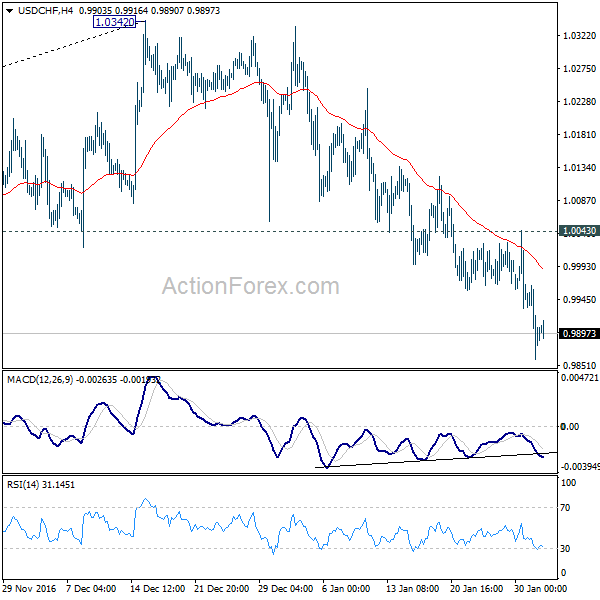

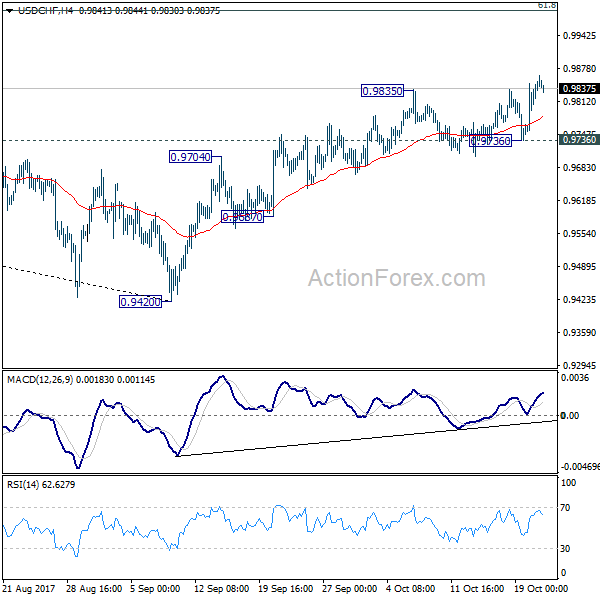

Daily Pivots: (S1) 0.9897; (P) 0.9917; (R1) 0.9945; More…

No change in USD/CHF’s outlook as consolidation from 0.9854 is in progress. Intraday bias remains neutral for the moment. In case of another recovery, upside should be limited by 1.0008 support turned resistance and bring fall resumption. On the downside, break of 0.9854 will extend the decline from 1.0237 to 0.9716 cluster support (50% retracement of 0.9186 to 1.0237 at 0.9712).

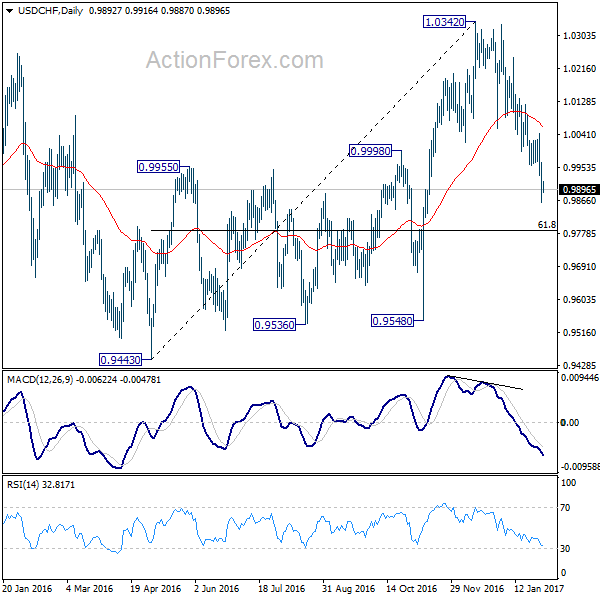

In the bigger picture, USD/CHF’s break of long term trend line support is the first indication of medium term reversal. Focus is now back on 0.9879 support. Sustained break should confirm that medium term up trend from 0.9186 has completed at 1.0237 already. Further fall should be seen to 0.9716 cluster support (50% retracement of 0.9186 to 1.0237 at 0.9712) next. Break will target 61.8% retracement at 0.9587.