Daily Pivots: (S1) 1.0033; (P) 1.0045; (R1) 1.0062; More….

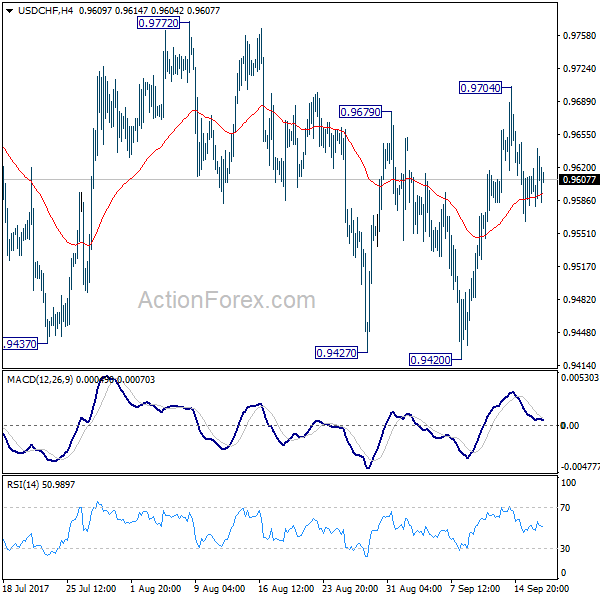

USD/CHF rises to as high as 1.0076 so far and intraday bias remains on the upside for 1.0098/0128 resistance. Decisive break there will resume larger rally from 0.9186. On the downside, below 1.0027 minor support will turn intraday bias back to the downside for 0.9926 support instead.

In the bigger picture, USD/CHF drew strong support from medium term trend line and rebounded. That suggests rise from 0.9186 is still in progress. Further break of 1.0128 will confirm up trend resumption and target 1.0342 key resistance. Nevertheless, break of 0.9716 will dampen this bullish view and at least bring deeper fall to 0.9541 key support.