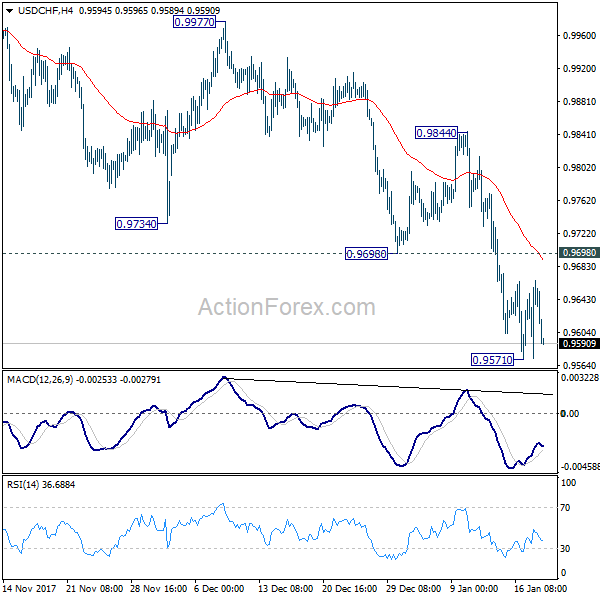

USD/CHF’s fall from 0.9901 extended lower last week. Further fall could be seen initially this week with focus on 61.8% retracement of 0.9181 to 0.9901 at 0.9456. Sustained break there will target a test on 0.9181/6 key support zone. Nevertheless, break of 0.9655 minor resistance will indicate completion of the pull back. Intraday bias will be turned back to the upside for 0.9901 next.

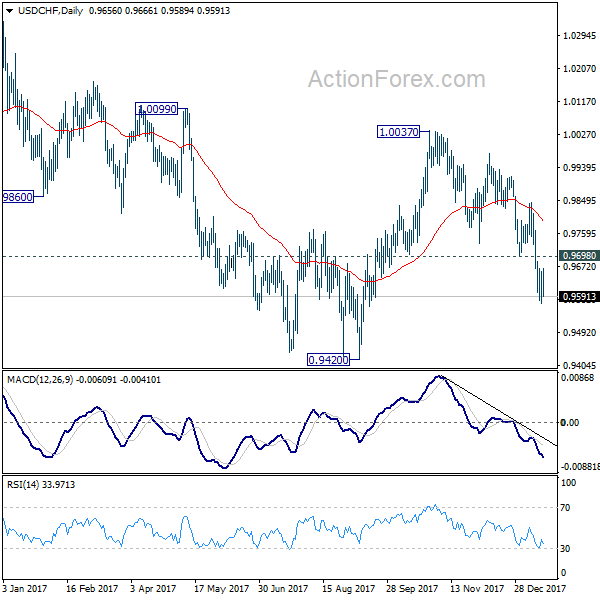

In the bigger picture, decline from 1.0237 is seen as the third leg of the pattern from 1.0342 (2016 low). It could have completed at 0.9181 after hitting 0.9186 key support (2018 low). Further rise could be seen to retest 1.0237 high. After all, medium term range trading will likely continue between 0.9181/1.0237 for some time.

In the long term picture, price actions from 0.7065 (2011 low) are not clearly impulsive yet. Thus, we’ll treat it as developing into a corrective pattern, at least, until a firm break of 1.0342 resistance.