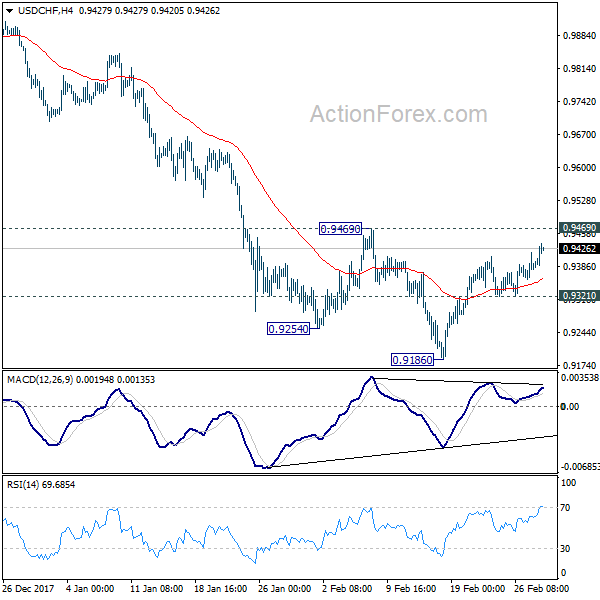

Daily Pivots: (S1) 0.9922; (P) 0.9937; (R1) 0.9951; More…

With 4 hour MACD crossed below signal line, intraday bias in USD/CHF is turned neutral first. On the upside, above 0.9951 will target 1.0014 resistance. Upside could be limited by 61.8% retracement of 1.0237 to 0.9695 at 1.0030. On the downside, below 0.9842 minor support will turn bias back to the downside for retesting 0.9695 low instead.

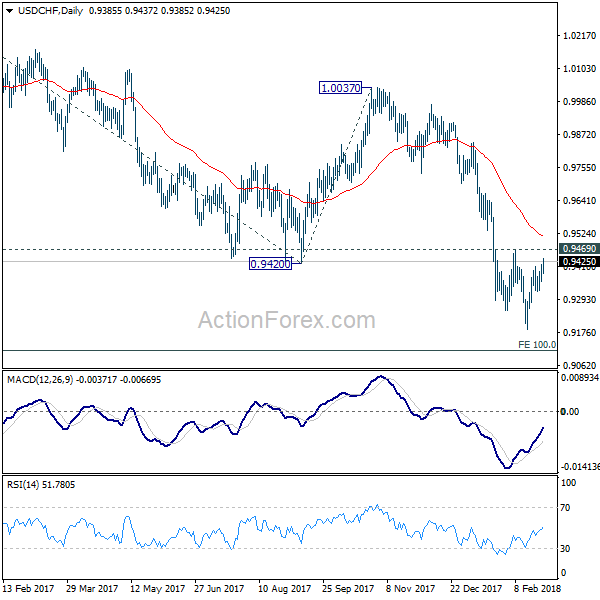

In the bigger picture, current development suggests that up trend from 0.9186 (2018 low) has completed at 1.0237 already. Deeper decline would be seen to 61.8% retracement of 0.9186 to 1.0237 at 0.9587 and below. For now, USD/CHF is seen as in long term range pattern between 0.9186 and 1.0342. Hence, we’d pay attention to bottoming signal below 0.9587. However, sustained break of 1.0014 will revive medium term bullishness and turn focus back to 1.0237 high.