Daily Pivots: (S1) 0.8457; (P) 0.8472; (R1) 0.8487; More…..

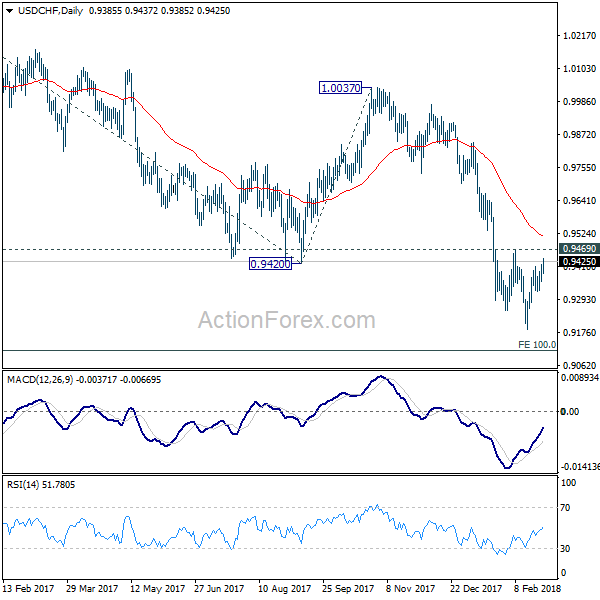

Intraday bias in USD/CHF remains on the downside for retesting 0.8431 support. Firm break there will resume whole decline from 0.9223 towards 0.8332 low. On the upside, above 0.8540 minor resistance will turn intraday bias neutral. But risk will stay on the downside as long as 0.8747 resistance holds, in case of recovery.

In the bigger picture, price actions from 0.8332 (2023 low) are currently seen as a medium term corrective pattern, with fall from 0.9223 as the second leg. Strong support could be seen from 0.8332 to bring rebound. Yet, overall outlook will continue to stay bearish as long as 0.9243 resistance holds. Firm break of 0.8332, however, will resume larger down trend from 1.0146 (2022 high).