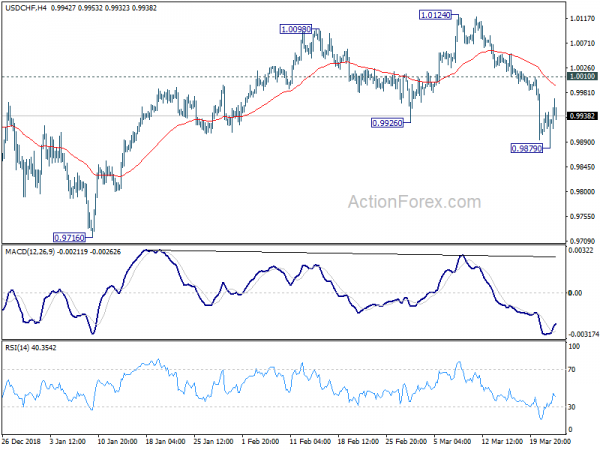

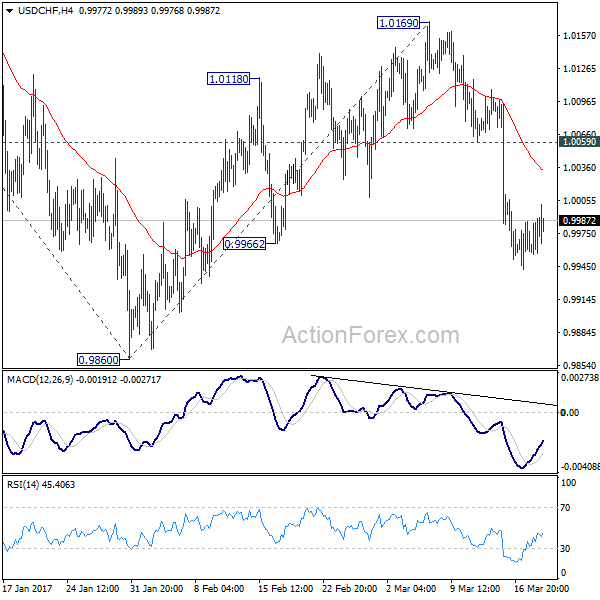

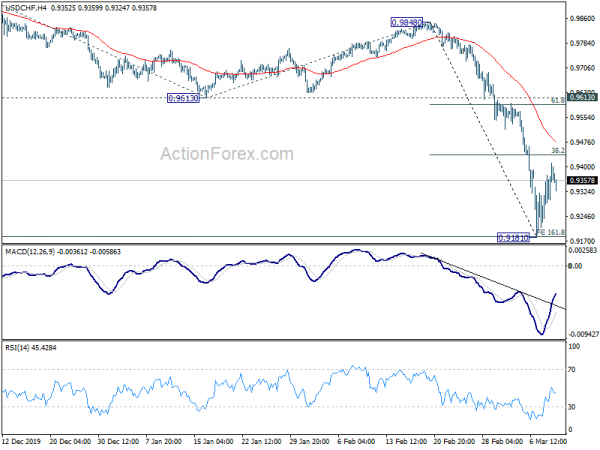

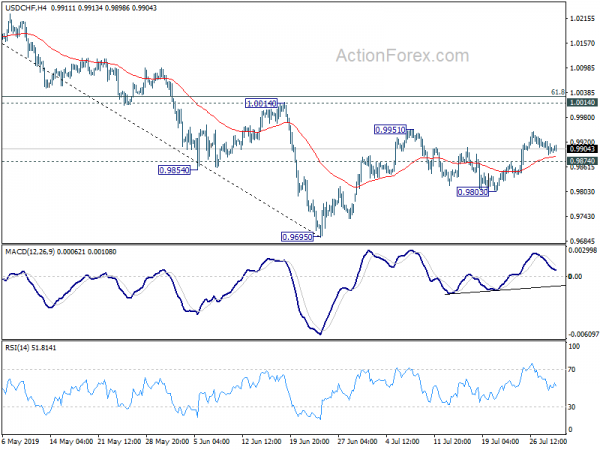

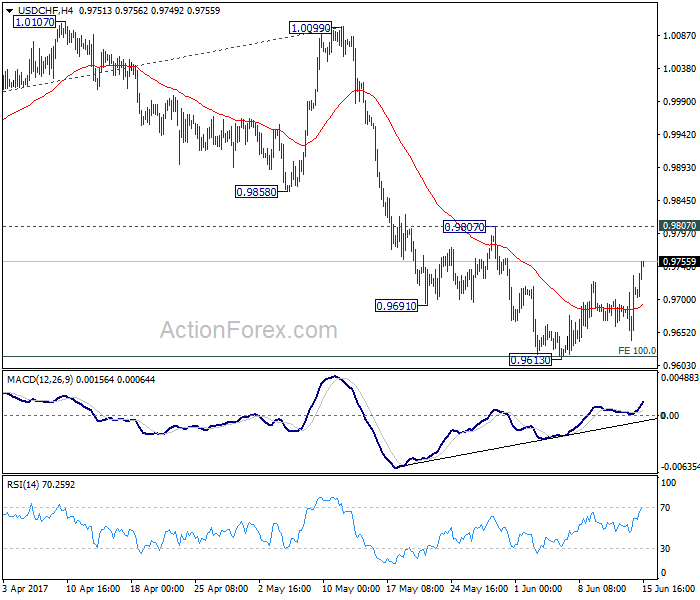

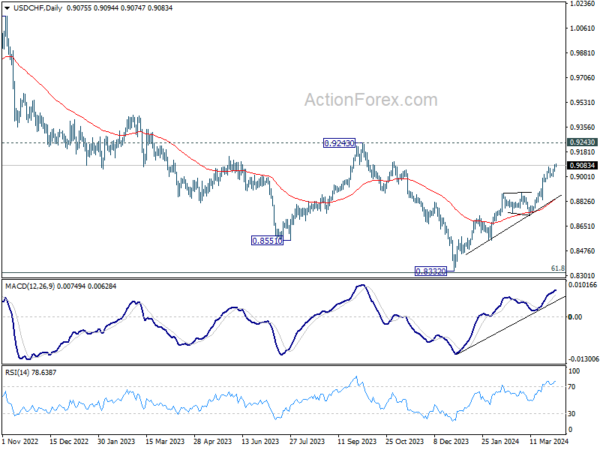

Daily Pivots: (S1) 0.9900; (P) 0.9923; (R1) 0.9943; More…..

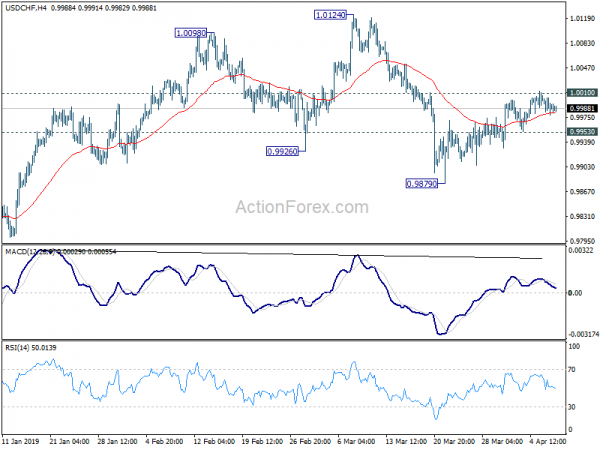

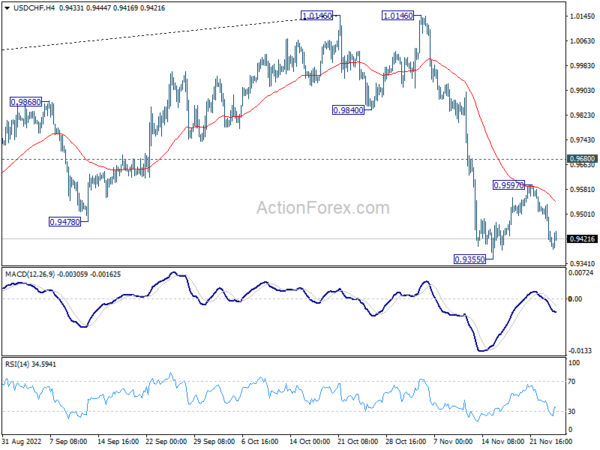

With 4 hour MACD crossed above signal line, intraday bias in USD/CHF is turned neutral first. Another fall is mildly in favor with 1.0010 minor resistance intact. On the downside, below 0.9879 will resume the fall from 1.0124 to 0.9716 key support. Nevertheless, break of 1.0010 will turn bias back to the upside for 1.0124/28 resistance zone.

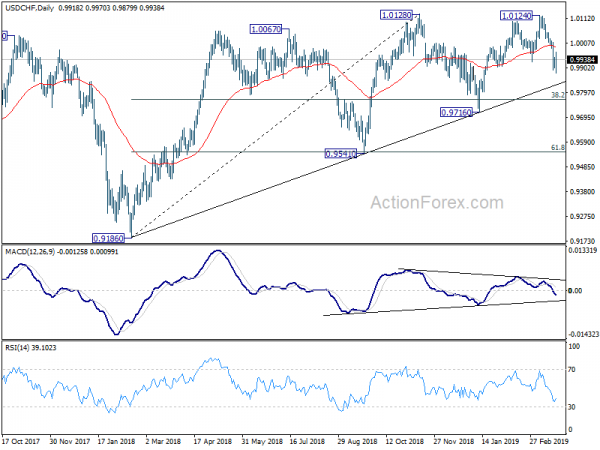

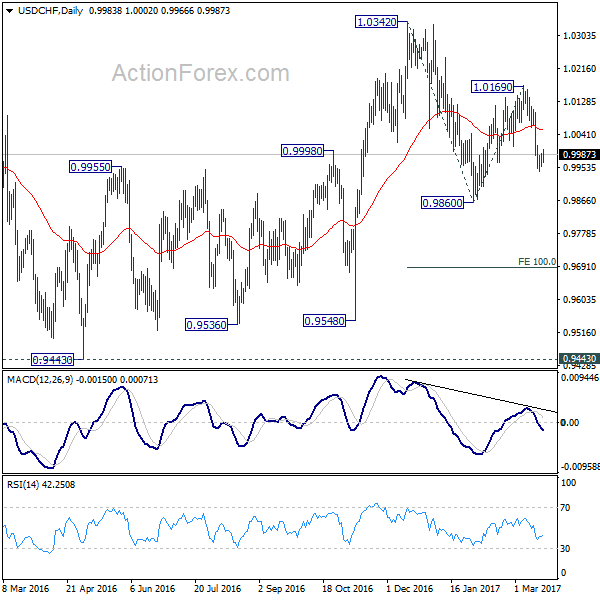

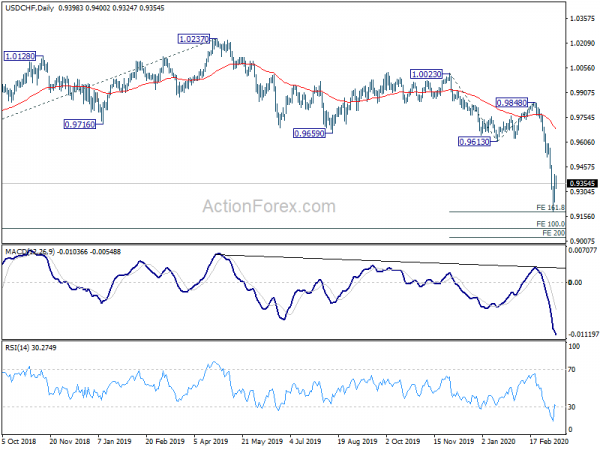

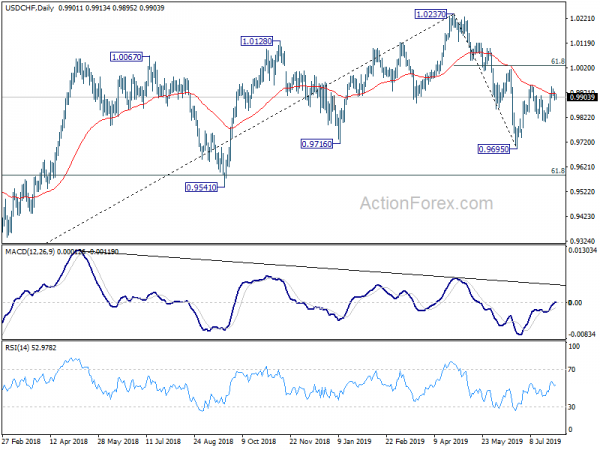

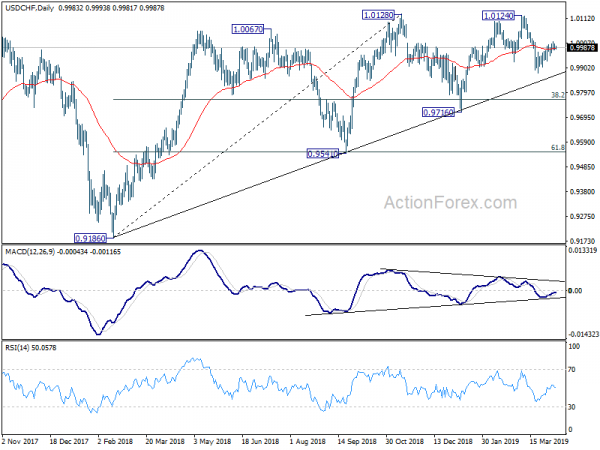

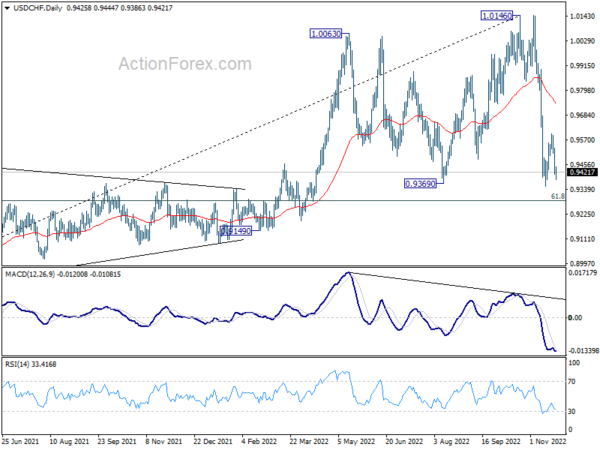

In the bigger picture, focus is back on medium term trend line (now at 0.9803). Decisive break there argue that whole rise from 0.9186 has completed. Further break of 0.9716 will confirm reversal and target next next support level at 0.9541. Nevertheless, there is still a chance that price action from 1.0128 are forming a consolidative pattern with fall from 1.0124 as third leg. If this is the case, stronger support should be seen between 0.9716 and the trend line to contain downside.