Daily Pivots: (S1) 0.9117; (P) 0.9138; (R1) 0.9178; More….

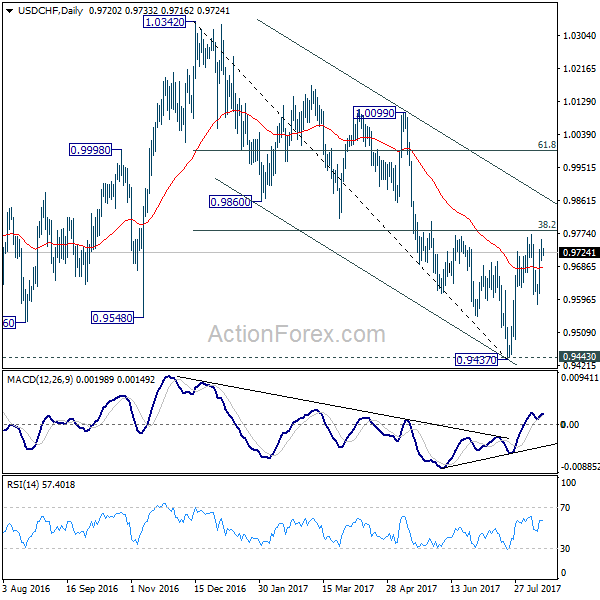

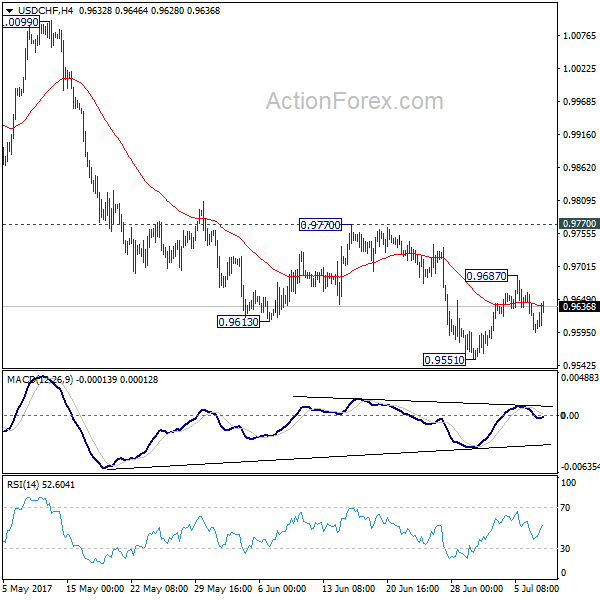

Intraday bias in USD/CHF is turned neutral with current retreat. On the upside, above 0.9157 will resume the rebound from 0.8987 to retest 0.9223 high. On the downside, break of 0.9077 support will bring retest of 0.8987. Break there will resume the fall from 0.9223 to 38.2% retracement of 0.8332 to 0.9223 at 0.8883.

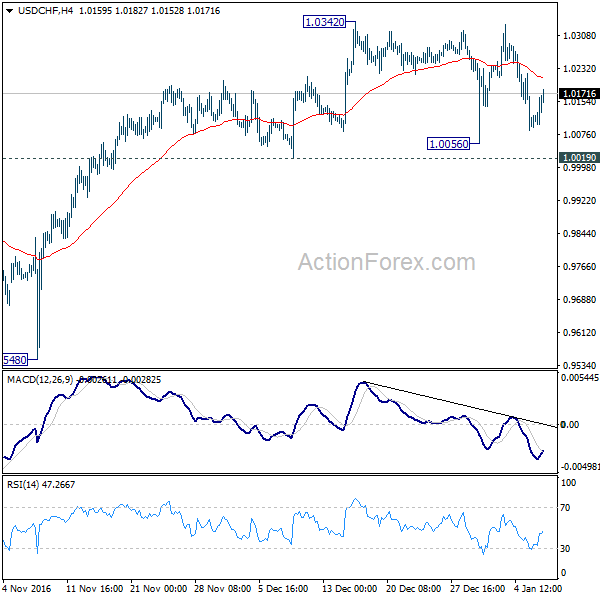

In the bigger picture, price actions from 0.8332 medium term bottom are tentatively seen as developing into a corrective pattern to the down trend from 1.0146 (2022 high). Rejection by 0.9243 resistance, followed by sustained break of 38.2% retracement of 0.8332 to 0.9223 at 0.8883 will strengthen this case, and maintain medium term bearishness. However, decisive break of 0.9243 will argue that the trend has already reversed and turn medium term outlook bullish for 1.0146.