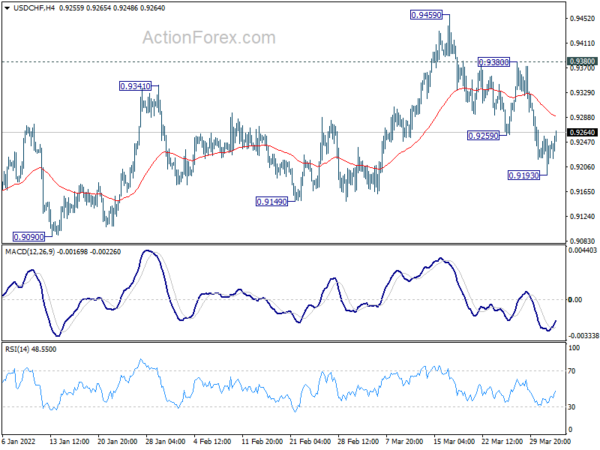

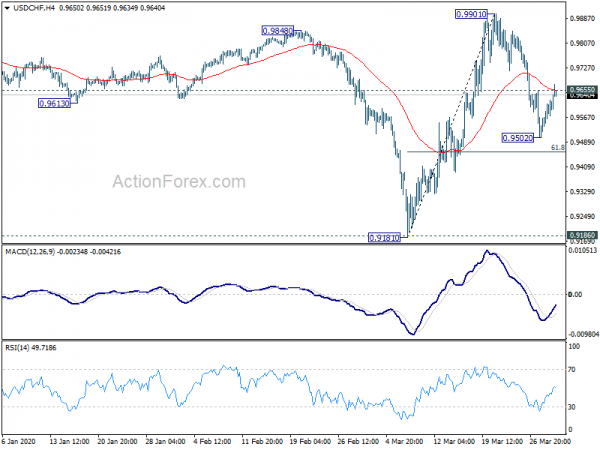

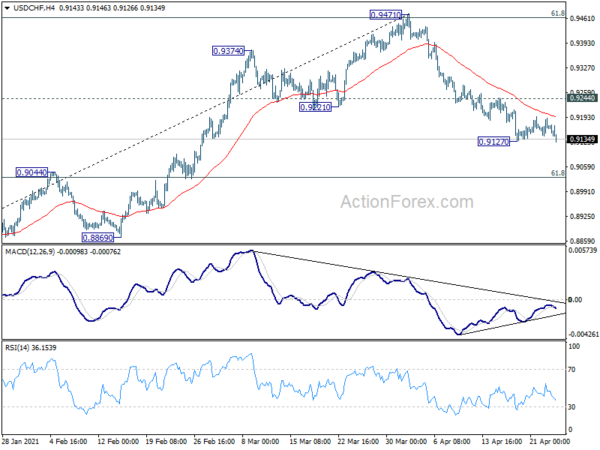

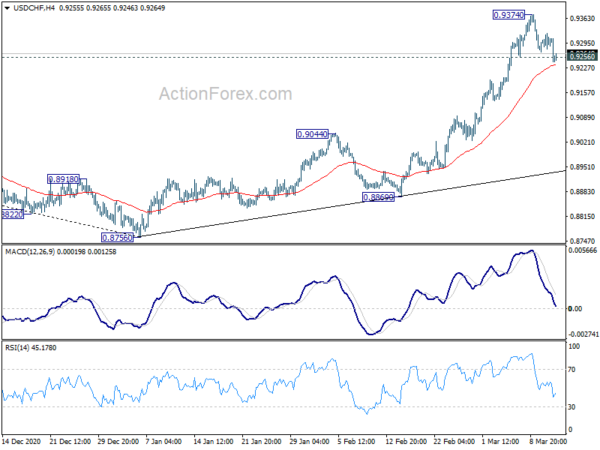

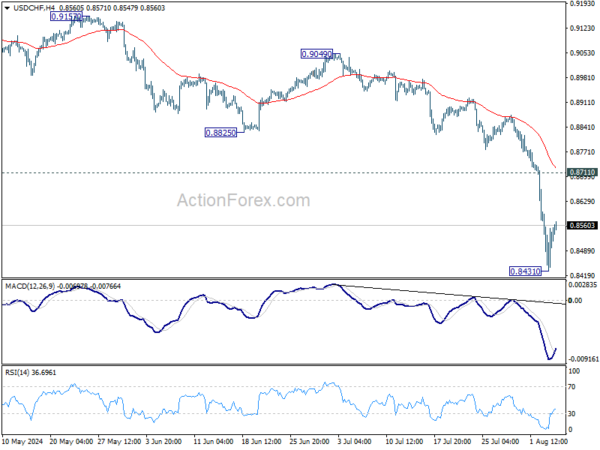

Daily Pivots: (S1) 0.9194; (P) 0.9226; (R1) 0.9258; More….

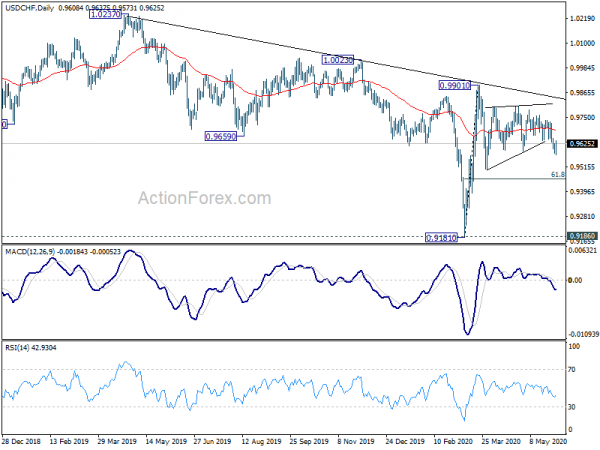

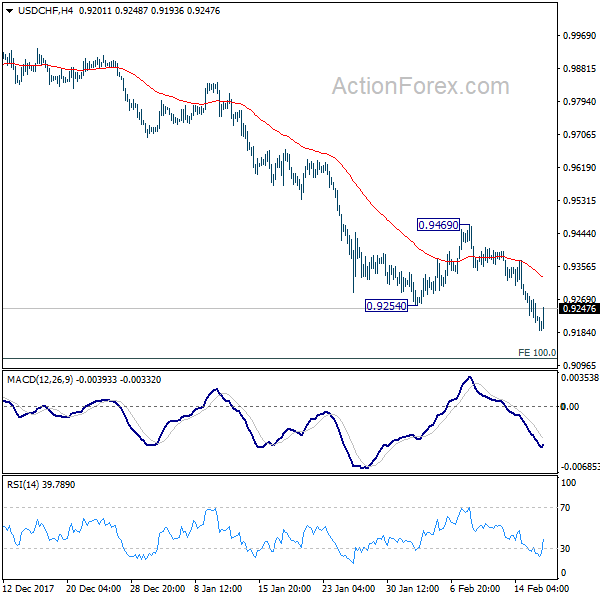

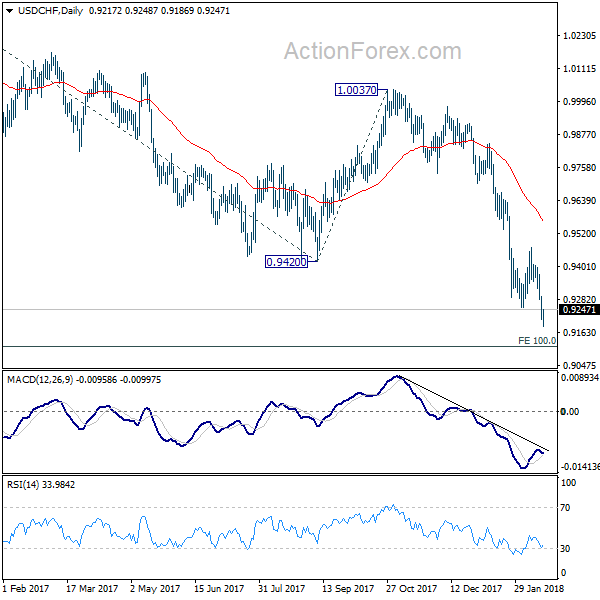

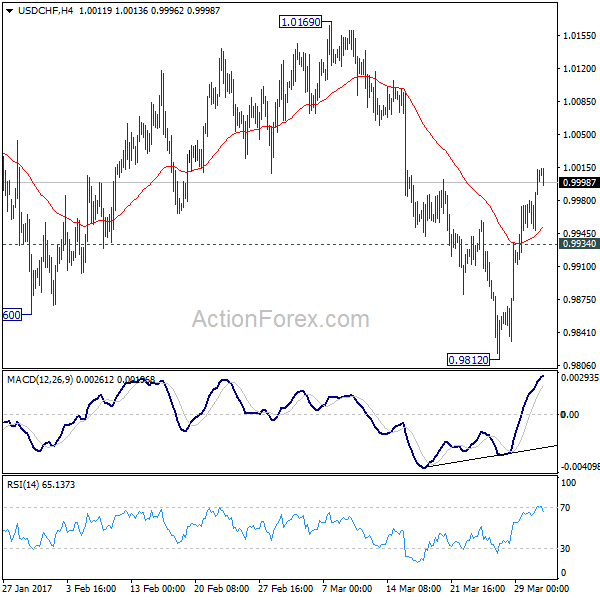

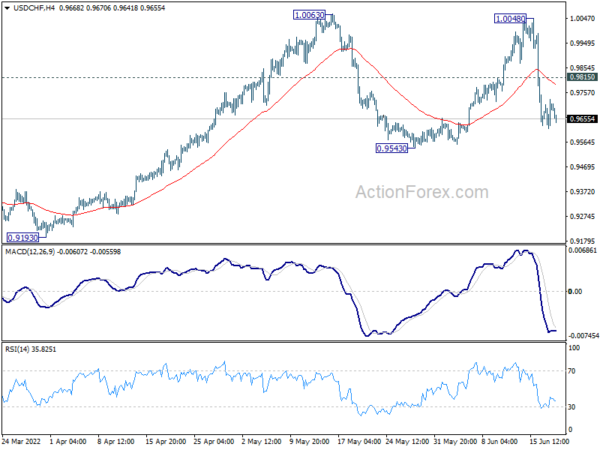

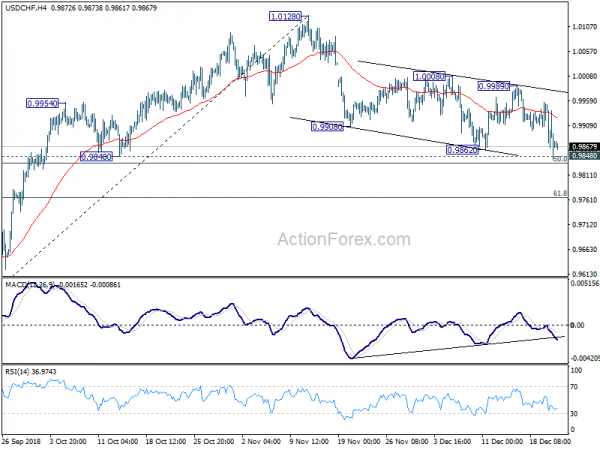

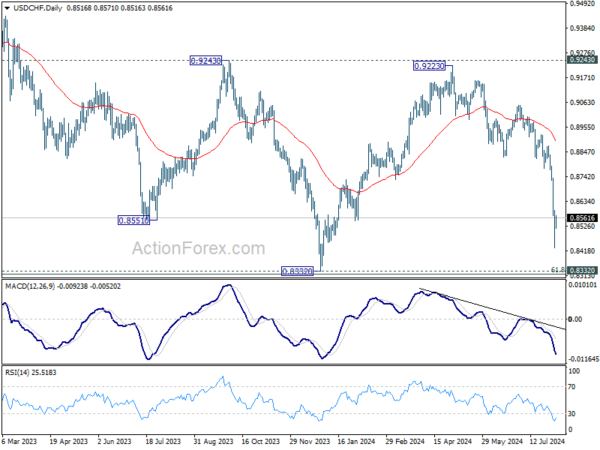

Intraday bias in USD/CHF is turned neutral with current recovery. But further fall could still be seen as long as 0.9380 resistance holds. Below 0.9193 will resume the decline from 0.9459 to 0.9149 support. Firm break there will turn near term outlook bearish for 0.9090 support and below. On the upside, above 0.9380 resistance will flip bias back to the upside for 0.9459 resistance instead.

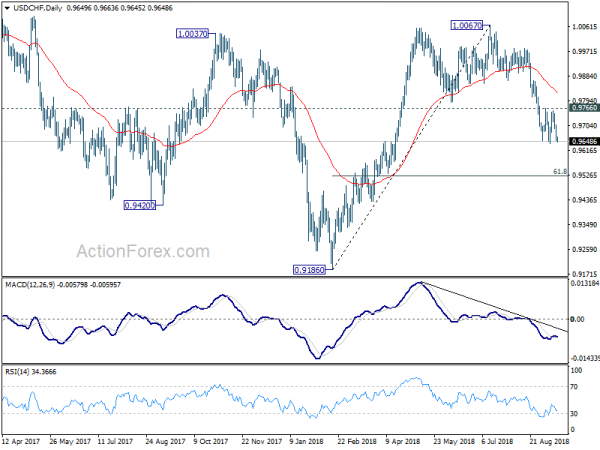

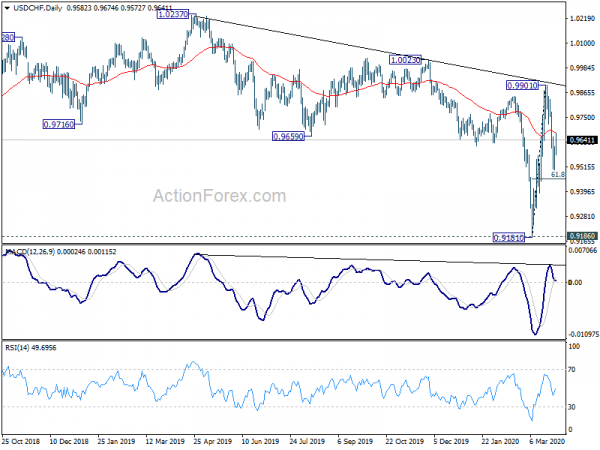

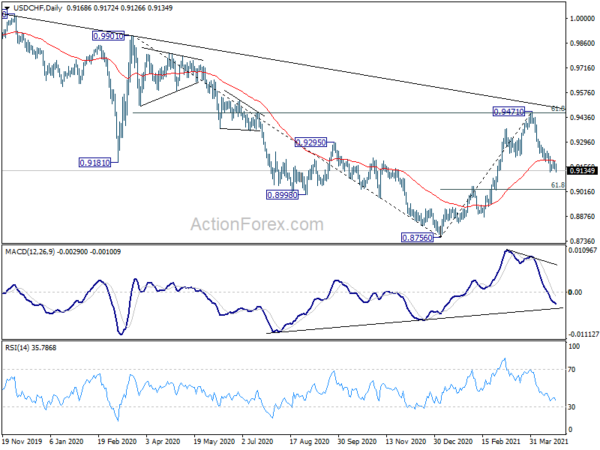

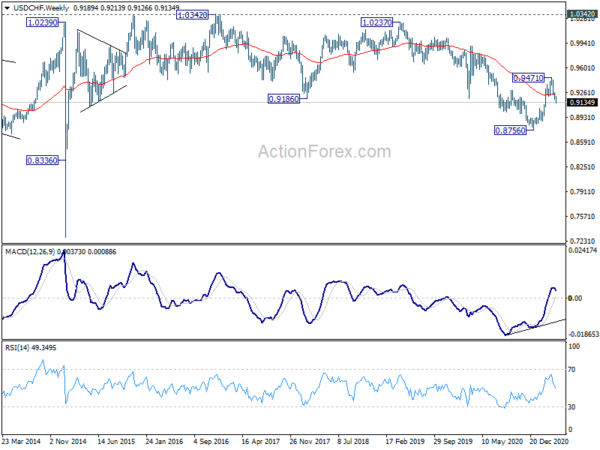

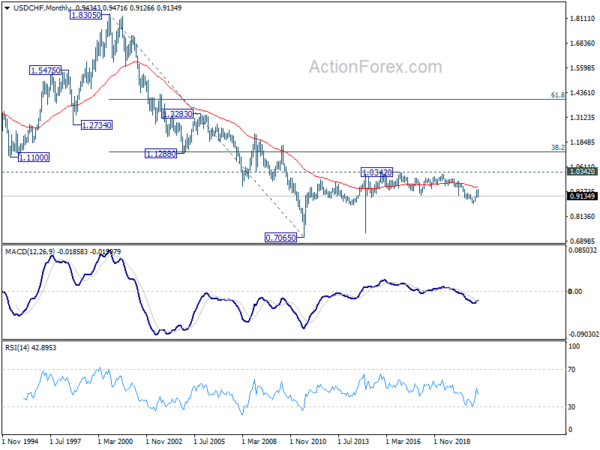

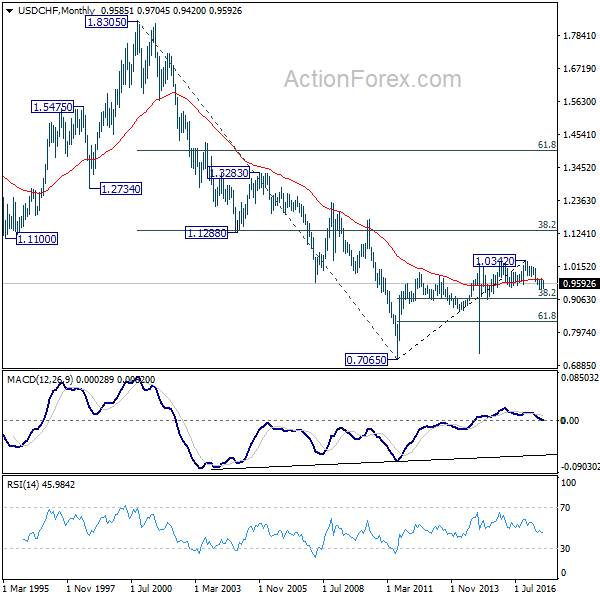

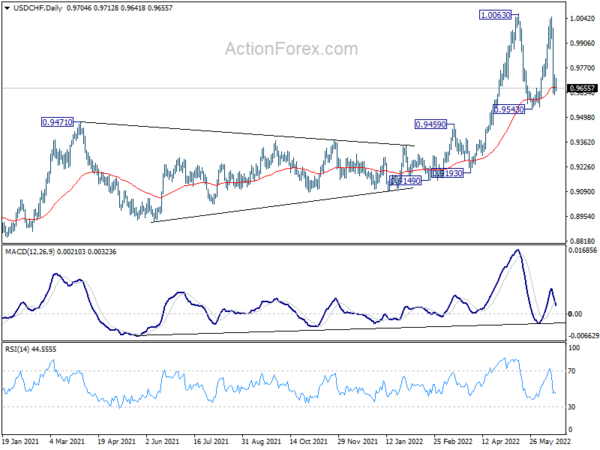

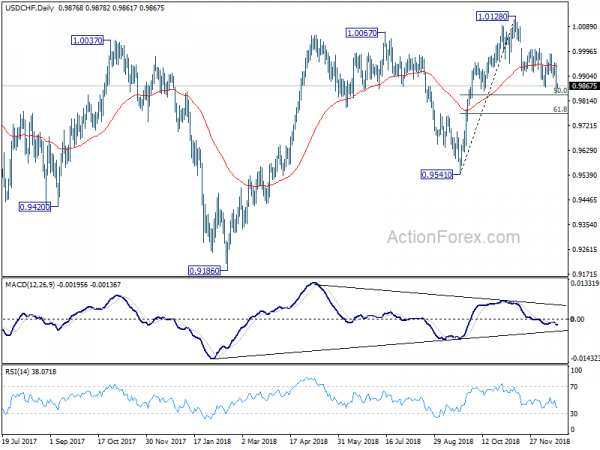

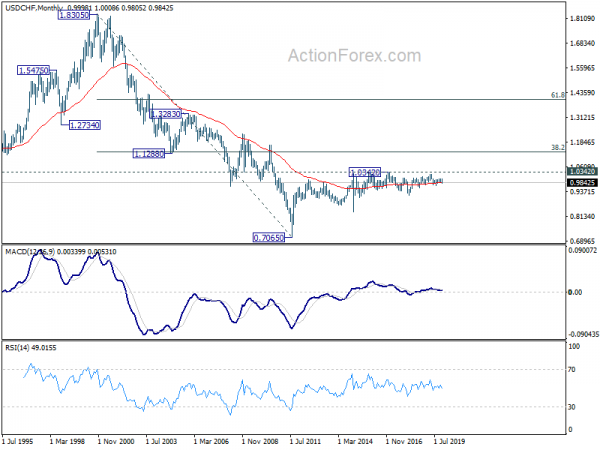

In the bigger picture, medium term outlook will be neutral at best as long as 0.9471 resistance holds. Larger down trend could still extend through 0.8756 (2021 low). However, firm break of 0.9471 will argue that whole down trend form 1.0342 (2016 high), has completed with waves down to 0.8756. A medium term up trend should be set up to target 1.0237/0342 resistance zone.