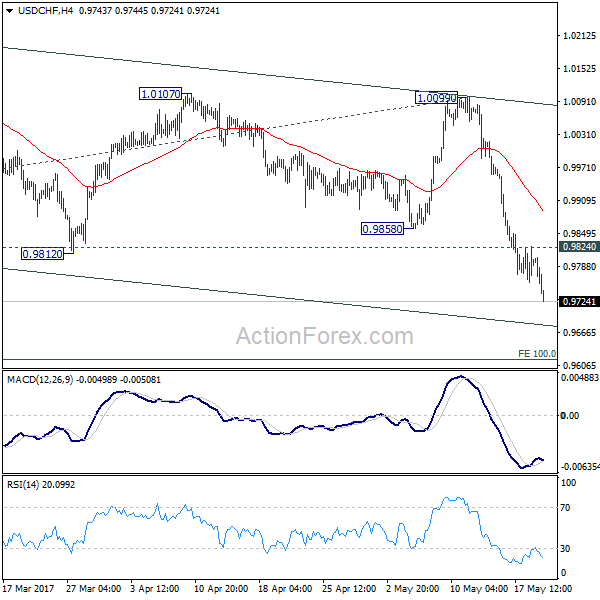

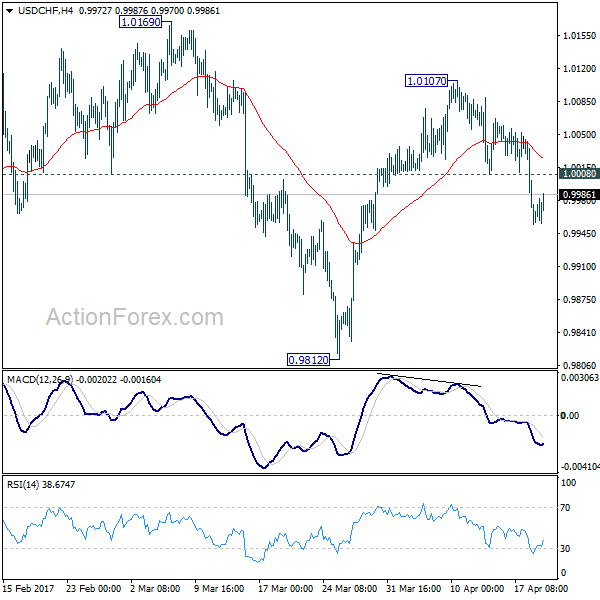

Daily Pivots: (S1) 0.9889; (P) 0.9913; (R1) 0.9950; More…

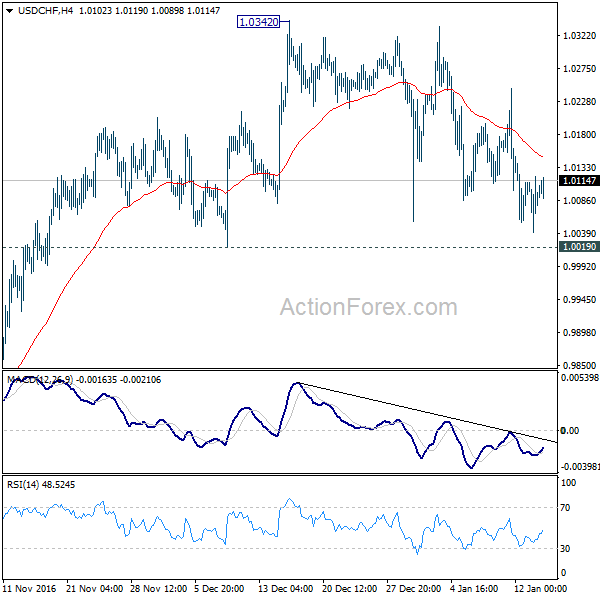

USD/CHF is staying in consolidation pattern from 1.0027 and intraday bias remains neutral. Further rise is expected as long as 0.9851 support holds. On the upside, break of 0.9970 will bring retest of 1.0027 resistance next. On the downside, though, break of 0.9851 will indicate completion of whole rise from 0.9659 and turn outlook bearish for retesting this low.

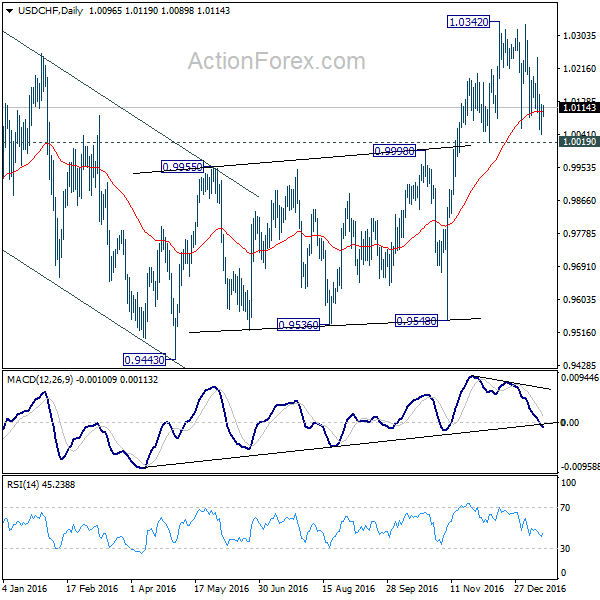

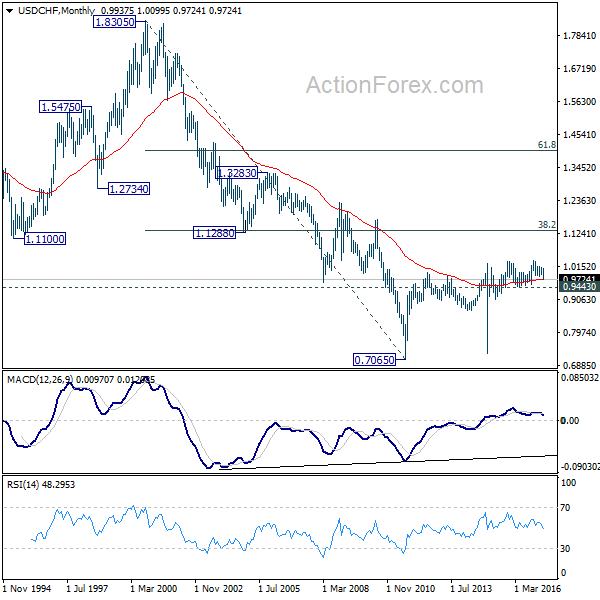

In the bigger picture, medium term outlook remains neutral as USD/CHF is staying in range of 0.9659/1.0237. In any case, decisive break of 1.0237 is needed to indicate up trend resumption. Otherwise, more sideway trading would be seen with risk of another fall. Meanwhile, break of 0.9695 support will target 0.9541 support instead.