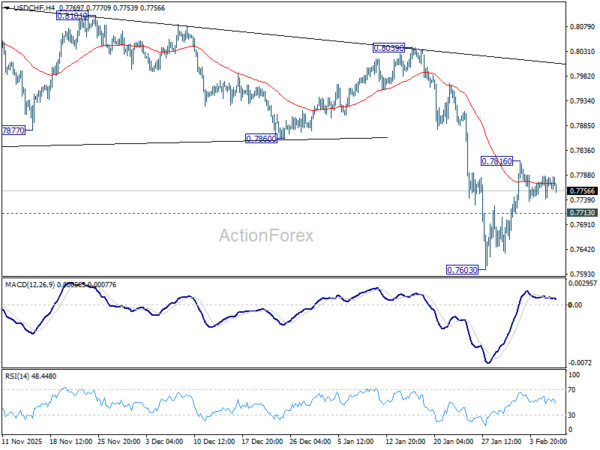

USDCHF Outlook

USD/CHF Mid-Day Outlook

Daily Pivots: (S1) 0.7753; (P) 0.7771; (R1) 0.7799; More….

Intraday bias in USD/CHF remains neutral for the moment. On the upside, above 0.7816 will resume the rebound from 0.7603 short term bottom to 55 D EMA (now at 0.7896). But strong resistance should be seen there to limit upside. On the downside, below 0.7713 minor support will bring retest of 0.7603. Firm break there will resume larger down trend to 0.7382 projection level next.

In the bigger picture, larger down trend from 1.0342 (2017 high) is still in progress and resuming. Next target is 100% projection of 1.0146 (2022 high) to 0.8332 from 0.9200 at 0.7382. In any case, outlook will stay bearish as long as 55 W EMA (now at 0.8166) holds.

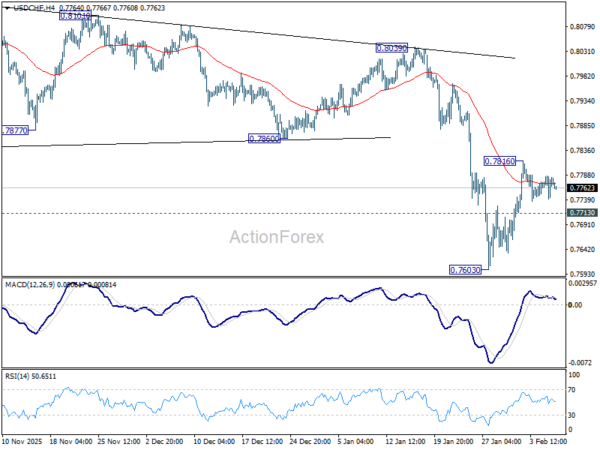

USD/CHF Daily Outlook

Daily Pivots: (S1) 0.7753; (P) 0.7771; (R1) 0.7799; More….

No change in USD/CHF's outlook and intraday bias stays neutral at this point. On the upside, above 0.7816 will resume the rebound from 0.7603 short term bottom to 55 D EMA (now at 0.7896). But strong resistance should be seen there to limit upside. On the downside, below 0.7713 minor support will bring retest of 0.7603. Firm break there will resume larger down trend to 0.7382 projection level next.

In the bigger picture, larger down trend from 1.0342 (2017 high) is still in progress and resuming. Next target is 100% projection of 1.0146 (2022 high) to 0.8332 from 0.9200 at 0.7382. In any case, outlook will stay bearish as long as 55 W EMA (now at 0.8166) holds.

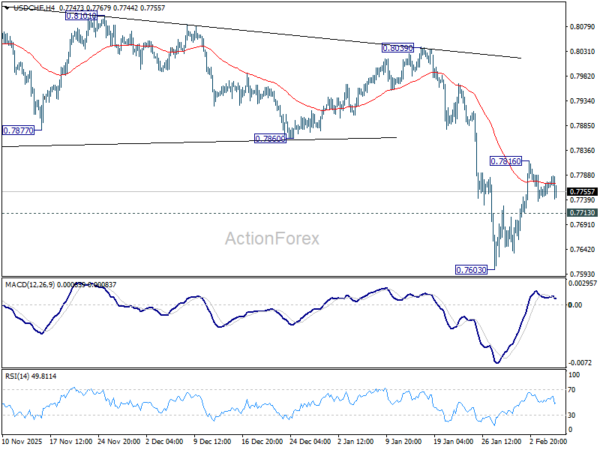

USD/CHF Mid-Day Outlook

Daily Pivots: (S1) 0.7754; (P) 0.7765; (R1) 0.7785; More….

Intraday bias in USD/CHF stays neutral and outlook is unchanged. On the upside, above 0.7816 will resume the rebound from 0.7603 short term bottom to 55 D EMA (now at 0.7905). On the downside, below 0.7713 minor support will bring retest of 0.7603. Firm break there will resume larger down trend to 0.7382 projection level next.

In the bigger picture, larger down trend from 1.0342 (2017 high) is still in progress and resuming. Next target is 100% projection of 1.0146 (2022 high) to 0.8332 from 0.9200 at 0.7382. In any case, outlook will stay bearish as long as 55 W EMA (now at 0.8166) holds.