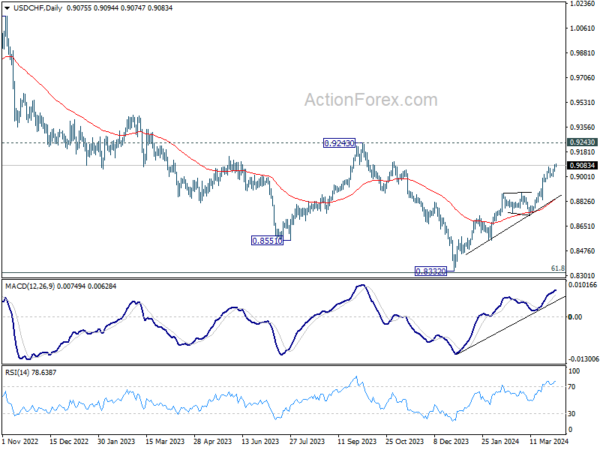

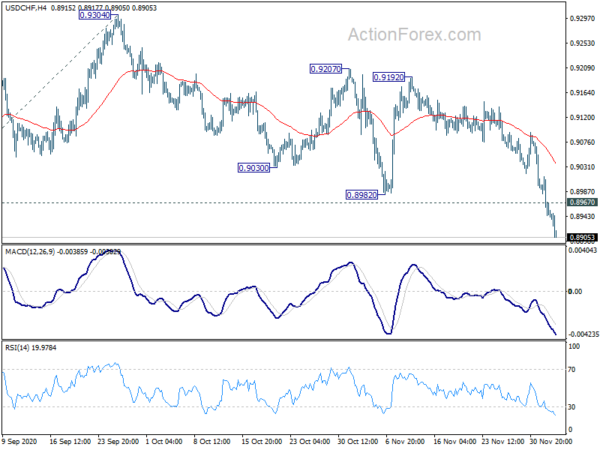

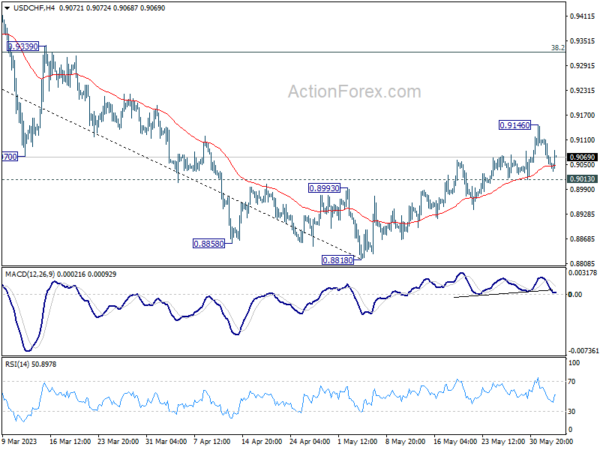

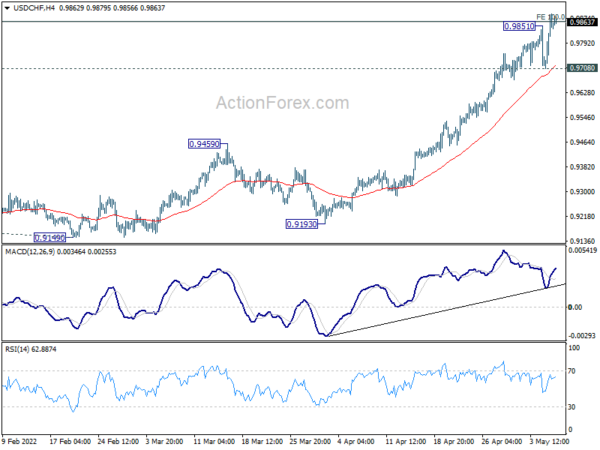

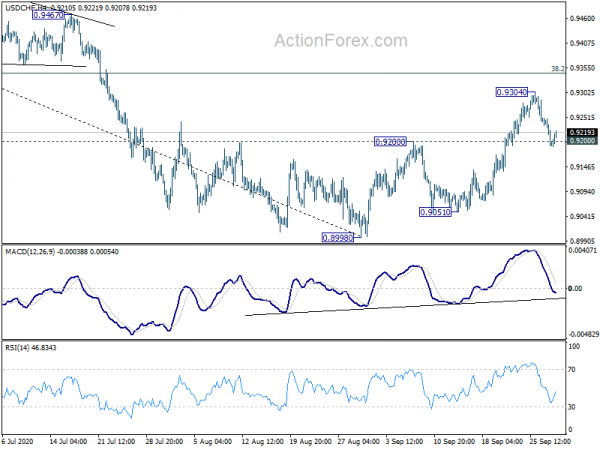

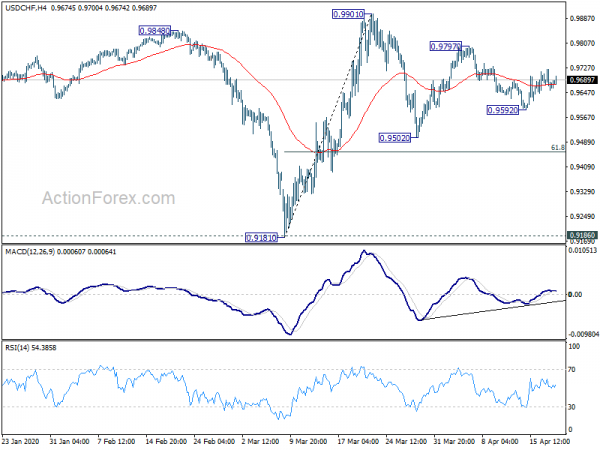

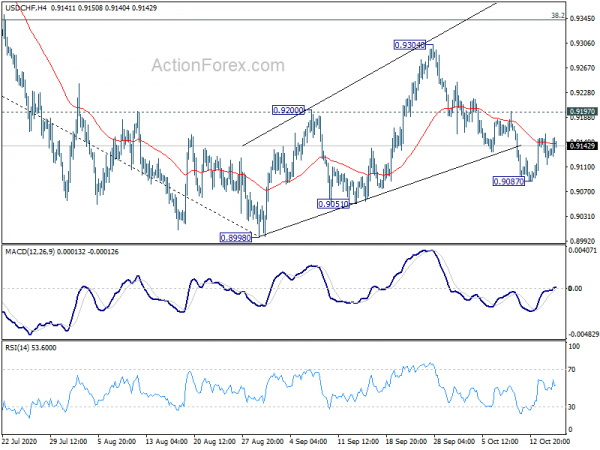

Daily Pivots: (S1) 0.9050; (P) 0.9071; (R1) 0.9100; More….

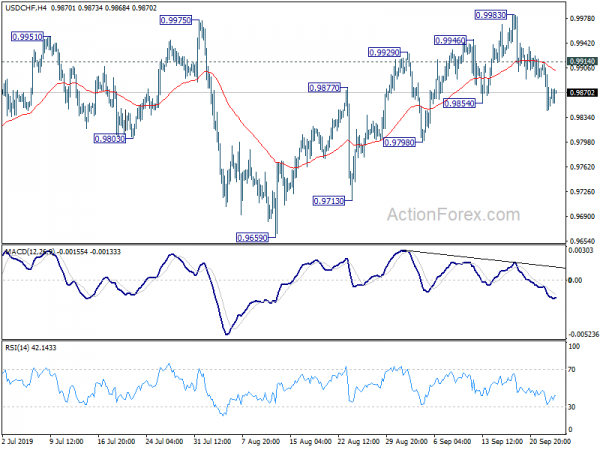

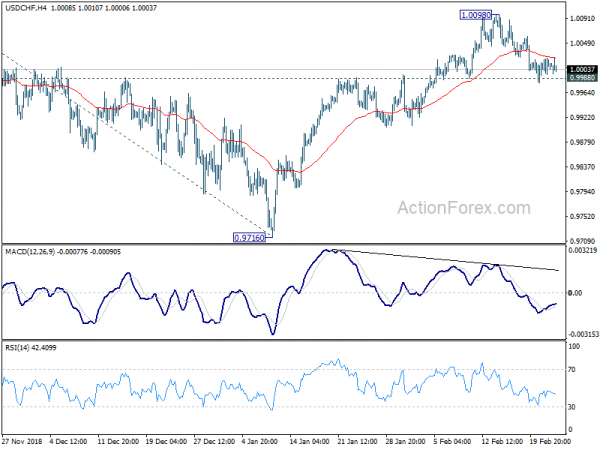

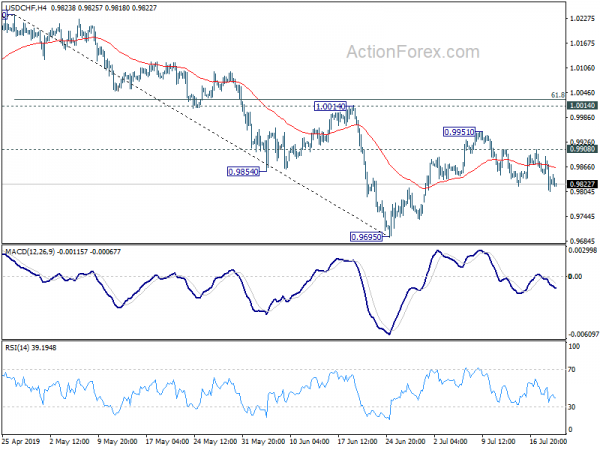

USD/CHF’s rally is in progress and intraday bias stays on the upside. Current rise is in progress for 0.9243 key resistance next. On the downside, break of 0.9005 support is needed to indicate short term topping. Otherwise, outlook will stay bullish in case of retreat.

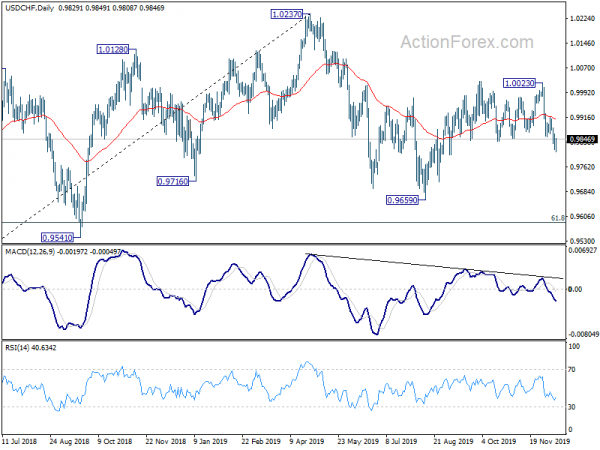

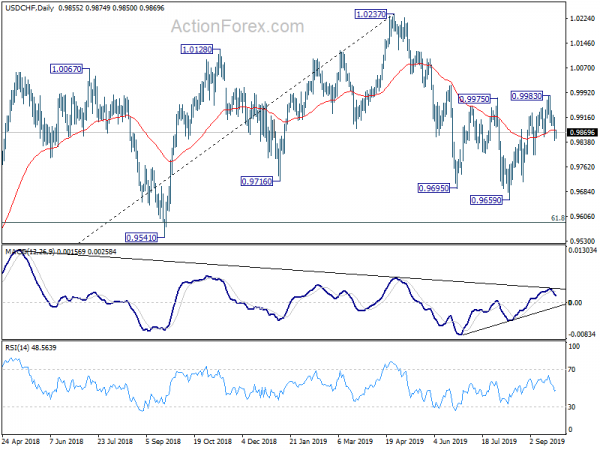

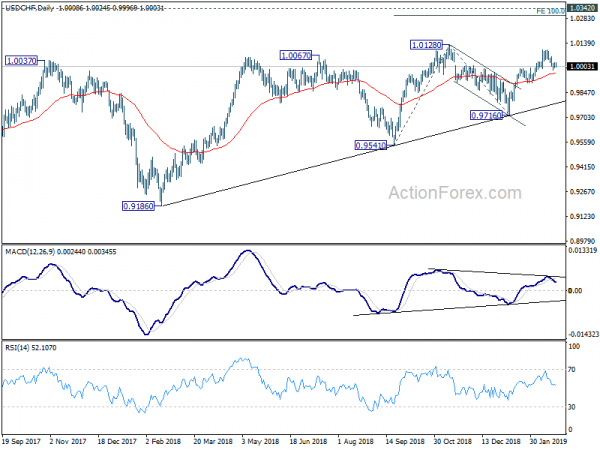

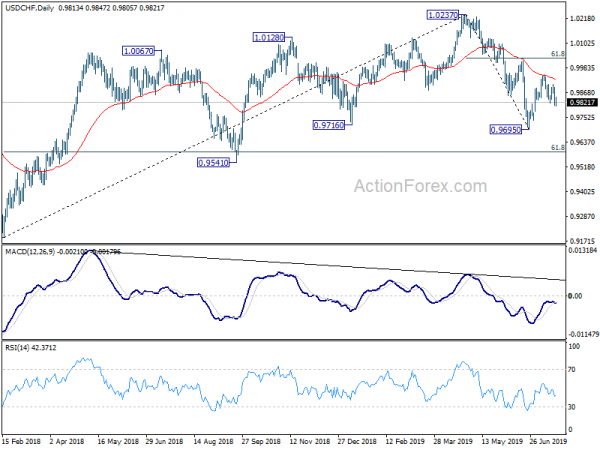

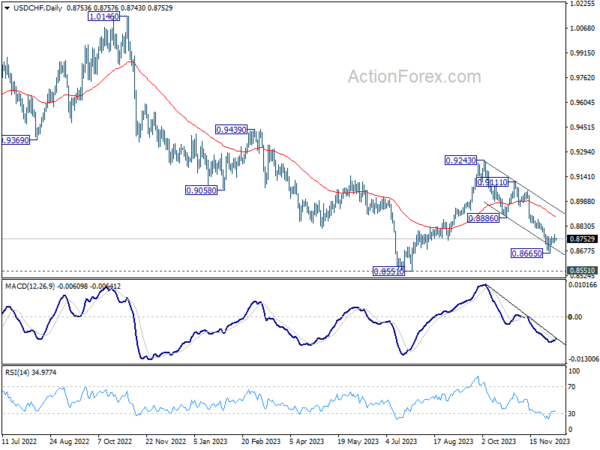

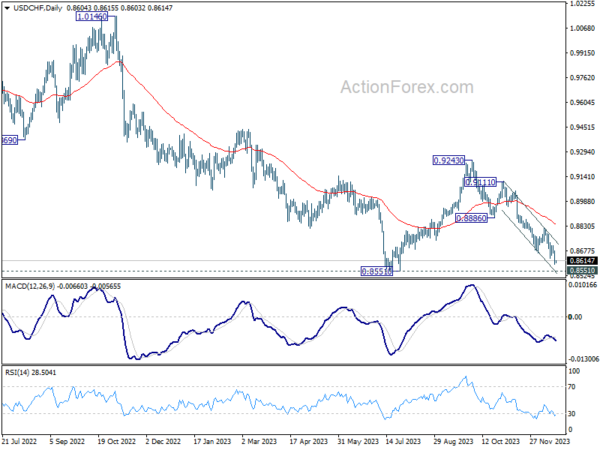

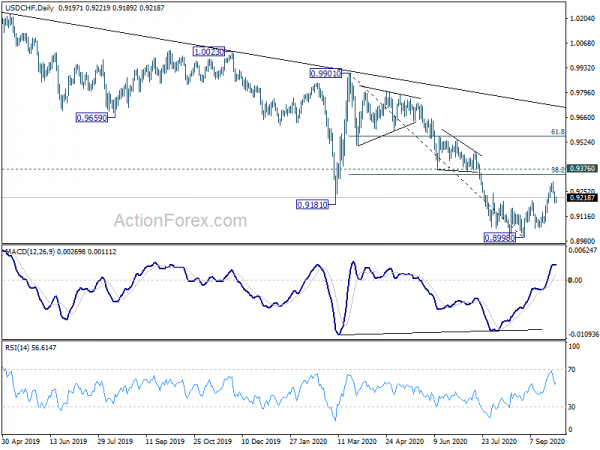

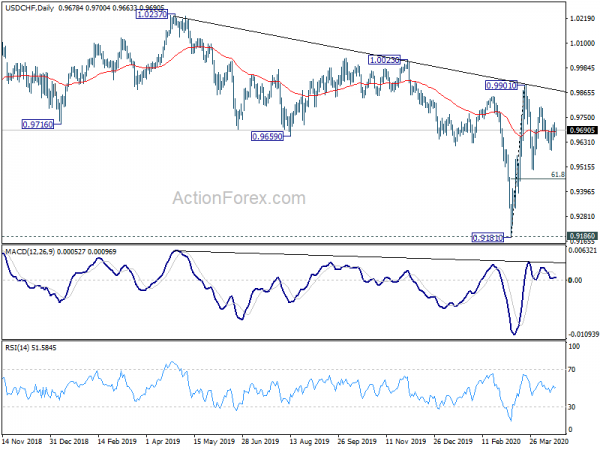

In the bigger picture, price actions from 0.8332 medium term bottom as tentatively seen as developing into a corrective pattern to the down trend from 1.0146 (2022 high). Further rise would be seen as long as 0.8728 support holds. But upside should be limited by 0.9243 resistance, at least on first attempt.