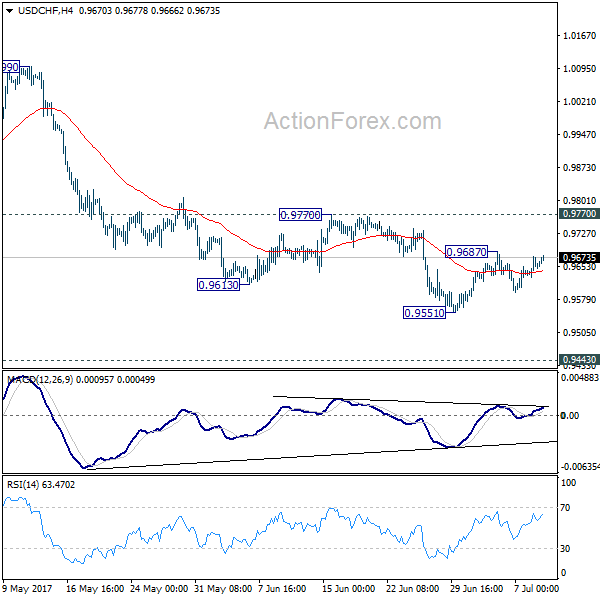

Daily Pivots: (S1) 0.9632; (P) 0.9653; (R1) 0.9677; More……

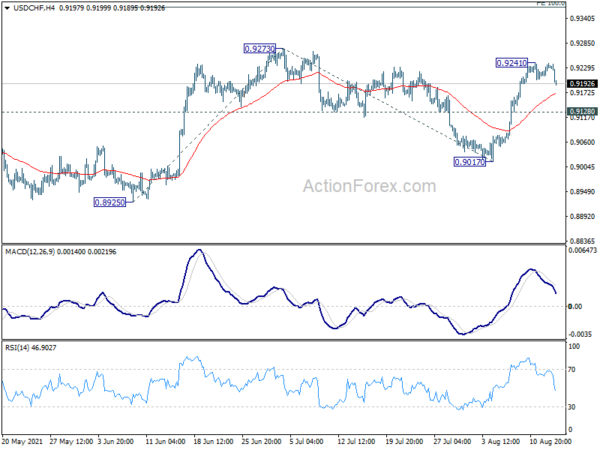

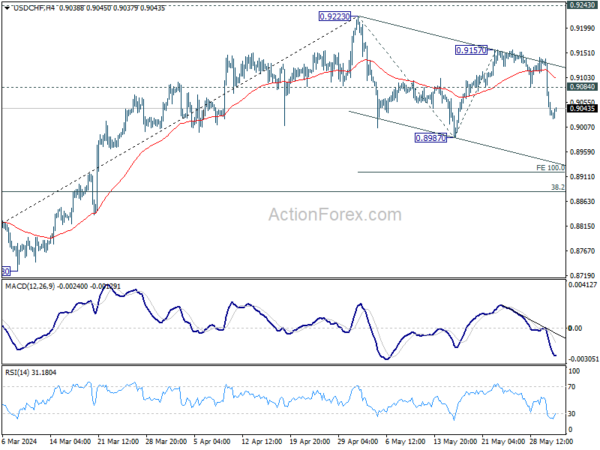

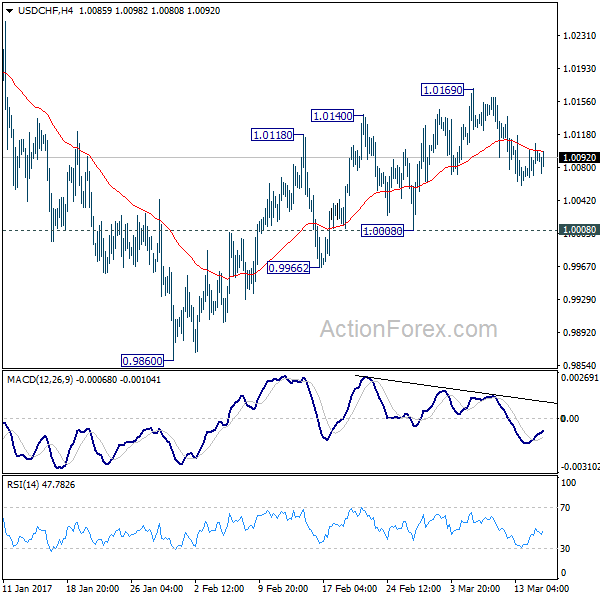

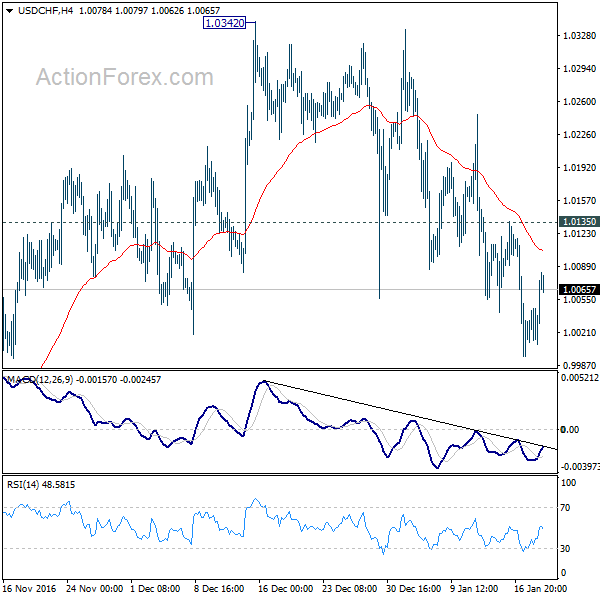

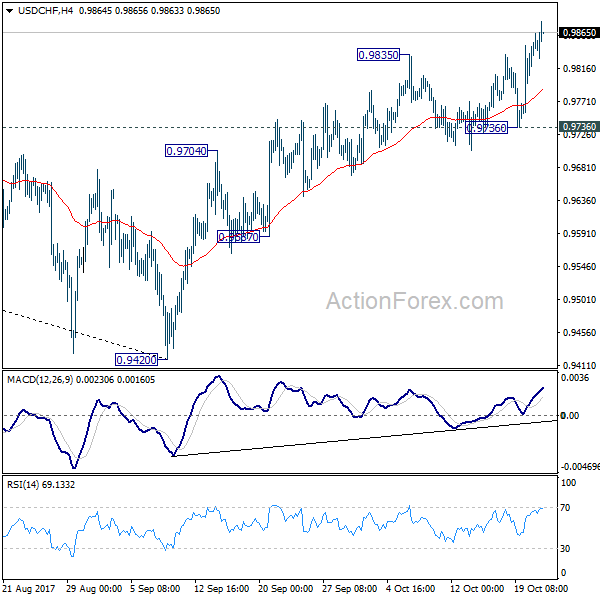

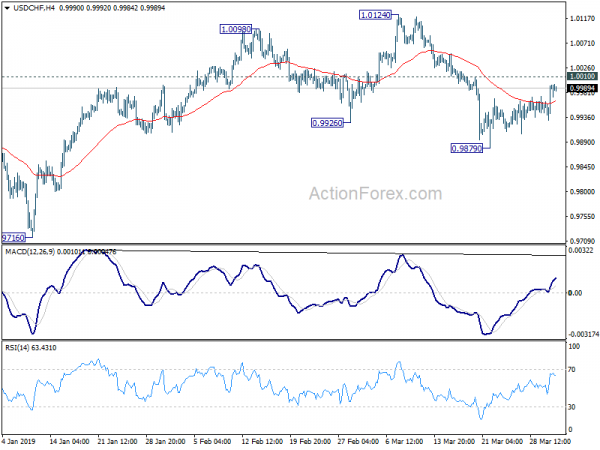

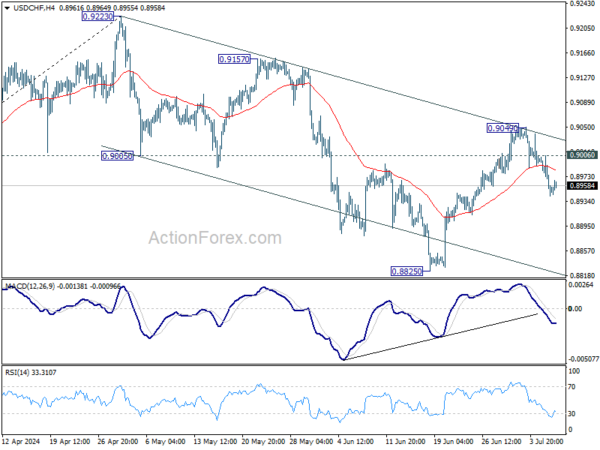

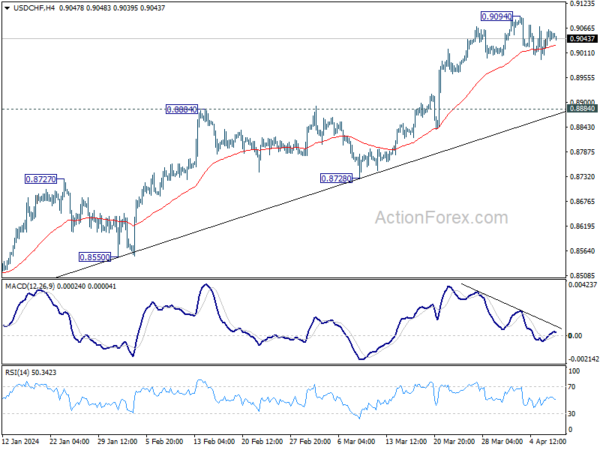

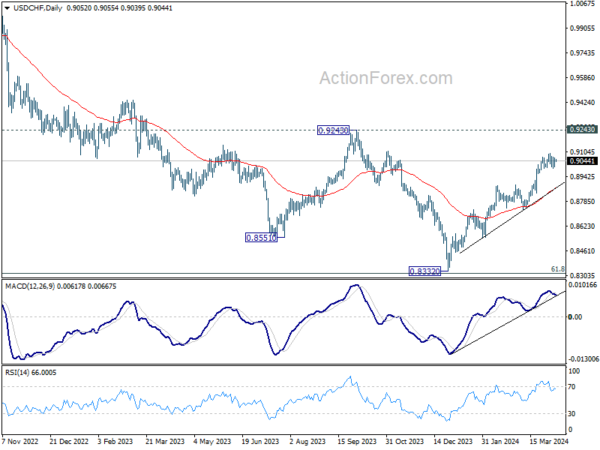

USD/CHF recovers mildly today as consolidation from 0.9551 is still in progress. In case of further rise, upside should be limited by 0.9770 resistance and bring fall resumption. Break of 0.9551 will extend the whole fall from 1.0342 and target 0.9443 key support level next. We’d expect strong support from there to bring rebound. Meanwhile, firm break of 0.9770 will indicate near term reversal, on bullish convergence condition in 4 hour MACD.

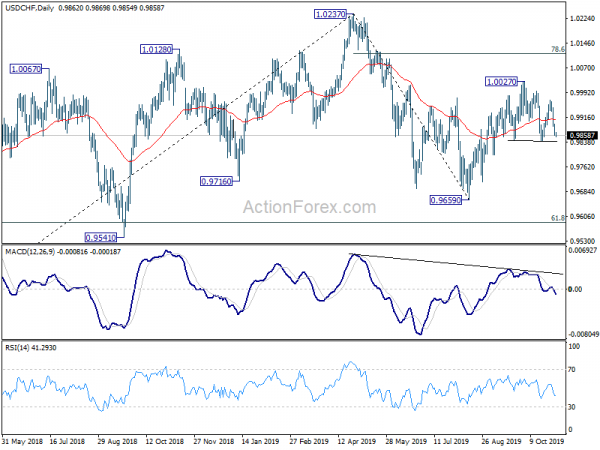

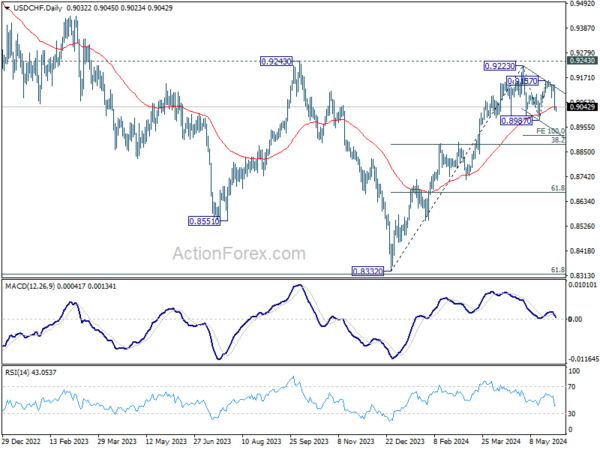

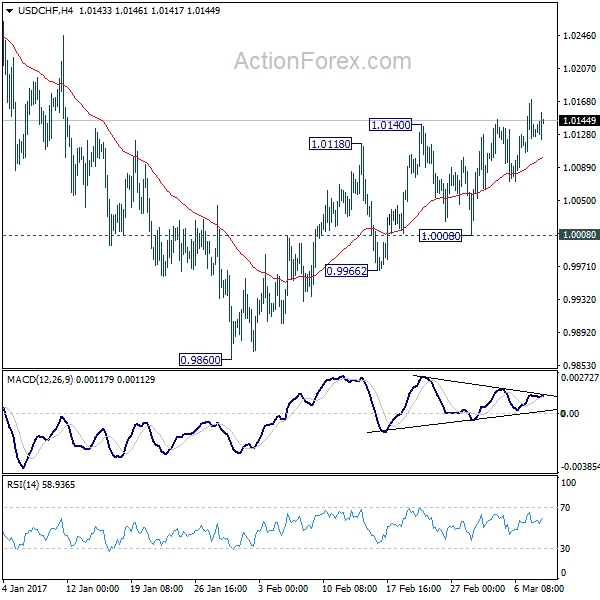

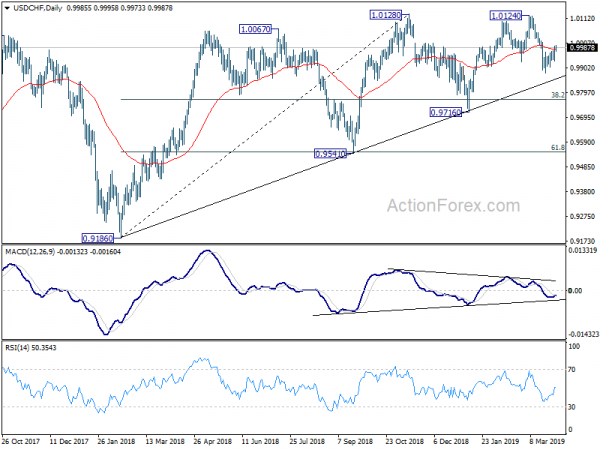

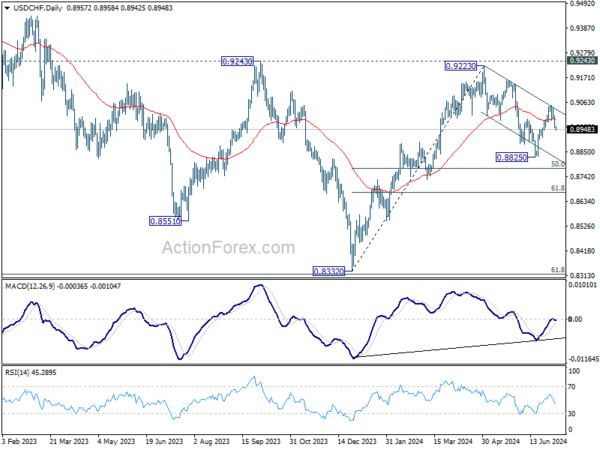

In the bigger picture, USD/CHF is still bounded in medium term range of 0.9443/1.0342 for the moment. Consolidative trading would likely continue and medium term outlook remains neutral. Break of 1.0342 key resistance is needed to confirm underlying bullish momentum in the pair. Meanwhile, downside attempts should be contained by 0.9443 key support level. However, sustained break of 0.9443 will carry larger bearish implication and target 0.9 handle.