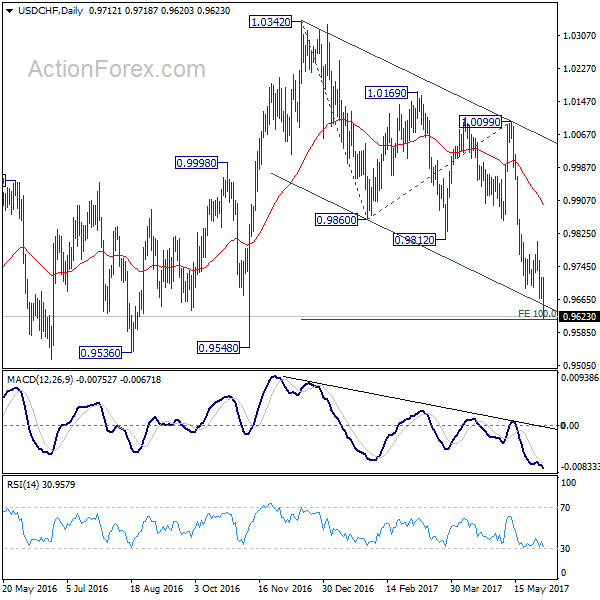

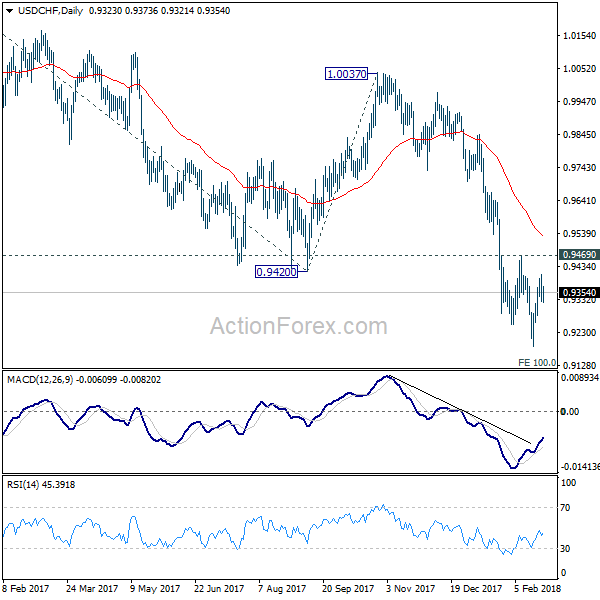

Intraday bias in USD/CHF remains on the downside for the moment. Corrective rebound from 0.8998 has completed with three waves up to 0.9304. Further fall should be seen for retesting 0.8998 low. On the upside, break of 0.9218 minor resistance will turn bias back to the upside for 0.9304 instead.

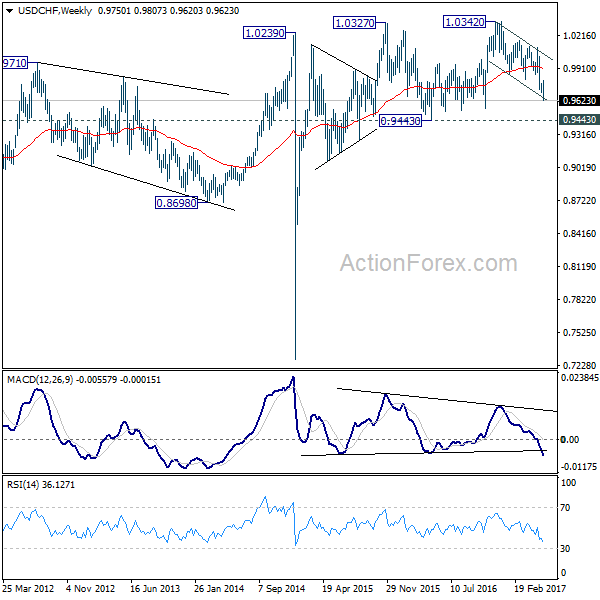

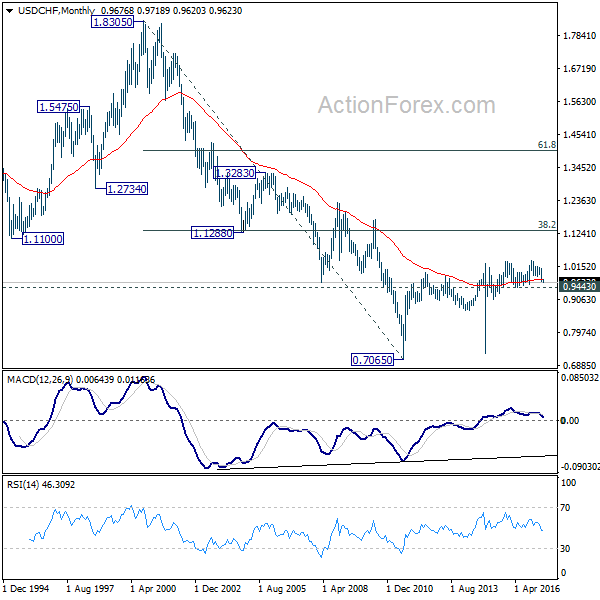

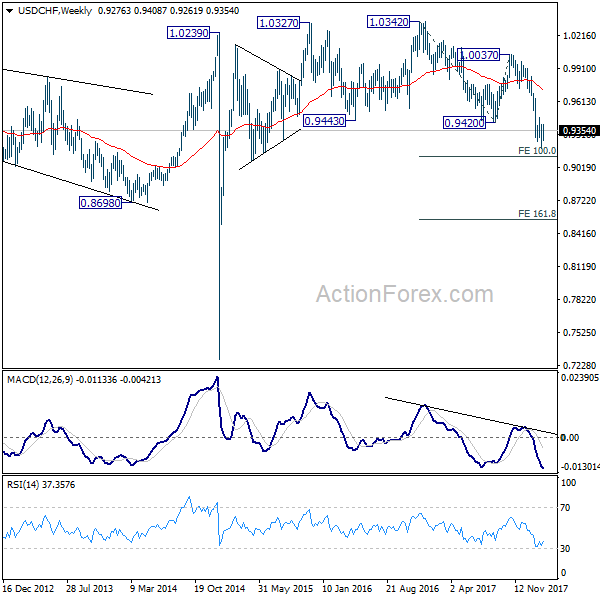

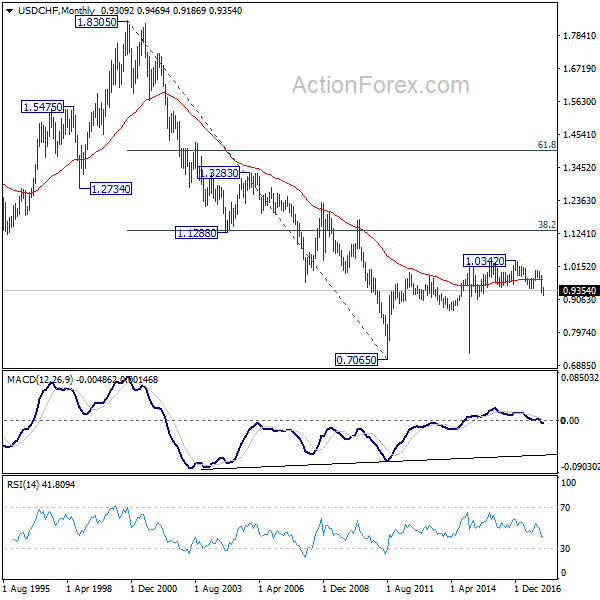

In the bigger picture, decline from 1.0237 is seen as the third leg of the pattern from 1.0342 (2016 high). There is no clear sign of completion yet. On resumption, next target will be 138.2% projection of 1.0342 to 0.9186 from 1.0237 at 0.8639. Nevertheless, strong break of 0.9376 support turned resistance will be an early sign of trend reversal and turn focus back to 0.9901 key resistance for confirmation.