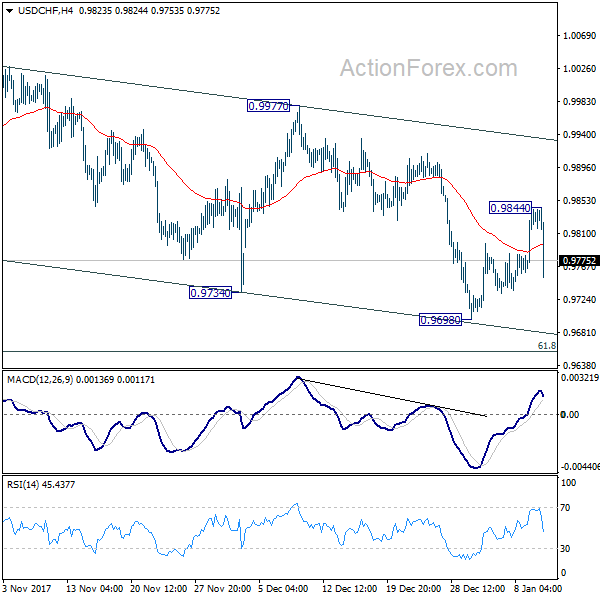

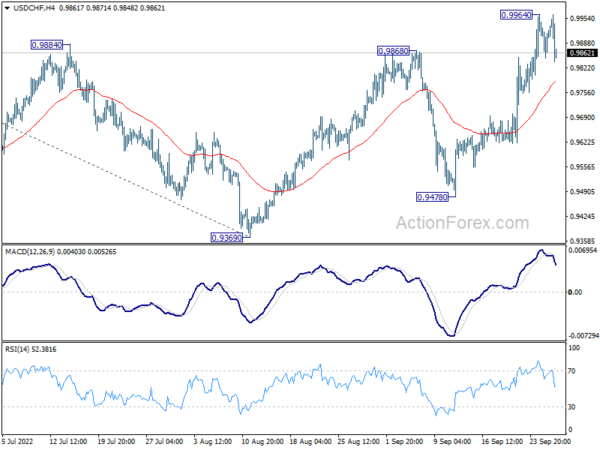

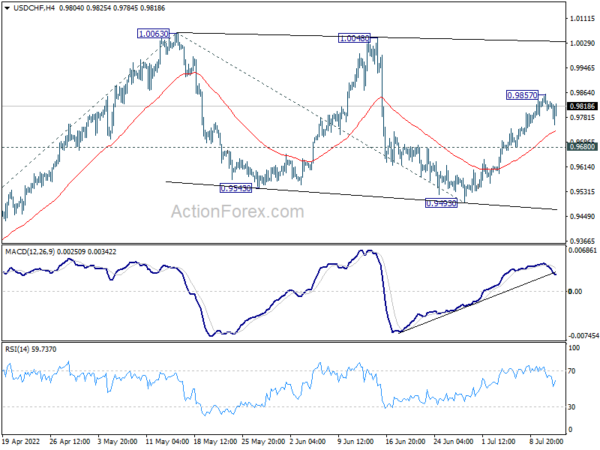

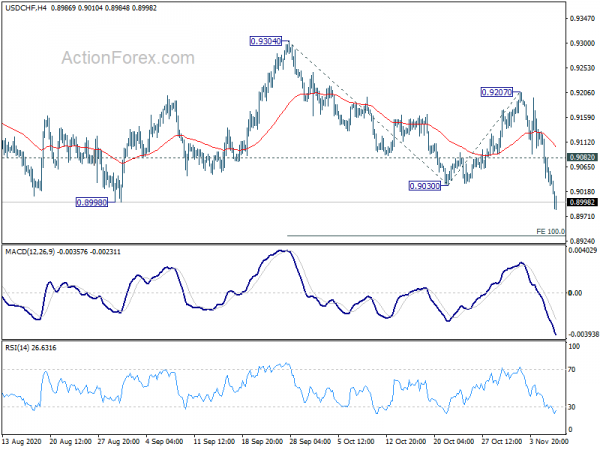

Daily Pivots: (S1) 0.9780; (P) 0.9811; (R1) 0.9863; More….

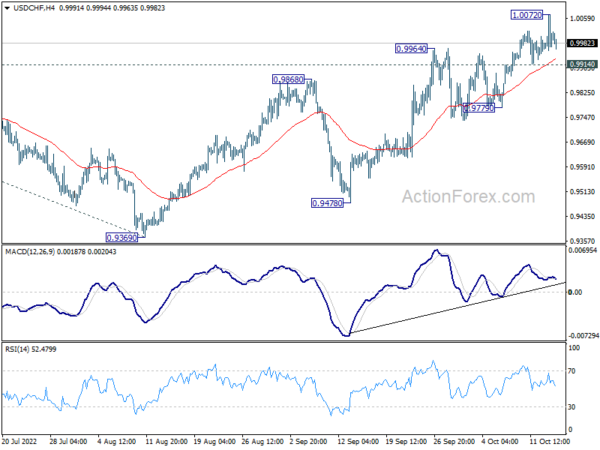

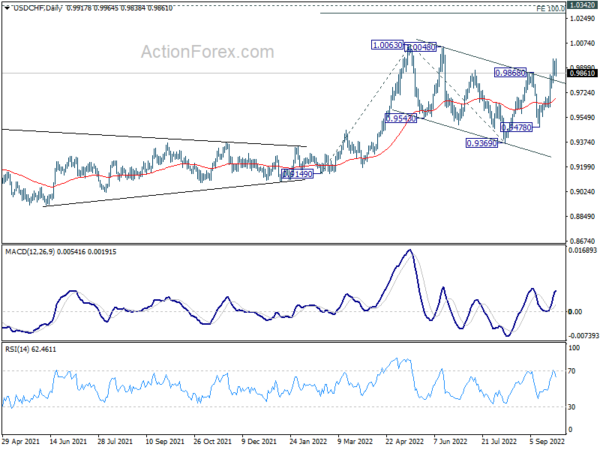

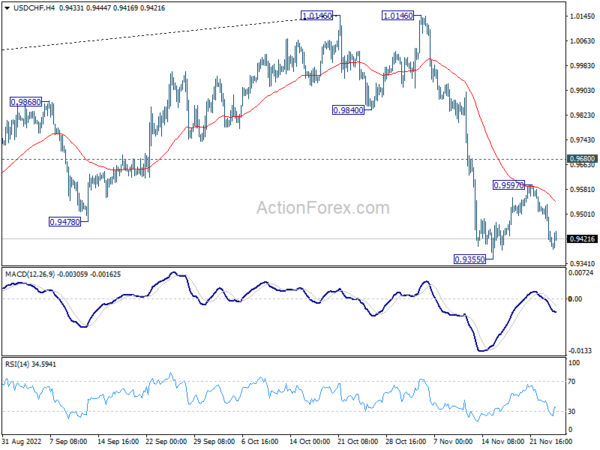

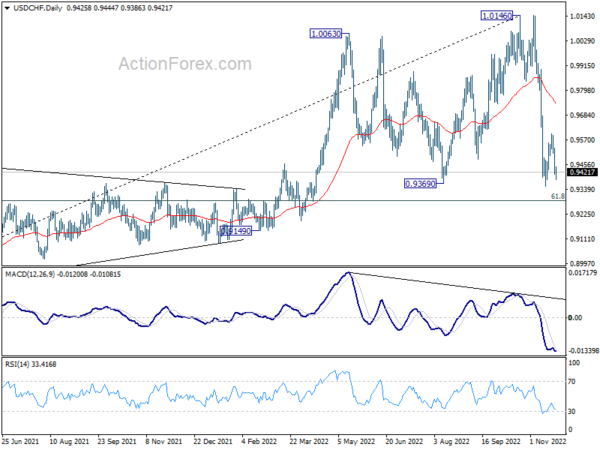

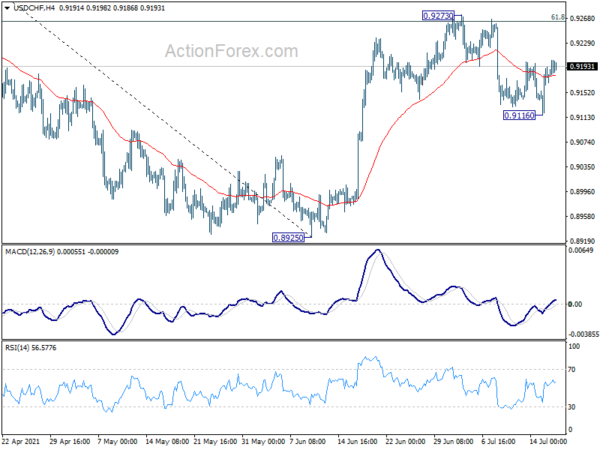

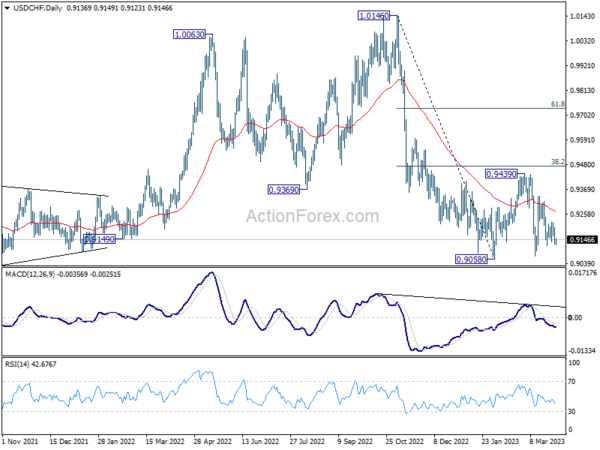

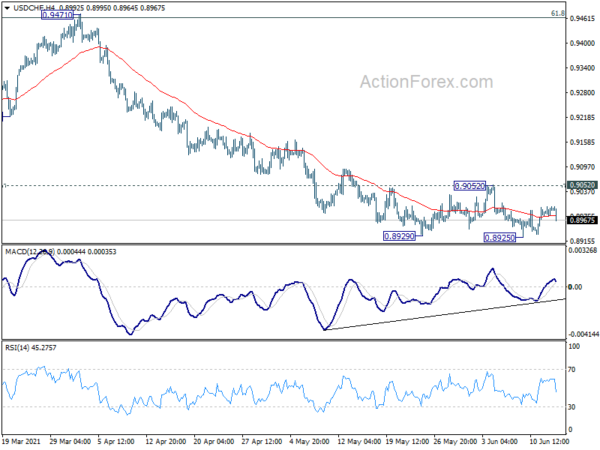

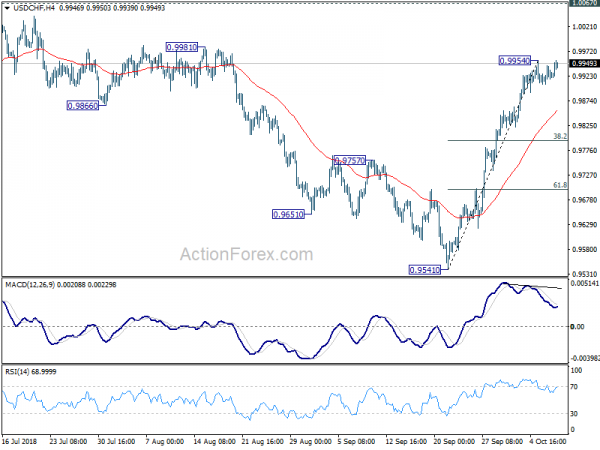

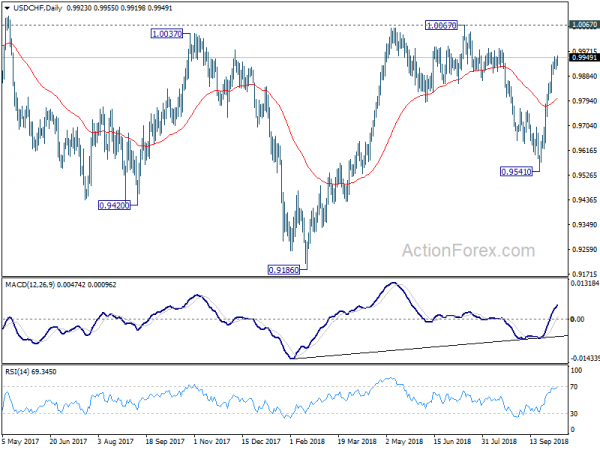

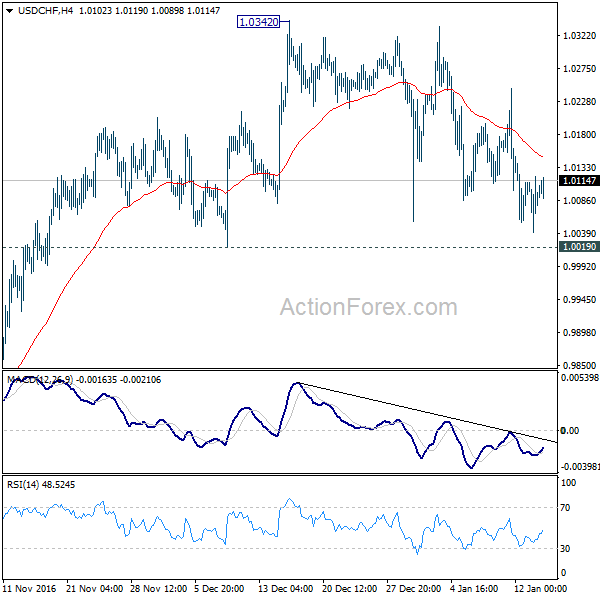

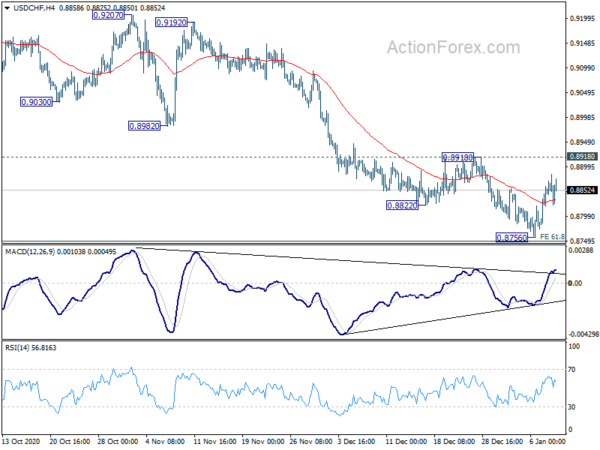

USD/CHF’s rebound was limited at 0.9844 and drops sharply. Intraday bias is turned neutral first with mixed near term outlook. Nonetheless, we’re still slightly favoring that correction from 1.0037 has completed with three waves down to 0.9698. Above 0.9844 will turn bias back to the upside for 0.9977 resistance for confirming this bullish view. However, break of 0.9698 will extend such correction to 61.8% retracement of 0.9420 to 0.1.0037 at 0.9656 before completion.

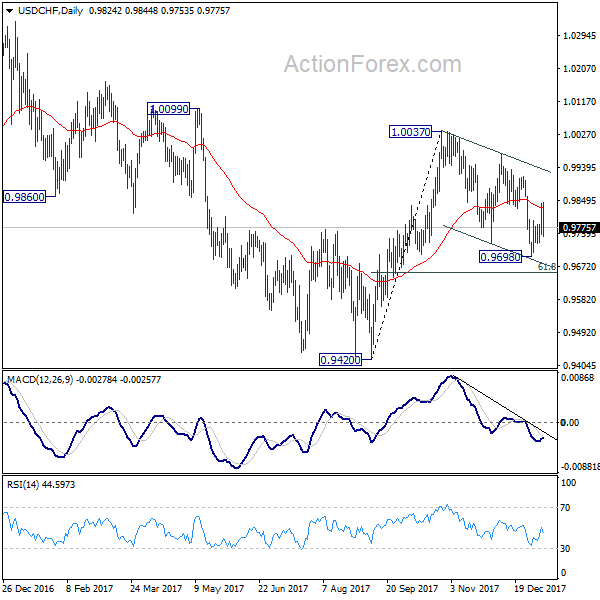

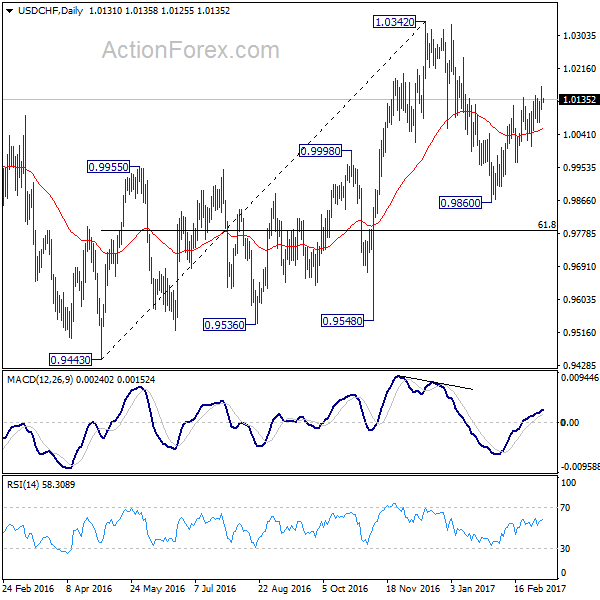

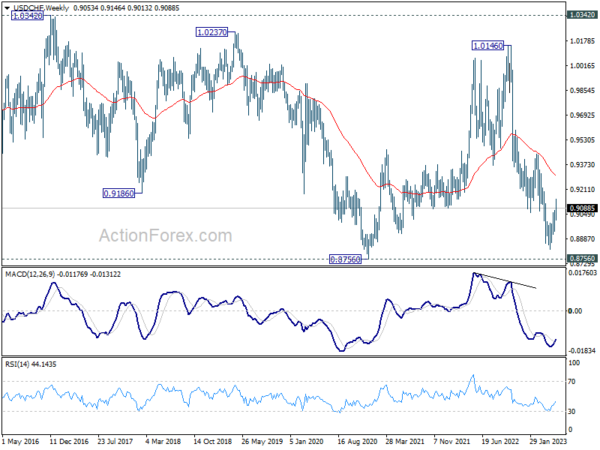

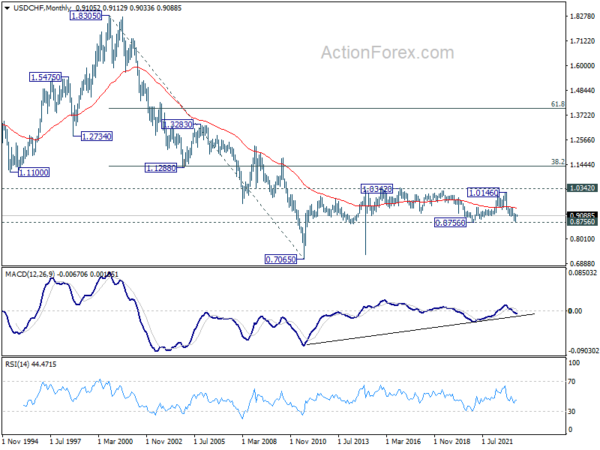

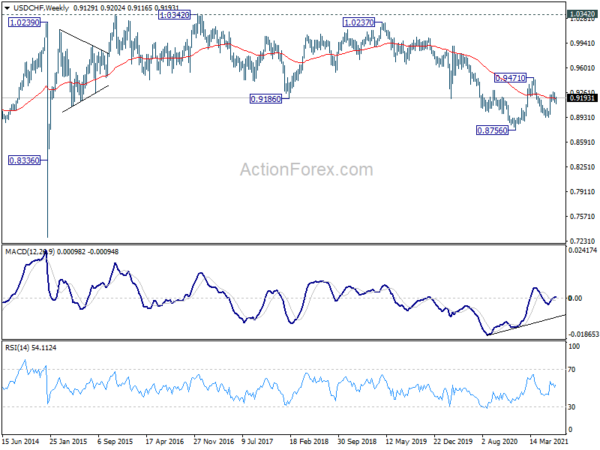

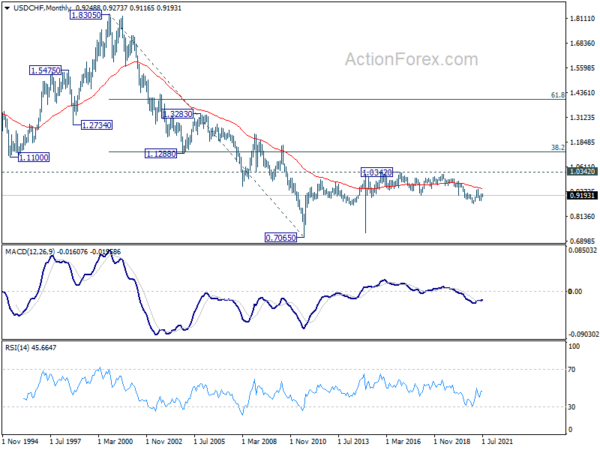

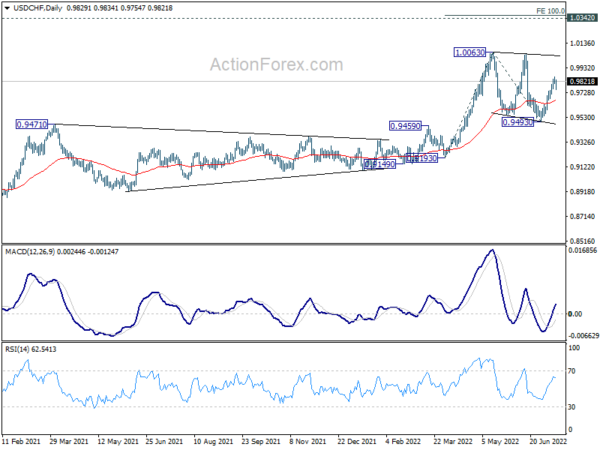

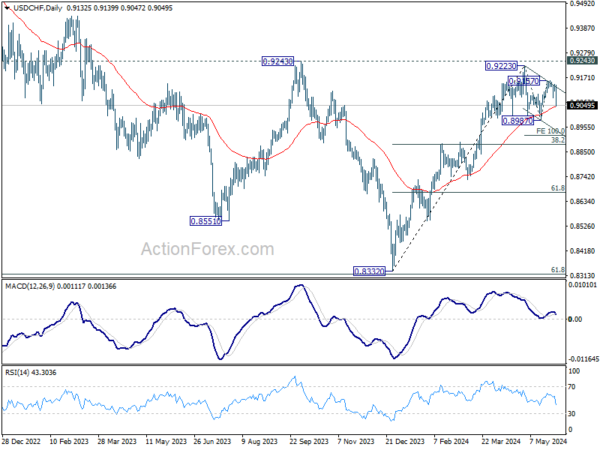

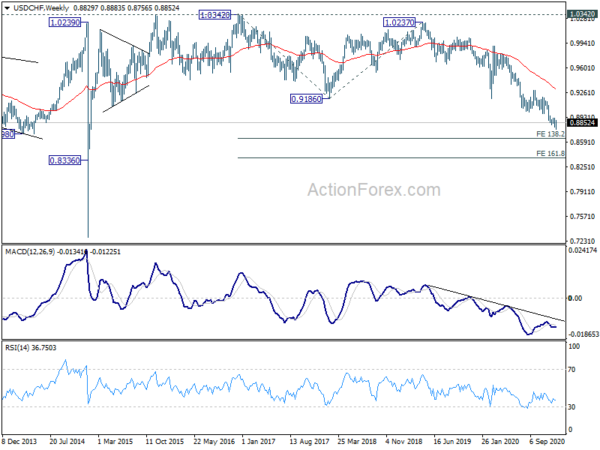

In the bigger picture, range trading continues between 0.9420/1.0342. At this point, 0.9420 appears to be a strong support level. Therefore, in case of decline attempt, we don’t expect a firm break of this level. Nonetheless, strong break of 1.0342 is also needed to confirm upside momentum. Otherwise, medium term outlook will stay neutral.